Author: Zhou, ChainCatcher

The Bank of Japan (BOJ) decided to raise the policy interest rate by 25 basis points from 0.5% to 0.75% at its monetary policy meeting ending on December 19, 2025. This marks the second rate hike by the BOJ since January of this year, with the current interest rate level reaching the highest record since 1995.

The decision was passed unanimously with a 9:0 vote, fully aligning with market expectations. All 50 economists surveyed prior to the meeting had predicted this rate hike, marking the first time during Governor Kazuo Ueda's tenure that there was a "unanimous" expectation for a rate increase.

In a press conference, BOJ Governor Kazuo Ueda pointed out that the short-term interest rate being at a 30-year high does not carry any special significance, and the officials will closely monitor the impact of interest rate changes. He stated that there is still a distance from the lower limit of the neutral interest rate range, and the market should not expect an accurate neutral interest rate range to be provided in the short term. The pace of future monetary support policy adjustments will depend on economic growth, price performance, and the financial market environment at that time.

Ueda emphasized that assessments of the economic outlook, price risks, and the likelihood of achieving targets will be updated at each meeting, and decisions will be made accordingly. He acknowledged that the estimated range for Japan's neutral interest rate is broad and difficult to measure accurately, requiring observation of the actual feedback from the economy and prices following each interest rate change. If wage increases continue to be transmitted to prices, a rate hike is indeed possible.

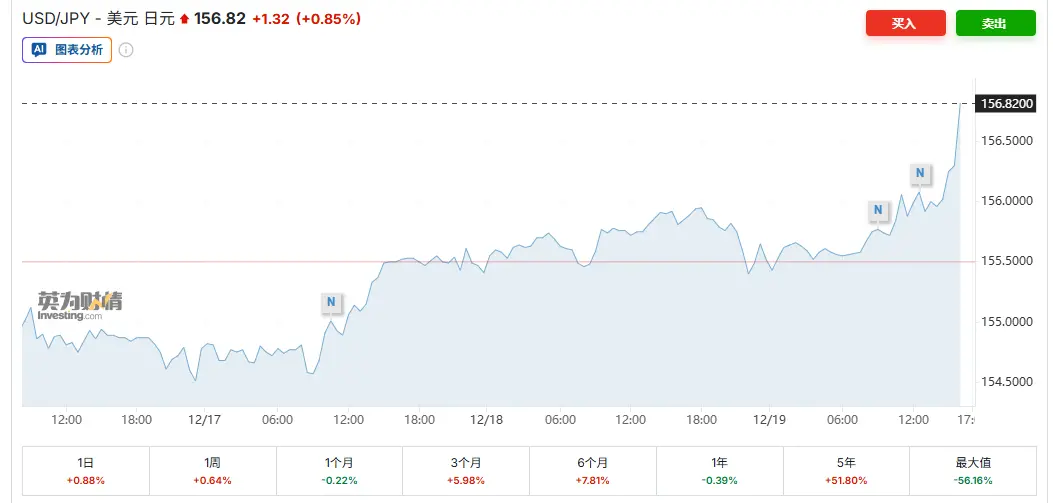

The capital markets reacted relatively calmly: the USD/JPY exchange rate rose slightly by 0.3% to 156.06; the yield on Japan's 30-year government bonds increased by 1 basis point to 3.385%; the Nikkei 225 index rose by 1.5% during the session to 49,737.92 points; Bitcoin surged past $87,000, with an intraday increase of 1.6%. Overall, risk assets did not show significant selling pressure.

Looking back at the fundamentals, this rate hike in Japan was well-supported by data. In November, the core CPI increased by 3.0% year-on-year, meeting expectations, with inflationary pressures remaining strong and exceeding the 2% policy target for 44 consecutive months; additionally, wage growth momentum is solid, and confidence in large manufacturing has risen to a four-year high. Even in the face of U.S. tariff pressures, adjustments in corporate supply chains have shown significant resilience, with impacts being less than expected.

At the same time, Japan's major labor unions have set wage increase targets for the upcoming "Shunto" (spring wage negotiations) that are on par with last year, indicating that the momentum for wage growth is still ongoing after achieving the largest wage increases in decades last year.

Overall, although the rate hike is small, it marks Japan's formal farewell to the long-term ultra-loose era and may become an important turning point for global risk asset liquidity at the end of the year.

Has the market fully digested the expectations?

Current market pricing indicates that the BOJ may raise rates again as early as June or July next year. Tang Yuxuan from JPMorgan Private Bank believes that due to sufficient market pricing, the rate hike will have a limited uplifting effect on the yen. It is expected that there will be another rate hike to 1% in 2026, with the USD/JPY fundamentals remaining around the high of 150, and 160-162 being a potential defensive range, as negative interest differentials and fiscal risks will continue to limit the yen's appreciation potential.

However, some analysts question whether this timeline is too aggressive, suggesting that October 2026 is a more realistic window, allowing enough room to assess the impact of rising borrowing costs on corporate financing, bank credit, and household consumption. At that time, the results of the spring wage negotiations and the yen exchange rate will be core assessment indicators.

Additionally, Morgan Stanley expects that after the 25bp rate hike, the BOJ will still emphasize the accommodative nature of the policy environment, as rates remain below neutral levels. The future tightening path will be gradual and highly data-dependent, without presuming an aggressive route.

Investinglive analyst Eamonn Sheridan believes that since real interest rates remain negative, the overall policy is still accommodative, and the next rate hike is not expected until mid to late 2026 to observe the actual penetration of borrowing costs into the economy.

For a long time, Japan's ultra-low interest rate environment has provided massive cheap liquidity to global markets. Through "yen carry trades," investors borrow yen at low costs and invest in high-yield assets such as U.S. stocks and cryptocurrencies. This mechanism is substantial and has been a key support for the bull market in risk assets over the past several years.

Although the latest TIC data shows that Japanese capital has not yet significantly flowed back from the U.S. Treasury market (with holdings increasing to $1.2 trillion by the end of October), this trend may gradually emerge as the attractiveness of Japanese government bonds (JGB) rises, potentially pushing U.S. Treasury yields and global dollar financing costs upward, exerting pressure on risk assets.

Currently, most major central banks are in a rate-cutting cycle, while the BOJ's rate hike creates a policy divergence. This contrast can easily trigger the unwinding of arbitrage trades, and the highly leveraged, 24-hour trading characteristics of the cryptocurrency market are likely to feel the liquidity shock first.

Macro analysts have warned that if the BOJ raises rates on December 19, Bitcoin may face the risk of retracing to $70,000. Historical data shows that after the last three rate hikes, Bitcoin experienced significant corrections, typically falling 20%-30% within 4-6 weeks. For example, it dropped 23% in March 2024, 26% in July, and 31% in January 2025, with the market previously highly concerned that this rate hike would repeat this historical pattern.

Warners believe that the BOJ's rate hike remains one of the biggest variables in current asset pricing, and its role in global capital markets is underestimated, with a policy shift potentially triggering widespread deleveraging effects.

On the other hand, neutral views argue that simply attributing historical declines to the BOJ's rate hikes is overly simplistic, and the expectations for this rate hike have been extremely sufficient (the cryptocurrency market has already adjusted in advance since last week), with most panic sentiment already priced in. Analysts state that the market fears uncertainty more than the tightening itself.

It is worth mentioning that, according to Bloomberg, the BOJ is expected to begin the gradual liquidation of ETF assets as early as January 2026. As of the end of September, its ETF holdings were valued at approximately 83 trillion yen. If multiple rate hikes occur in 2026, bond sell-offs may accelerate, and the continued unwinding of yen carry trades could trigger sell-offs in risk assets and yen repatriation, having a profound impact on the stock market and cryptocurrencies.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。