Author: SoSoValue

The winter of 2025 is colder than in previous years, not just in terms of temperature, but also in the sharp decline of the perceived temperature in the crypto market.

If you only look at the news, it seems bustling: Bitcoin is repeatedly hitting new highs with the support of Wall Street, the scale of ETFs is skyrocketing, and the regulatory stance of various governments seems to be warming up. The U.S. President's pardon for CZ even became a hot topic in global political news.

However, when you shift your gaze from Bitcoin to the broader "altcoin territory," you will feel a suffocating silence. The once certain feeling of "getting rich as long as you're in the game" has vanished, replaced by the confusion of dwindling account balances in silence.

This is not an ordinary bull-bear cycle, but rather the crypto industry's delayed "coming of age." Over the long two years from 2024 to 2025, the market underwent a brutal deception elimination: the bubble was burst by the regular army, and the old myths of wealth creation were thoroughly debunked.

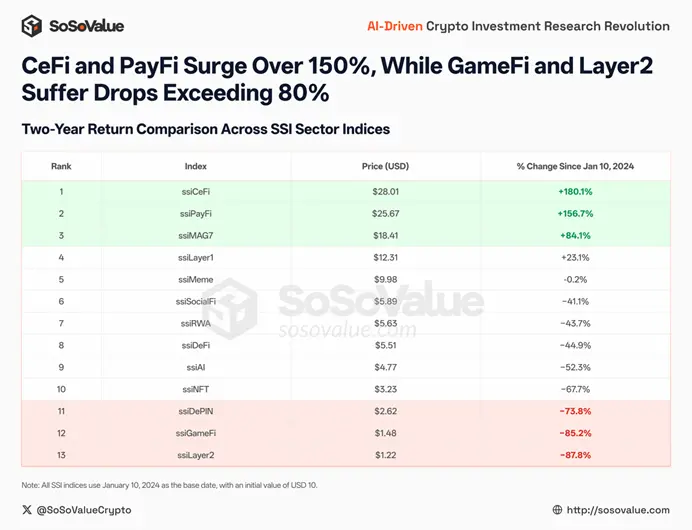

To see the truth, we conducted a simple and crude experiment at the beginning of 2024: assuming that in January 2024, you invested $10 in various sectors (L2, Meme, DeFi, etc.), what would happen by the end of 2025?

Two years later, the answer is clear: starting from the same $10, some have turned into $28, while others are left with only $1.2.

Figure 1: The SSI crypto index shows extreme differentiation in two-year returns: CeFi and PayFi increased by over 150%, while GameFi and Layer2 retracted by over 80% (Data source: SoSoValue)

Why is this happening? Because once that door opened, the crypto world began to split.

1. The Walls Are Up: The "Asset Boundaries" of the ETF Era

“Capital is no longer a blind flow of water; it is capital strictly constrained by pipelines.”

To understand the current market, we must return to January 10, 2024: the U.S. SEC approved the listing and trading of spot Bitcoin ETFs on that date.

At that moment, the cheers masked a harsh reality: funds were "isolated."

Before the ETF era, the flow of funds in the crypto market resembled a "waterfall" flowing downstream. Funds entered through the "fiat-stablecoin-exchange" channel, all within the same native crypto account system. When Bitcoin's rise brought about a "wealth effect," funds could seamlessly slide into riskier Ethereum and then spill over into altcoins, forming a classic "sector rotation."

ETFs changed this transmission chain. Traditional funds can now hold crypto exposure in brokerage accounts, with the underlying corresponding to continuous purchases and custody of spot Bitcoin; but its trading, risk, and compliance boundaries are encapsulated within the product structure, and funds remain more in a compliant closed loop of "buy-hold-rebalance," making it difficult to naturally convert into a redistribution demand for exchanges-stablecoins-on-chain risk assets. The result is that Bitcoin has gained a more stable marginal buyer, while the old cycle of "Bitcoin profits spilling over and driving altcoin seasons" has clearly failed in this round.

1.1 Specialization Within the Walls: ETFs Established a Harsh "Asset Boundary"

The approval of the spot BTC ETF in 2024 means that traditional financial funds have officially entered the crypto market; but it also established a clear "configurable asset boundary": only a very few assets can obtain a pass to enter the walls.

By 2025, the institutionalization of this wall has further strengthened. On September 18, 2025, the SEC approved a universal listing standard for exchanges to adopt "Commodity-Based Trust Shares" to simplify the listing process for eligible commodity/digital asset ETPs.

Note: This does not mean "all coins can have ETFs," but rather clarifies the "categories that can enter the walls" as financial products that can be standardized for listing—the boundaries are clearer.

Even with a pass, the voting of funds is extremely "specialized": Wall Street's money mainly recognizes BTC, reluctantly allocates ETH, and for other targets, it mostly takes tentative positions.

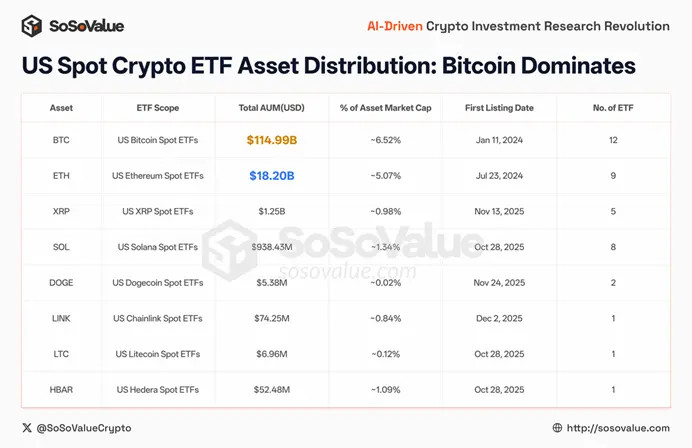

SoSoValue ETF dashboard data reveals this specialization:

- BTC: The total net asset value of ETFs is about $115 billion, becoming the absolute "macro asset" in compliant channels.

- ETH: The total net asset value of ETFs is about $18.2 billion, having a place but significantly lagging in scale.

- When assets like SOL, XRP, and DOGE gradually enter tradable compliant containers in 2025, the data remains cold: entering the "configurable asset pool" does not automatically equate to a "fund tsunami." The logic of funds within the walls is not about "narratives," but rather "risk weights."

Figure 2: Clear preferences of compliant funds: Bitcoin dominates, while other assets have not received significant allocations in U.S. spot crypto ETF asset distribution, data source: SoSoValue)

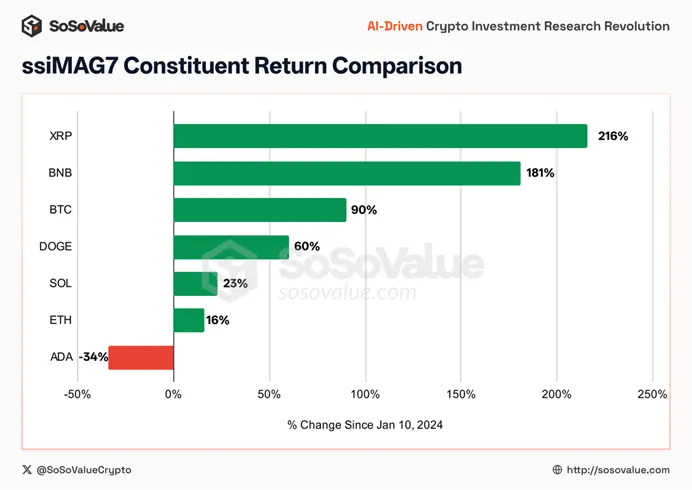

Looking further at the ssiMAG7 index (the top 7 cryptocurrencies), although the index closed at $18.4, up 84%, if you look closely, it does not reflect a broad market rally, but rather conceals a deep structural differentiation:

- Specific catalysts driving: XRP (+216%) and BNB (+181%) recorded significant excess returns, greatly outperforming BTC (+90%). The former benefited from the elimination of regulatory uncertainties, while the latter relied on monopolistic market share. Assets with clear "compliance" or "business barriers" have become the core driving force behind the index's upward movement.

- Market base established (compliant funds dominate): BTC (+90%) acted as the "stabilizing force." As the absolute core of compliant funds, it established the "passing line" for this bull market. Although its explosive power is not as strong as XRP/BNB, as the core occupying 32% of the index's weight, it represents the foundational level of the entire market.

- Technical asset premiums fading: Once regarded as the "duopoly of public chains," SOL (+23%) and ETH (+16%) performed mediocrely over the two-year period, barely outpacing risk-free rates; the veteran public chain ADA (-34%) even recorded negative returns.

Figure 3: MAG7 component return rates are extremely differentiated: compliant and monopolistic assets significantly outperform, while public chain narratives lose excess returns (data source: SoSoValue)

This differentiation breaks the past market convention of "blue-chip broad gains." This round of the bull market is not a simple beta (Beta) rally, but a brutal "structural selection": funds exhibit extreme selectivity, concentrating on assets with compliance certainty, market monopoly positions, or macro attributes, while public chain assets that solely rely on "ecological narratives" are losing the support of high valuations.

This is particularly evident in the performance of the ssiLayer1 index ($12.30, up 23%). Excluding the pull effect of BNB, ETH, which occupies more than half of the weight, has actually dragged down the sector's performance. Data indicates that the alpha returns of the infrastructure sector have significantly converged, and the simple "infrastructure expansion" logic can no longer obtain excess premiums in the capital market.

This reveals a cold reality: the allocation logic of institutional funds is no longer "sprinkling pepper," but rather exhibiting extreme "selective admission."

Moreover, the funds within the crypto walls also show a high degree of consistency: they heavily allocate to core assets with compliance certainty or monopolistic barriers (such as BTC, BNB, XRP), while maintaining only "defensive allocations" for public chains that solely rely on "technical narratives" (ETH, SOL). As for those long-tail assets (the vast majority of altcoins outside the walls) that haven't even obtained this "logical entry ticket," they face systematic liquidity exhaustion.

2. The "Shadow Game" in U.S. Stocks: Fire Inside the Walls, Ice Outside

If ETFs have siphoned off stable allocation funds, then "crypto concept stocks" in U.S. stocks have drained active risk capital.

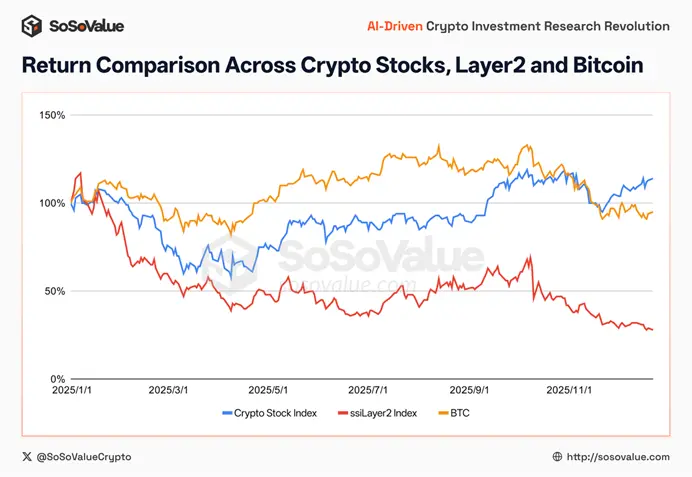

A phenomenon has emerged that leaves seasoned crypto investors feeling extremely disconnected: Why is the crypto sector on Nasdaq so hot, while the on-chain world is freezing cold?

Figure 4: Risk capital flows to U.S. stocks: crypto concept stocks strengthen, while on-chain assets like Layer2 continue to bleed (data source: SoSoValue)

The answer lies in the substitution effect: Wall Street has turned "crypto trading" into a shadow game of "codes (Tickers)." Funds complete speculation within the closed loop of USD → Nasdaq, rather than flowing into the on-chain ecosystem.

2.1 The Directional Siphon of "Digital Asset Treasury (DATs)": Only Sucking BTC, Not Overflowing to Downstream

Represented by MicroStrategy (MSTR), publicly traded companies have woven a narrative of "Bitcoinization of balance sheets." For retail investors, buying MSTR is akin to buying a "leveraged Bitcoin option." This money indeed becomes purchasing power on-chain, but it is an extremely exclusive purchasing power. Every penny MSTR raises in U.S. stocks precisely flows into Bitcoin (BTC). This mechanism acts like a huge "one-way pump," continuously pushing up Bitcoin's one-sided market while completely cutting off the possibility of funds overflowing downstream (L2, DeFi).

The outcome for imitators is even harsher: when more companies attempt to replicate the "MicroStrategy myth" by putting ETH/SOL into their treasuries, U.S. stocks often respond coldly: the market votes with its feet, proving that in Wall Street's eyes, the only assets that can be written into balance sheets as "digital gold" are still mainly BTC and ETH, while most altcoins' DATs are more about announcing a massive financing plan, with the stock market transferring to the crypto market, using information asymmetry to have a bunch of KOLs describe an impossible financing amount as an imminent altcoin buying wave, providing an opportunity to offload.

Figure 5: Comparison of market capitalization and mNAV of publicly traded crypto asset reserve companies (data source: SoSoValue)

2.2 Circle (CRCL) Compliance Carnival and Discrepancy: The Excitement Remains on Nasdaq

The listing of Circle reflects the strong demand from traditional funds for "compliant crypto exposure." Public trading data shows that CRCL reached a peak of $298.99 in June 2025, corresponding to a market capitalization of $70.5 billion.

Figure 6: Circle's market capitalization exceeded $70 billion at the beginning of its listing (Data source: SoSoValue)

This indicates that Wall Street indeed craves a "compliant stablecoin narrative." However, the subsequent sharp decline (shareholder sell-offs) and high turnover also indicate that the market treats it as a trading chip in U.S. stocks, rather than transporting this hot money into on-chain PayFi protocols.

Similarly, assets like Coinbase (COIN) are often assigned a "scarcity premium": because in the U.S. stock market, it is one of the few absolutely compliant "crypto exposure containers" available for purchase.

Whether it is ETFs or DATs/token stocks, they form two massive "breakwaters." Funds circulate in a closed loop of USD -> Nasdaq -> BTC.

The hotter the U.S. stock market, the more aggressive the unilateral accumulation of BTC becomes, while other on-chain ecosystems (Alts) resemble a forgotten wasteland—people on the shore watch the "big fish" Bitcoin revel, but no one is willing to jump into the water to feed the smaller fish.

3. The Collapse of Old Narratives and the Twilight of "VC Coins"

“When the tide goes out, we find that not only speculators are swimming naked, but also the infrastructure of grand narratives.”

If Nasdaq's "crypto shadow stocks" are enjoying a liquidity feast, then the collapse of the on-chain "infrastructure" sector is a silent disaster caused by a lack of water.

In the past two cycles, the most profitable business model in the crypto market has been "VC grouping—technical narrative—high valuation financing—issuing tokens on exchanges." This was also the foundation of the prosperity of Layer 2, GameFi, and NFTs. However, the SoSoValue SSI index has declared the bankruptcy of this model with a set of cold data.

3.1 Naked Humiliation: The Value Regression of Layer 2

Let’s first look at a shocking set of data (using January 2024 as a $10 benchmark):

- ssiLayer2 index: $1.22 (approximately 87% drop);

- ssiGameFi index: $1.47 (approximately 85% drop);

- ssiNFT index: $3.2 (approximately 68% drop).

Figure 7: Layer 2, GameFi, and NFT have retracted 68%–88% over two years, with narrative-driven sectors collectively failing.

In two years, dropping from $10 to $1.2 means that if you believed the narrative of "Ethereum's Layer 2 network explosion" in early 2024 and held on until now, your assets are nearly worthless.

Why?

Most of these projects launched with extremely high FDV (Fully Diluted Valuation) but had very low initial circulation. Between 2024 and 2025, a massive amount of tokens unlocked like the sword of Damocles hanging over their heads. Every day, millions of dollars' worth of tokens were released from VCs and teams, thrown into the secondary market.

Against the backdrop of a lack of incremental funds, these tokens ceased to be "stocks" and became "liabilities." Crypto "investors" finally woke up: they were not buying into a future technological ecosystem, but rather paying for the liquidity to exit the primary market.

The $1.22 of the ssiLayer2 index is the most ruthless pricing of "infrastructure with only supply and no demand." To what extent has this oversupply reached? According to L2BEAT data, as of 2025, there are over 100 active Layer 2 networks in the market. Excluding a few leading projects, the remaining 90+ chains resemble desolate ghost towns, yet still carry hundreds of billions in diluted valuations.

It marks the complete loss of market trust in the VC-led "low circulation, high valuation" harvesting model.

4. The Illusion of Meme: A Safe Haven or a Meat Grinder?

“People escaped from the complex scythe, only to jump into a bloodier arena.”

Against the backdrop of the VC coin collapse, Meme coins seem to have become the only bright spot in 2024–2025. Amid the shouts from countless communities, Memes are portrayed as the "people's asset" against Wall Street and VCs.

The SoSoValue SSI Meme index reading at the end of 2025 appears to confirm this: $9.98.

Figure 8: From January to December 2024, the ssiMeme index increased by over 350%, but fell nearly 80% from its peak, returning to its original point. (Data source: SoSoValue)

It seems to be the only sector that "outperformed" altcoins and preserved capital over the two-year period. But don’t be fooled. Behind this $9.98 lies the harsh truth of the most brutal game of this cycle.

4.1 Survivorship Bias and 80% Retracement

If we delve into the data, we find that the ssiMeme index has retracted nearly 80% from its peak.

What does this mean?

It means that the "prosperity" of the Meme sector was mainly concentrated in the first half of 2024. At that time, funds, out of disdain for VC coins, surged into the fully circulating Meme market, pushing up the index. However, by 2025, the story changed.

With the political Meme craze sparked by Trump and the proliferation of tokens from various celebrity politicians, the Meme market quickly devolved from a "resistance zone" into the most efficient "harvester."

4.2 The Siphon of Politics and Celebrities

In January 2025, political Memes became the market focus. This was no longer a spontaneous celebration of community culture, but a direct monetization using political influence and attention. Public reports indicate that the chip structure of many such tokens is highly concentrated, with price fluctuations entirely dependent on a single political event or tweet.

Meanwhile, celebrity token launches have compressed the "Pump and Dump" rhythm to the extreme. Funds entering the market are no longer for long-term holding but for completing trades within hours or even minutes.

The "capital-preserving" $9.98 of the ssiMeme index is filled by the losses of countless entrants at the 2025 highs. It reveals a structural dilemma: Meme is not a value asset; it is a "suboptimal container" during periods of limited liquidity.

When the market has no better options, funds choose Memes for their simpler rules (fully circulating) and clearer outcomes (no lock-up). But when sentiment recedes, Memes lacking fundamental support will drop harder than any asset. For most latecomer retail investors, this remains a dead end.

5. The Shadow of Giants: Systemic Importance and Responsibility Vacuum

“They have the power of a shadow central bank, yet still want to retain the freedom of pirates.”

If the fluctuations in asset prices are the market's self-regulation, then the frequent systemic shocks in 2025 expose the extreme fragility of the industry's infrastructure. This year, the crypto market experienced multiple chain liquidations triggered by macro fluctuations (such as trade war panic and geopolitical friction). Under pressure testing, the three giants of trading, payment, and settlement (Binance, Tether, Tron) still stand tall, but hidden worries have turned from rumors into evidence.

5.1 The Casino Took All the Money on the Table

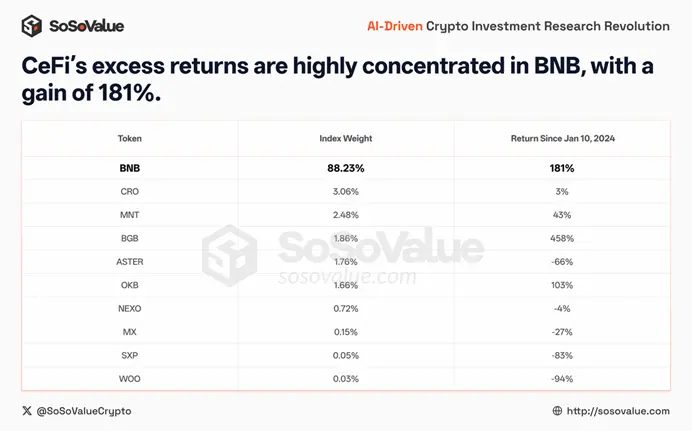

Among all indices, only the CeFi (Centralized Finance) index surged to $28. Does this mean that the exchange technology is impressive and the service is good? Wrong. If you look at the constituent stocks, BNB accounts for 88% of the weight. The truth is harsh: this $28 is a confirmation of "channel monopoly." In the gold rush, the miners all perished; only those running casinos and selling shovels made a fortune.

Figure 9: CeFi's excess returns are highly concentrated in BNB, with an increase of 181%. (Data source: SoSoValue)

5.2 The Alienation of Infrastructure: Bloodsucking, Black Boxes, and Political Gambling

When we focus on these three giants, we find a common dangerous tendency: they are maintaining their shaky empires by sacrificing neutrality (bloodsucking) and seeking political shelter (gambling).

- Binance: From "Servant" to "Vampire"

As the king of liquidity, Binance began sacrificing its neutrality as infrastructure in 2025 to maintain high profits.

l The Fall of Listing Logic (Meme Transformation): To cope with the liquidity exhaustion of VC coins, Binance aggressively shifted to the "Meme economy," listing a large number of high-volatility assets lacking fundamentals. The exchange transformed from a place of value discovery into a distribution channel for "toxic assets," training users to become high-frequency speculators to maximize fee extraction.

l The Black Box of Technology (October 11 Major Liquidation): In the crash on October 11, Binance's margin engine, relying on internal prices rather than external oracles, caused assets like USDe to decouple, triggering billions of dollars in erroneous liquidations. Although a $300 million compensation fund was established afterward, this "spending to avert disaster" and refusal to acknowledge legal responsibility exposed its arrogance as a privatized central bank—when the referee makes a mistake, users can only pray for its "mercy," rather than relying on the fairness of the rules.

l Market Maker Collusion Risk: Investigations into projects like GPS and SHELL have shown that market makers on the Binance platform have repeatedly been suspected of manipulating new coin prices. Although official penalties were imposed, this also exposed the tip of the iceberg of internal conflicts of interest.

- Tether: The Unregulated "Private Empire"

Tether (USDT) remains the "shadow dollar" of the crypto world, its dominance unshakable. However, this dominance is built on an increasingly opaque foundation.

l The Audit Mystery: Despite profits surpassing Wall Street investment banks, Tether still refuses to undergo a thorough statutory audit, only providing snapshot "attestation reports." This means that the outside world cannot rule out the possibility of fund misappropriation before and after the snapshot time.

l Weaponization of the Balance Sheet: Tether has established the "Tether Evo" department, using user reserve interest to build a private business empire spanning neurotechnology, agriculture, and even football teams (the Juventus acquisition case). It is leveraging the privileges of public infrastructure to evade regulatory risks associated with a single stablecoin business; this "too big to fail" structure itself poses a significant moral hazard.

- Tron: The "Settlement Highway" of the Gray Economy

If Binance is the exchange and Tether is the central bank, then Tron is effectively the "underground SWIFT."

l Monopolist of USDT: Data from 2025 shows that the Tron network carries 50% of the global USDT circulation, becoming the preferred settlement layer for "Southeast Asia" and even sanctioned regions.

l Hotbed of Money Laundering Activities: This efficiency comes with a massive compliance black hole. Investigations reveal that although Huione Group was sanctioned, its related wallets still processed nearly $1 billion in fund flows on the Tron network. The larger Tron’s scale effect, the more pronounced its characteristics as an illegal financial highway.

5.3 The Political Gamble of "Industry Leaders"

The most disturbing trend is not the gray area at the business level, but the attempts by industry "leaders" to "buy the rules."

- Justin Sun's "Letter of Indenture": Faced with the potential secondary sanctions "nuclear button" on Tron and its supernodes, Justin Sun demonstrated a high degree of political speculation. He not only attempted to package Tron as a U.S. publicly listed company through a reverse merger to seek procedural protection; he also invested $75 million in the Trump family project World Liberty Financial (WLF) in 2025. This blatant political donation attempts to tie the fate of a public chain to U.S. political power.

- CZ's "Century Pardon": If Justin Sun is still trying, then CZ has already validated the feasibility of this path. On October 23, 2025, the U.S. White House officially announced that Trump exercised his presidential pardon, pardoning Zhao Changpeng. The shockwaves this news sent through the crypto community even surpassed Bitcoin's new highs. It marked the culmination of the DOJ's years-long compliance crackdown, ultimately rendered null by the intervention of top political power.

A Talisman or a Death Warrant?

The actions of Justin Sun and CZ essentially transform what should be technically neutral crypto infrastructure into political bargaining chips. They have staked their lives and fortunes entirely on the Trump family. This deep entanglement of interests may secure them a "get out of jail free card" for four years, but it also means they have positioned themselves in absolute opposition to the Democratic Party and the establishment. The political pendulum will always swing back. When the winds change, this fragile balance built on "political protection money" is likely to face an even more severe reckoning and backlash.

The lesson of 2025 is that the market is beginning to realize that being merely "big" is not enough.

In the context of ETF entry, Circle's listing, and traditional financial capital eyeing the crypto space, if crypto-native giants cannot resolve the issues of "transparency" and "public accountability," they will ultimately be replaced by more compliant competitors (such as stablecoins issued by Wall Street investment banks and compliant exchanges).

The rise of the ssiCeFi index may represent the end of the "barbaric growth" dividends of the past decade, but it does not indicate the direction of crypto for the next decade.

6. A New World After the Great Divergence—Reconstructing Value in Certainty

“The foundations of the old world are loosening, while the contours of the new world remain unclear.”

In the face of the fragmented landscape at the end of 2025, a sharp question confronts all practitioners: Outside the walls, traditional funds are envious but are intercepted by ETFs and U.S. stock concept stocks; no matter how much Nasdaq revels, on-chain liquidity remains depleted; inside the walls, the infrastructure we rely on is either crazily draining retail investors or engaging in high-risk political gambles.

Has this industry reached its end?

For those accustomed to the wild era—financing through a white paper and rallying through a story—the end of this era is indeed suffocating. The so-called "cryptocurrency," as a speculative symbol, is receding.

But for observers of financial history, this is precisely the darkest moment before dawn. Every "death" is for the sake of "rebirth." Standing at the end of 2025, that experiment which began at $10 has helped us strip away the noise. We see that the term "cryptocurrency" is disappearing, replaced by "on-chain finance."

Two years of turbulence and differentiation have completely reshaped the entire framework of the crypto industry. As the bubble recedes, we see that future value will no longer be defined by narratives but will be reconstructed by two dimensions of "certainty": usable money (stablecoins) and honest accounts (on-chain finance).

6.1 The "Ascendancy" of Stablecoins: From "Entry Channel" to "Stateless Cash"

In the past, we understood stablecoins as "tickets to enter the crypto world": converting fiat into USDT/USDC, entering exchanges, and completing a round of speculation. By 2025, the meaning of stablecoins has gradually shifted from "crypto tools" to "digital incarnations of the dollar." Its core is not blockchain, but rather the dollar re-entering the world in another form.

If Bitcoin is the "digital gold" first accepted by mainstream finance in the crypto world, then stablecoins are more like the second truly accepted "digital cash" by the public; they do not require users to understand decentralization, only requiring users to feel a simple advantage: faster, cheaper, and less hassle than banks.

The rise of the PayFi sector proves this point: it does not rely on storytelling to raise valuations but on solving the pain points of traditional finance to gain premiums. In inflationary countries or regions with foreign exchange controls, the growth of stablecoins is driven by reality: traditional bank transfers are slow, fees are high, and funds can even be frozen without reason. Stablecoins provide an alternative path without "human barriers."

Thus, this is a competition about the "efficiency of dollar distribution." Whoever can deliver dollars to those who need them globally at a lower threshold and cost will become the new infrastructure. Stablecoins have "dismantled" the dollar from the walls of banks, transforming it into a universal component that can circulate 24/7. You do not have to see it as a Trojan horse, but you must recognize its real implications: stablecoins are an upgrade of the dollar's form in the digital age, and their expansion is not based on slogans but on solving inefficiencies and obstacles in the real world.

6.2 The "Decoding" of On-Chain Finance: Rewriting Risk from "Credit" Back to "Rules"

If stablecoins solve the problem of "fund circulation efficiency," then on-chain finance and prediction markets are reconstructing the two core dimensions of finance: Credit and Information.

In the past two years, the systemic risks of centralized entities (CeFi) have essentially stemmed from the abuse of "discretionary power." When matching, clearing, and custody all occur in an opaque database, managers have a god-like perspective to modify the ledger. Under this mechanism, the so-called "risk control" often becomes a fig leaf for specific interest groups.

The value of on-chain finance lies not in ideological "decentralization," but in "execution-level certainty." Take leading protocols like Hyperliquid as an example; they solidify clearing logic and risk parameters into immutable smart contracts. This means that financial rules are no longer malleable clay in the hands of managers but rigidly enforced physical laws. Market participants no longer need to pray for the platform to "be a good person," but only need to verify that the code "operates according to the rules." This marks the evolution of financial risk management from "credit-based games" to "code-based engineering."

The same logic extends to the information domain. Prediction markets underwent a critical identity transformation in 2025: they shed the label of "online gambling" and evolved into "event derivatives exchanges."

Information Pricing Mechanism: From "Opinion Inflation" to "Efficient Market"

In an era where AI generates infinite noise and media is filled with bias, opinions are the most inflated asset, while truth is the scarce hard currency. The core mechanism of Polymarket is not simple "voting," but "arbitrage based on information advantage." For example, in the 2024 election, while traditional polling agencies still rely on inefficient phone surveys, traders with exclusive data (like the famous "French whale") conduct neighborhood research by hiring professional teams and place heavy bets in the market. This mechanism forces participants to pay "information verification costs." In a pool of billions of dollars, the principal becomes a filter for noise—emotional outbursts are instantly swallowed, and only "signals" verified by real money can determine prices. This makes prediction markets the highest signal-to-noise ratio information discovery tool in human society.

Deepening Financial Functions: Macro Hedging and Parametric Insurance

More profound changes lie in the fact that prediction markets standardize "uncertain events" that were previously untradeable in the real world into tradable financial assets.

New Benchmark for Macro Risk Management: Institutional investors are beginning to use prediction markets to manage macro risks. For example, regarding the Federal Reserve's interest rate decisions (FOMC), investors are no longer limited to high-threshold treasury futures but are conducting more precise cross-market arbitrage through prediction market contracts. This not only improves capital efficiency but also provides the market with sharper macro expectation indicators than traditional surveys.

Inclusive "Parametric Insurance": Just as Robinhood has shown retail investors, purchasing "Houston Rain" contracts is essentially a decentralized micro-insurance. It breaks the high claims costs and opaque terms of traditional insurance—users make reverse bets against specific long-tail risks (like extreme weather, flight delays, or policy changes). Once an event is triggered, smart contracts automatically pay out. This marks the descent of hedging functions from Wall Street into the daily lives of ordinary people.

The progress of human financial history is essentially a process of continuously lowering transaction costs. On-chain finance eliminates "trust intermediaries," and prediction markets eliminate "information noise." In the new financial world of the future, the black box will be broken by code, and truth will be priced by capital.

In Conclusion

“Coming of age is never a celebration; it is a forced process of growing up.”

This cycle has not seen a broad rise, only selection. For every investor involved, the significance of 2024-2025 lies in its breaking of the illusion that "just being present guarantees a win." For those still stuck in the relics of the old era, trapped in PPTs and unlocking curves, that $1.2 index serves as their final epitaph.

While we are still entangled in the fluctuations of coin prices, a deeper and more conclusive transformation is quietly advancing at the heart of Wall Street: According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has granted permission to the Depository Trust & Clearing Corporation (DTCC) in the form of a no-action letter, allowing the company to custody and recognize tokenized stocks and other real-world assets (RWA) on the blockchain.

DTCC is not a "crypto company"; it is the infrastructure hub of the U.S. capital markets. DTCC disclosed that the amount of securities transactions it processed in 2024 was approximately $370 trillion.

This may be the ultimate fate of crypto technology. Regulation is not meant to eliminate the crypto world but to issue it a ticket to enter the new world. It has filtered out scams that attempt to print counterfeit money through token issuance; it has retained those technologies that can enhance asset circulation efficiency and build trust.

Just as the internet ultimately permeated every pore of business, no longer distinguishing between "online and offline"; the future of finance will also no longer distinguish between "on-chain and off-chain." All financial activities will operate on the blockchain, a more efficient ledger.

“If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” - Satoshi

Whether BTC can restart a bull market in 2026 remains to be seen!

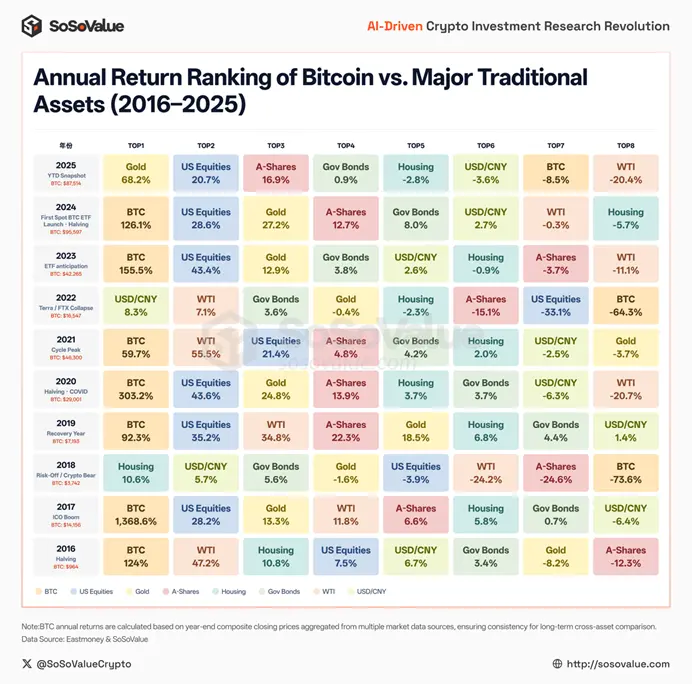

Figure 10: Comparison of Annual Returns of Bitcoin and Major Traditional Assets (2016–2025) (Data Source: SoSoValue, Public Data Compilation)

Note: The data in the above chart is based on the SoSoValue index compilation tool. This index compilation tool simplifies and visualizes the previously expensive professional backtesting systems used by fund companies, allowing ordinary investors to establish their own crypto asset tracking framework and validate every intuition with data. If you also want to build your own quantitative framework to continuously observe and track crypto, you can try the SoSoValue index compilation tool, which has a filtering backtesting function similar to the expensive professional tools used in fund companies but is easier to use.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。