Author: 1912212.eth, Foresight News

The most anticipated protagonist in the derivatives track is finally about to make its debut. A few days ago, rumors circulated from the Lighter team's market leader that its TGE would take place before the end of the year, with only 3 days left until 2026, making it highly likely that the TGE will happen soon. Initial trading will be limited to the Lighter platform, but Coinbase and Bybit have included it in their roadmap. OKX and Binance have also pre-launched its perpetual contracts.

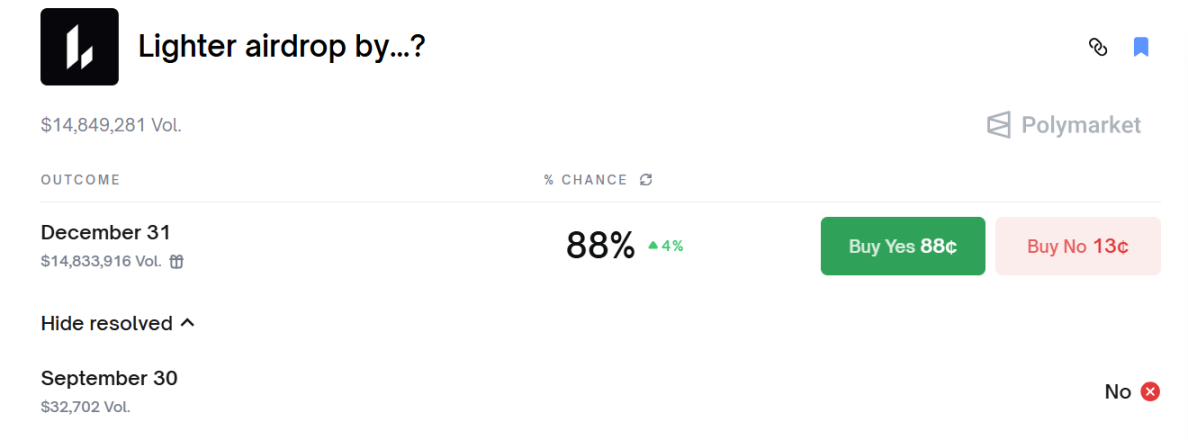

Polymarket has also provided predictions, with the latest data showing that the market is betting on an 88% probability of an airdrop this year, with a total market transaction volume reaching $14.85 million.

The Launchpad event of the exchange MEXC shows that the LIT token sale will officially end tonight at 9 PM, with an FDV of $1.6 billion and $2 billion respectively.

Airdrop accounts for 25% of total supply, no lock-up

Lighter is a DEX focused on perpetual contract trading, built on ZK Rollup technology, aiming to provide an efficient and low-cost trading experience. The Lighter airdrop is based on a points system, with the second quarter points being distributed by December 27, 2025, totaling approximately 12.4 million points, after cleaning to exclude wash trading. The airdrop accounts for 25% of the total supply, which is 250 million LIT, sent directly to eligible wallets without the need for claiming or lock-up.

Lighter's founder and CEO, Vladimi, specifically mentioned that through anti-cheating algorithms (data science and clustering methods to identify "witch" accounts), the points of witch accounts will be redistributed to eligible traders. There is an appeal mechanism for witch screening, and so far, the number of appeals has been lower than expected. The specific algorithm details will not be disclosed to avoid targeted optimization. Lighter is confident in the final determination of witch accounts.

The points conversion rate is estimated to be 20-28 LIT per point, with the OTC value of points around $11. The overall community allocation is 50%, with the remaining 25% reserved for future airdrops, partnerships, and grants. The Lighter team's market leader stated that the TGE and airdrop will launch simultaneously, and there will be no payments for CEX listings.

The total supply of the LIT token is 1 billion, with 50% allocated to the community, including the initial airdrop and future incentives. LIT is neither an equity nor a dividend token. Therefore, the fees generated by the protocol will not be used to distribute dividends or payouts to investors but will be reinvested into the protocol itself for ecosystem expansion, product growth, and, most importantly, token buybacks.

The remaining portion is allocated to the team, investors, and ecosystem development, with investor shares locked for 3 years and released linearly to reduce early selling pressure. A dual token/equity structure will not be adopted in the future.

The design of LIT aims to capture the value of the protocol, including token buybacks through protocol fees, staking mechanisms, and access to exclusive features. Protocol fees mainly come from professional market makers (MM) and high-frequency traders, while retail investors are permanently exempt from fees.

Currently, Lighter's perpetual and spot trading zk circuits have completed audits and are officially open-sourced. The team has released complete verification code, allowing external independent verification of every order, cancellation, and liquidation operation of Lighter L2 on Ethereum to ensure authenticity.

84% probability of FDV exceeding $2 billion

In November this year, Lighter completed a $68 million financing against the trend, with a valuation of $1.5 billion, led by Ribbit and Founders Fund, with participation from Haun Ventures and Robinhood. Both the financing amount and the venture capital lineup are quite impressive.

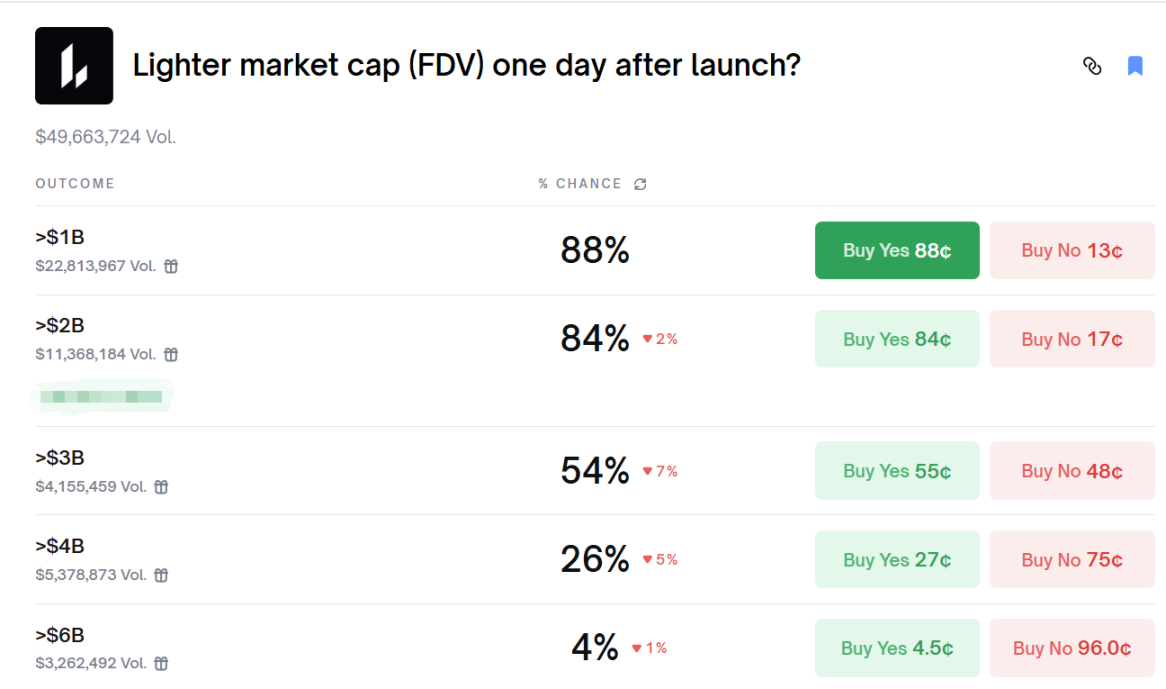

Although the market is currently in a bear phase, there is still considerable enthusiasm for it. Data on Polymarket shows that the market bets on an 88% probability that its FDV will exceed $1 billion on the day after its launch, with an 84% probability of exceeding $2 billion.

If the FDV exceeds $2 billion, the token price will be above $2.

In comparison, the current FDV of HYPE is $25 billion, with a transaction volume of $24.12 billion over the past 7 days. Aster's FDV is $5.784 billion, with a transaction volume of $21.54 billion over the past 7 days.

Lighter's transaction volume over the past 7 days is $28.387 billion, with a transaction volume of $2.147 billion in the past 24 hours, surpassing Aster's $1.833 billion and HYPE's $1.33 billion.

According to data from DefiLlama, Lighter's total TVL has risen to $1.392 billion, with total fee revenue exceeding $100 million this year.

According to Bitget market data, the latest price of LIT's perpetual contract is $3.46, with an FDV exceeding $3 billion. Whether this momentum can be maintained until the airdrop release remains to be seen.

Jake O, head of OTC trading at Wintermute, stated, "The Lighter TGE will become an important indicator of the current market risk appetite, and how the market digests the first 25% of the token supply released will largely reflect the strength of overall market sentiment."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。