Are We in an "Irrational Exuberance"?

Written by: Brad Stone, Bloomberg

Translated by: Saoirse, Foresight News

Two months before the stock market crash on "Black Monday," which triggered the Great Depression, an economist from Massachusetts named Roger Babson expressed deep concern over the surge of retail investors borrowing money to speculate in stocks. In a speech, he declared, "The stock market crash will come sooner or later, and it could be devastating." Following his remarks, the market promptly fell by 3%, a decline that was referred to at the time as the "Babson Drop." However, as Andrew Ross Sorkin writes in his compelling new book, "1929: The Inside Story of the Worst Stock Market Crash in Wall Street History and How It Destroyed a Nation," in the weeks that followed, "the market shook off Babson's ominous prediction," partly due to optimism surrounding new consumer products like radios and cars, with "imaginative" investors regaining the upper hand.

Today, many individuals like Babson are warning about the risks in the field of artificial intelligence (AI), particularly regarding the valuations of public and private tech companies and their blind pursuit of the elusive goal of artificial general intelligence (AGI) — systems capable of performing nearly all tasks that humans can, and even surpassing human abilities. Data analysis firm Omdia reports that by 2030, tech companies' annual spending on data centers will approach $1.6 trillion. The hype surrounding AI is immense, yet its prospects as a profit-generating tool remain entirely hypothetical, leaving many clear-headed investors perplexed. However, much like a century ago, the mindset of "fear of missing out on the next big opportunity" is prompting many companies to ignore these "doomsday predictions." Advait Arun, a climate finance and energy infrastructure analyst at the Center for Public Enterprises, states, "These companies are like playing a game of 'Mad Libs,' believing that these bold technologies can solve all existing problems." He recently released a report titled "It's Either a Bubble or Nothing," which questions the financing behind data center projects and points out, "We are undoubtedly still in a phase of irrational exuberance."

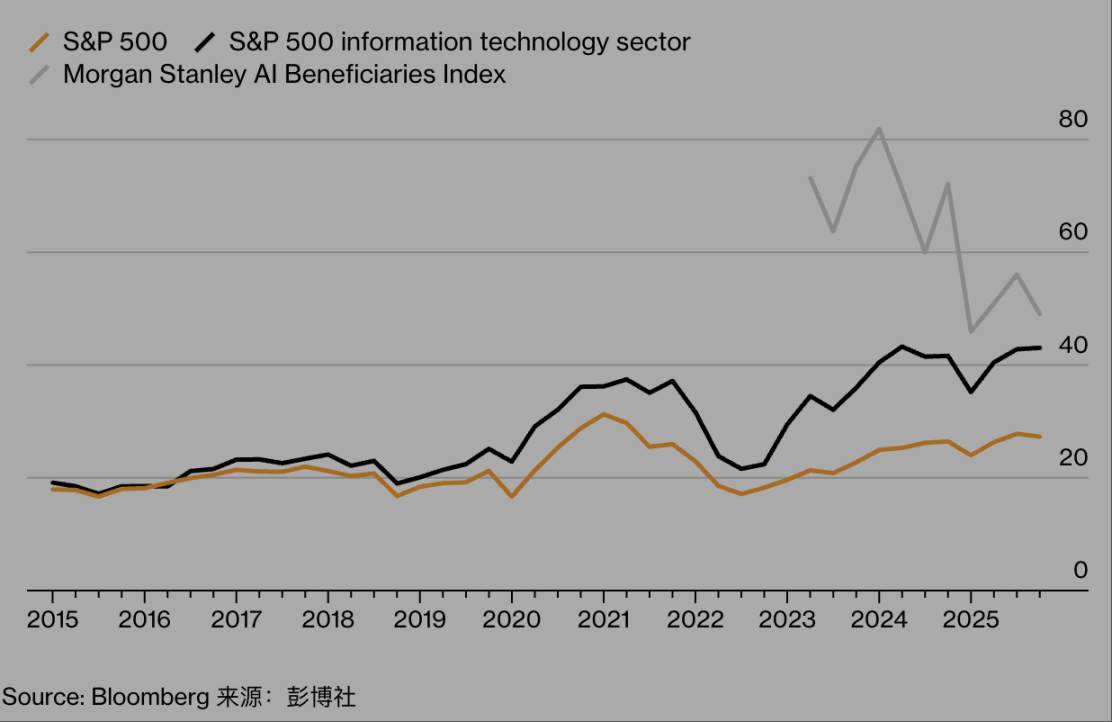

Tech Stocks Soar:

Source: Bloomberg

(This chart uses three index lines (S&P 500, S&P 500 Information Technology Sector, Morgan Stanley AI Beneficiary Index) to show the process from 2015 to 2025 in the U.S. stock market, where AI-related stocks initially soared due to hype, then fell back as the bubble burst, reflecting the speculative frenzy and retreat risks in the AI field.)

Journalists should generally avoid debating whether a certain resource or technology is overvalued. I do not have a strong stance on whether we are in an "AI bubble," but I suspect that the question itself may be too narrow. If we define a "speculative bubble" as "the value of an asset diverging from its ascertainable fundamentals, leading to unsustainable increases," then bubbles seem to be almost everywhere, and they appear to be inflating and deflating in sync.

Børge Brende, CEO of the World Economic Forum, points out that there may be bubbles in the gold and government bond sectors. He recently stated that since World War II, the overall debt situation of countries has never been so severe; as of December 12, gold prices had surged nearly 64% within a year. Many financial professionals believe there is also a bubble in the private credit sector. This market, which amounts to $3 trillion, is funded by large investment institutions providing loans (many of which are used to build AI data centers) and is not constrained by the strict regulations of the commercial banking system. Jeffrey Gundlach, founder and CEO of asset management firm DoubleLine Capital, recently referred to this opaque, unregulated lending phenomenon as "junk loans" on Bloomberg's "Odd Lots" podcast; Jamie Dimon, CEO of JPMorgan Chase, called it "the spark that could ignite a financial crisis."

The most absurd phenomena appear in areas where "intrinsic value is difficult to assess." For example, from the beginning of the year to October 6, the total market capitalization of BTC increased by $636 billion, but by December 12, it not only retraced all its gains but also experienced a more significant decline. According to data from cryptocurrency media company Blockworks, the virtual currency "Meme Coins," which commemorated internet hotspots, peaked at a trading volume of $170 billion in January but plummeted to $19 billion by September. Leading the decline were TRUMP and MELANIA — two coins launched by the First Family of the United States two days before the presidential inauguration, which have since dropped in value by 88% and 99%, respectively, since January 19.

Many investors evaluating these cryptocurrencies do not focus on their potential to create intrinsic value for shareholders and society (as one would when assessing a traditional company's stock that reports earnings) but rather purely on the opportunity to "make quick money." Their attitude towards cryptocurrencies resembles that of someone approaching a dice table in Las Vegas, filled with a speculative mindset.

Investors (especially those attracted to cryptocurrencies, sports betting, and online prediction markets) are attempting to treat financial markets as a casino to "manipulate," which may be driven by demographic factors. A recent survey by Harris Poll found that 60% of Americans today yearn to accumulate vast wealth; among Gen Z and millennial respondents, 70% expressed a desire to become billionaires, while only 51% of Gen X and baby boomers felt the same. A study by financial firm Empower last year indicated that Gen Z believes "financial success" requires an annual salary of nearly $600,000 and a net worth of $10 million.

Thanks to TikTok videos, group chats, Reddit, and the internet's "instant and unavoidable" nature, people around the world can simultaneously learn about money-making opportunities. In principle, this seems unproblematic, but in reality, it has sparked a wave of imitation, fierce competition, and "groupthink" — a phenomenon that makes the new Apple TV series "Pluribus" particularly relevant. The traditional economy, with its complex and diverse dimensions, has been replaced by the "attention economy": the so-called attention economy is "the things that everyone around the world is collectively obsessed with at any given moment."

In the business world, the focus of this "collective obsession" is AI; in popular culture, following the "Pedro Pascal craze," there has emerged the "Sydney Sweeney craze," along with the "6-7 craze" (if you don't have teenagers at home, you might want to Google it). Over the past year, thanks to the influence of celebrities like Lisa from the K-pop group BLACKPINK, the "cute yet practically worthless animal-shaped plush toys" launched by Chinese toy manufacturer Pop Mart International Group have become a global sensation, which we might call "Labubble" (referring to the Labubu craze).

The food sector also evidently has a "protein bubble": from popcorn manufacturers to breakfast cereal producers, everyone is touting their products' "protein content" to attract health-conscious consumers and GLP-1 (a diabetes medication often used for weight loss) users. In the media sector, Substack newsletters, celebrity-hosted podcasts (like Amy Poehler's "SmartLess" and Meghan Markle's "Archetypes"), and the almost weekly release of "authorized celebrity documentaries" (Netflix's latest includes "Becoming Eddie" about Eddie Murphy and a documentary about Victoria Beckham) may also exhibit signs of a bubble. W. David Marx, author of "A Blank Space: A Cultural History of the 21st Century," states, "Today, everyone's 'reference group' is global, far exceeding the visible range around them and transcending their actual class and status. In these markets, there may emerge 'global synchronous trends' that were previously unimaginable."

Of course, the risks in the AI field are far greater than those associated with "Labubu" products. No company wants to fall behind, so all industry giants are striving to advance by building computational infrastructure through "complex financing arrangements." In some cases, this involves "special purpose vehicles" (remember those special purpose vehicles from the 2008 financial crisis?) — these vehicles carry debt to procure graphics processors (i.e., AI chips) from Nvidia, and some observers believe that the depreciation of these chips may occur faster than expected.

Tech giants have the capacity to absorb any consequences arising from this "FOMO-induced frenzy": they primarily rely on strong balance sheets to fund data centers, and even if white-collar workers generally believe that "the current version of ChatGPT is sufficient for writing annual self-evaluations," these giants can handle it with ease. However, other companies are taking riskier measures. Oracle — a traditionally conservative database provider that would not typically be expected to become a challenger in the AI frenzy — is raising $38 billion in debt to build data centers in Texas and Wisconsin.

Other so-called "new cloud vendors" (like CoreWeave and Fluidstack, among relatively young companies) are constructing dedicated data centers for AI, Bitcoin mining, and other purposes, and these companies are also heavily borrowing. At this point, the "cumulative impact" of the AI bubble is beginning to appear increasingly severe. Gil Luria, managing director at investment firm D.A. Davidson & Co., echoes Roger Babson from a century ago when he states, "When some institutions are building billions of dollars' worth of data centers with borrowed money and don't even have real customers, I start to worry. Lending to speculative investments has never been a wise move."

Carlota Perez, a Venezuelan researcher who has studied economic booms and busts for decades, also expresses concern. She points out that in a "casino-like economy characterized by excessive leverage, fragility, and bubbles that burst once doubts spread," technological innovation is being transformed into high-risk speculation. In an email, she wrote, "If the AI and cryptocurrency sectors collapse, it could trigger a global crisis of unimaginable scale. Historically, a truly productive golden age only arrives when the financial industry pays the price for its actions (rather than always being bailed out) and when society imposes reasonable regulations on it." Until then, hold on tightly to your Labubu plush toy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。