Introduction

Market Overview

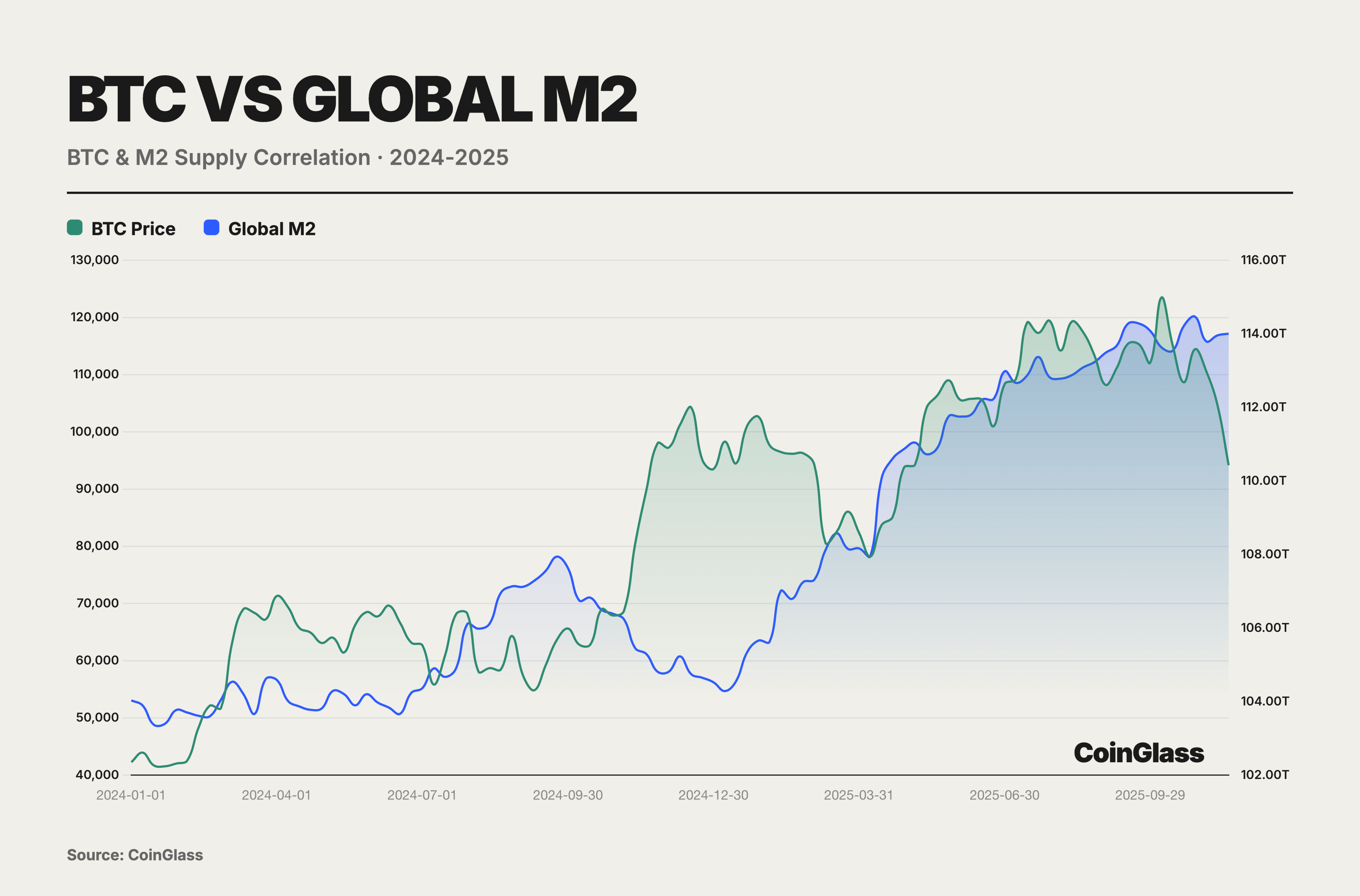

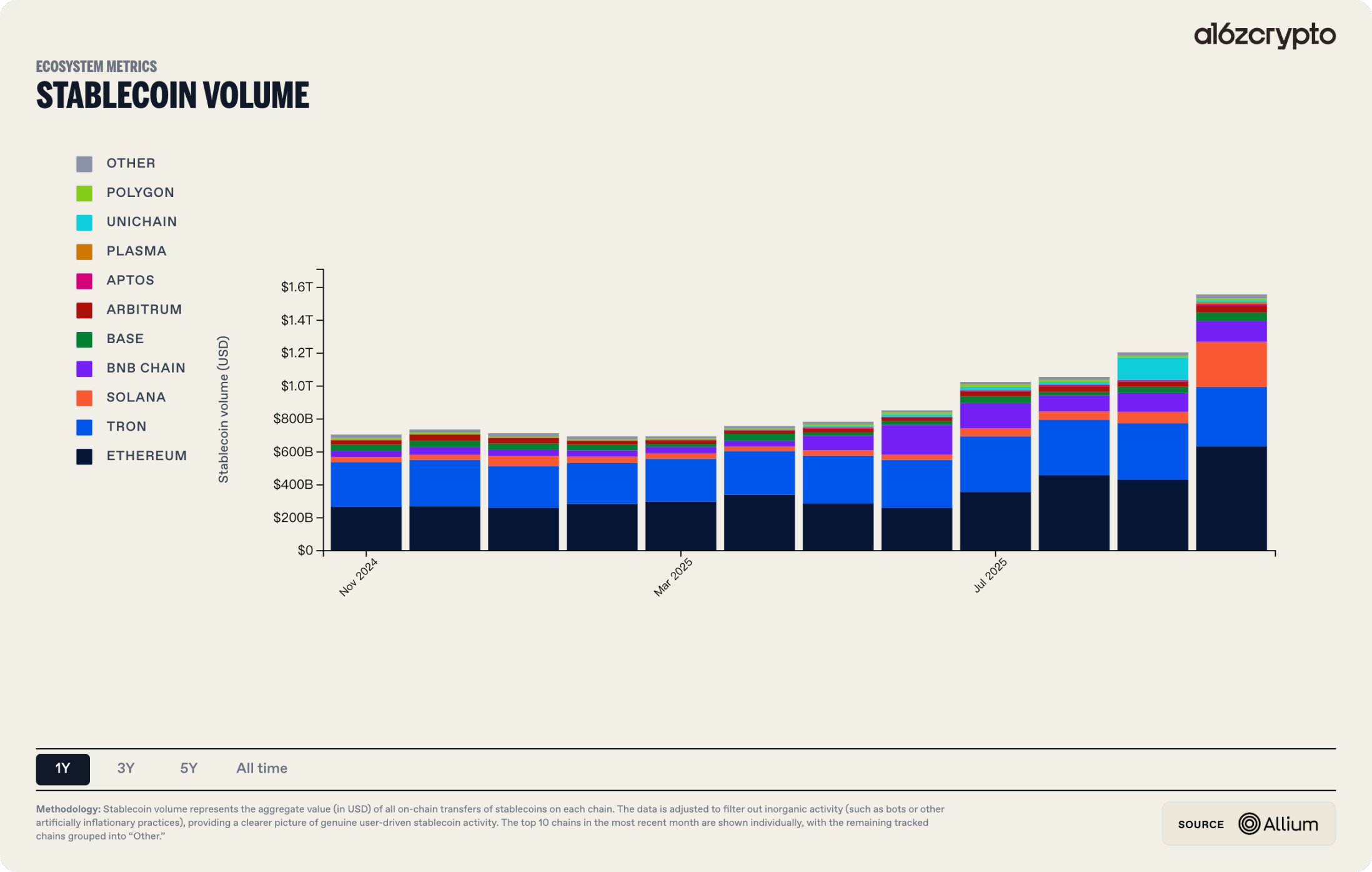

In 2025, the scale and application scenarios of stablecoins and DAT expanded simultaneously, beginning to directly interface with traditional finance at the boundary level. The total market capitalization of stablecoins once exceeded $230 billion, with an annual on-chain settlement scale of approximately $1.5 trillion. Supported by legislation such as the GENIUS Act, it gradually solidified as the underlying settlement layer for cross-border payments and on-chain finance. The DAT model provided a standardized path for traditional institutional investors to gain exposure to crypto assets through compliant equity or fund vehicles, with the market value of its held BTC and ETH assets exceeding $140 billion at their peak, representing a year-on-year increase of over three times. RWA acted as a key intermediary: anchoring cash flows from real-world assets on one end, while connecting stablecoins with the on-chain settlement and valuation system of DAT on the other. The BCG-Ripple 2025 report predicts that the tokenized asset market will expand from the current approximately $600 billion to nearly $18.9 trillion by 2033, with a compound growth rate of about 53%, providing a scale assumption basis for this evolution.

2025 also marks a turning point for decentralized derivatives, transitioning from proof of concept to actual market share competition. Mainstream on-chain derivatives protocols made substantial progress in technical architecture, product forms, and interaction experiences, beginning to form a considerable alternative to the trading and listing advantages of CEX. High-performance application chain architectures, represented by Hyperliquid, validated that decentralized infrastructure can directly compete with centralized matching platforms in specific scenarios regarding throughput, latency, and capital efficiency. Intent-centric architecture became the core paradigm for upgrading the DeFi end experience in 2025: users only need to specify the target state, while Solvers or AI agents competitively search for the optimal execution path off-chain, then submit it for on-chain settlement, significantly lowering the operational threshold for complex transactions.

In 2025, the on-chain integration of RWA became an important symbol of the crypto industry's move towards the mainstream. Its growth momentum mainly came from two aspects: first, a marginally relaxed regulatory environment, with the U.S. striving to reshape its position as a crypto financial center, with U.S. Treasury bonds and stocks becoming the core assets for tokenization; second, a strong real demand—many global investors lack direct and convenient channels for trading U.S. stocks, while tokenization somewhat lowers the entry barriers posed by nationality and geography. Data from Token Terminal shows that the market value of stock tokens grew by 2695% in 2025.

At the same time, the brand effect of leading issuance and trading platforms gradually emerged: Ondo, xStocks, and others, using on-chain accessible traditional financial assets as entry points, became representative players in the RWA narrative; mainstream exchanges like Bitget and Bybit continued to invest resources in the listing, trading, and liquidity support of related assets. Coupled with the advantages of eliminating cumbersome account openings and 24/7 trading availability, stock tokens became a significantly upward trending focus in the market in 2025. A report from Bitget indicated that during Q3 2025, its stock contract trading volume increased by 4468% quarter-on-quarter, with cumulative trading volume surpassing $10 billion.

In an environment where macro narratives and regulatory frameworks gradually clarify and uncertainties converge, more complex trading structures and competitive spaces are opened. Based on this macro and institutional background, the second part will turn to an empirical profile of centralized trading infrastructure: by quantitatively tracking the distribution of spot and derivatives trading volumes, market share changes of mainstream CEX, and the capital flows of BTC spot ETFs, it will depict the funding allocation paths of various participants in 2025, the structural share rearrangement among trading platforms, and the impact of institutional capital entry on overall market liquidity and price discovery mechanisms.

Centralized Derivatives Exchanges

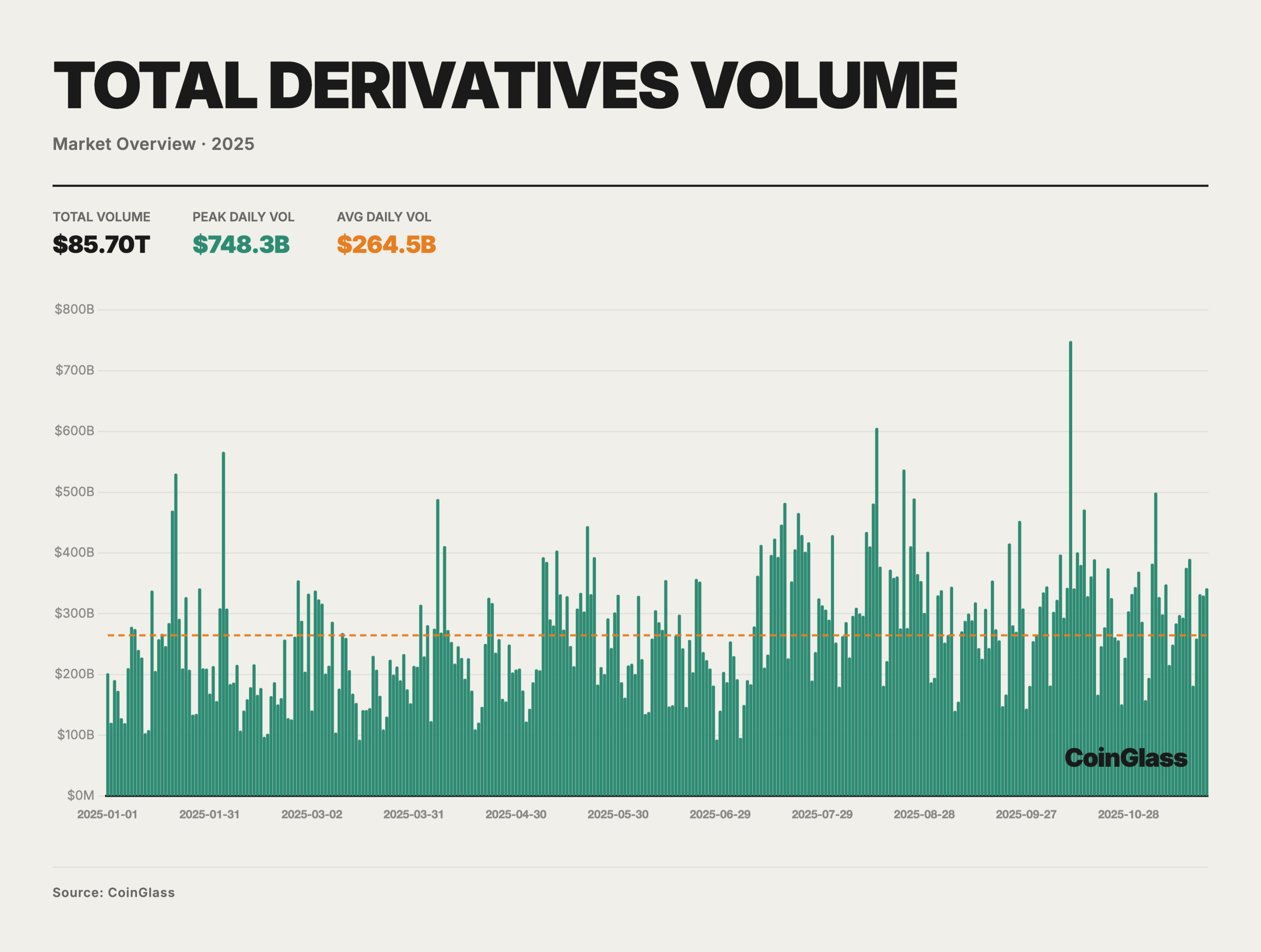

CEX Derivatives Trading Volume

In 2025, the total trading volume of the crypto derivatives market was approximately $85.70 trillion, with an average daily trading volume of about $264.5 billion. Against a backdrop of still tight macro liquidity and phase-wise recovery of risk appetite, the overall trading activity for the year exhibited a structure of "low first, then high, with fluctuations." Currently, derivatives have become the primary venue for price formation and risk management for most mainstream assets. The orange dashed line in the chart indicates repeated days of increased trading volume above the average, with a single-day peak of approximately $748 billion on October 10, significantly higher than the normal levels for the year, reflecting that during accelerated market phases, derivatives have become the core battleground for price discovery and leveraged speculation. On a monthly basis, the average daily trading volume in Q1 was mostly around $200 billion, gradually increasing from Q2, with daily averages in July-August and October rising above $300 billion.

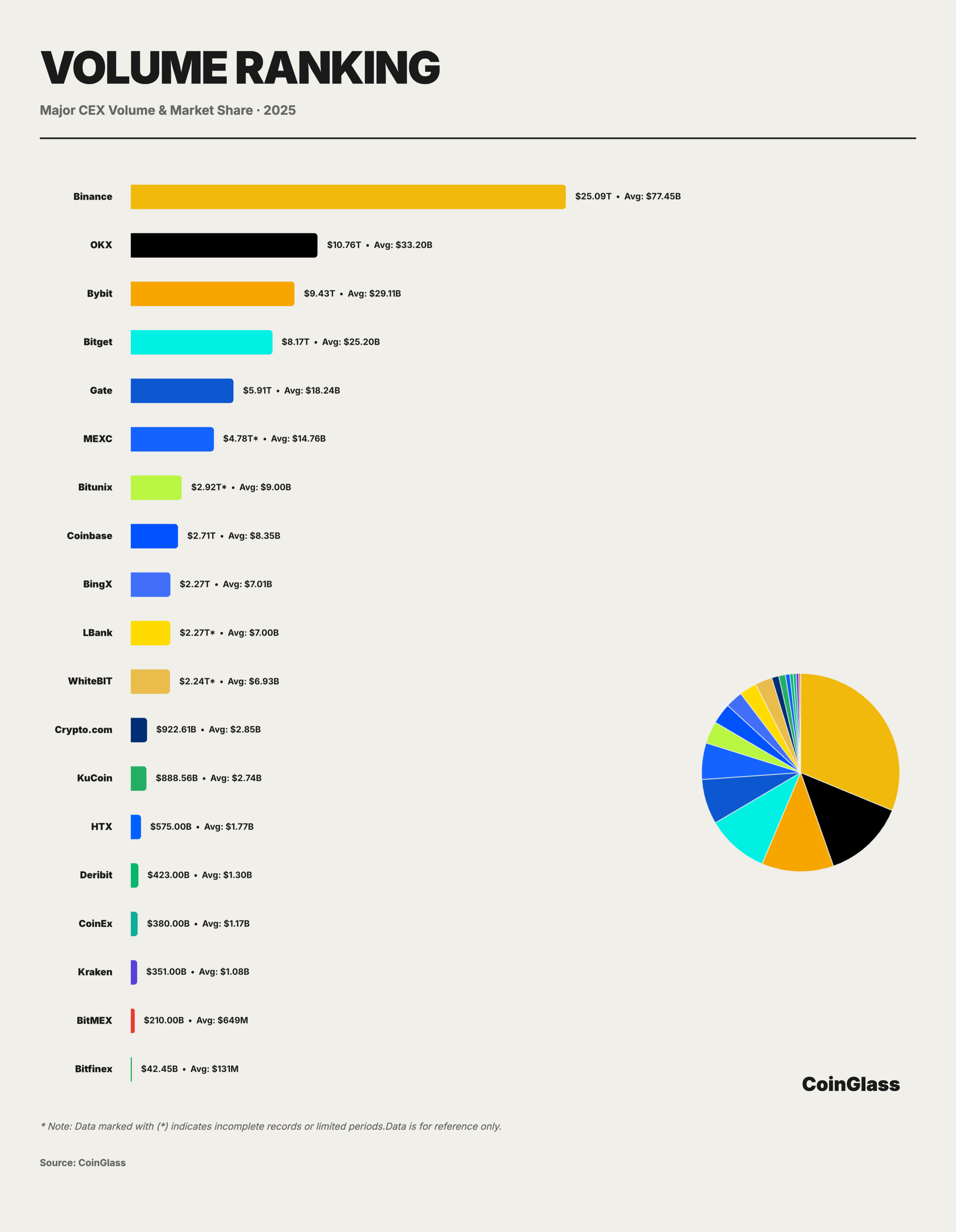

Behind the total trading volume of $85.70 trillion and the average daily trading volume of $264.5 billion, the market share distribution shows a highly concentrated characteristic. Binance firmly occupies the market leadership position with a cumulative trading volume of $25.09 trillion and an average daily trading volume of $77.45 billion, holding a market share of about 29.3%. This means that for every $100 of trading volume in the global derivatives market, about $30 occurs on Binance.

The competitive landscape of the second tier shows significant differentiation. OKX, Bybit, and Bitget follow closely, with cumulative trading volumes ranging from approximately $8.2 to $10.8 trillion and daily averages between $25 billion and $33 billion, collectively accounting for about 62.3% of the total market share along with Binance. OKX ranks second with a total of $10.76 trillion and an average daily volume of $33.20 billion, holding about 12.5% of the market share. Bybit follows closely with a cumulative trading volume of $9.43 trillion and an average daily volume of $29.11 billion, holding about 11% market share. Bitget ranks fourth with a total of $8.17 trillion and an average daily volume of $25.20 billion, holding about 9.5% market share.

Gate.io ranks fifth with $5.91 trillion and an average daily volume of $18.24 billion, with its market share dropping to about 6.9%. Although Gate, as an established exchange, still maintains a certain scale, the gap between it and the top three is widening. More notably, there is a gap phenomenon after Gate: BingX's $2.27 trillion is less than 40% of Gate's, while Crypto.com and KuCoin have fallen to the billion-dollar level ($922.61 billion and $888.56 billion), accounting for only 3-4% of Binance. Platforms like Crypto.com and KuCoin, with individual market shares of about 1%, primarily serve regional or niche customer segments, and their bargaining power and liquidity stickiness are significantly weaker than those of the leading platforms. In terms of year-on-year and quarter-on-quarter growth rates of trading volume, Bitunix is in the leading range for both indicators, with the steepest growth slope, making it one of the fastest-growing platforms in terms of trading volume.

This cliff-like distribution reveals the Matthew effect of platform economics, where leading platforms form a self-reinforcing cycle due to liquidity advantages. For small and medium platforms, it is necessary to establish differentiated positioning in niche markets; otherwise, they will face continuous pressure of market share loss.

CEX Derivatives Open Interest

In 2025, global crypto derivatives open interest (OI) experienced a dramatic oscillation path characterized by an initial decline followed by a rise and then a sharp drop. After experiencing deep deleveraging in Q1, OI once plummeted to an annual low of $87 billion due to panic, but then showed strong resilience in Q2, completing a confidence rebuild from hesitant probing to moderate accumulation. This recovery trend evolved into an almost frenzied accumulation of leverage in Q3, with capital accelerating into the market, pushing OI to a historical peak of $235.9 billion on October 7. The highly crowded trading structure significantly increased the probability and intensity of market corrections, with a lightning-fast deleveraging in early Q4 wiping out over $70 billion in open interest in just one day, accounting for one-third of the total open interest. Nevertheless, the OI's drop to $145.1 billion still represented a 17% increase from the beginning of the year, and the overall capital accumulation in the second half of the year was significantly higher than in the first half.

Based on the average daily open interest data from major CEX in 2025, the global derivatives market has solidified into a clearly tiered oligopoly. The top ten centralized exchanges collectively hold about $108.3 billion in OI, with Binance accounting for about $30 billion in average daily OI, representing about 28%. Bybit, Gate, and Bitget have average daily OIs of approximately $19 billion, $15.6 billion, and $15.3 billion, respectively, collectively controlling about 73% of the total tradable leveraged positions in the market; when including OKX, the top five platforms' OI share exceeds 80%, indicating extremely high concentration among the leaders. Binance, with an average daily open interest of about $30 billion, has established a tiered leading advantage, with its volume nearly equal to the sum of the second and third places, playing a decisive role as the cornerstone of market liquidity. Following closely is the second tier composed of Bybit, Gate, and Bitget, with each maintaining average daily open interest in the high range of $15 billion to $19 billion, collectively controlling half of the market; among them, the daily difference between Gate and Bitget is only about $300 million, indicating a high degree of competition in market share.

OKX's open interest data is relatively low, partly because OKX offers a product structure with higher capital utilization, allowing funds to quickly rotate between different trading pairs and products, distributed across non-trading modules such as spot, wealth management, and staking, thus the open interest indicator cannot fully reflect the real scale of deposited funds. Additionally, there may be some divergence between trading volume and open interest on certain platforms, and investors should pay more attention to trading structures and capital distribution rather than relying solely on open interest indicators.

CEX Liquidity Depth

Based on the bilateral liquidity depth data of major assets (BTC/ETH/SOL) in 2025, the market presents a structure that is starkly different from OI. Binance undoubtedly leads the field with a tiered advantage, boasting a BTC depth of $536 million, which is 2.6 times that of the second place and nearly equivalent to the total of the other four platforms combined, establishing its absolute position as the global liquidity hub for cryptocurrency derivatives. OKX, with a BTC depth of $202 million and an ETH depth of $147 million, demonstrates its hard power in accommodating large trades, proving that it remains the preferred choice for institutions and whales after Binance.

For BTC, Bitget ranks third with a bilateral depth of approximately $103 million, about 2.7 times that of Bybit and 7 times that of Gate, contributing nearly 11.5% to the total market BTC depth. For ETH, Bitget's ±1% depth is approximately $97.48 million, nearing 70% of OKX's, significantly higher than Bybit and Gate, contributing nearly 20% to the total market ETH depth. This results in a liquidity distribution where Binance is absolutely leading, OKX firmly in second place, and Bitget consistently occupying the core of the second tier. Even in the relatively weak liquidity of SOL, Bitget still provides over $22.42 million in ±1% depth, about 60% of OKX and Bybit, accounting for approximately 14% of the total market SOL depth, indicating its considerable order absorption capability in high-volatility, relatively long-tail mainstream assets.

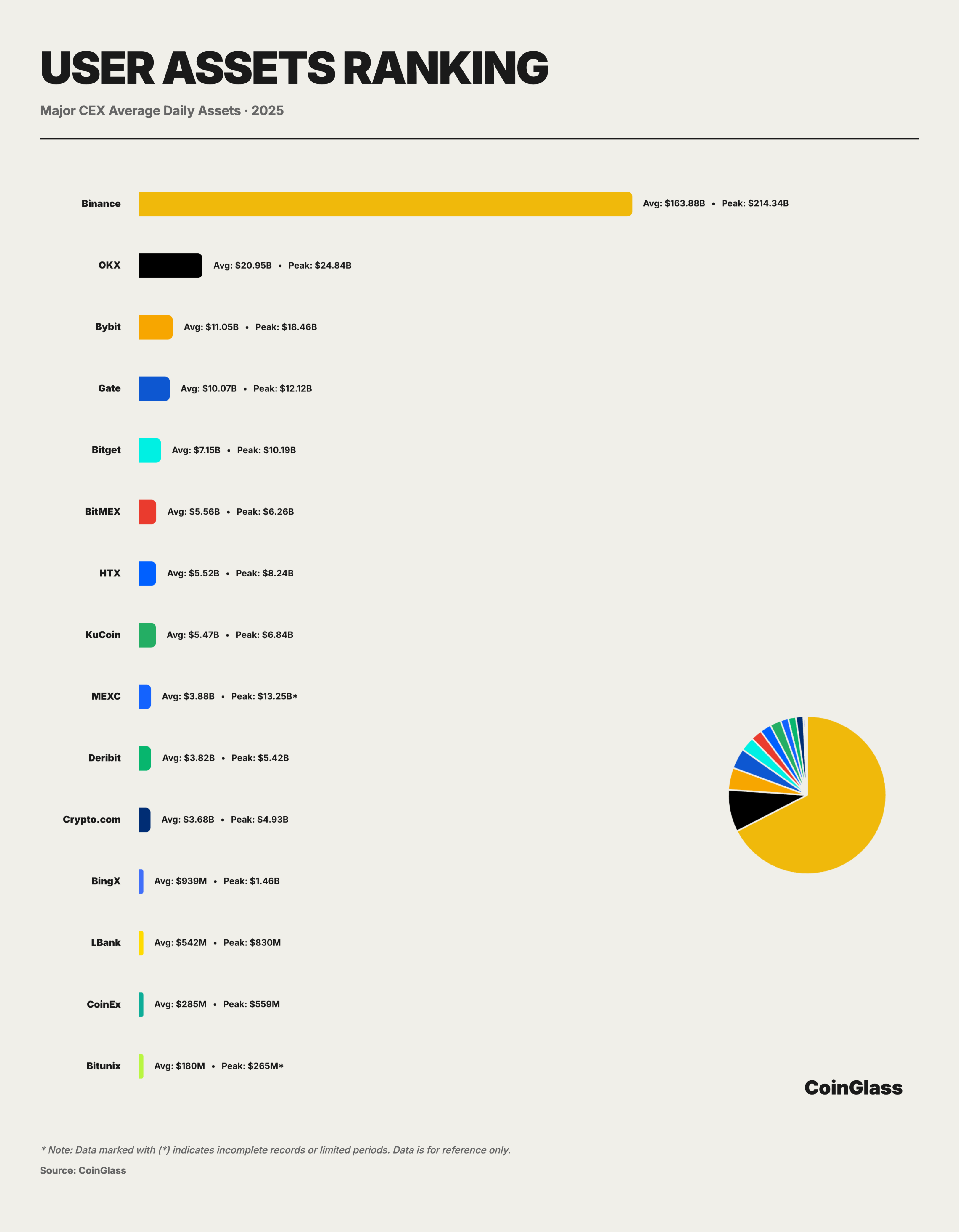

CEX User Asset Accumulation

Based on the user asset accumulation data for 2025, the crypto market shows a highly concentrated unipolar structure at the custody level. According to the Herfindahl-Hirschman Index calculation, the concentration of CEX custody assets in 2025 is 5352, indicating that the cryptocurrency exchange market is in a state of extreme oligopoly, with Binance alone accounting for over 72% of the market share. Binance's average daily custody assets are approximately $163.9 billion, with a peak of about $214.3 billion during the year, which is 2.5 times the total assets of the next seven major platforms combined. This concentration means that, in terms of actual fund storage and custody, Binance effectively assumes a role similar to that of a "systemic infrastructure," and its operational and compliance status has an amplifying effect on the robustness of the entire crypto market.

OKX ranks second with approximately $21 billion in average daily assets and a peak of $24.8 billion, about twice the size of third-place Bybit, demonstrating its advantage in user fund retention and medium to long-term asset accumulation. However, this bipolar + multiple mid-tier platform structure means that custody risk is highly concentrated in the top two platforms. If any platform experiences a tail event in compliance, technology, or operations, the spillover effect will far exceed the market share of a single platform. After the second tier, the market enters a more fiercely competitive range of tens of billions. Bybit, Gate, and Bitget have average daily assets of approximately $11.05 billion, $10.07 billion, and $7.15 billion, respectively, collectively forming the next tier of asset carriers. The top five platforms together absorb over 90% of user assets, indicating a high concentration of user funds.

CEX Rankings

To further translate the concentration of derivatives trading on the CEX side from a volume narrative to comparable quality dimensions, CoinGlass conducted a comprehensive scoring and ranking of major derivatives CEX. The following chart focuses on basic trading data as the core weight and provides sub-scores and weighted totals from dimensions such as product, security, transparency, and market quality, thereby visually presenting the structural gaps among different platforms in liquidity bearing, risk control constraints, and information disclosure.

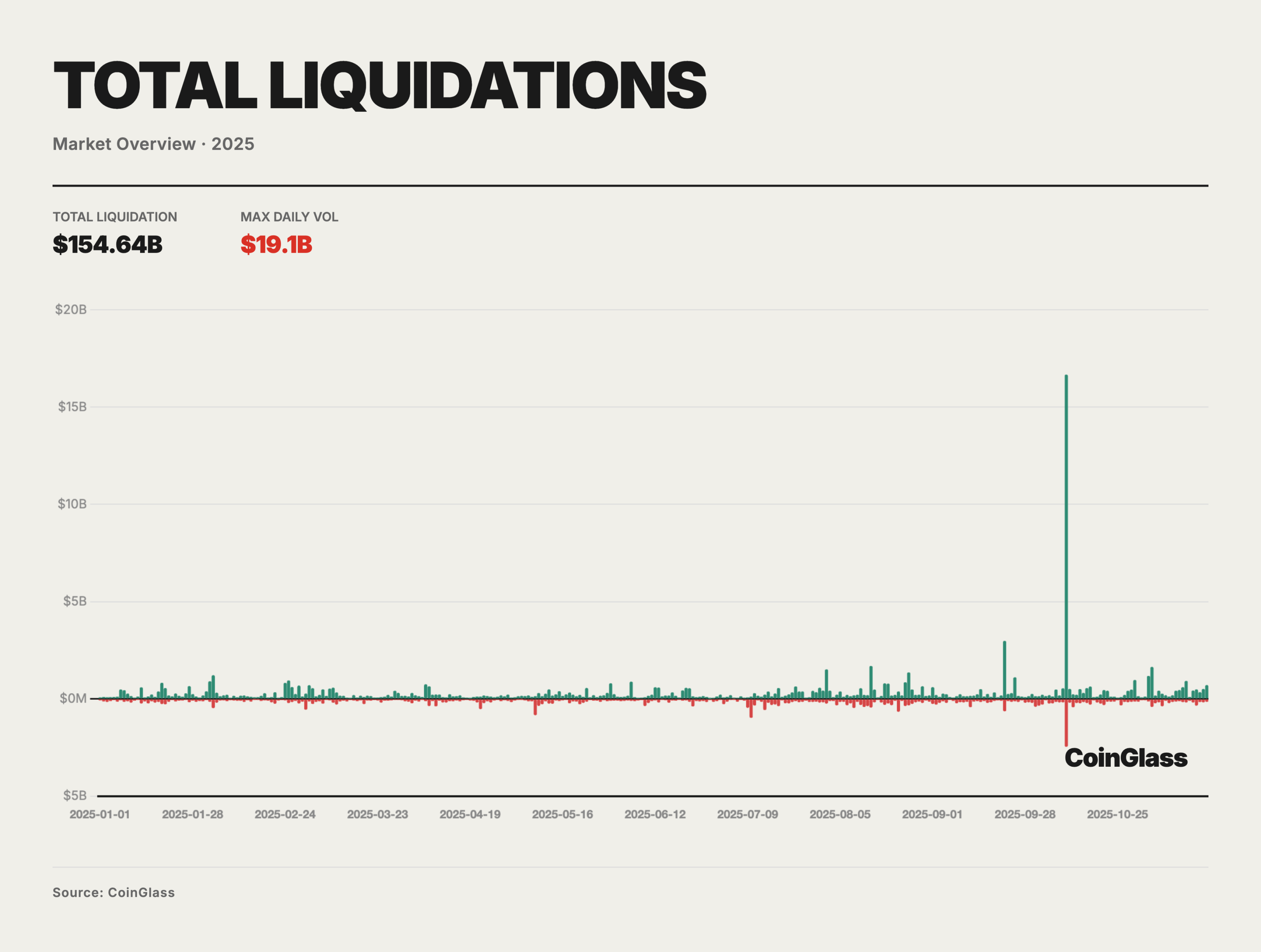

Clearing Data

In 2025, the total nominal amount of forced liquidations for both long and short positions was approximately $150 billion, corresponding to an average daily leverage shuffle of about $400-500 million. On the vast majority of trading days, the scale of long and short liquidations remained in the tens of millions to hundreds of millions range, primarily reflecting daily margin adjustments and short-term position clearings in a high-leverage environment, with limited medium to long-term impact on prices and structures. The real systemic pressure concentrated in a few extreme event windows, with the mid-October deleveraging event on October 10-11 being the most typical.

On October 10, 2025, the liquidation scale across the market reached an extreme peak during the sample period, with total liquidations exceeding $19 billion, far surpassing the single-day highs of previous liquidation events. Combined with the disclosure rhythm of some platforms and feedback from market makers, the actual nominal liquidation scale may approach $30-40 billion, several times that of the previous cycle's second-highest event. Structurally, the liquidations on that day were heavily skewed towards the long side, with long liquidations accounting for about 85-90%, indicating that the BTC and related derivatives markets were in an extremely crowded long leverage state before the event occurred.

From a causal chain perspective, the trigger point for the October 10-11 event came from an exogenous macro shock. On October 10, U.S. President Trump announced that starting November 1, a 100% tariff would be imposed on Chinese imports and plans to implement export controls on key software, significantly raising market expectations for a new round of high-intensity trade wars, leading global risk assets to shift into a clear risk-off mode. Prior to this, BTC had reached a historical high of about $126,000 in 2025, driven by easing expectations and expanded risk appetite, with the derivatives market's long leverage utilization at a high level, and the basis between spot and futures being elevated, placing the entire system in a fragile state of high valuation + high leverage. The exogenous macro negative news landed in this context, becoming the direct trigger for igniting the concentrated liquidation chain.

What truly determines the magnitude of the event's impact is the leverage and product structure that had already formed beforehand, as well as the design of the clearing mechanism. Compared to three or four years ago, the 2025 market features more perpetual products with high open interest, more mid to small-cap assets, and more large platforms, significantly raising the overall nominal leverage scale; at the same time, many institutions adopted complex strategies involving long-short hedging, cross-product, and cross-term approaches, which superficially appeared as "risk hedging," but in reality, heavily relied on the orderly operation of the clearing engine and ADL mechanism under extreme conditions, with tail risks not effectively managed. Once the clearing and risk management mechanisms deviated from their ideal trajectories under pressure, the hedging legs that should have offset each other would be mechanically dismantled, and combinations originally constructed as neutral or low net exposure would be forced to reveal high net directional positions.

After the price fell below the critical margin threshold on October 10, the conventional incremental liquidation logic was first activated, with a large number of margin-deficient longs being thrown into the order book for market price liquidation, triggering the first round of concentrated deleveraging. As the liquidity in the order book was rapidly consumed, some platforms' insurance funds struggled to fully absorb the losses, and the long-untouched automatic deleveraging (ADL) mechanism was forced to intervene. By design, ADL is used in extreme situations, when insurance funds are insufficient, to forcefully reduce shorts to prevent prices from being directly driven to extreme levels by liquidation pressure, thereby triggering the last line of defense against insolvency for the platform. However, in this event, the execution of ADL exhibited significant deviations in price transparency and execution paths: some positions were forcefully reduced at prices significantly diverging from market prices, causing the short positions of leading market makers, including Wintermute, to be liquidated at points far from reasonable price levels, making it nearly impossible to hedge losses through normal trading; meanwhile, the triggering of ADL was mainly concentrated on illiquid altcoins and long-tail contracts rather than mainstream assets like BTC/ETH, causing many institutions employing structural strategies such as short BTC / long Alt to quickly lose their short hedging legs, rapidly exposing them to significant downward risks in altcoin positions. The deviation in the execution of the clearing and ADL mechanisms, compounded by infrastructure-level issues, amplified the pressure. Under extreme market conditions, several centralized platforms and on-chain channels experienced congestion in withdrawals and asset transfers, with cross-platform funding channels partially interrupted at critical moments, making typical cross-exchange hedging paths unable to proceed smoothly, leading market makers, even if willing to take on counterparty risk, to struggle to hedge risks in a timely manner on other platforms or markets. In this situation, professional liquidity providers were forced to reduce quotes or even temporarily withdraw due to risk control, further entrusting price discovery to the automated logic of the clearing engine and ADL. Meanwhile, under high load conditions, some CEX experienced matching and interface lags or even brief outages, while the crypto market lacked clear circuit breaker and centralized bidding mechanisms like those in traditional stock and futures markets, forcing prices to continue sliding on the order book dominated by passive liquidations, further amplifying tail volatility.

In terms of outcomes, the impact of this event on different assets and platforms was highly uneven, but we believe the long-term effects of this event are highly underestimated. The maximum drop for mainstream assets like BTC and ETH was roughly in the 10-15% range, while many altcoins and long-tail assets experienced extreme retracements of 80% or even close to zero, reflecting that the liquidation chain and ADL execution produced the most severe price distortions on the least liquid targets. Compared to the Terra/3AC period in 2022, this round of events did not trigger large-scale institutional chain defaults; although market-making institutions like Wintermute suffered some losses due to the ADL mechanism, their overall capital remained sufficient, with risks more concentrated in specific strategies and assets, rather than spreading throughout the entire system through complex market structures.

On-Chain Derivatives and DAT

On-Chain Derivatives

The fiscal year 2025 is not only a watershed moment in the history of digital asset development but also a key year for CME to establish its position as the global center for cryptocurrency pricing and risk transfer. If 2024 was the inaugural year for spot ETFs, then 2025 marks the deepening of the on-chain derivatives market. In this year, we witnessed institutional capital shift from purely passive allocation to actively managing through complex derivatives strategies, with the liquidity moat between the compliant on-chain derivatives market and the unregulated offshore market being thoroughly restructured.

The most disruptive product innovation in 2025 was undoubtedly the launch and popularization of Spot-Quoted Futures (codes QBTC and QETH). Unlike traditional futures, these contracts aim to provide a closer anchoring to spot prices through a special settlement mechanism, significantly reducing basis risk and roll costs.

With the launch of real-time data for the CME BTC Volatility Index (BVX), the market is likely to welcome tradable volatility futures in 2026. Institutional investors will have direct tools to hedge unknown risks for the first time, without needing to simulate through complex options combinations.

In 2025, we witnessed the normalization and scaling of basis trading. With the exponential growth of assets under management for spot ETFs, using CME futures for cash-and-carry arbitrage not only became a mainstream strategy for hedge funds but also a key link connecting traditional financial interest rates with crypto-native yields.

Currently, leveraged funds hold net short positions of up to 14,000 contracts. In-depth analysis shows that this is actually a direct product of basis trading. Leveraged funds buy BTC in the spot market or through ETFs while simultaneously selling an equivalent amount of futures contracts on CME. This combination is delta neutral, aimed at profiting from the basis yield when futures prices exceed spot prices. As the inflow of funds into spot ETFs increases, the short positions of leveraged funds have also increased simultaneously. This proves that the short positions are not directional shorts but are intended to hedge the long inventory brought by spot ETFs. At its peak, leveraged funds held net short positions of 115,985 BTC, indicating that leveraged funds are the main providers and carriers of liquidity for spot ETFs.

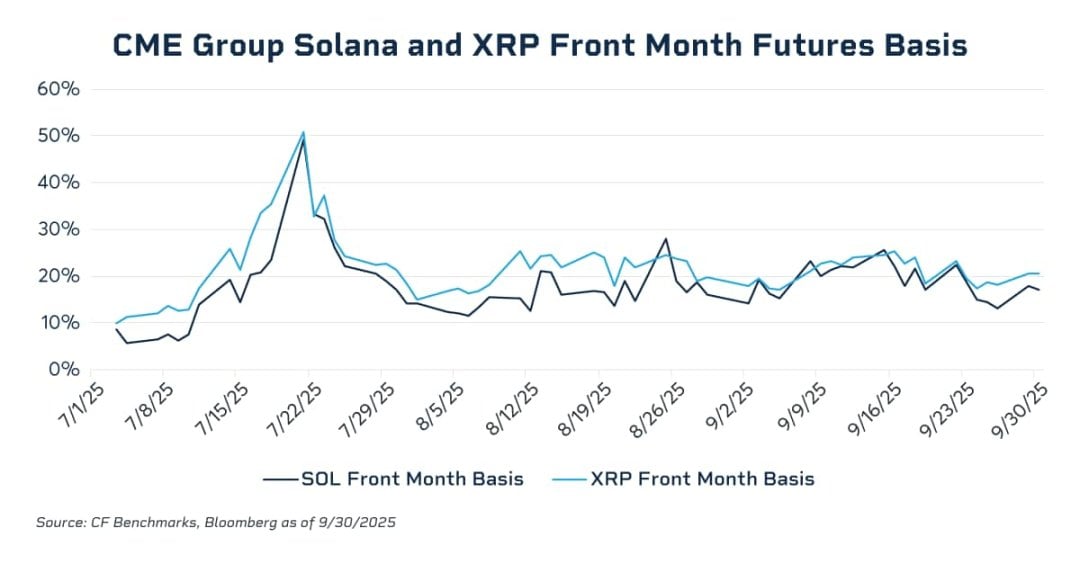

Data shows that the annualized basis of front-month contracts soared to the 20-25% range during the bull market in November 2024, while it compressed to nearly 0 during the deleveraging period in Q1. In July 2025, the annualized basis of SOL and XRP near-month futures contracts once surged to nearly 50%, far exceeding the basis levels typically seen in BTC futures, clearly exposing the lack of effective cross-market arbitrage forces in the related markets. In the absence of highly liquid, regulated spot investment tools, institutional funds find it difficult to scale deploy cash and arbitrage structures for futures shorts/spot longs, and thus cannot exert continuous pressure on excessively high basis premiums. With the launch of SOL and XRP spot ETFs under a universal listing regulatory framework, this structural gap is partially filled, providing the necessary spot vehicles and liquidity foundation for compliant institutional capital to enter the market and compress futures basis through arbitrage. As the CFTC approves spot trading, it is highly likely that margin offsets between spot and futures will be realized in 2026. This will release billions of dollars in idle capital and greatly enhance the market's leverage efficiency. At that time, the friction costs of basis trading will drop to historical lows, and basis levels may further converge to those of traditional commodities.

In November 2025, the average daily trading volume of the CME cryptocurrency sector reached a historic 424,000 contracts, with a nominal value of $13.2 billion, a year-on-year increase of 78%. This figure surpassed any single-month performance in 2024 and approached the levels seen during the peak of the 2021 bull market, but its composition is healthier, driven more by institutional hedging and arbitrage rather than pure retail speculation.

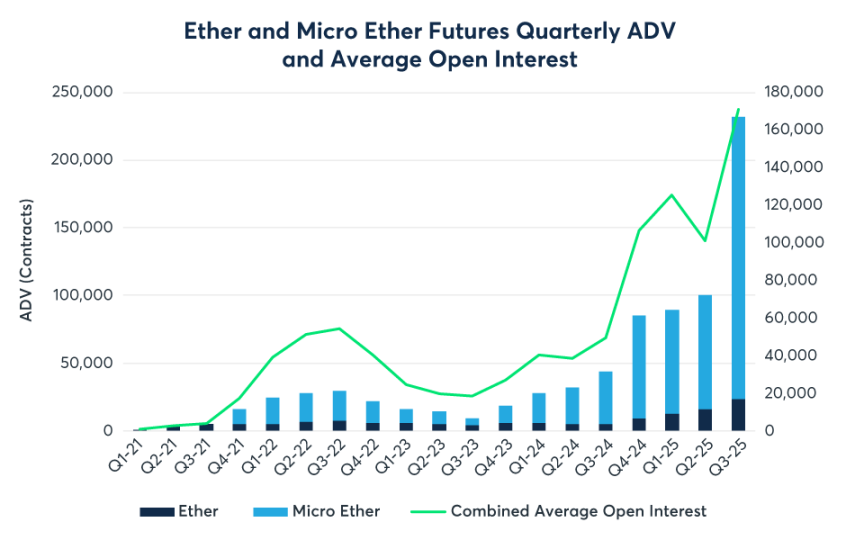

Although BTC still maintains an absolute advantage in nominal open interest, 2025 was a year of explosive growth for ETH derivatives liquidity. Data shows that the average daily trading volume of ETH futures in the third quarter surged by 355% year-on-year, far exceeding the growth rate of BTC. The passage of the GENIUS Act in July 2025 removed the last compliance barrier for traditional financial institutions to enter the market, directly driving the CME cryptocurrency complex to set a record of $31.3 billion in average daily open interest in Q3. Micro contracts continue to play a foundational role in liquidity. In Q3, the average daily volume of micro ETH futures (MET) reached an astonishing 208,000 contracts. According to broker data, many mid-sized hedge funds and family offices prefer to use micro contracts for position adjustments to more precisely match the scale of their spot investment portfolios, avoiding the granularity issues brought by standard contracts (5 BTC / 50 ETH).

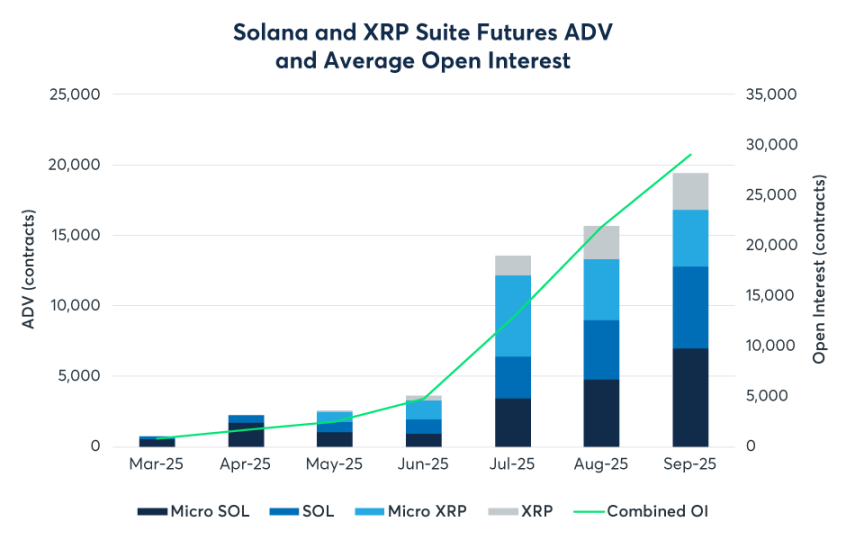

For a long time, CME was merely a dual oligopoly market for BTC and ETH. However, this pattern was broken in 2025. With the launch of SOL and XRP futures and options, CME officially entered the multi-asset era. As a strong competitor for the third-largest asset, SOL futures have performed impressively since their launch in March. By Q3, the cumulative trading volume reached 730,000 contracts, with a nominal value of $34 billion. More importantly, the open interest of SOL futures rapidly surpassed $2.1 billion in September, setting a record for the fastest doubling of new contract open interest. Meanwhile, XRP futures have traded 476,000 contracts since their launch in May. The XRP options launched on October 13 became the first such product regulated by the CFTC in the market. This marks that institutional investors no longer equate cryptocurrencies with BTC. For assets like SOL and XRP, which have different risk-return characteristics, institutions are beginning to seek compliant hedging channels, indicating that multi-strategy crypto hedge funds will be more active on CME in the future.

DAT

At the beginning of the 2025 fiscal year, the update ASU 2023-08 released by the Financial Accounting Standards Board (FASB) officially took effect, and this rule change is the cornerstone of the explosive growth in the financial performance of the DAT sector this year. The new standard mandates that companies measure certain crypto assets at fair value and directly include changes in fair value in the current net profit. Digital Asset Treasury (DAT) refers to publicly listed companies that systematically migrate a significant portion of their treasury reserves, far exceeding daily operational needs, from cash and short-term debt to digital assets like BTC, ETH, and SOL. They treat crypto assets as core allocations on the balance sheet rather than marginal speculative positions. Compared to spot ETFs, DAT is not a passive tracking tool but a corporate entity with complete operational rights and capital operation capabilities. Company management can continuously increase the number of digital assets per share through value-added financing methods such as convertible bonds and ATM issuances, creating what is known as the DAT flywheel effect. When the stock price has a premium relative to net asset value (NAV), the company issues more shares to purchase more digital assets, diluting equity while increasing the per-share crypto amount, which in turn supports or even amplifies the premium.

In 2025, the BTC holdings of publicly listed companies in the DAT sector followed an almost monotonically increasing trajectory, rising from about 600,000 at the beginning of the year to about 1.05 million by November, accounting for approximately 5% of the theoretical total supply of BTC; among them, Strategy increased its holdings from about 447,000 to about 650,000, remaining an irreplaceable core of treasury in absolute terms, but its market share fell from about 70% to just over 60%, with the incremental growth coming more from mid-sized DATs.

In the second and third quarters, various models of DAT collectively entered the market, pushing total BTC holdings over the one million mark. By the fourth quarter, although net fund inflows plummeted from their peak and the DAT stock price premium was significantly squeezed, the curve only showed a slowdown in slope rather than a directional reversal, with no systemic deleveraging or forced liquidations occurring. The trend indicates that the so-called bubble burst is more about re-pricing at the equity level rather than the collapse of BTC positions on the asset side. DAT has transformed from a round of thematic trading into a structural buying layer within the regulatory framework, forming a buffer on the supply side of BTC that is locked in by corporate governance, accounting standards, and information disclosure systems. Meanwhile, the industry structure has evolved from "one whale dominates" to "giant whales + long-tail groups," with the risk focus substantively shifting from the price of the coin itself to the financing structures, corporate governance, and regulatory impacts of individual DATs. The key for the DAT sector is no longer to predict the short-term rise and fall of BTC but to understand the financing structures, derivatives exposures, and macro hedging logic behind these companies. In the upcoming 2026, as the MSCI index review approaches and the potential shift in global monetary policy looms, the volatility tests faced by DAT companies are just beginning.

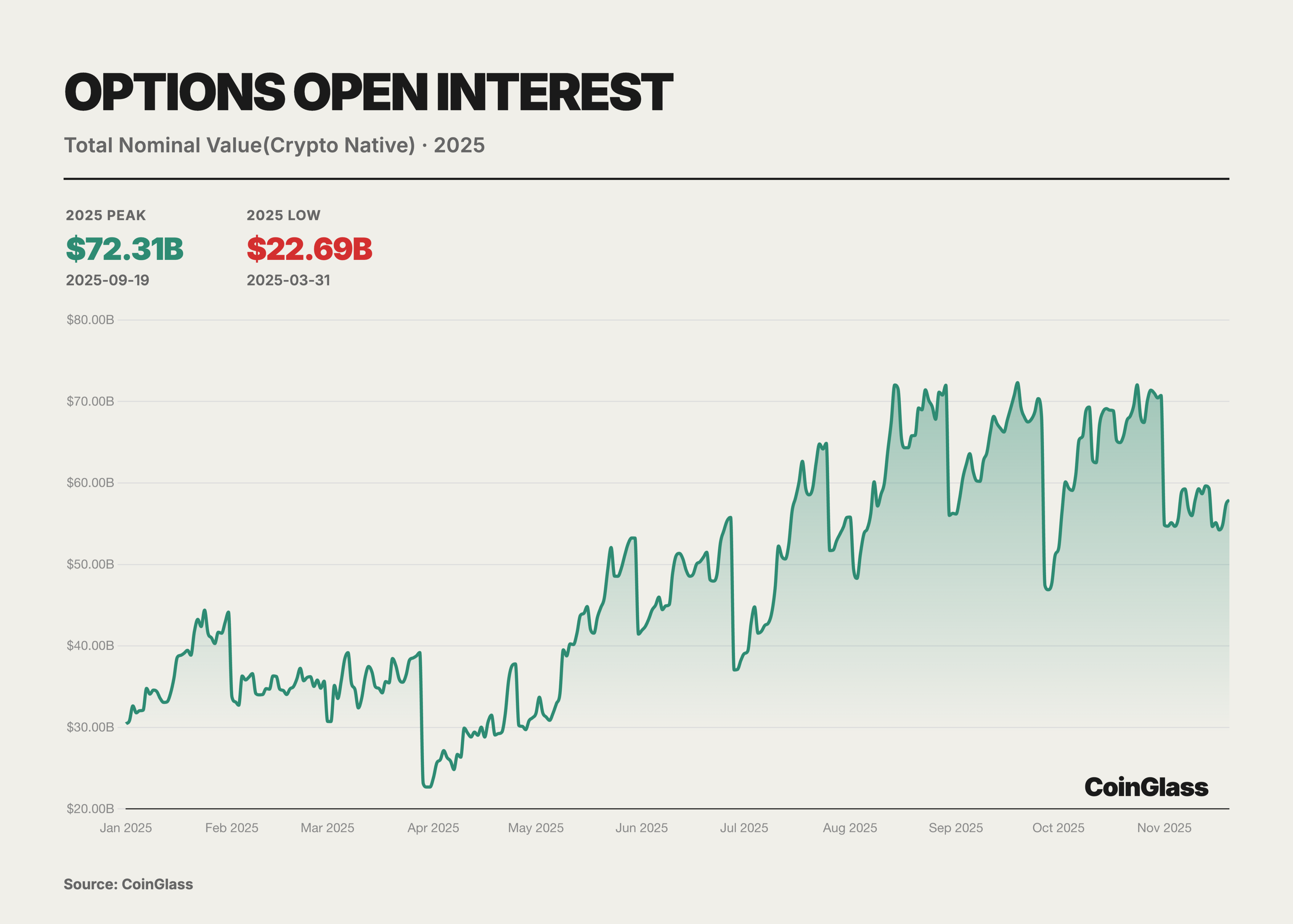

Options Market

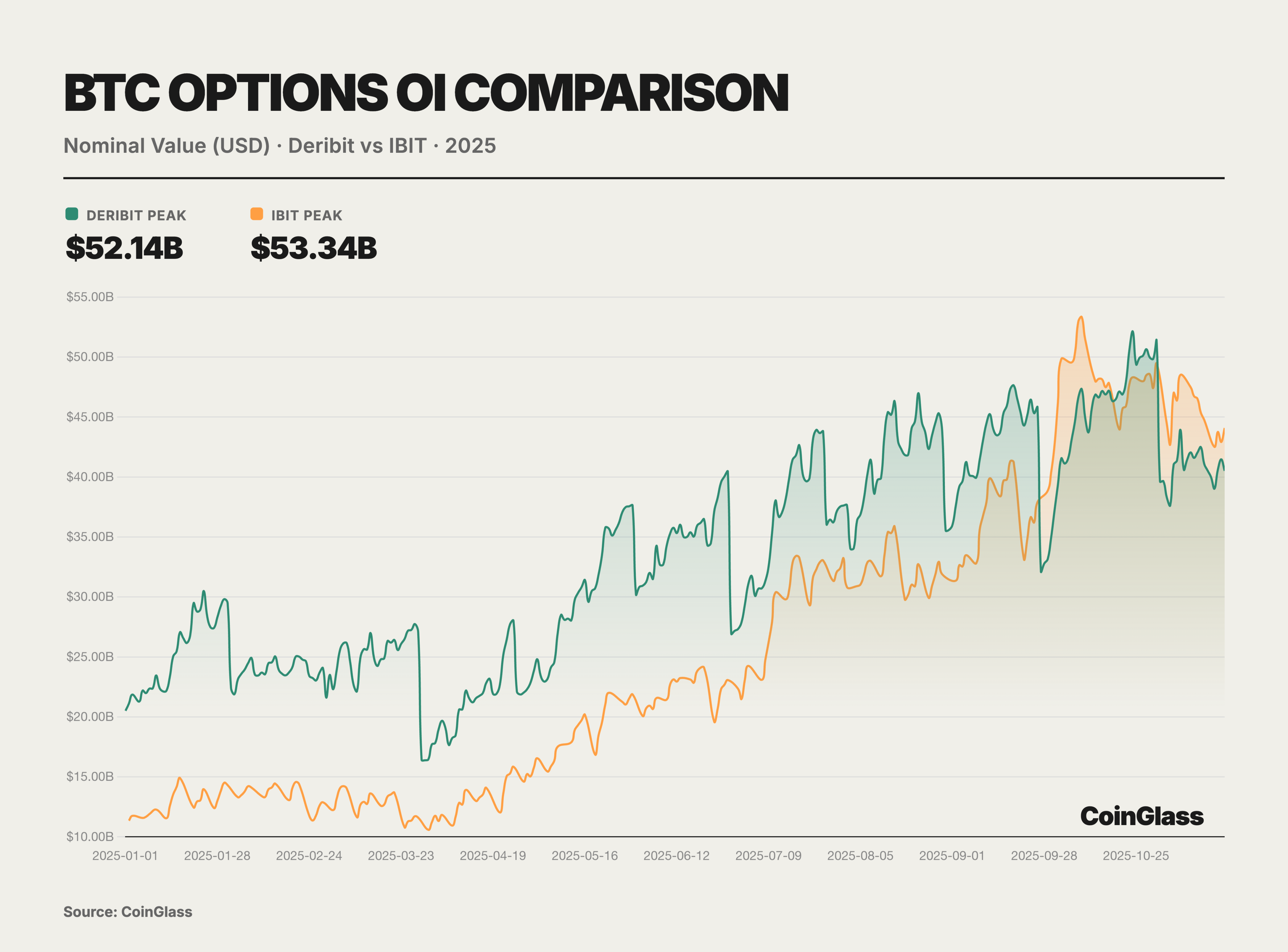

The core narrative of the options market this year is defined by two major milestone events, which together reshape the logic of global digital asset pricing power. The first is the acquisition of offshore options giant Deribit by the largest compliant exchange in the U.S., Coinbase, for $2.9 billion. This merger not only marks the integration of traditional compliant exchanges with native crypto liquidity but also redefines the infrastructure landscape of global derivatives trading. The second is the rise of BlackRock's IBIT ETF options, which, by the end of the third quarter of 2025, surpassed the long-dominant Deribit in open interest for the first time, marking that traditional financial capital has officially challenged crypto-native platforms in volatility pricing power. Prior to this, Deribit enjoyed an almost monopolistic advantage, controlling about 85% of the global crypto options market share by the end of 2024.

Throughout this year, the involvement of traditional financial institutions has become a watershed moment for changes in the options market. With the evolution of the regulatory environment in the U.S., several Wall Street institutions have launched BTC ETFs and their options products. Notably, BlackRock's IBIT began offering options trading in November 2024 and quickly rose to become a new giant in the BTC options market in 2025. Overall, the market landscape in 2025 presents a dual-track feature: on one hand, there are crypto-native platforms represented by Deribit, and on the other hand, there are traditional financial channels represented by IBIT and ETF options.

BlackRock's IBIT ETF options have risen strongly, posing a direct challenge to Deribit. As a spot BTC ETF listed on the NASDAQ in the U.S., IBIT's options have seen a sharp increase in open interest since their launch at the end of 2024, becoming the largest BTC options trading vehicle globally by November 2025, replacing Deribit's long-standing dominance. The success of IBIT options highlights the significant influence of traditional financial power—large numbers of institutional investors, previously restricted by regulations from participating in offshore platforms, have entered the BTC options market through IBIT, bringing substantial capital and demand. The credibility and compliance framework of large asset management companies like BlackRock behind IBIT have also attracted more conservative institutions to use options for BTC risk exposure management. As of November 2025, IBIT, as the largest spot BTC ETF, has an asset management scale of up to $84 billion, providing ample spot support and liquidity foundation for the options market, clearly demonstrating the strong demand for spot ETF options.

Aside from Deribit and IBIT, less than 10% of the BTC options market is divided among exchanges like CME and a few other crypto trading platforms. The Chicago Mercantile Exchange (CME), as a traditional regulated venue, offers options trading based on BTC and ETH futures. After several years of development, CME's market share has increased, but as of Q3 2025, its share of global BTC options open interest is only about 6%. This reflects the limited market appeal of futures-based options compared to more flexible crypto-native platforms and ETF options. Centralized exchanges like Binance and OKX have also attempted to launch BTC and ETH options products in recent years, but user participation has been relatively low. The derivatives trading volume of these exchanges is mainly concentrated in perpetual contracts and futures, with options business accounting for only a small portion of their derivatives landscape. Platforms like Bybit also offer USDC-settled options trading, but their overall market share is similarly limited. Other exchanges represented by OKX and Binance contribute only about 7% of BTC options open interest in total. Overall, the crypto options market in 2025 presents a highly concentrated situation: crypto-native platforms (led by Deribit) continue to dominate non-ETF varieties like ETH, while traditional financial platforms (represented by IBIT) have gained ground in BTC options, leading to a dual oligopoly structure that marginalizes other players. Notably, in the ETH options space, since there are no similar spot ETF options products like IBIT, Deribit remains almost the sole center of ETH options liquidity, with over 90% market share. This means that Deribit's dominance in the ETH options market remains solid in 2025, while IBIT's impact is mainly felt in the BTC domain. Looking ahead, with the approval of ETH spot ETF options in April 2025, it is possible that ETH ETF options will also be launched subsequently and gradually participate in the competition. However, as of November 2025, the ETH options market is still dominated by crypto-native exchanges, with no traditional institutional-level competitors like IBIT emerging.

DeFi

PerpDEX

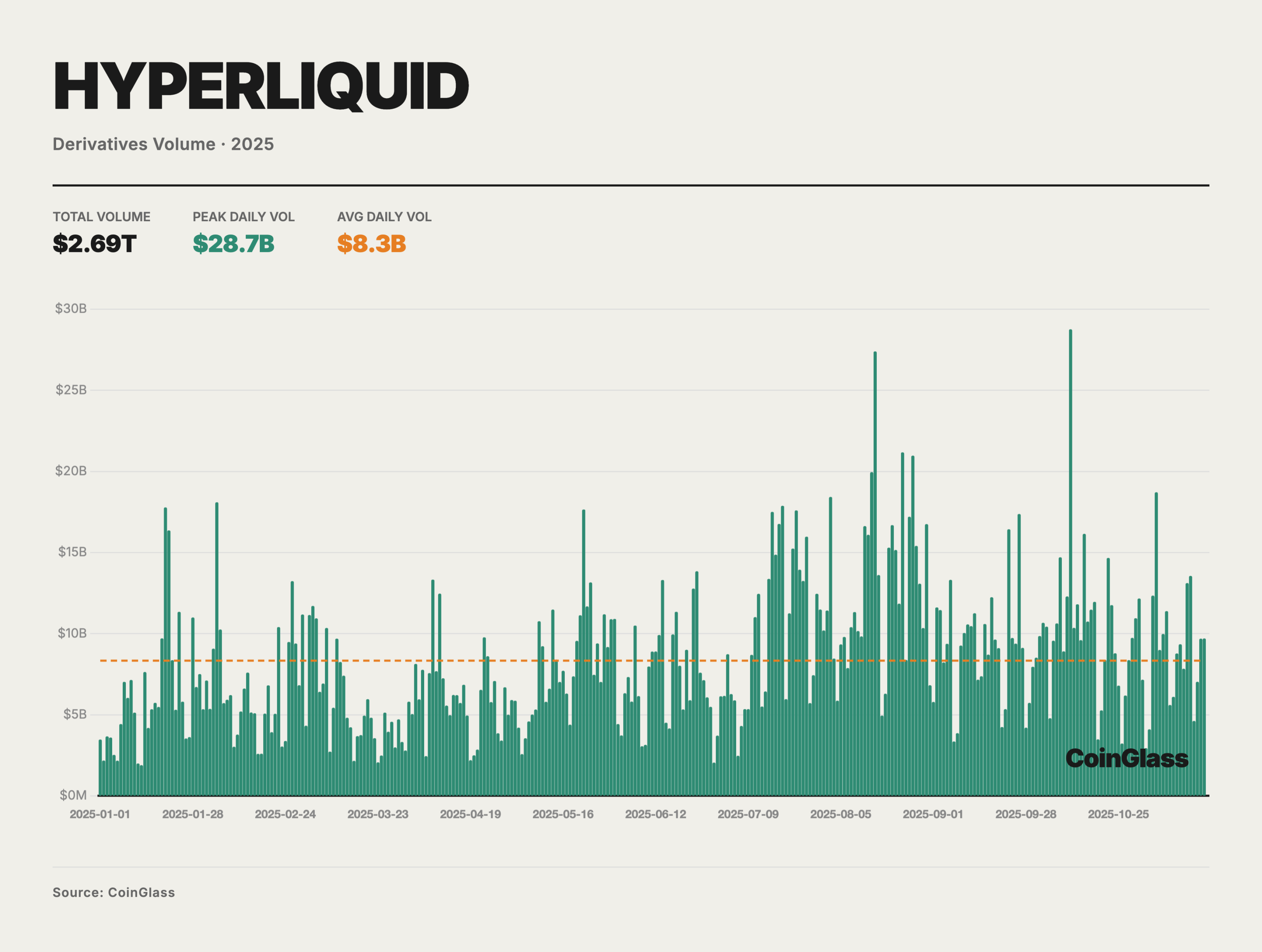

The year 2025 was an exceptionally brilliant year for PerpDEX. The entire market saw explosive growth in trading activity, continuously breaking historical records. Monthly trading volume exceeded $1.2 trillion for the first time in October, with total on-chain derivatives trading volume reaching several trillion dollars for the year. The surge in trading volume and market share is driven by multiple factors, including performance breakthroughs, rising user demand, and changes in the regulatory environment. Retail investors, institutional trading departments, and venture capital funds all turned their attention to this thriving sector in 2025.

Hyperliquid is undoubtedly the leader in the PerpDEX market in 2025. In the first half of the year, the platform almost dominated the entire sector, with market share reaching as high as 70-80%, and in May, Hyperliquid's on-chain perpetual contract trading volume peaked at about 71%. This astonishing volume made Hyperliquid almost synonymous with the PerpDEX market in the first half of 2025.

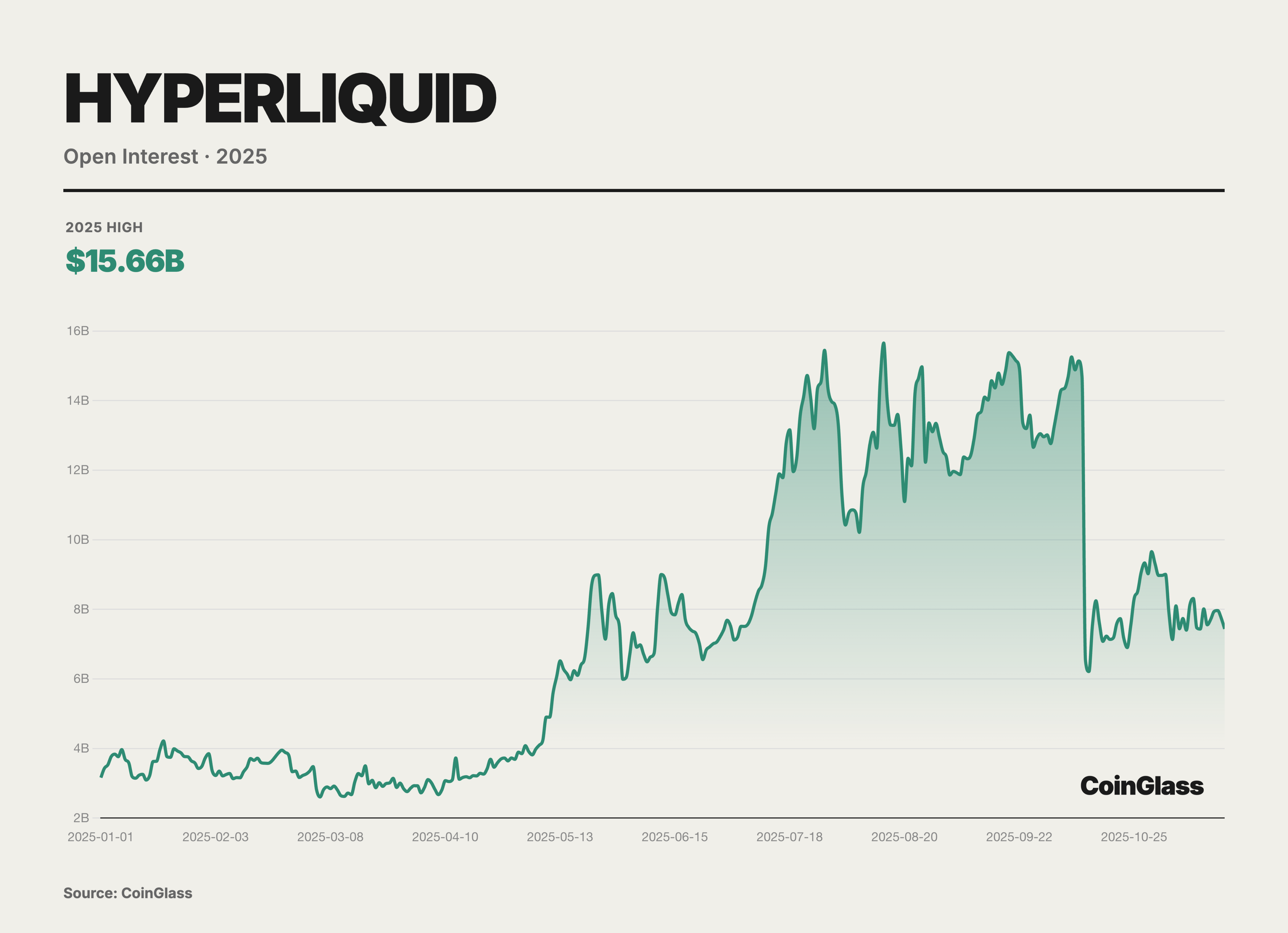

Hyperliquid not only attracted massive trading volume but also accumulated a significant amount of open contracts. Data from October 2025 shows that its perpetual contract open interest reached $15 billion, accounting for about 63% of the total holdings of major decentralized perpetual platforms. This indicator reflects that a large amount of capital chooses to stay long-term on Hyperliquid, demonstrating traders' high trust in the platform's liquidity and stability.

Unlike traditional ETH L1 or general-purpose public chains, Hyperliquid has built a custom Layer1 blockchain specifically for high-frequency derivatives trading. This chain employs a self-developed HyperBFT consensus mechanism, capable of supporting 200,000 orders per second, with transaction confirmation delays as low as 0.2 seconds. This performance even surpasses many centralized exchanges, making Hyperliquid the first exchange to achieve speeds and liquidity close to CEX on-chain. The platform uses a fully on-chain order book (Central Limit Order Book) model, ensuring depth and quote quality, allowing professional traders to enjoy a matching experience comparable to traditional exchanges on-chain.

Although Hyperliquid dominated in the first half of 2025, the market landscape of PerpDEX shifted from a single leader to multiple strong players with the strong entry of new participants in the second half of the year. Entering the third and fourth quarters, Hyperliquid's market share saw a significant decline—from about 70-80% at mid-year to 30-40% by year-end. On-chain data shows that in November, Hyperliquid's trading volume share had dropped to about 20%, while new stars like Lighter and Aster rapidly emerged: Lighter accounted for about 27.7%, Aster for 19.3%, and another dark horse, EdgeX, reached 14.6%. This indicates that the market, once dominated by Hyperliquid, has evolved into a competitive landscape with multiple players in just a few months. High trading incentives, differentiated product strategies, and capital support have driven the rise of these challengers, leading to an intensified competition in the entire PerpDEX field in the second half of 2025.

Prediction Market

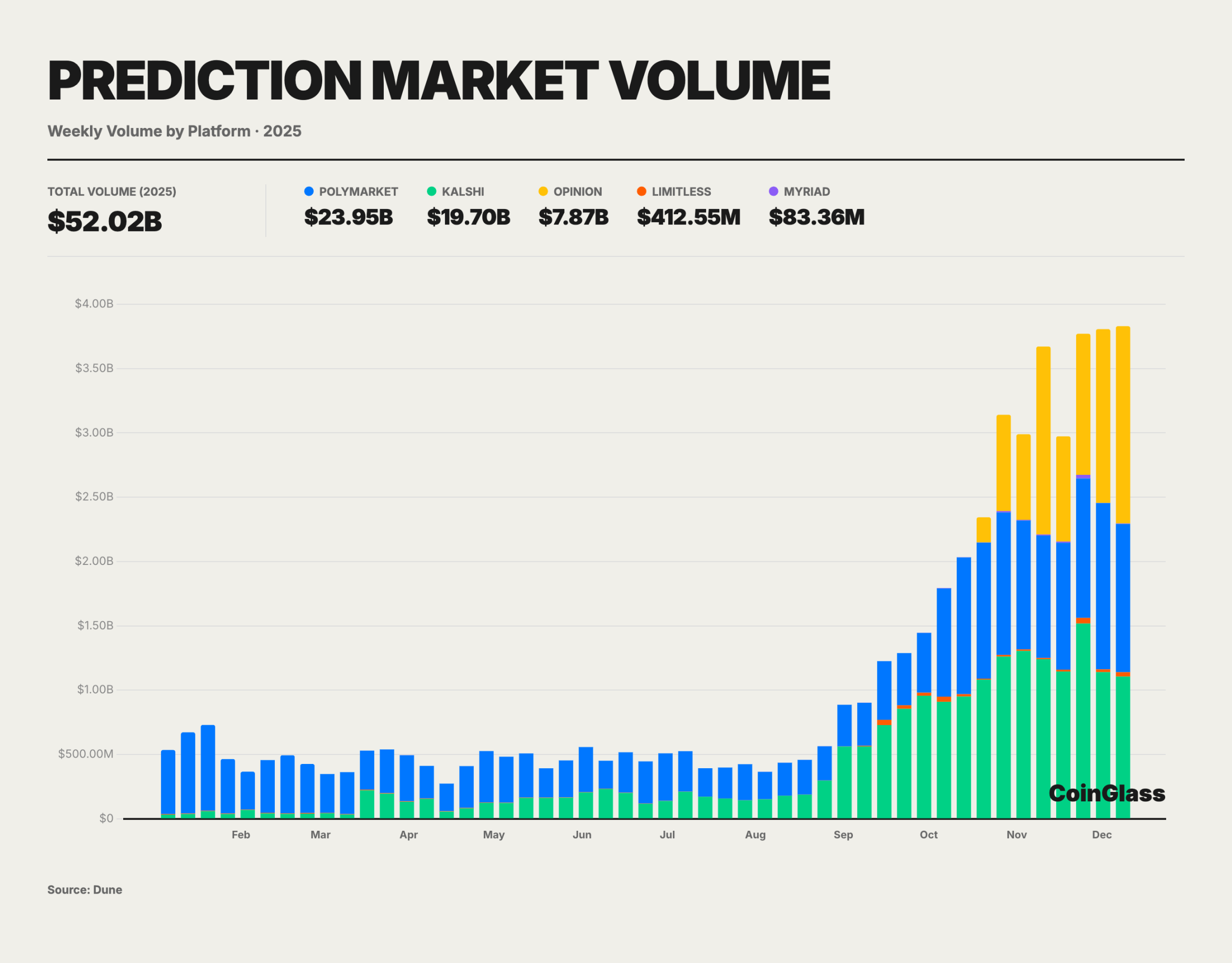

The crypto prediction market experienced explosive growth in 2025, with total trading volume from January to November reaching approximately $52 billion, significantly surpassing the peak levels during the 2024 U.S. election.

As the largest prediction market platform by trading volume globally, Polymarket's cumulative trading volume in 2025 has exceeded $23 billion. The platform's daily active users approached 60,000, nearly tripling since the beginning of the year; monthly active user peaks are estimated to have exceeded 450,000, indicating a significant increase in public participation. Currently, the total number of registered trading users on the Polymarket platform is about 1.35 million, reflecting the rapid expansion of the user base over the past year. The large user group and abundant liquidity have allowed several popular markets to accumulate individual contract trading volumes in the hundreds of millions, with highly liquid markets accommodating tens of millions of dollars in and out without severe slippage. In high liquidity, liquidatable, and clearly defined event scenarios, prediction market prices are often used as supplementary indicators. Reports indicate that during the U.S. election in November 2024, Polymarket's daily trading volume once reached nearly $400 million, accurately predicting the election results, in contrast to traditional polls that showed deviations. This example highlights the information aggregation capability and pricing accuracy of decentralized prediction markets in major events, laying the foundation for further mainstream adoption in 2025.

Web3 Wallet

As the first touchpoint connecting users with decentralized networks, Web3 wallets have undergone a fundamental leap in strategic importance in 2025. Wallets are no longer merely containers for private key storage or simple transfer tools; they have evolved into on-chain traffic entry points that integrate digital identity (DID), asset management, decentralized application (DApp) operating systems, and social graphs.

Looking back over the past five years, the form of Web3 wallets has experienced dramatic evolution. Early wallets required users to have a high level of technical understanding, needing to manage mnemonic phrases, understand gas fee mechanisms, and manually configure networks. This high barrier led to a significant user drop-off rate, with data showing that over 50% of users abandoned the wallet setup stage due to the complexity of the process. The most notable industry feature this year is the large-scale implementation of account abstraction and the standardization of chain abstraction technology. The integration of these two technologies has enabled Web3 wallets to first achieve user experiences that can compete with Web2 financial applications. Complex private key management, obscure gas fee mechanisms, and fragmented multi-chain liquidity are being encapsulated by intelligent protocols in the background, reducing user friction to historical lows.

At the same time, the entry of institutional-level capital has forced upgrades in wallet security architecture, with the combination of multi-party computation (MPC) technology and trusted execution environments (TEE) becoming standard for leading wallets, fundamentally changing the fragile security model where the private key is everything.

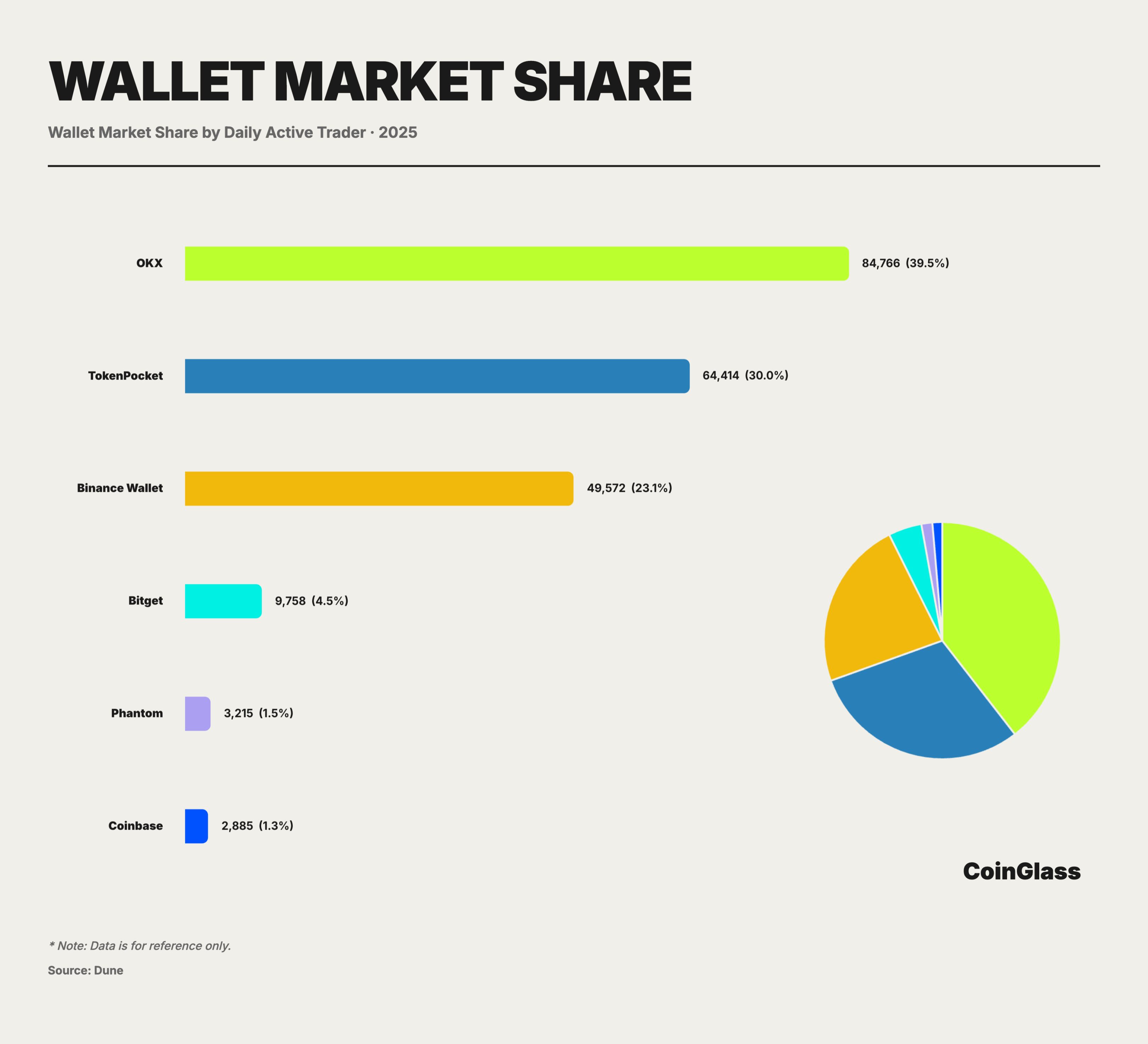

In the market landscape of 2025, characterized by a dominant player and multiple strong competitors, the OKX Web3 wallet stands out as a comprehensive leader in the industry due to its combination of technological innovation and an all-encompassing ecosystem, excelling in usability and functional integration. As a super aggregator for Web3 entry, the OKX wallet boasts over 5 million monthly active users, with its core design philosophy centered on encapsulating complex on-chain logic behind a minimalist interface. Through a unified dashboard, users can easily manage assets spread across more than 100 public chains without the need to manually add contracts.

At the same time, the OKX Web3 wallet is one of the earliest products in the industry to deeply integrate DEX aggregators. While many other wallets still support swap functions on a single chain, the OKX wallet has already achieved multi-chain transaction aggregation within the wallet itself. Its built-in OKX DEX aggregator covers over 100 public chains, automatically finding the best trading paths for users through smart routing. After initiating a swap request within the wallet, the aggregator simultaneously calls multiple DEX quotes and splits the routing to ensure transactions are executed at optimal prices with minimal slippage.

In addition to the OKX Wallet, which has long held a leading position in the industry, 2025 also saw the rise of many newcomers, such as Binance Wallet. The core of Binance Wallet's emergence in 2025 lies in the growth strategy of Binance Alpha: embedding early project discovery and trading directly into the wallet, allowing users to participate in early projects, airdrops, and TGEs through a path similar to centralized products. The official positioning of Alpha is closer to a "discovery and screening pool for pre-listing projects," enhancing transparency and participation in the process, and converting on-chain participation into more frequent trading behaviors and retention through task-based and equity-based mechanisms. This Alpha-driven wallet growth is reflected very directly in the data.

In 2025, Bitget Wallet is betting on PayFi, bridging on-chain finance with real-world consumption, and promoting Wallet Card. The gas-free GetGas covers multi-chain gas payments and supports Google/Apple/email social logins. It natively integrates with Ondo and other RWA, allowing for the trading of tokenized U.S. stocks, while also providing QR code and card payments, as well as stablecoin finance Plus, positioning itself as an everyday finance app.

Summary

The main theme of the crypto derivatives market in 2025 is a re-pricing shift from high-leverage retail speculation to the parallel evolution of institutional capital, compliant infrastructure, and on-chain technology. Macro liquidity determines trends, with crypto amplifying volatility in a high Beta environment amid expectations of interest rate cuts and shifts in risk appetite, while geopolitical and policy factors provide triggers; throughout the year, the deleveraging phase saw an external shock in October combined with crowded leverage from Q3, causing the total open interest across the network to retract over $70 billion from its peak within two days and resulting in a peak of over $10 billion in liquidations.

On the CEX side, with an annual trading volume of approximately $85.7 trillion, open interest, depth, and custody have highly concentrated towards leading platforms, which enhance price discovery and execution efficiency, while also magnifying compliance, operational, and technical events into systemic risks; under declining inventories and thinning order books, this concentration simultaneously amplifies upward marginal thrusts and liquidity vacuums during downturns. Extreme liquidations expose the fragility of the margin—liquidation—insurance fund—ADL chain: when insurance funds are under pressure and cross-platform transfers are congested, the non-transparent execution of ADL and deviations from market prices can dismantle hedging legs, causing neutral positions to passively turn into directional risks, necessitating a re-evaluation of stress tests around liquidation mechanisms and fund accessibility. Institutionalization is more concentrated in on-exchange derivatives and DAT: CME has introduced compliant innovations like spot pricing futures, promoting the normalization of basis trading, connecting ETF spot demand with futures hedging into replicable arbitrage chains; DAT has formed balance sheet-type configurations/funding flywheels driven by accounting and financing tools, making buying more "locked in," but shifting the risk focus from coin prices to financing structures, corporate governance, and regulatory impacts. The pricing power in the options market is also shifting, with the merger and integration of compliant exchanges and the rise of ETF options concentrating BTC volatility flows towards traditional financial channels. On the DeFi side, PerpDEX is approaching CEX experiences and moving towards multi-strong competition, relying on high-performance application chains and intent-centric architectures, while the account/chain abstraction of prediction markets and wallets is pushing discovery, trading, and distribution to the application layer.

In summary, the current derivatives market presents distinct structural opportunities and asymmetric risks: opportunities mainly exist in the low-risk basis arbitrage space emerging from the integration of compliant spot and derivatives tools (such as ETF options), as well as the functional replacement of traditional centralized liquidity by high-performance on-chain infrastructure (PerpDEX); while risks are highly concentrated in the potential reversal of financing logic in the DAT sector, which could trigger a double whammy of equity and coin price declines, as well as systemic liquidation hazards due to liquidity mismatches in the highly concentrated CEX clearing system. Looking ahead to 2026, as the global regulatory framework accelerates convergence and the liquidity environment potentially shifts, the core competitiveness of the market will focus on whether trading infrastructure can maintain clearing resilience within extremely crowded leverage chains, and whether capital can find the most efficient flow paths between compliance and decentralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。