Very important‼️ Highly recommended reading‼️ What is the OECD's CARF? What is the difference between CARF and CRS, and what is CRS 2.0? What impact does it have on those holding cryptocurrencies?

An article to help you understand CARF

First, let's talk about the concept: CARF (Crypto-Asset Reporting Framework) is a set of cross-border tax automatic exchange framework for crypto assets launched by the OECD (Organisation for Economic Co-operation and Development) in 2022.

What is this? The goal of CARF is singular: to enable tax authorities in various countries to automatically grasp the transaction and holding data of residents' crypto assets.

In simpler terms, CARF's system is the CRS for the cryptocurrency field. Recently, we have discussed CRS extensively, and everyone already knows that the CRS system involves the submission of data on tax residents from different countries by brokers and banks, while CARF is the cryptocurrency version of CRS.

Now, we mentioned that the data submitters for CRS are brokers and banks, so who are the data submitters for CARF? You, being clever, have probably already guessed it right.

The reporting entities for CARF are RCASP (Reporting Crypto-Asset Service Providers), which include but are not limited to:

Centralized exchanges

Market makers (brokers)

Custodians

Non-custodial platforms that provide trading matching or exchange services.

Among these, the most concerning data submitters are cryptocurrency exchanges, especially compliant cryptocurrency exchanges, which must provide all information about users trading on their platform. To expand a bit, if the data submitted under CRS is primarily based on balances, the data submitted under CARF is almost all transactions!!

What does "almost all transactions" mean? It means literally that all transaction-related actions you take on the exchange will be submitted as part of CARF data. And transactions do not only refer to buying and selling between cryptocurrencies, such as buying $BTC with USDT or selling Bitcoin for USDT; it also includes exchanging USDT for CNY, HKD, or USD, and vice versa.

Do you understand? In other words, both buying and selling actions and OTC fiat actions are considered transactions, and all these transactions will be submitted. Moreover, information about transfers will also be submitted, whether you are transferring from the exchange to the blockchain, from the blockchain to the exchange, or transferring between exchanges; all these transfer data will be submitted.

(CARF will require exchanges to record transfer information related to external wallets and provide traceable evidence to tax authorities when necessary.)

But that's not all; the OECD has extended the concept of transfers to include staking and lending, and even liquidity mining, IPOs, and interest-earning activities within exchanges are considered transactions or transfers that need to be reported. (Of course, there are some very strict exemption conditions, but they do not apply to the vast majority of people, so I won't go into detail.)

Now, to summarize a bit, in simpler terms:

Apart from account balances, almost all actions involving changes in balances will be submitted in an aggregated form.

The OECD has included many seemingly financial actions within the reportable scope, such as staking rewards, lending interest, and platform financial products, which may be classified as reportable income, transfers, or exchange events, depending on whether the platform participates as an RCASP and can identify the consideration relationship.

These actions are considered relevant transactions for tracking potential tax events. The report targets reporting users for annual aggregated data (not detailed transaction specifics). The data includes almost all actions that directly affect "balance" changes, excluding the balance itself.

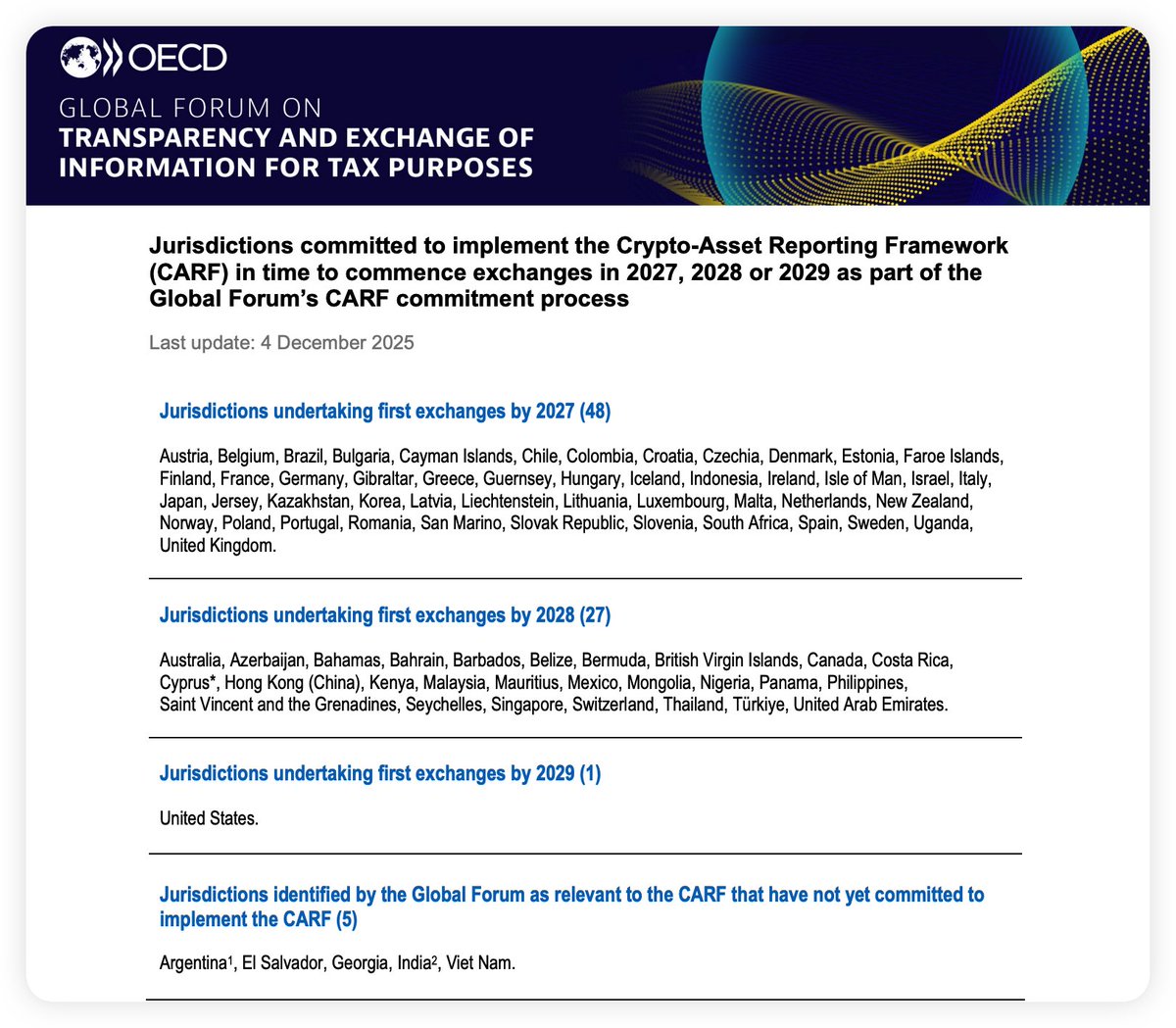

The intensity of this report is incomparable to CRS; it can be said that this data is a weapon for increasing tax revenue for any country that collects capital gains tax, provided that the country has joined the OECD. I guess everyone is anxious to know whether China is on the list. I have screenshots of all the lists, and China is not currently on the list, but Hong Kong, China is on the list for 2028.

(The year of the list is the year of submission, and often data needs to be prepared a year in advance; for example, countries submitting data in 2027 will start recording in 2026.)

So, does this mean that Chinese residents will not be reported?

Yes, China is not on the first batch of exchange lists (whether CARF information exchange will occur with China depends on whether China chooses to participate and establish exchange relationships with relevant jurisdictions), meaning CARF data will not be automatically exchanged with Chinese tax authorities through the CARF mechanism. However, exchanges may still report to their local tax authorities and retain traceable records.

So, if you are purely a Chinese tax resident registered with an exchange using a Chinese passport or ID, you will not be submitted to the CARF system.

Does this mean that Chinese residents can rest easy? Not necessarily. Although CARF data is not submitted to Chinese tax authorities, exchanges are required to report on-chain data as part of KYC for personal information collection. Even if China has not joined, data may flow back indirectly through FATCA or CRS, and it cannot be ruled out that mainland China may indirectly participate in CARF through Hong Kong.

Moreover, CRS 2.0 may soon begin to be implemented. CRS 2.0 is a digital upgrade of CRS, focusing on formally including custodial crypto assets, electronic money, and digital financial accounts into the global tax automatic exchange system. (There is too much content; I will write separately in a few days.)

In other words, 2.0 has upgraded to include cryptocurrency content. In simpler terms, exchanges will start implementing the submission of both CRS 2.0 and CARF data from 2026. The data required for CRS 2.0 includes balances (custodial) within exchanges, total interest from custodial accounts, other income, total gains from sales or redemptions (including crypto holdings, transfers, exchange income), total interest from deposit accounts, etc.

So, there is no way around it. Overall, whether it is CRS 2.0 or the submission of CARF documents, for any cryptocurrency user in a country that collects capital gains tax, it is almost 100% exposed. Of course, unless all your operations are on-chain and do not go through centralized exchanges, including OTC.

Now thinking about it, this might be the trend for the development of DEX and Perp DEX; at least currently, "decentralized" protocols can be exempt.

However, if the protocol has any entity, such as a development team, DAO governors, or front-end custodians exercising control (such as holding upgrade keys, managing smart contracts, operating AMM or front-end interfaces), it may be considered a reporting entity (RCASP for CARF or RFI for CRS) and must fulfill due diligence and reporting obligations. Purely decentralized protocols with no single controlling party may currently not trigger reporting.

Is there anything else to say? Yes, if a partner's exchange registration is under a company, data will also be submitted based on the company's registered location. For example, if the registered location is Singapore, then CARF will be submitted to the tax authorities in Singapore.

(Company accounts will also be subject to due diligence and reported according to their tax resident jurisdiction, and may involve information requirements for controlled persons or ultimate beneficiaries, depending on local implementation rules.)

PS:

On a global level: The OECD has completed CRS 2.0 and released the 2025 consolidated text, while also launching CARF. Many jurisdictions plan to apply the revised guidelines starting in 2026 and will make the first submission and exchange of 2026 data in 2027; XML Schema v3.0 will be widely required starting in 2027.

On the Chinese level: China has had CRS running for many years. As for when CRS 2.0 will be incorporated into domestic law and whether and when CARF will be implemented, it will still depend on the official domestic rules released by the State Taxation Administration and other competent authorities.

@bitget VIP, lower rates, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。