Author: Wang Lijie

We are standing at multiple breaking points in history, and a new normal that is more intense and disruptive than we imagine is approaching. The three pillars that have supported global economic prosperity over the past forty years—demographic dividends, globalization of labor division, and inclusive technological advancements—are simultaneously collapsing before our eyes. This is not alarmism, but a reality we must face. In the next decade, from 2026 to 2035, the world will undergo earth-shattering changes that will profoundly affect our wealth landscape and investment strategies.

The "4B Movement" and "Fertility Strike": Deep Cracks in Social Structure

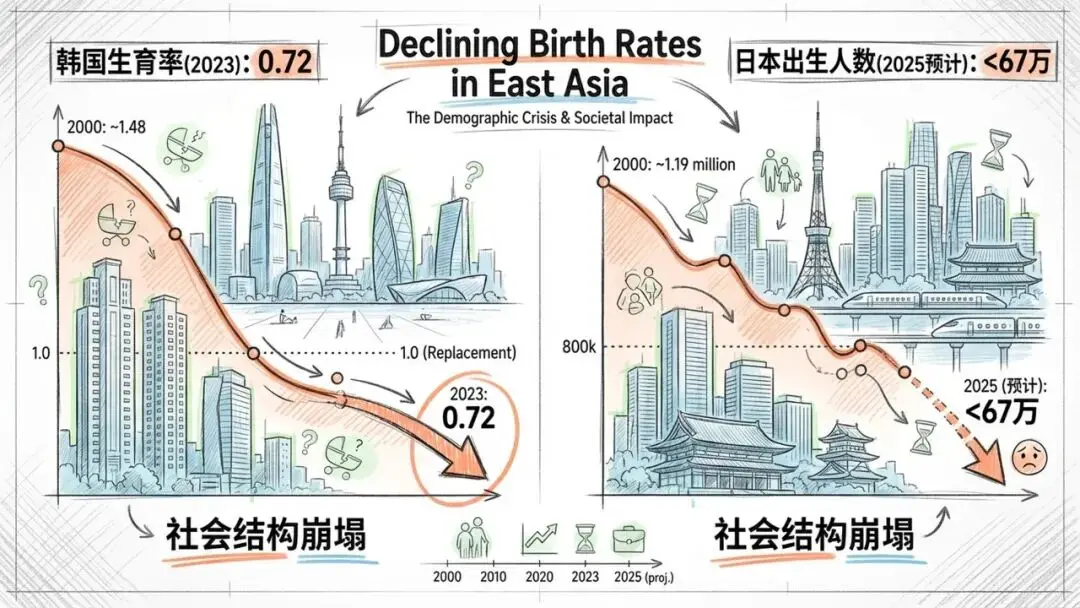

Let us first focus on a shocking phenomenon: the cliff-like decline in global fertility rates. This is not a simple numerical change, but a signal that social structures are undergoing profound transformation.

Take South Korea as an example, where the total fertility rate fell to an astonishing 0.72 in 2023. This means that, on average, each woman will give birth to only 0.72 children in her lifetime. Such a level of decline far exceeds normal fluctuations in fertility rates, pointing directly to the shaking of social foundations. The situation in neighboring Japan is also concerning; although its fertility rate is slightly higher than that of South Korea, the number of births is expected to drop below 670,000 by 2025, marking the lowest point since statistics began in 1899, with a decline rate far exceeding the government's most pessimistic predictions.

Behind this trend are complex interwoven socio-economic factors. In South Korea, young women have launched a massive "4B Movement"—that is, "No Marriage, No Childbirth, No Dating, No Sexual Relations." This sounds like a plot from a science fiction novel, yet it is happening in reality.

This "4B Movement" is essentially a "reproductive strike" against patriarchal capitalist society. Young women in South Korea, under the multiple pressures of workplace gender discrimination, "widow-style parenting," and social stereotypes, have chosen this form of resistance. When they feel that social mobility is unattainable and even maintaining a decent life is difficult, "cutting off descendants" becomes a rational and final counterattack.

The consequences of this phenomenon are devastating. South Korea has the fastest aging population in the world, and it is expected that by 2065, the population aged 65 and older will account for nearly half. This not only means that the pension system will face immense pressure but will also comprehensively impact national finances, healthcare systems, and even military recruitment. In Japan, young people are generally trapped in a "low-desire" state, choosing not to marry or have children, and no longer believing that hard work will lead to a good life, instead pursuing low-cost personal entertainment. This is a form of "mild despair," a laid-back attitude towards life.

Economic Nihilism and Climate Anxiety: Reshaping the Worldview of the Younger Generation

You might think this is a unique situation in East Asian countries. However, Western developed countries are also experiencing similar demographic trends, albeit for slightly different reasons.

Today's young people, especially those born after 2000, are generally permeated by a sense of "economic nihilism." They deeply feel that no matter how hard they work, the traditional "American Dream" or "middle-class life" is out of reach. Sky-high housing prices make homeownership a luxury, with a single house potentially requiring the entire income of two people over a decade. When the traditional path of "owning a house and car, starting a family" is blocked, young people naturally choose to "live in the moment," seeking immediate pleasure or investing in high-risk cryptocurrencies, hoping for a chance to "turn a bicycle into a motorcycle."

For them, having children is a typical "high investment, long cycle, low immediate return" project, and it is naturally excluded from their life plans. This rational consideration has led to a global decline in the willingness to have children.

In addition to economic factors, "climate anxiety" has also become an important factor influencing young people's decisions. Many young people in the West are reluctant to have children due to concerns about climate change. They believe that "bringing a child into a world destined to burn is immoral," which is not only an economic consideration but also a profound moral and ethical reflection. When people lose confidence in the future of the Earth, the instinct to reproduce can also be overwhelmed by this rational concern.

This "active contraction" of the population trend is spreading globally and will trigger a series of macroeconomic consequences in the coming years:

Permanent Tightening of the Labor Market

The decrease in the young population will lead to a shortage of labor supply, especially in healthcare, construction, and low-end service industries. In the short term, this may push up wages, but the rising cost of living will outpace wage growth, leading to stubborn inflation rather than an increase in real purchasing power.

Collapse of Total Consumer Demand

Not marrying and not having children means the disintegration of the family as a basic unit of consumption. Demand for durable goods such as houses, cars, and home appliances will shrink in the long term. Future consumption structures will shift towards experiential and instant gratification consumption.

Rewrite of the Social Contract

Our existing pension system is essentially a "Ponzi structure," relying on a continuously growing young population to pay pensions. When the base of the pyramid shrinks, the pension crisis will fully erupt in the 2030s. The government will then face the difficult choice of cutting benefits or initiating severe inflation.

In this context, can traditional investment methods still work? The answer is clearly no.

The Underlying Logic of Wealth Transfer and the Explosion of Digital Assets

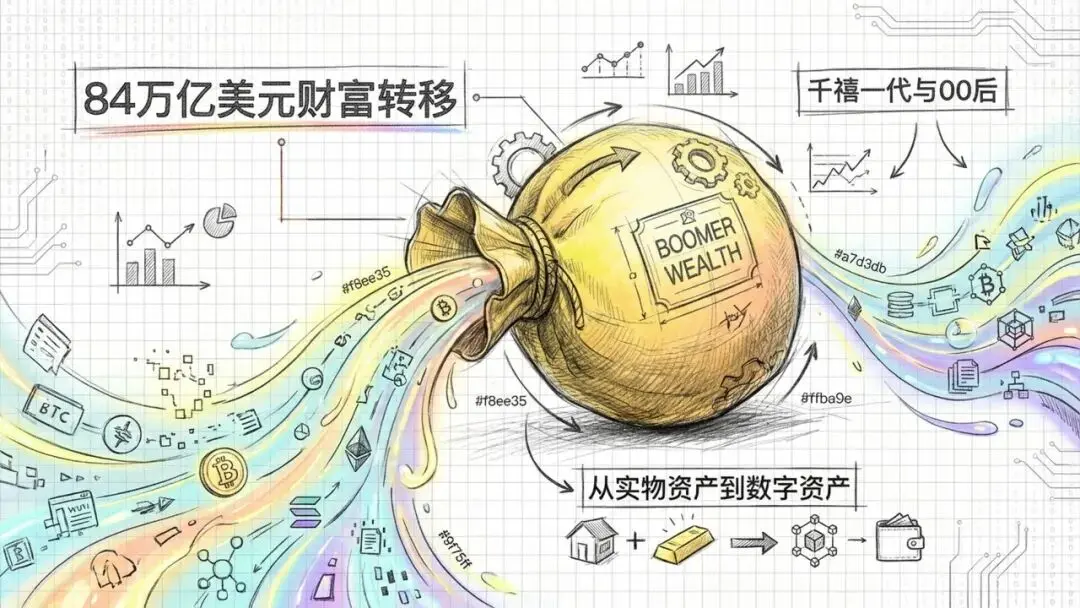

Understanding the background of the aforementioned demographic structure allows us to truly grasp why the next decade will witness the largest intergenerational wealth transfer in human history, and how this transfer will trigger a dramatic revaluation of asset prices, becoming the key precursor logic for the explosion of digital assets.

In the next twenty years, especially from 2026 to 2035, up to 84 trillion dollars of wealth will be transferred from the baby boomer generation to the millennial and post-2000 generations. This is not just a numerical change, but a transformation in the "character" of capital. The wealth of the baby boomer generation is mainly concentrated in real estate, blue-chip stocks, and traditional pensions, and they believe in "long-term holding" and "value investing." But will the post-2000 generation, who grew up in the internet age, financial crises, and asset bubbles, allocate assets according to their parents' logic?

The answer is, most likely not! This massive amount of capital will become the main fuel for driving up digital assets, especially cryptocurrencies and alternative investments. This is completely consistent with the "economic nihilism" logic we mentioned earlier.

Why Digital Assets?

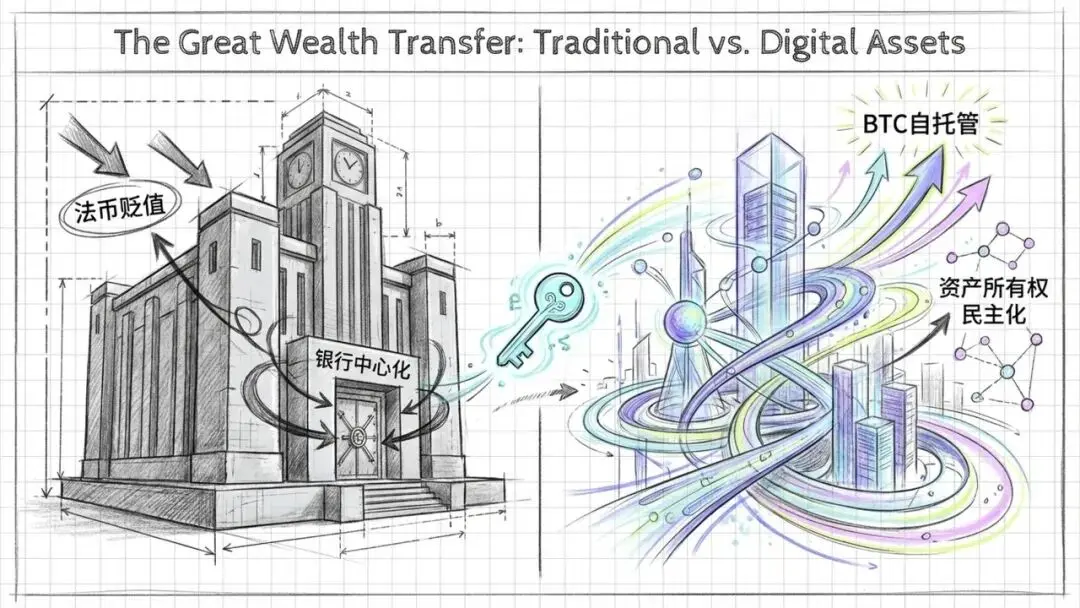

Distrust of the Traditional Financial System

The post-2000 generation has experienced the 2008 financial crisis, the 2020 unlimited quantitative easing, and the subsequent high inflation. They believe that fiat currencies are constantly depreciating, and the traditional banking system is inefficient and manipulated by a few. Therefore, decentralized digital assets like Bitcoin are not just investments, but also a form of "hedge asset" and "silent protest." They believe that in the new digital world, they can gain fairer competitive opportunities.

Inaccessibility and Substitutability of Real Estate

When housing prices are sky-high and the expectation of population shrinkage blurs the long-term value retention of real estate, young people are more willing to invest their wealth in the digital asset market, which has good liquidity, low barriers to entry, and high explosive potential. They seek digital wealth that can be carried with them and flow freely around the world, rather than traditional real estate.

High Risk Appetite and Desire for "Get Rich Quick"

Young people are no longer satisfied with annualized returns of 4%-5%; they need "exponential growth" that can change their fate. Data shows that the adoption rate of cryptocurrencies among the younger generation is more than three times that of their parents, and they are more inclined to take speculative positions. This "YOLO" mentality will profoundly affect market volatility in the next decade.

De-dollarization and Digital Assets: Seeking New Financial Anchors

Driven by the intergenerational transfer of wealth, the decade from 2026 to 2035 will be a key period for the convergence of de-dollarization and the mainstreaming of digital assets. This trend is not only driven by geopolitical factors but is also profoundly influenced by the investment preferences of young people.

The scale of U.S. debt will enter an unsustainable exponential growth phase in the next decade. As interest payments continue to erode fiscal revenues, the Federal Reserve will ultimately be forced to engage in more covert but larger-scale "monetization of fiscal deficits," that is, solving problems through continuous money printing. This will continue to shake global confidence in dollar assets.

For central banks, gold may be the preferred alternative reserve. But for young individual investors holding massive amounts of capital, Bitcoin and stablecoins will play the roles of "digital gold" and "digital dollars." They see them not only as speculative tools but also as a "Noah's Ark" against the dilution of fiat currency purchasing power.

At the same time, we will witness a large-scale trend of "tokenization of real-world assets" (RWA). Young people are accustomed to round-the-clock, fragmented trading. Putting houses, artworks, and even government bonds on the blockchain not only increases asset liquidity but also aligns with the post-2000 generation's new definition of "asset ownership"—"my private key is my ownership." This will be one of the largest upgrades to financial infrastructure in the next decade. Previously inaccessible high-quality assets, such as commercial real estate and private equity, will become accessible through tokenization, achieving "asset democratization." This will alleviate young people's economic anxiety and inject new liquidity into traditional assets.

AI and Robotics: The Non-Inclusiveness of Wealth Under the Cantillon Effect of Technology

The advancement of AI and robotics is irreversible. However, there is a common misconception in the market that technological progress will automatically benefit everyone. In reality, the AI wave from 2026 to 2035 is likely to exacerbate social inequality, which we refer to as the "technological Cantillon effect."

The traditional Cantillon effect refers to the phenomenon where the first recipients of newly printed money become wealthier, while the last recipients face rising prices, leading to a transfer of wealth from the masses to those closest to the money printing press.

This logic applies equally in the AI era. The core production resources of AI are computing power, data, and algorithm models, which are extremely expensive and highly concentrated in a few tech giants and early investors, such as Nvidia, Microsoft, and Google. Ordinary people are almost impossible to own these core assets; we can only access their systems as consumers or managed entities.

When AI significantly increases productivity, the new wealth will first manifest in soaring profits and stock prices of tech companies. The shareholders and executives of these companies are "closest to the technology printing press," and they will be the first to enjoy the dividends of asset appreciation. This "capital-biased technological progress" means that the rate of return on capital will far exceed the rate of return on labor, leading to a further decline in the share of wages in GDP.

For ordinary workers, AI brings not a blessing but a competitor. Although AI may create new jobs in the long run, during the transformation period of the next decade, we first face the risk of "being replaced." Even if nominal wages increase, they often cannot keep pace with the rise in asset prices driven by technological dividends, such as housing prices, stocks, education, and healthcare. The general public is effectively paying for the deflationary effect of technology (wage pressure) and the inflationary effect of assets (widening wealth gap) simultaneously.

With the combination of robotics technology, especially humanoid robots and large language models, both blue-collar and white-collar jobs will be impacted. This impact replaces human cognitive abilities. If the wealth generated by explosive productivity growth cannot be fairly distributed in the form of wages, society will face a severe purchasing power crisis, potentially leading to structural contradictions of "overproduction" and "insufficient consumption."

Therefore, our investment strategy must be clear: go long on companies that own robots and short on labor costs that will be replaced by robots. We must become shareholders of technology rather than being replaced as "costs."

Financial Trends: From Value Investing to "Event Betting"

The turbulent macro environment and changes in the investment behavior of the younger generation are causing the financial market to undergo profound alienation. The traditional function of "value discovery" is weakening, while the "event prediction market" that hedges uncertainty and engages in speculative betting is rapidly rising.

Have you paid attention to platforms like Polymarket and Kalshi? In 2024 and 2025, these prediction platforms will experience explosive growth. Users can place real-money bets on the outcomes of specific events, such as the results of the U.S. presidential election, the timing of Federal Reserve interest rate cuts, and the outbreak of geopolitical conflicts. Especially Kalshi, which, after gaining regulatory approval, saw its trading volume rapidly climb, at one point capturing over 60% of the global market share.

This is not merely simple gambling; in the eyes of institutional investors, prediction markets are becoming an extremely important new derivative tool:

Precise Hedging

Compared to vague traditional hedging tools like gold or government bonds, prediction markets can achieve event-level precise hedging. For example, if there are concerns that a certain candidate's election will negatively impact the renewable energy sector, one can now directly buy a contract on Kalshi for that candidate's victory to hedge potential losses.

Information Discovery Function

The prices in prediction markets are often more accurate than polls and expert forecasts because they aggregate the collective wisdom of real money. As the saying goes, "Where the money is, there is the truth." This mechanism makes prediction markets efficient information aggregators, providing clear probability anchors for complex macro environments.

However, as funds flow from traditional markets into prediction markets, we also face two major risks:

Financial Nihilism

Funds are no longer flowing to support enterprises that produce for the real economy but are instead directed towards purely zero-sum betting games, making the financial market resemble a "casino." When young people find that studying company financial reports is not as quick as "betting" in prediction markets, the foundation of value investing will be further eroded.

Distortion of Reality and "Soros Reflexivity"

When the scale of prediction markets becomes large enough, serious "reflexivity" phenomena may occur. Huge amounts of capital may attempt to intervene in the outcomes of real events to win bets, such as manipulating public opinion or spreading fake news. This will lead to financial markets enslaving the real world in return, with "truth" becoming a plaything of capital.

Therefore, in asset allocation, it is essential to include "event assets" in the investment portfolio as necessary insurance against extreme macro fluctuations, while also being wary of the systemic vulnerabilities that this "over-financialization" may bring.

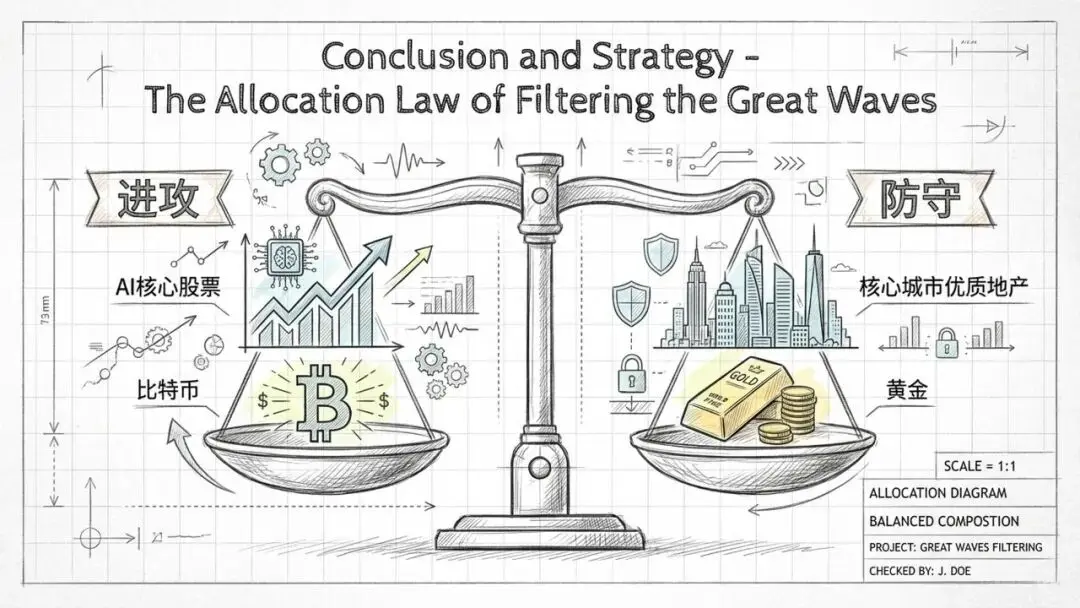

The Rule of Allocation in the Sandstorm: Extreme Barbell Strategy

Based on the above in-depth analysis, I propose a core recommendation for asset allocation in the next decade: traditional diversification is no longer sufficient to meet future challenges. What we need is an "extreme barbell" strategy to cope with the "active contraction" of the population environment and the wealth distribution pattern brought about by the "technological Cantillon effect."

On the offensive side, we should embrace "technological monopolies" and "digital scarcity":

Go long on beneficiaries of the "technological Cantillon effect"

Concentrate funds on tech giants that possess core computing power, private data, and control over general large models. In the "winner-takes-all" AI era, the survival space for second-tier tech companies will be compressed.

Go long on "digital scarcity"

Bitcoin, as a core asset to combat fiat currency depreciation and accommodate intergenerational wealth transfer, should occupy an important position in growth-oriented investment portfolios. As the post-2000 generation gains wealth discourse power, digital assets will enjoy liquidity premiums.

Seek remnants of the "demographic dividend" in emerging markets

Avoid East Asia and focus on regions with healthy population structures, such as India and Southeast Asia, but carefully assess their infrastructure capacity and political stability.

On the defensive side, we need to hedge against "chaos" and "event risks":

"Prediction Market Strategy Desk"

Institutional investors should establish dedicated strategy desks to utilize compliant platforms like

Kalshifor targeted hedging against specific risks such as geopolitical conflicts and policy shifts.Physical Assets

Given that "economic nihilism" drives young people away from real estate, high-quality residential properties and land in core cities will maintain their value due to supply-side stagnation and their role as a safe haven for the "old rich." However, caution is needed regarding property tax risks and areas with extremely limited land supply.

Gold

As the ultimate de-politicized monetary reserve, gold remains a core allocation for hedging against sovereign debt crises.

Which Assets Should Be Avoided?

Low to mid-end labor-intensive service industries

These will face dual pressures from soaring labor costs and AI replacement, leading to severe challenges to profit margins.

Traditional consumer stocks reliant on population growth

In a society of "active contraction," the growth logic of such enterprises has been broken. Baby products, mass apparel, and consumer goods dependent on family formation will face long-term market shrinkage.

In summary, the period from 2026 to 2035 will be a brutal era of "great selection." Whether we can see through the despair behind the population "active contraction," the deprivation behind the AI "Cantillon effect," and the nihilism behind the financial "gamification" will determine whether we can preserve or even increase our wealth in this great transformation. The future no longer offers inclusive beta returns, only highly differentiated alpha. In this new world, we must either become shareholders of technology or winners of events; otherwise, we may become mere footnotes of the era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。