1. Preface

Historical market data paints a fragmented picture: in 2024, stablecoins, acting as the on-chain "aorta," facilitated a massive $36.3 trillion in flow, yet they have failed to become a payment tool that penetrates the economic "capillaries"—with an offline penetration rate of less than 6%.

This vast market gap is precisely the opening chapter of Solulu's story. Its ambition is to become the "infrastructure engineer" connecting on-chain value with offline entities. From a "compliance-first" global licensing layout, to the U Card that integrates daily consumption, and the settlement network reshaping cross-border trade, Solulu is systematically "building bridges and paving roads" for the large-scale adoption of stablecoins.

This report will delve into the analysis: Solulu's goal is not to be an all-round "straight-A student," but rather the "dark horse" that precisely breaks through the barriers and ignites the market.

2. Market Overview: The Stablecoin Arena with Both Potential and Chasm

The current stablecoin market shows an unprecedented development trend: on-chain settlement volume has achieved a historic breakthrough, but offline application penetration remains severely insufficient. This pattern of "online prosperity, offline desert" not only reveals the industry's status quo but also points the way forward.

2.1 In-depth Market Analysis: From Trading Pair to Financial Foundation

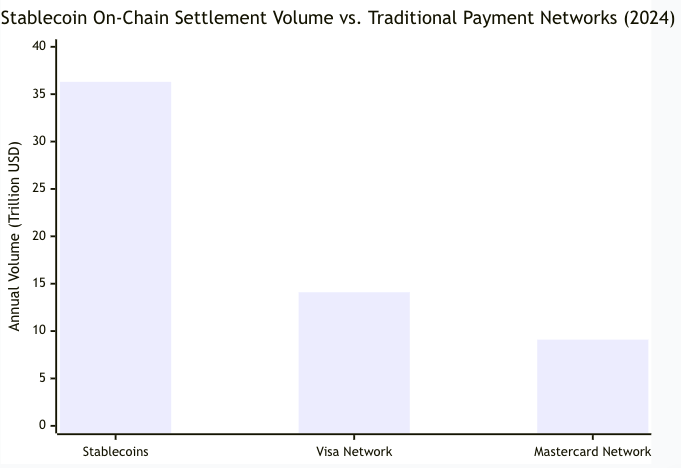

Stablecoins have completed the critical leap from internal trading pairs within the cryptocurrency market to global financial infrastructure. On-chain data from 2024 fully confirms this trend:

Chart Interpretation:

The annual on-chain settlement volume of stablecoins reached $36.3 trillion. This figure not only surpassed the combined annual transaction volume of Visa ($14.1T) and Mastercard ($9.1T) for the first time but, more importantly, reveals the huge potential of stablecoins as a global value transfer layer. It proves that stablecoins have already become a massive throughput settlement network on the blockchain.

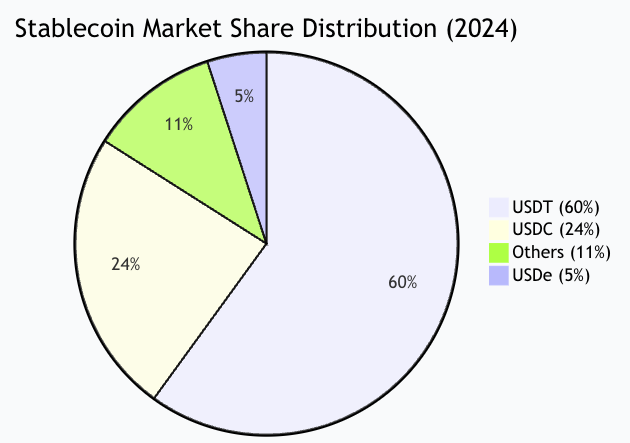

Simultaneously, the stablecoin market landscape exhibits a trend of diversification:

Chart Interpretation:

● USDT, leveraging first-mover advantage and extensive exchange support, occupies approximately 60% of the market share, becoming the market benchmark.

● USDC, with its high transparency and strict regulatory compliance, has won the favor of institutions and compliance-sensitive users, occupying about 24% of the market.

● New generation stablecoins like USDe quickly captured 4%-5% of the market by providing yield through innovative derivative hedging mechanisms without relying on traditional bank account reserves, demonstrating the market's innovative vitality.

2.2 Core Contradiction: On-Chain Giant, Offline Infant

Despite the impressive on-chain data for stablecoins, their performance in the real economy presents a stark contrast. The current penetration rate of stablecoins in offline payment scenarios is estimated to be still below 6% – this means that over 94% of daily consumption scenarios have not yet been touched by this digital asset.

The fragmentation of "online prosperity, offline desert" prompts a deeper investigation into the root causes behind the chasm, focusing on three core contradictions: First, the high barrier to user experience, where professional concepts like private key management, Gas fees, and cross-chain deter ordinary users. Second, the lack of payment channels, missing convenient tools that seamlessly connect on-chain assets with offline merchants. Third, uncertain regulatory environments, where policy ambiguity leads most merchants and users to adopt a wait-and-see attitude.

These profound industry pain points precisely constitute Solulu's core opportunity. A platform capable of systematically solving these problems will undoubtedly hold the key to unlocking the trillion-dollar payment market.

2.3 Policy Inflection Point: From Grey Area to National Strategy

The signing of the US GENIUS Act in July 2025 pressed the "compliance accelerator" for the stablecoin industry, becoming a milestone event in its development history.

The core regulations of this act are clear: Firstly, issuers must be "licensed operators," meaning stablecoins must be issued by financial institutions regulated at the U.S. federal or state level. Secondly, reserve assets emphasize "safety first," limited to high-quality liquid assets such as U.S. dollar cash and short-term U.S. Treasury bonds. Thirdly, regulatory responsibilities achieve "clear division of powers and responsibilities," defining the core roles of the Federal Reserve, the Office of the Comptroller of the Currency, and other agencies in stablecoin regulation.

The significance of this policy shift is particularly far-reaching: stablecoins have completely bid farewell to the "regulatory grey area" and officially entered the core landscape of "national financial strategy," seen as a key tool for maintaining the U.S. dollar's hegemony in the digital age. For Solulu, which has always adhered to the core principle of "compliance first," this policy dividend undoubtedly opens an unprecedented window of development – the clarification of regulation not only removes the biggest industry uncertainty but also grants compliant operators an unreplicable first-mover advantage.

3. Project Analysis: SOLULU – Building the Full-Scenario Ecosystem for Stablecoins

3.1 Vision & Positioning: Becoming the Next-Generation Financial Value Transfer Layer

Solulu's ambition far exceeds being a single-function trading platform. It targets the most core, yet persistently unbridged, chasm in the stablecoin ecosystem – how to truly transition stablecoins from "trading assets" to "practical currency."

Its vision is to build a global default, multi-chain, multi-currency stablecoin financial infrastructure. This positioning means Solulu is not content with being a "supplement" within the existing system; it aims to become the underlying protocol supporting the free flow of value, enabling stablecoins to transmit freely, instantly, and at low cost globally, just like internet information.

The realization of this vision relies on a profound industry insight: the future of stablecoins lies not in higher annualized yields, but in broader application scenarios and a smoother user experience. Solulu's mission is to promote the identity transition of stablecoins – from speculative assets with fluctuating prices on the accounts of a few speculators, to electronic cash freely usable in ordinary people's wallets, and ultimately upgraded into an indispensable compliant payment and settlement tool in corporate financial management.

3.2 Five Business Engines: Constructing Robust Pillars for a Value Closed Loop

To achieve the above vision, Solulu has systematically deployed five core businesses. They are interlinked, forming a self-reinforcing ecological closed loop:

3.2.1 Exchange Engine (Ecological Entry Point & Liquidity Cornerstone)

This is not only the traffic starting point of the ecosystem but also aspires to become the core hub of global stablecoin liquidity. Its core advantages lie in:

● Multi-Chain & Multi-Currency Support: Supports versions of mainstream stablecoins like USDT, USDC on mainstream public chains such as Ethereum, BNB Chain, Solana, and plans to expand to non-USD stablecoins like Euro-pegged and offshore RMB-pegged stablecoins, truly achieving "one platform, global assets."

● Deep Aggregated Liquidity: Through partnerships with top market makers and a built-in intelligent routing system, when a user initiates a swap, it automatically finds the best price across multiple DEXs and liquidity pools, ensuring minimal slippage for large transactions and saving users every penny.

3.2.2 Payment Engine (Key Lever for Integrating Real-World Consumption)

This is the most intuitive manifestation of realizing the "Payment Freedom" vision, with its core product being the virtual and physical U Card:

● Global Consumption Without Barriers: Deeply integrated with the global Visa and Mastercard networks, users can spend directly at millions of online and offline merchants worldwide after card issuance. The system automatically converts stablecoins into local fiat currency at real-time exchange rates, achieving "seamless payment" and completely hiding the complexity of blockchain technology.

● Ultimate Security & Convenience: Supports advanced security features like single-use card numbers, spending limit management, instant freeze/unfreeze, combined with facial recognition registration, finding the optimal balance between convenience and security.

3.2.3 Trade Engine (Strategic High Ground for Conquering B2B Applications)

Solulu keenly captures the pain points of the trillion-dollar international trade market, launching a next-generation settlement network based on stablecoins:

● Revolutionary Efficiency Improvement: Shortens the 3-7 days required by traditional letters of credit and wire transfers to within 24 hours, reducing fees accounting for 1%-3% of the total transaction value to fixed network costs of tens of dollars.

● Smart Contract Empowerment & Trust: Through partnerships with platforms like the Web3 e-commerce platform Caviar, develops "Trade Smart Contract" templates. Funds can be locked and automatically released upon fulfillment of conditions like bill of lading receipt, with all key nodes recorded on-chain, significantly reducing disputes and enhancing transparency.

3.2.4 Social Engine (Building a Moat with High-Frequency Stickiness)

Solulu Chat is not a simple functional addition but a scenario revolution, aiming to seamlessly embed payment into the highest-frequency human social behavior:

● Financial-Grade Social Experience: Integrates end-to-end encrypted communication, supports stablecoin red packets, group wallets, and one-click payment requests, realizing "pay while chatting."

● Opening New Business Channels: Provides merchants with an immersive "chat-and-buy" sales closed loop, combining customer service consultation with payment completion, greatly improving conversion rates. This is not just functional innovation but also a core barrier for building user stickiness and viral spread.

3.2.5 Incentive Engine (Growth Flywheel Driving Ecological Cold Start)

The innovative Liquidity Program is the "fuel system" of the ecosystem, cleverly binding user interests deeply with platform development:

● Value Contribution Equals Earnings: Users become "Liquidity Contributors" by staking stablecoins, receiving market-competitive base income and "Arbitrage Quota" for purchasing SOLU at a discount.

● Sustainable Community Incentives: Combined with multi-level referral rewards, it quickly builds the initial user and liquidity network, forming a positive cycle of "more users -> higher liquidity -> better user experience -> attract more users."

3.3 Ecological Value Core: The Dual-Spiral Value System of the SOLU Token

The SOLU token serves as the "economic lifeblood" circulating throughout the entire Solulu ecosystem, with its value propelled by a dual-spiral engine of "Rigid Demand" and "Powerful Deflation".

3.3.1 Token Basic Information

● Name: Solulu Token

● Ticker: SOLU

● Total Supply: 1 Billion tokens

● Initial Issuance Chain: BNB Chain (BEP-20)

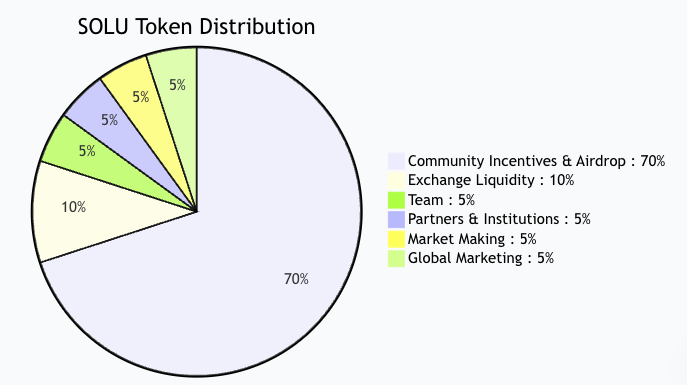

● Token Distribution:

The allocation mechanism of the SOLU token is meticulously designed with clear strategic intent:

● 70% Global Promotion Incentives & Airdrops highlight the "community-first" core principle, aiming to rapidly build a user network through large-scale ecological incentives, transforming early participants into ecological co-builders and forming a powerful growth flywheel.

● 20% Liquidity & Market Allocation (Exchange Liquidity 10%, Market Makers 5%, Global Marketing 5%) jointly ensure post-listing trading depth and market stability, laying a solid foundation for the ecosystem's healthy development.

● 10% Core Contributor Allocation (Team & Institutions/Strategic Partners 5% each) are both subject to long-term lock-up and linear release mechanisms, ensuring the project's core forces are deeply bound to the long-term interests of ecological development, demonstrating the team's firm confidence in the project's future.

3.3.2 Rigid Demand: Deeply Embedded in the Ecological Value Flow

SOLU is a fundamental asset, seamlessly integrated as an integral component of every core platform operation:

● Payment & Discounts: Using SOLU to pay platform handling fees (swaps, card transactions, etc.) will enjoy significant discounts, creating sustained and rigid buying demand.

● Governance & Rights: As the platform evolves, SOLU will develop into a governance token, granting holders the right to vote on key decisions like fee adjustments and treasury usage, giving the community real ownership.

● Staking & Revenue Sharing: Users staking SOLU can share platform revenue. Future high-tier privileges (e.g., advanced U Cards, API limits) may also require staking SOLU.

3.3.3 Powerful Deflation: Building a Clear Value Appreciation Path

To combat inflation and drive long-term value growth, Solulu has designed a very decisive deflationary mechanism:

● Revenue Buyback & Burn: The platform will use a portion of its handling fee revenue (e.g., 30%) to periodically buy back and burn SOLU on the open market.

● Full Burn of Ecological Taxes: All transaction "taxes" generated within the Liquidity Program will be 100% used to buy back and burn SOLU.

● Clear Scarcity Target: Solulu has set a clear long-term goal – through continuous burning, ultimately reduce the total circulating supply of SOLU from 1 billion to 210 million tokens. This commitment provides long-term holders with a clear value expectation.

Through the combination of "application scenarios creating demand, deflation mechanisms ensuring scarcity," the SOLU economic model forms a powerful value closed loop: the more prosperous the ecosystem, the more revenue, the greater the burn intensity, the scarcer the token, thereby attracting more people to hold and use it, ultimately driving the entire Solulu ecosystem's continuous upward development.

4. Core Advantages & Potential Risks

4.1 Triple Moat

Facing the fierce competition and complex challenges in the stablecoin track, Solulu is systematically building three formidable moats to defend its long-term value and competitive barriers.

The first moat is the proactive compliance barrier. While most projects in the industry were still taking a wait-and-see approach towards regulation, Solulu has already taken the lead in obtaining the US MSB license and is actively pursuing regulatory qualifications in key markets like the New York State MTL and UAE VARA. This "compliance-first" strategic layout allows it to seize a valuable first-mover advantage in the wave of tightening global regulation, turning compliance from a common industry challenge into its most solid trust cornerstone.

The deeper moat lies in the synergistic effect of the business ecosystem. Solulu is not a single-function tool but a full-stack platform integrating asset exchange, daily payment, cross-border trade, and social finance. Its business modules form a powerful "1+1>2" synergy: the Exchange Engine provides a stable liquidity entry point for payment and trade; the U Card payment connects the last mile between on-chain assets and real-world consumption; Social Finance creates high-frequency interactive user sticky scenarios. This ecological design significantly increases user switching costs, building a competitive barrier far superior to single-function products.

The third moat is the solid technical foundation supporting the ecosystem's operation. The platform adopts a microservices architecture and multi-chain compatibility technology, enabling it to calmly handle high-concurrency transaction requests, ensure high system availability, and possess outstanding future-oriented scalability – ensuring the entire ecosystem can smoothly evolve with market demand iterations and technological innovations, maintaining leading service capabilities in the industry.

4.2 Risks & Challenges

Despite Solulu's considerable prospects demonstrated by its multiple moats, its development path must still overcome challenges in several key areas. These challenges, though difficult, precisely point to the core battlefields that must be conquered for stablecoin adoption and conceal opportunities to convert advantages into victories.

The first challenge is establishing a differentiated advantage in a competitive red ocean. The current track is crowded with crypto-native payment tools like Binance Pay and BitPay occupying market share with first-mover advantages, as well as traditional financial giants and tech companies eyeing the space with their mature ecosystems. This competitive landscape actually confirms the track's core value, and Solulu's key to breaking through lies precisely in its unique positioning as a "full-stack ecosystem" – through the synergistic effects of its asset exchange, payment, trade, and social businesses, it carves out a differentiated development path in homogeneous competition, upgrading the battle from single payment tools to a contest of ecosystem capabilities.

The second is the challenge of strategic balance in global compliance layout. The progress of obtaining key market licenses like New York MTL, UAE VARA, and Singapore MAS will indeed directly impact the pace of globalization, but this highlights the foresight of Solulu's "compliance-first" strategy. The platform is not passively responding to regulation but proactively turning compliance layout from a potential risk point into a core competitiveness – by establishing clear regulatory qualifications in key markets, it sets a trust benchmark in the global digital asset payment field. This strategy of "building trust through compliance" can instead form an unreplicable barrier in the long-term competition.

Ultimately, everything hinges on the long-term endeavor of cultivating new user habits and driving market education. Transforming stablecoins from trading assets into daily payment tools indeed requires changing users' deeply ingrained financial behaviors, involving high education costs and slow conversion cycles. Nevertheless, excelling in this area will forge Solulu's most enduring competitive advantage. Once user education is accomplished through the U Card's ease of use and wide payment adoption, cementing the concept of "stablecoin as a payment tool" in the public's mind, it will create a nearly insurmountable lead and deep user stickiness. A competitive barrier built on user habits is fundamentally stronger than one reliant on short-term marketing efforts.

5. Conclusion & Outlook

The emergence of Solulu precisely positions itself at the historic opportunity for stablecoins to transition from "financial assets" to "practical tools." Its strategic vision of full-scenario coverage, pragmatic attitude of compliance-first, and the "five-in-one" ecological structure collectively constitute its unique potential as a dark horse in the race.

However, its path to becoming an industry benchmark is paved through the process of addressing core challenges. The currently visible competitive red ocean, compliance barriers, and user education difficulties, while not insignificant challenges, also accurately outline the commanding heights Solulu can occupy if it breaks through – establishing differentiation through its full-stack ecosystem in competition, building trust barriers through its first-mover advantage in compliance, and cultivating user loyalty through ultimate experiences in education. These three challenges precisely point the necessary path for Solulu to transition from a dark horse to a leader, and are the precise targets of its strategic layout.

In this emerging field where blueprint and execution are equally important, Solulu has already demonstrated a remarkable start with its clear path to breakthrough. The next 12-24 months will be a critical window to verify its execution capability: user growth curves, key license approvals, and TVL health will become the core metrics measuring its quality as a dark horse.

The stablecoin market is currently on the eve of an explosion. With its unique ecological approach and clear breakthrough path, Solulu has already secured a favorable position on the track of this payment revolution. How this dark horse transforms challenges into opportunities is worth the market's close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。