Author: zhou, ChainCatcher

The cryptocurrency wallet market in 2025 is witnessing a brutal battle for market share.

As the meme coin craze fades, high-frequency trading users are flocking to exchange-based wallets that offer lower fees and stronger incentives. In the face of the closed-loop ecosystem of exchanges, the survival space for independent players is continuously being compressed.

Against this backdrop, Phantom's performance has attracted attention. At the beginning of the year, it raised $150 million, pushing its valuation to $3 billion. Since the fourth quarter, the project has launched its own stablecoin CASH, a prediction market platform, and a crypto debit card, attempting to find new growth points beyond trading.

$3 Billion Valuation: From Solana Origins to Multi-Chain Expansion

Looking back at Phantom's development history, in 2021, the Solana ecosystem had just exploded, and the on-chain infrastructure was still not perfect. Traditional crypto wallets like MetaMask primarily supported Ethereum, lacking compatibility with other chains, resulting in a subpar user experience.

Typically, when creating a wallet, users must manually write down a seed phrase of 12 or 24 words; if lost, the keys will permanently render the assets unrecoverable, which makes many potential users feel that the process is cumbersome and risky.

The three founders of Phantom had previously worked for years at 0x Labs (an Ethereum DeFi infrastructure project). They seized this opportunity and chose to enter from Solana, creating a wallet with a simple interface and intuitive operation. Their core innovation lies in optimizing the backup process: providing various simple methods such as email login, biometrics, and encrypted cloud backup to assist in replacing the manual writing of seed phrases, significantly lowering the entry barrier for newcomers.

In April 2021, the Phantom browser extension was launched, and within months, the user base surpassed one million, becoming the preferred choice for Solana users. According to RootData, in July of the same year, while still in the testing phase, Phantom secured $9 million in Series A funding led by a16z; in January 2022, Paradigm led a $109 million Series B round, bringing its valuation to $1.2 billion; by early 2025, Paradigm and Sequoia led another $150 million round, pushing its valuation to $3 billion.

As the scale expanded, Phantom began its multi-chain expansion, supporting multiple public chains including Ethereum, Polygon, Bitcoin, Base, and Sui, attempting to shed the label of being a "Solana-only wallet." However, Phantom still does not natively support BNB Chain, and users have previously complained that Phantom supports ETH but not BNB Chain, leading to missed airdrop opportunities.

Joys and Concerns in 2025

For Phantom, 2025 is a tale of two extremes: rapid breakthroughs on the user and product front, contrasted with significant erosion of trading volume share by exchange-based wallets.

Specifically, user growth is a bright spot. Phantom's monthly active users grew from 15 million at the beginning of the year to nearly 20 million by the end, with growth rates ranking among the top in independent wallets, especially with noticeable user increases in emerging markets like India and Nigeria.

At the same time, Phantom's custodial asset scale surpassed $25 billion, with peak weekly earnings reaching $44 million, and annual revenue at one point exceeding MetaMask's. Currently, Phantom's cumulative revenue is close to $570 million.

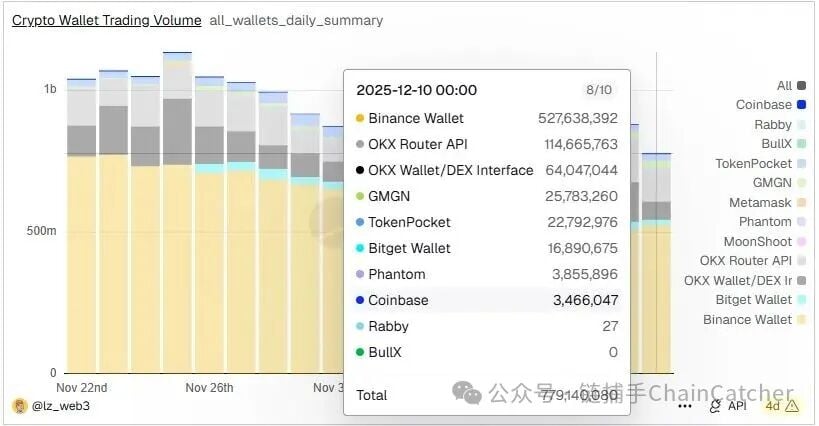

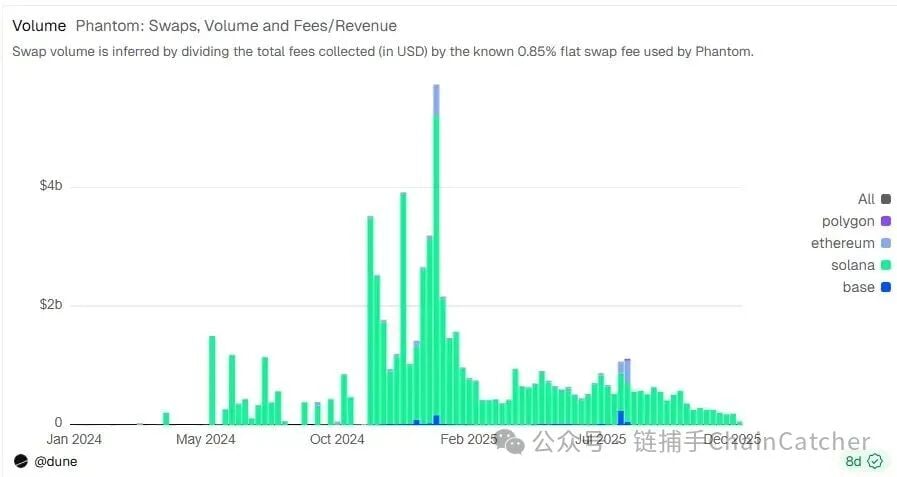

However, concerns on the trading volume side are equally prominent. According to Dune Analytics data, Phantom's share of the embedded swap market across the network fell from nearly 10% at the beginning of the year to 2.3% in May, and further shrank to only 0.5% by the end of the year. Exchange-based wallets, leveraging fee advantages, rapid new listings, and substantial airdrop subsidies, have attracted a large number of high-frequency trading users, with Binance Wallet currently holding nearly 70% of the market and OKX (wallet + routing API) accounting for over 20%.

The market's greater concern for Phantom lies in its deep binding to Solana. Data shows that 97% of Phantom's swap transactions occur on Solana, while Solana's total locked value (TVL) has dropped over 34% from its peak of $13.22 billion on September 14, currently falling to a six-month low of $8.67 billion. This directly drags down Phantom's core trading metrics.

In the face of these pressures, Phantom is betting its resources on new products, attempting to carve out a second growth curve.

On the product front, Phantom has launched a series of differentiated features:

- In July, it integrated Hyperliquid perpetual contracts, driving approximately $1.8 billion in trading volume within just 16 days, generating nearly $930,000 in revenue through a rebate mechanism (builder codes);

- In August, it acquired meme coin monitoring tool Solsniper and NFT data platform SimpleHash, further solidifying its coverage of segmented trading needs.

- The native stablecoin CASH, launched at the end of September, quickly surpassed $100 million in supply, with peak trading exceeding 160,000 transactions in November. Its core competitiveness lies in fee-free P2P transfers and accompanying lending rewards;

- In December, it launched the Phantom Cash debit card in the U.S., allowing users to spend on-chain stablecoins directly and compatible with mainstream mobile payments like Apple Pay and Google Pay;

- On December 12, it announced the launch of a prediction market platform, integrating the Kalshi prediction market within the wallet, which is now open to eligible users;

- It also launched a free SDK "Phantom Connect," allowing users to seamlessly access different web3 applications with the same account, further lowering the onboarding barrier for developers and users.

Among these, the most attention-grabbing are the debit card and the CASH stablecoin, as Phantom attempts to solve the "last mile" problem of cryptocurrency asset consumption.

Phantom CEO Brandon Millman has publicly stated that there will be no token issuance, IPO, or self-built chain in the short term, and all efforts will focus on refining the product to make the wallet a financial tool usable by ordinary people. He believes that the ultimate goal in the wallet space is not who has the largest trading volume, but who brings cryptocurrency into everyday payments first.

However, the "last mile" of cryptocurrency payments is not an easy path, and Phantom is not the first independent non-custodial wallet to launch a debit card.

Prior to this, MetaMask had already partnered with Mastercard, Baanx, and CompoSecure in Q2 2025 to launch the MetaMask Card, supporting real-time conversion of cryptocurrencies to fiat for spending, rolling out in the EU, UK, Latin America, and other regions. MetaMask's card has broader coverage and launched earlier, but is limited by the Ethereum and Linea networks, resulting in higher costs and slower speeds, with user feedback indicating it is "convenient but used infrequently."

In contrast, Phantom's debit card started later and is currently only being rolled out in a limited capacity in the U.S., with actual adoption still to be observed. Theoretically, it may be more competitive in cost-sensitive emerging markets due to Solana's low fee advantage, but in terms of global coverage and merchant acceptance, it still has a significant gap compared to the MetaMask Card.

Regarding stablecoins, if CASH cannot form a sustained network effect, it may follow the path of other wallets' native stablecoins that experienced a "high start and low decline," such as MetaMask's native stablecoin mUSD, which quickly surpassed $100 million in supply after launch but fell to about $25 million in less than two months.

Conclusion

As the meme craze fades, trading volume is no longer a reliable moat, and independent wallets must return to the essence of financial services.

Overall, Phantom integrates Hyperliquid perpetual contracts and the Kalshi prediction market on the trading side to retain advanced users; on the consumption side, it bets on the CASH stablecoin and debit card, attempting to bring on-chain assets into everyday life.

This dual-track drive of "trading derivatives + consumer payments" is Phantom's self-redemption under the pressure of the Matthew effect in the wallet space. It is not only seeking a second growth curve but also defining the ultimate goal of independent wallets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。