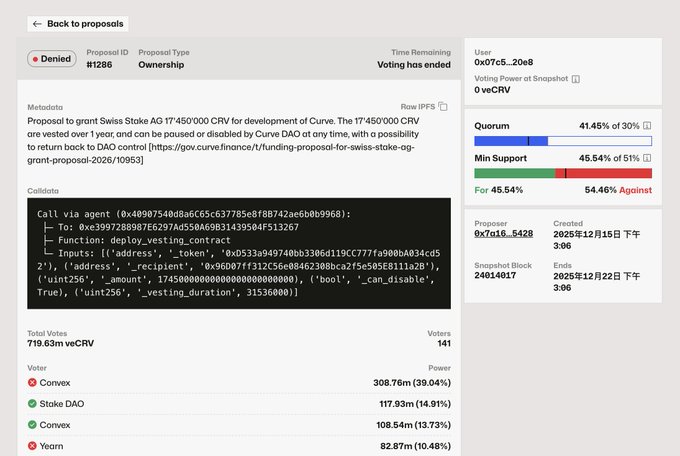

A few days ago, a grant proposal from Curve was rejected. The proposal was to allocate 17M $CRV in development funds to the development team (Swiss Stake AG). Both Convex and Yearn voted against it, and their voting power was sufficient to influence the final outcome.

Since the governance issues with Aave began to escalate, governance has started to attract market attention, and the inertia of simply giving money has begun to break. There are two key points behind this Curve proposal:

A portion of the community does not oppose granting funds to AG, but they want to know how previous funds were used, how future funds will be used, whether it is sustainable, and whether it has brought benefits to the project. At the same time, this overly primitive grant model leads to a situation where once the money is given out, there are no constraints. In the future, the DAO needs to establish a Treasury, with income and expenditure being transparent, or increase governance constraints.

The large voting powers of veCRV do not want to dilute their value. This is a clear conflict of interest; if the projects supported by the CRV grant cannot foreseeably create benefits for veCRV, they are unlikely to receive support. Of course, Convex and Yearn also have their own interests and influence, but we will not discuss that for now.

This proposal was initiated by Curve founder Mich, and AG has been one of the teams maintaining the core codebase since 2020. The roadmap provided by AG for this grant roughly includes continuing to advance llamalend, including support for PT and LP, as well as the expansion of the on-chain foreign exchange market and crvUSD. It seems worthwhile, but whether it justifies a grant of 17M $CRV needs to be calculated separately, especially since Curve's governance has many differences from Aave, with its power distributed among several distinct teams.

Comparing ve with conventional governance models:

To conclude, most conventional governance models currently have no advantages in their design. Of course, if a DAO is mature enough, traditional structures can operate well, but unfortunately, there is not yet a project in Crypto that has matured to that level. For example, even the leading project Aave, which has market consensus, can encounter issues.

If we discuss model design separately, ve has certain advanced aspects. Firstly, it has cash flow; it is backed by liquidity control. When there is a demand for liquidity from the outside, this power will be bribed. Therefore, even if you do not want to lock your assets long-term, you can delegate your tokens to proxy projects like Convex/Yearn to earn returns.

Thus, ve is a model that binds voting rights to cash flow. The future evolution is likely to follow a "governance capitalism" route, where vetoken binds voting rights to "long-term locking," essentially filtering for those with large capital who can withstand liquidity loss and are capable of long-term strategic play. Over time, the result is that governors gradually shift from the ordinary user base to a "capital group."

At the same time, due to the existence of proxy layers like Convex/Yearn, many ordinary users, even loyal users, who hope to earn returns while not losing liquidity and flexibility, will gradually choose to delegate governance to these projects.

This voting also reveals some clues; in the future, Mich may not be the main character in Curve's governance, but rather those with large voting powers. When issues arose in Aave's governance, someone proposed the idea of "delegated governance/elite governance," which is quite similar to the current structure of Curve. Whether this is good or bad will need time to test.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。