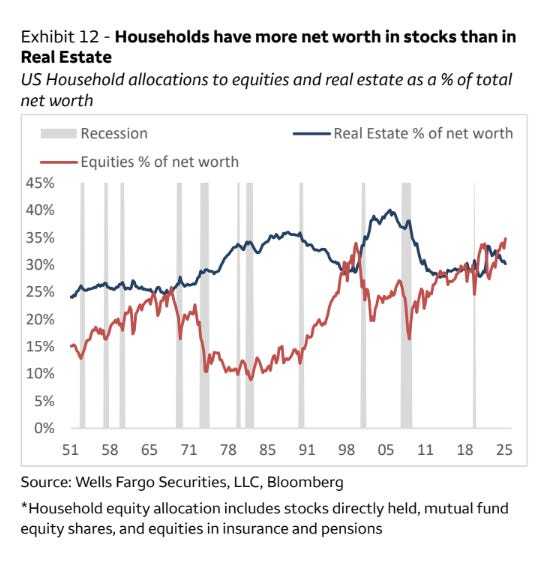

Today, the prototype of the big short, Mike Burry, shared a chart (see 👇 Chart 1) — "American households have a net worth in stocks that exceeds that in real estate."

This chart illustrates the comparison of the "proportion of stocks" (red line) and "proportion of real estate" (blue line) in American household assets from 1951 to the present. Currently, it is the third time the red line has surpassed the blue line, meaning that the total value of stocks held by the American public exceeds the value of their homes. In the past 70 years, this situation has only occurred twice:

The first time was in the late 1960s: The "Nifty Fifty" bubble in the U.S. stock market, followed by a decade-long "stagflation" bear market, where the stock market plummeted.

The second time was in the late 1990s: The internet bubble, where the Nasdaq index fell from 5000 points to just over 1100 points, a drop of 70%, taking 15 years to recover.

But will this time be the same old story? I think not, because #AI, compared to the early internet bubble, has a value and practicality, as well as a significant paradigm shift that brings a productivity revolution to society, which cannot be compared.

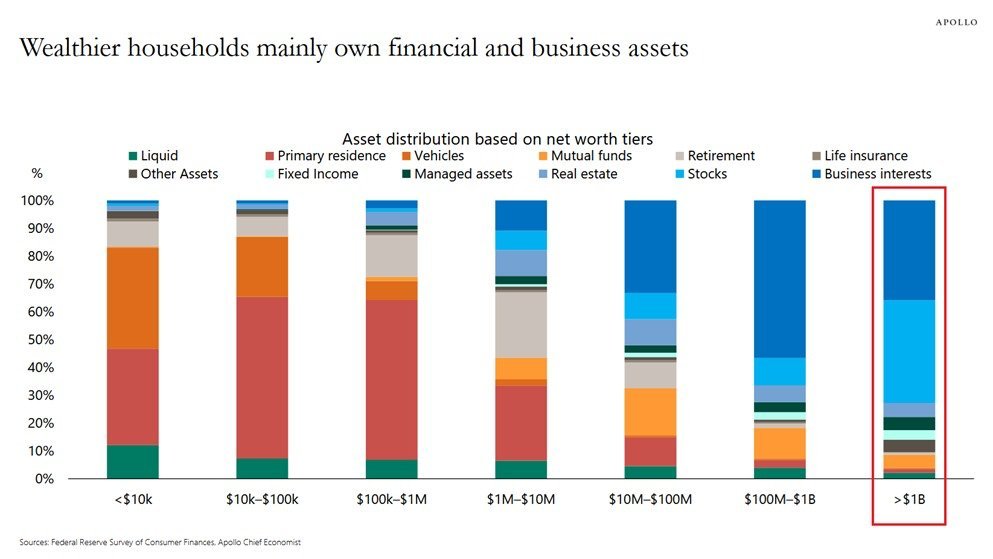

Now let's look at the second chart, 👇 Chart 2, which shows the asset allocation strategies of the top wealthy individuals, helping to clarify the above concerns. The net worth in stocks exceeding that in real estate does not need to be worrisome:

This chart is titled "Wealthier households mainly own financial and business assets." It divides net worth into seven tiers, from the lowest "less than $10,000" to the highest "over $1 billion," showing where different classes of people spend their money.

The core conclusion can be summarized in one sentence: The poor rely on houses and cars to "maintain appearances," while the rich rely on stocks and companies to "generate wealth." Let's break it down layer by layer:

1️⃣ Net worth < 10k (less than $10,000): What you mainly see are "primary residences" (red) and "vehicles" (orange).

This is basically a true reflection of the ordinary working class. The hard-earned money is mostly invested in necessities — the house they live in and the car they drive. Stocks? Almost none. This is why it is said that "Americans with a net worth below $1 million almost completely do not hold stocks," because for them, buying stocks is a luxury; they need to secure basic needs first.

2️⃣ Net worth 10k - 100k ($10,000 to $100,000): The proportion of real estate has increased (the red section is larger), and vehicles also account for a portion.

People in this stage may have just finished paying off their mortgage or are still in the process, with a similar asset structure to the previous group, but with a heavier emphasis on real estate. Stocks are still very few.

3️⃣ Net worth 1M - 10M ($1 million to $10 million): Here we start to see changes!

"Stocks" (blue) and "business equity" (dark blue/black) begin to appear, and their proportions are not small. "Retirement accounts" (gray) have also increased. This indicates that this group of people has started to consider using investments to make money, rather than just relying on their salaries.

4️⃣ Net worth > 1B (over $1 billion): Here comes the key point! This column is highlighted by me.

You can see that at the top is "business equity" (dark blue), and below it is "stocks" (light blue). 37% is in stocks, and 35% is in business equity! Together, they exceed 70%!

These top wealthy individuals do not keep their wealth in banks earning interest, nor do they put it all into a single property. They either directly hold shares or equity in the companies they founded or invested in, or they invest in publicly traded stocks. This is the true way of "capitalists," allowing their assets to grow on their own.

The wealth gap is essentially a gap in asset allocation. The poor lock their money in illiquid, slow-appreciating physical assets (houses, cars); the rich invest their money in financial assets that generate cash flow and capital appreciation. To cross social classes, simply working hard is not enough; one must learn to invest. We need to shift our asset allocation from "consumption-based" to "production-based," just like the wealthy. Embracing quality assets is the best choice for rapid wealth accumulation; following in the footsteps of the rich is the way to remain invincible! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。