The battlefield of market makers is not the K-line chart, but the LOB.

Author: Dave

Why do we always experience bad luck shortly after buying altcoins? Why can't seemingly gigantic market makers handle the sell orders of 1011?

Why do the market makers we talked to after 1011 all calmly say they didn't lose much that day or even made a profit? This article will introduce you to the order book and order flow of market makers.

1. Limit Order Book (LOB)

The battlefield of market makers is not the K-line chart, but the LOB.

Core concepts:

Depth: The volume of orders at each price level.

Tick Size: The smallest unit of price movement. In a high-frequency environment, tick size is crucial for queuing strategies.

Price Improvement: When the price you offer is better than the current best bid and ask (NBBO), you create value for the market.

For example, if the current BTC bid is 100,000 and the ask is 110,000, if you bid at 101,000, you narrow the spread and create value for the market.

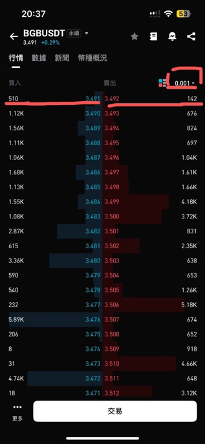

While writing this article, I thought about how to explain this section to everyone, and I felt that nothing is clearer than directly showing the real order book. Let's help a good friend of bg promote it, using bgb as an example.

Above is the order book of bgb with the smallest tick size. We see that the minimum is 0.001, and the current market depth is only over 1,000 dollars, with a very small spread, hitting the minimum tick size. At the same time, the depth is distributed in a "Christmas tree" shape, with larger order volumes further away from the market. However, when we increase the tick size a bit, we find that the depth should be distributed in a trumpet shape, with larger order volumes closer to the market, more liquidity, and fewer orders further away (one reason for the liquidity vacuum of 1011).

Speaking of the Christmas tree, this article is scheduled to be published on December 24, Christmas Eve. I wish everyone a Merry Christmas!

2. Market Maker Profit Source: Spread

The spread is not just profit; it mainly consists of three parts of cost:

Order Processing: Exchange fees, hardware delays, manpower.

Inventory Risk: The risk of holding a position while the price moves against you, which we discussed in the previous episode.

Adverse Selection: This is the most critical—when you execute a trade, the other party may have information you do not know. In other words, you might be taken advantage of by someone with insider information.

There are also three types of spreads: Quoted Spread, Effective Spread, and Realized Spread. The quoted spread is the easiest to understand, the ask-bid price difference, while the realized spread measures the actual profit left for the market maker after price adjustments: 2 x (Ptrade – Pfuturemid), which includes the future median price, somewhat like considering opportunity costs.

3. Order Flow

Order flow is the orders received by market makers. This is a very deep topic, as market makers will perform various operations on order flow, such as hedging, matching, modifying orders, etc., in order to manage their book. There are quite a few professional concepts and operational techniques involved, and it may even involve legal issues, such as agency trades not being able to act as counterparties to principal trades due to conflicts of interest. This article will only introduce the concepts of Order Flow Toxicity and VPIN. If a market maker boss hires me, I will update my fans on professional order flow management.

Toxic Flow refers to orders from informed traders who know that prices are about to change, resulting in realized spread losses because they know P_futuremid through insider information. Therefore, as market makers, we must also be careful not to be taken advantage of by toxic insiders.

Non-toxic Flow (Noise/Retail Flow) comes from retail investors or funds that passively adjust their weights. This is the "food" that market makers like the most.

To protect themselves, market makers will adjust their quotes as a defense mechanism against toxic flow. A simple way to prevent "toxicity" is to assume that all active orders are toxic. If a buy order comes in, the market maker will immediately lower the reservation price, causing the overall quotes to drop. This also answers the question left from the previous chapter about why we always buy at high points, as market makers will adjust quotes for risk control. But the smart reader might ask again, what if an insider buys a large amount? What if they use their information advantage to aggressively hit the market? Yes, this could be what happened during 1011, and it's also the reason why large market makers with billions in assets couldn't handle the orders.

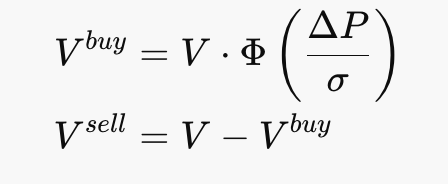

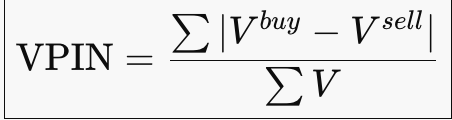

Core Indicator: VPIN (Volume-weighted Probability of Informed Trading).

VPIN ≈ The probability that market makers are continuously hit by "one-way flow" in the current market. When there is a large amount of one-sided pressure, MM inventory accumulates on one side, and the mean reversion hypothesis fails. At this point, market makers will withdraw orders (Pull quotes) and temporarily not provide liquidity to wait for the order flow to restore symmetry. But what if the order flow doesn't restore symmetry? Or if the order flow deviates too much and causes them to get liquidated? This is the tragedy of 1011. I’m thinking of writing an episode about how exchanges made money during 1011; let’s see later.

Back to the main topic, after a VPIN anomaly, market makers will withdraw orders (Pull quotes) or widen the spread, effectively earning more service fees to compensate for losses at certain price levels, while also reducing size to control the speed of inventory accumulation.

This episode concludes the first part of our market maker story. From the perspective of retail investors, the truth about how market makers operate has been revealed. Next, I will introduce some more "institutional" topics from the market maker's perspective, so hold on tight.

Every episode of an anime ends with a preview of the next episode, and this article has one too: If we enter the world of Jujutsu Kaisen, order flow is "cursed energy," and quote operations are "techniques." In the next article, we will look at the "domain expansion" in market making.

To know what happens next, stay tuned for the next installment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。