In every wave of the cryptocurrency market, data silently records the events. When we look back at the trading world of 2025, the overlooked numbers hide the true pulse of the market, the collective wisdom of traders, and the deep changes in the Web3 ecosystem.

AiCoin 2025 Annual Web3 Report: By analyzing over 500,000 searches, 4.11 million AI interpretation queries, and an average of 35 million K-line data requests per day, along with community interactions, alert settings, live discussions, and other multidimensional data, we present a complete portrait of the trading ecosystem.

Chapter 1: The Real Map of Information Flow - Searches, Alerts, and Keywords

1.1 Search Popularity: The Absolute Dominance of ETH

The total annual search count exceeds 500,000, with ETH leading the way at 370,000 searches, accounting for a staggering 74%.

Behind this number lies Ethereum's absolute dominance in the smart contract ecosystem. From DeFi to NFTs, from Layer 2 to emerging applications, ETH has always been the focal point of market attention.

Why is ETH's search popularity so high? There are three reasons:

First, ETH is the cornerstone of the DeFi ecosystem. Top DeFi protocols like Uniswap, Aave, and Curve are deployed on Ethereum, and users of these protocols often search for the latest developments and technical progress of ETH before making decisions.

Second, ETH's technical upgrades are highly anticipated. From the Merge to Dencun, every upgrade of Ethereum sparks widespread discussion and searches in the market.

Third, ETH is the market's "barometer." When ETH performs strongly, the entire market often follows suit; when ETH shows weakness, the market tends to slump. This keeps traders' attention on ETH consistently high.

1.2 Self-Selected Coin Rankings: The Emerging Power of SOL

In the "Annual Self-Selected Coin Rankings," SOL surpassed BTC (30,347 times) and ETH (28,131 times) with 31,457 additions, becoming the most关注的新兴资产.

The significance of this data is profound. The self-selected feature represents traders' long-term attention to specific coins. When a coin is added to the self-selected list, it indicates that traders believe this coin is worth continuous tracking.

Why has SOL surpassed BTC to become the most self-selected coin? What does this reflect?

First, the explosive application of the SOL ecosystem. From the NFT marketplace Magic Eden to the DEX aggregator Jupiter, the Solana ecosystem is experiencing rapid development. Traders want to seize this ecological dividend, hence adding SOL to their self-selected list.

Second, SOL's price volatility is greater. Compared to the relative stability of BTC and ETH, SOL's higher volatility provides more opportunities for short-term traders.

Third, SOL represents a new investment narrative. As the market shifts from the narrative of "Bitcoin as a store of value" and "Ethereum smart contracts" to "high-performance public chains," SOL, as a representative of this narrative, naturally garners more attention.

Summary: Search popularity reflects the market's immediate attention, while self-selected rankings reflect the market's long-term optimism. The highest search popularity for ETH indicates that the market is focused on ETH's latest developments; the most self-selected status for SOL suggests that the market is most optimistic about SOL's long-term prospects. The combination of these two data points showcases a diversified market landscape.

1.3 Alert Settings: Binance ETH/USDT Perpetual's 286,708 Alerts

In the annual ranking of the most added alert pairs, Binance ETH/USDT perpetual tops the list with 286,708 alerts.

The significance of this data is profound. The alert feature represents traders' attention to specific price levels. When the alert count for a trading pair exceeds 280,000, it indicates that this trading pair has become a "focus battlefield" in the market.

Why is it ETH/USDT perpetual? There are three reasons:

First, ETH/USDT is one of the most liquid trading pairs in the market. Compared to other pairs, it has a smaller spread and lower slippage, making short-term traders more willing to set alerts and execute trades on this pair.

Second, the leverage characteristics of perpetual contracts attract a large number of short-term traders. The alert feature is particularly important in perpetual trading—traders need to enter or exit at specific price levels to manage risk. The 286,708 alerts represent the market's high attention to ETH's price fluctuations.

Third, this reflects an improvement in traders' risk management awareness. No longer blindly chasing gains or losses, traders are using the alert feature to precisely control their entry and exit points. This is a sign of market maturity.

1.4 Smart Search Keywords: A Real-Time Barometer of Market Sentiment

The ranking of the most searched topic keywords in the annual smart search is as follows:

1. BTC 45-Minute Cycle Trend Analysis — The highest popularity in ultra-short-term technical analysis

2. AI's Impact on ETH Prices — The combination of AI topics and ETH

3. BNB Price Trend Analysis/Future Trends — Continued attention to exchange tokens

4. AI's Impact on Bitcoin (BTC) — A glimpse of the popularity of AI topics

5. Analysis of the Reasons for SOL's Plunge — Demand for in-depth analysis of market anomalies

6. XRP Price Trends/Future Predictions — Specialized analysis of specific coins

7. Contract Trading Plans/Contract Strategies — Practical demand for trading strategies

8. 2025 Market Predictions/Trend Analysis — Demand for macro trend judgments

9. The Impact of Federal Reserve Rate Cuts on Cryptocurrencies — Analysis of the relationship between macroeconomics and crypto

10. AiCoin Platform Function Usage Tutorial — Demand for learning how to use tools

The deeper implications behind this ranking:

Dominance of Technical Analysis: The top three keywords are all related to technical analysis (45-minute cycle, price trend analysis), indicating that traders still rely on technical aspects for decision-making. The emergence of the specific 45-minute cycle reflects a market shift from daily to ultra-short-term analysis.

The Explosion of AI Topics: The 2nd and 4th positions are about AI's impact on prices, indicating that AI has become a hot topic in market discussions. Traders want to understand "the impact of the AI era on the crypto market," reflecting the disruption of traditional trading logic by the AI revolution.

Specific Coin Analysis: The 3rd, 5th, and 6th positions focus on BNB, SOL, and XRP, indicating that traders are no longer satisfied with macro analysis but require in-depth analysis of specific coins. Each coin has its own ecosystem and logic that needs specialized research.

Combination of Strategy and Macro: The 7th position's "Contract Trading Plans" and the 9th position's "Impact of Federal Reserve Rate Cuts" indicate that traders are simultaneously focusing on micro strategies and macro backgrounds. They are no longer purely technical or fundamental traders but are comprehensive traders.

Demand for Tool Learning: The 10th position's "AiCoin Platform Function Usage Tutorial" indicates that users are actively learning how to better use tools. This reflects that the complexity of tools is increasing, and users' willingness to learn is also rising.

Summary: The ranking of smart search keywords reflects traders' multidimensional and multilayered information needs. They need both technical analysis and AI insights; they require specific coin analysis and macro background understanding; they need trading strategies and tool tutorials. This is a market that is information-hungry and actively learning.

Chapter 2: Vitality Indicators of the Community Ecosystem - Chat Rooms, Dynamics, and Live Broadcasts

2.1 Top Ten Hot Words in Chat Rooms: A Micro Observation of Market Sentiment

The top ten hottest words in annual chat rooms are ranked as follows:

- Shanzhai — Represents attention to small coins

- BlackRock — Represents tracking of institutional funds

- Big Cake — A nickname for BTC, indicating BTC remains the center of discussion

- Profit — The outcome most concerning to traders

- Ether — A nickname for ETH, second only to BTC in popularity

- Transaction Fees — Reflects an increased awareness of trading costs

- Contracts — The popularity of perpetual contract trading

- Spot — The discussion heat of spot trading

- All In — Represents discussions on aggressive trading strategies

- Inscription — Represents attention to emerging asset classes

The deeper implications behind this ranking:

The top three hot words (Shanzhai, BlackRock, Big Cake) reflect three core market concerns: opportunities in small coins, movements of institutional funds, and Bitcoin's trends. This indicates that traders are simultaneously focusing on both "high-risk, high-reward" and "institutional movements."

The appearance of "Profit" and "Transaction Fees" indicates that traders have shifted from merely pursuing price increases to focusing on net profits. They are beginning to calculate trading costs, which is a sign of market maturity.

The parallel appearance of "Contracts" and "Spot" indicates that the market has formed a dual-track system of derivatives and spot trading. Traders flexibly switch between the two markets, seeking the optimal trading experience.

The emergence of the term "All In," while representing aggressive strategies, ranks relatively low (9th), indicating that most traders have learned risk management. Extremely aggressive strategies are no longer mainstream.

The appearance of "Inscription" represents the rise of emerging asset classes. From BRC-20 to various on-chain inscriptions, this new track is attracting increasing attention.

Summary: The ranking of chat room hot words reflects the collective wisdom of the market. It tells us that traders in 2025 are concerned about both opportunities (Shanzhai, Inscription) and risks (Transaction Fees, Profit), focusing on both mainstream (Big Cake, Ether) and derivatives (Contracts). This is a diverse, rational, and mature market.

2.2 APP Dynamic Square: SOL's 3,646 Appearances

In the annual ranking of the most frequently appearing coins in the APP Dynamic Square, SOL ranks first with 3,646 appearances.

This data perfectly echoes the previously mentioned "Annual Self-Selected Coin Rankings"—SOL not only has the most additions to self-selected lists but also appears most frequently in community dynamics. What does this indicate?

SOL has become the center of community discussion. Users share trading ideas, technical analyses, and news related to SOL in the dynamic square, which in turn attracts the attention and discussion of other users, forming a positive feedback loop.

From a data perspective, SOL's 3,646 appearances represent at least 3,646 pieces of user-generated content. The accumulation of this content is shaping a collective understanding of the "SOL ecosystem." When enough people discuss SOL, this cryptocurrency gains "market consensus."

This is also why SOL was able to achieve such strong performance in 2025—not just due to technical advantages, but also the power of community consensus.

2.3 Two Peaks of Official Live Broadcasts

The live broadcast with the most interactions of the year (1,640 interactions): "Three out of four hot searches are ETH; has the main force returned strongly?" (June 9)

What does the high interaction rate of this live broadcast indicate? When the market shows clear technical signals (such as ETH's consecutive breakthroughs), traders are most enthusiastic about discussing "does this represent a trend reversal?" The 1,640 interactions represent the community's high attention and divergence on this issue.

The official live broadcast with the most viewers of the year (1,777 viewers): "Mainstream Trends After Trump's Coin Launch" (January 20)

The high viewership of this live broadcast reflects the market's curiosity about the relationship between political events and the crypto market. News like Trump's coin launch often triggers market repricing. Traders want to understand "how the main force responds to such events," reflecting their attention to institutional movements.

The comparison between these two broadcasts is interesting: one is a technical discussion (ETH breakthrough), and the other is a fundamental discussion (political events). This indicates that the AiCoin community is concerned with both technical and fundamental aspects, making it a multidimensional trader community.

Chapter 3: Preferences in Content Consumption—Headlines, Push Notifications, and Information Value

3.1 The Most Viewed Headline of the Year: Metaplanet's 103,467 Views

"Metaplanet: A Pioneer in Japanese Companies Transforming into Bitcoin Reserves" garnered 103,467 views in the annual headlines, far surpassing other content.

Why did this headline receive such high attention? The reason lies in its representation of an important market turning point: traditional companies are beginning to incorporate Bitcoin into their asset allocation.

Metaplanet is a publicly listed company in Japan, and its decision to transform into Bitcoin reserves signifies:

- Increased Legitimacy for Institutions: When publicly listed companies start holding Bitcoin, it lends legitimacy to the entire industry.

- A New Paradigm for Asset Allocation: Bitcoin is transitioning from a "speculative asset" to a "strategic asset."

- A Global Trend: From MicroStrategy in the U.S. to Metaplanet in Japan, Bitcoin reserves are being promoted globally.

The viewership of over 100,000 indicates that traders have recognized the importance of this trend. They are contemplating, "If institutions are buying Bitcoin, should I also increase my allocation?"

3.2 The Top Three Push Notification Types by Click Volume

First Place: BTC/ETH Sudden Drop Push Notification

What does this ranking indicate? Traders are most concerned about extreme events. When BTC or ETH breaks through key resistance or falls below key support, it often signifies a trend change. The high click rate of breakthrough/breakdown notifications shows that traders have learned to make decisions at these critical moments.

Second Place: Market Anomaly Push Notification

Market anomalies include significant price increases, sharp declines, and surges in trading volume. The high click rate of these notifications indicates that traders are particularly sensitive to abnormal market fluctuations. Anomalies often signal new opportunities or risks.

Third Place: Liquidation Data Push Notification

The high click rate of liquidation data notifications reflects traders' attention to market risks. When they see a large number of liquidations occurring, traders ponder, "Does this indicate an impending market reversal?" Liquidation data has become an important indicator of market sentiment.

Summary: The common characteristic of these three types of notifications is high information density and strong decision relevance. They all represent key moments in the market where traders need to make quick decisions.

Chapter 4: The Evolution of Trading Tools—From Indicators to AI

4.1 Usage Ranking of Technical Indicators: The Mainstream Status of Trend Trading

The three most popular technical indicators ranking: MA (over 380,000) > EMA (over 370,000) > MACD (over 220,000)

The implications behind this ranking are profound: Trend trading remains the mainstream in the market.

The high usage rates of MA (Moving Average) and EMA (Exponential Moving Average) indicate that most traders still rely on trend-following strategies. Both indicators are based on historical averages of prices to determine the direction and strength of trends.

Why are these two indicators so popular?

- Simple and Effective: Compared to complex quantitative models, MA and EMA are easy to understand and use.

- Adaptation to Market Characteristics: The high volatility of the crypto market often allows trend-following strategies to yield stable returns.

- Historical Validation: These two indicators have been validated by the market for decades and are "proven" tools.

MACD (Moving Average Convergence Divergence) ranks third, with over 220,000 users. MACD is a more complex indicator that combines trend and momentum to identify market turning points. The fewer users of MACD compared to MA and EMA indicate that most traders prefer simpler tools.

4.2 Usage Ranking of Membership Features

The most used membership features: Large Orders, Custom Time Periods, and Chip Distribution

What do these three features have in common? They all involve the movements of "smart money."

- Large Orders: Show large transactions, helping traders track institutional movements.

- Custom Time Periods: Allow traders to select the time period that best suits their needs for detailed analysis.

- Chip Distribution: Displays the distribution of holdings at different price levels, helping traders understand market structure.

The high usage rates of these three features indicate that traders are increasingly focused on "the microstructure of the market." They are no longer satisfied with just looking at K-lines and indicators; they want to deeply understand "who is buying, who is selling, and at what price levels."

This is a sign of market maturity—an evolution from blindly following trends to tracking institutional movements.

4.3 Selection of K-line Periods: The Popularity of High-Frequency Trading

K-line period selection ranking: 15 minutes (most) > 5 minutes (second) > 1 hour (third)

This data reveals an important trend: the dominance of short-term trading. The number of traders selecting 15-minute and 5-minute periods far exceeds those choosing 1 hour or longer, indicating that intraday and ultra-short-term trading have become mainstream in the market.

Why has this shift occurred?

- The 24/7 Nature of the Crypto Market: Unlike the stock market, the crypto market trades around the clock, making it easier to capture opportunities with short periods.

- Improvement of Trading Tools: With the enhancement of trading tools and market liquidity, the predictability of short-term fluctuations is also increasing.

- The Popularity of High-Frequency Trading: More and more quantitative trading teams are entering the market, using ultra-short-term strategies.

The choice of a 15-minute period indicates that traders are pursuing quick entries and exits. This period is short enough to capture intraday fluctuations while long enough to filter out excessive noise.

4.4 Ace AI Interpretation: The Intelligent Trend Behind 4.11 Million Queries

Ace AI processed 4.11 million queries in 2025, identifying 1,463 cryptocurrencies.

The significance of this number is that AI is becoming a standard configuration for traders.

What does 4.11 million queries mean? It indicates that the AI interpretation feature has become an essential tool for professional traders.

The identification of 1,463 cryptocurrencies shows that Ace AI's coverage has reached the vast majority of trading pairs in the market. From mainstream coins to small coins, AI can provide interpretations.

What are traders seeking behind these 4.11 million queries?

- Confirmation: Seeking AI analysis to confirm trading decisions.

- Insights: Discovering patterns and signals that manual analysis might overlook.

- Reassurance: Reducing the psychological pressure of decision-making through AI's "objective" analysis.

The popularity of AI interpretation marks a shift in trading decisions from subjective judgment to data-driven approaches.

Chapter 5: Deep Revelations of Market Structure—Chip Distribution and Large Orders

5.1 The Price Level with the Most BTC Transactions: $104,990.4

The price level with the most BTC transactions is $104,990.4, representing the market's "center of gravity."

What is the "price level with the most transactions"? It refers to the price level at which the highest volume and funds have historically traded. What significance does this price level hold?

- Psychological Support/Resistance: This price level often becomes a future support or resistance level. When the price approaches this level again, traders will react based on historical memory.

- Market Consensus: This price level represents the "average cost" of market participants. When the price is above this level, most holders are in profit; when the price is below this level, most holders are in loss.

- Liquidity Center: This price level is often where liquidity is best, as there are the most buyers and sellers.

The appearance of the specific number $104,990.4 indicates that BTC has surpassed the $100,000 mark in 2025 and has formed an important trading center around this price level.

5.2 The Largest Large Orders and Transactions for BTC

The largest large order for BTC (order amount): $405 million; the largest single transaction: $328.5 million

How significant are these two numbers? For comparison:

- $405 million is equivalent to the annual management scale of a medium-sized hedge fund.

- $328.5 million for a single transaction is rare in traditional stock markets.

What do these numbers indicate?

First, the presence of institutional funds is very strong. Only institutional investors can make single transactions in the hundreds of millions. This indicates that BTC has evolved from a "retail asset" to an "institutional asset."

Second, market liquidity has reached a new level. When single transaction amounts reach hundreds of millions, it indicates that the market is deep enough to accommodate such large transactions without causing significant price fluctuations.

Third, this reflects an improvement in price discovery efficiency. The frequent occurrence of large transactions means that the market is more efficiently discovering the true price. Institutional investors reflect their market judgments directly in prices through large transactions.

Chapter 6: Records of Extreme Events—$40 Billion Liquidation on October 10, 2025

On October 10, 2025, the market experienced an extreme event: a single-day liquidation amount exceeding $40 billion.

How significant is this number? For comparison, it is equivalent to:

- 1/100 of the average daily trading volume of the global foreign exchange market

- The foreign exchange reserves of a medium-sized country

- The annual GDP of a country ranked in the top 100 for GDP

What does this liquidation event indicate?

First, a concentrated outbreak of leverage risk. When market sentiment is extremely pessimistic or optimistic, a large number of high-leverage positions can be liquidated in an instant. The $40 billion liquidation represents the forced closure of positions for millions of traders at the same time.

Second, the fragility of liquidity. Even in the 24/7 trading crypto market, extreme volatility can lead to liquidity exhaustion. When everyone wants to close their positions at the same time, market liquidity can vanish in an instant, resulting in a free fall in prices.

Third, a lesson for traders. This event reminds all participants that risk management is always the top priority. No matter how accurate your analysis is or how perfect your strategy may be, without proper risk management, a single extreme event can destroy everything.

This $40 billion liquidation is backed by the blood and tears of countless traders.

Chapter 7: Insights from Comprehensive Data—A Panoramic View of the Market

7.1 The Scale of Data Traffic: An Average of 35 Million K-line Data Requests Per Day

AiCoin processes an average of 35 million K-line data requests daily, with 2 million custom indicator K-lines.

What does this number represent? This is a data volume at the infrastructure level.

Every request is a trader making a decision; every calculation is an indicator being validated. Behind this data traffic is a complete trading ecosystem operating efficiently. From data acquisition, indicator calculation, to decision support, AiCoin has become the "nervous system" of the market.

7.2 The Multidimensionality of Data: From Search to Community to Tools

The value of this annual report lies in its demonstration of multiple dimensions of the market:

- Information Dimension: Search popularity, news interaction, headline views

- Community Dimension: Chat room hot words, dynamic square, live broadcast interaction

- Tool Dimension: Technical indicators, membership features, K-line periods

- Trading Dimension: Alert settings, AI interpretation, large order tracking

- Market Dimension: Chip distribution, large orders, liquidation data

The cross-validation of these dimensions forms a complete market understanding. When we see high search popularity for ETH, frequent alerts, active discussions in chat rooms, and numerous appearances in the dynamic square, we can be confident that ETH is indeed the market's focus.

Conclusion: Data is Truth, Trends are the Future

The crypto market in 2025 tells a story of evolution, maturity, and opportunity through data.

The shift in attention from ETH to SOL reflects the diversification of the ecosystem; the shortening of periods from 1 hour to 5 minutes reflects the acceleration of trading; the upgrade from simple indicators to AI interpretation reflects the deepening of intelligence.

And those 500,000 searches, 286,700 alerts, 4.11 million AI queries, 35 million data requests, 103,467 views of headlines, 1,640 interactions in live broadcasts, $405 million in large orders, and $40 billion in single-day liquidations all point in the same direction:

The market is becoming more rational, more efficient, and more data-driven.

In such a market, those who possess better data tools will have more opportunities. Those who can understand the implications behind the data more quickly will be able to seize trends earlier.

The AiCoin annual report is not just a summary of data; it is a testament to market evolution. It tells us:

- Institutional funds are entering the market (from Metaplanet's Bitcoin reserves to billion-dollar large orders)

- Traders are becoming more professional (from blindly following trends to tracking smart money)

- The market is becoming more efficient (from daily trading to 5-minute ultra-short-term trading)

- The ecosystem is becoming more diverse (from ETH's dominance to SOL's emerging strength)

As 2025 comes to a close, let us work together to discover the deeper opportunities in the market for 2026.

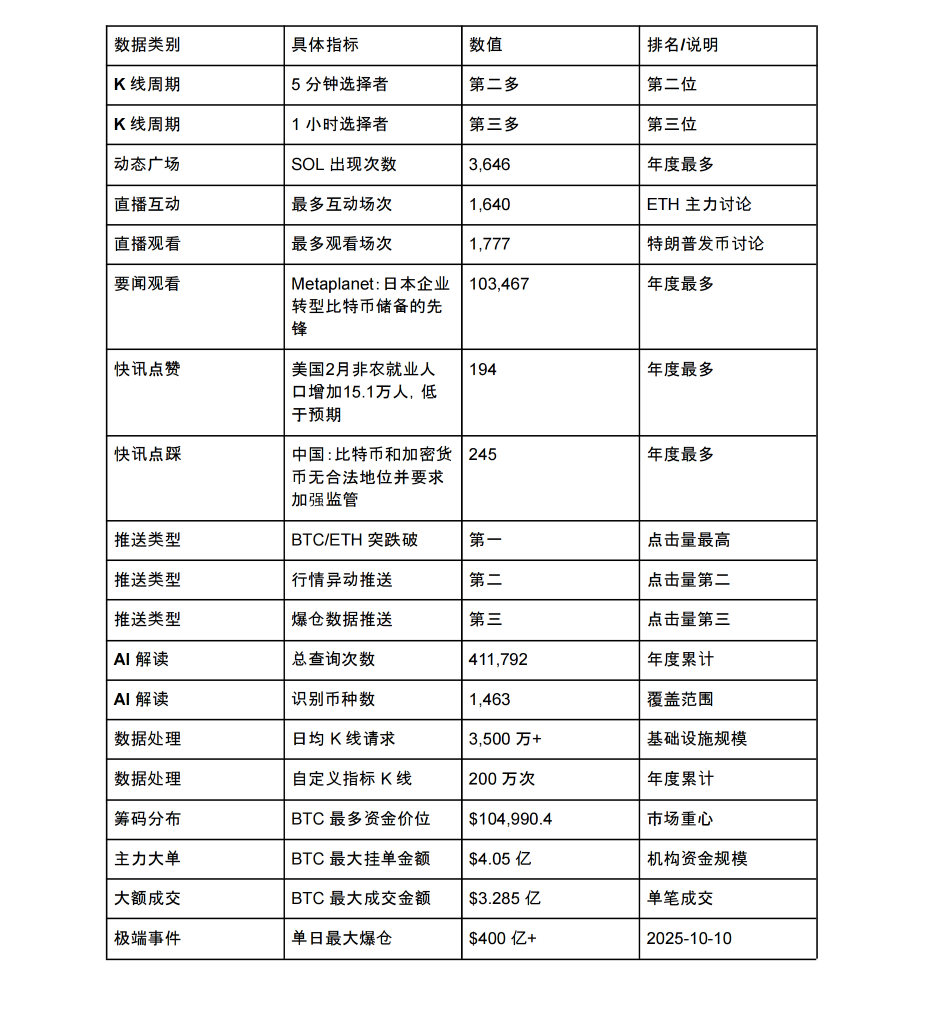

Appendix: Overview of 2025 Annual Report Data

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。