Author: Sanqing, Foresight News

At the beginning of New Year's Day 2026, the crypto market did not quiet down due to the holiday. At 3 AM today, the low market cap token BROCCOLI714 on the Binance platform experienced extreme market fluctuations. Suspected "abnormal account behavior" led to an imbalance in the token's order book structure and trading depth, causing significant divergence between spot and contract prices. Trader Vida (founder of Equation News) profited over $1.6 million from this event.

Source: Binance BROCCOLI71/USDT spot and BROCCOLI714USDT perpetual contract trading interface

BROCCOLI714 (CZ's Dog) is a community-driven meme coin on the BNB Chain, inspired by Binance founder Zhao Changpeng's pet dog "Broccoli." The "714" refers to the last three digits of the token's contract address, and there are multiple Broccoli-themed meme tokens on the BNB Chain, with the last digit of the contract address serving as a quick distinguishing feature. The project's official website and community later interpreted "714" as the founding date of Binance, and it was eventually listed on the spot market through a community vote (on March 27, 2025).

(Note: Binance released an announcement stating that it has noticed recent discussions regarding the market fluctuations of the BROCCOLI714 token and has initiated an internal review. According to the current system inspection results, the platform's risk control and security circuit breaker mechanisms are functioning normally. Additionally, based on the current internal data review results, no clear signs of hacking have been found, and the platform has not received any feedback regarding account theft through customer service or major client communication channels. Binance is currently conducting a comprehensive review of the orders and transaction data involved in this incident, and the relevant verification work is still ongoing.)

Long-term Ambush and Warning System

Opportunities always favor the prepared. The trader built a position of approximately $200,000 in BROCCOLI714 spot at a cost of $0.016 in November 2025 and held a $500,000 short position in contracts.

Based on the token's previous "rapid rise followed by a large sell-off within hours" market-making style, they set up monitoring: "Alert if the price increases by more than 30% within 1800 seconds."

Abnormal $26 Million Buy Depth

Starting at 3 AM Beijing time, BROCCOLI714 experienced unusual activity. The spot price skyrocketed, and the monitoring system subsequently issued an alert.

The order book showed abnormal signs.

Depth inversion: The spot buy orders at 10% depth had a $5 million buy order, while the contract buy orders at 10% depth only had $50,000.

Massive buy orders: The cumulative buy orders on Binance's spot market reached as high as $26 million, while the total market cap of the token at that time was only $40 million.

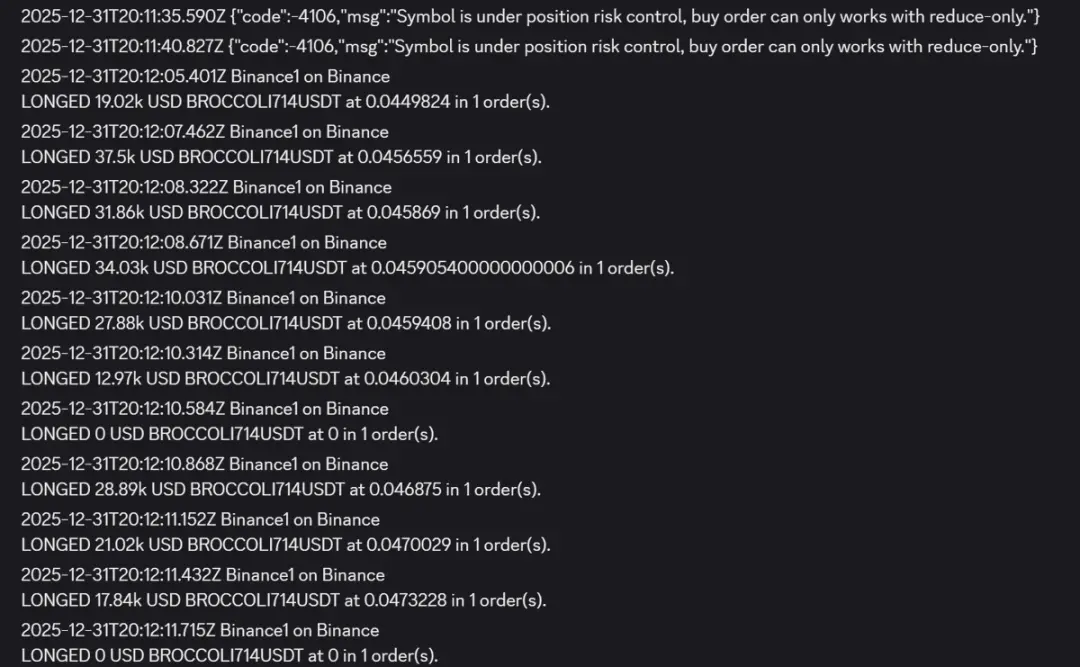

Three Steps to Achieve a Million Profit

Due to the significant price difference between spot and contracts, the trader's original $500,000 hedge position saw the spot value soar to $800,000, while the contract position did not increase proportionally due to the circuit breaker mechanism.

If they were to close the arbitrage position at this time, they could secure a profit of $300,000. However, observing the order book depth, Binance's spot price had a $5 million buy order at 10% depth, while the contract price only had a $50,000 buy order at 10% depth.

Moreover, for BROCCOLI714, which had a market cap of $40 million at that time, the order book buy orders amounted to $26 million. The trader inferred that there might be a user account theft or a bug in the market-making program.

At that time, Binance's contracts triggered a reduce-only circuit breaker protection mechanism, forcing the price to be controlled at $0.038, while the spot price had risen to $0.07.

Action: The trader used the trading terminal to attempt to open a long position every 5-10 seconds, trying to capture the moment when the circuit breaker mechanism refreshed or failed.

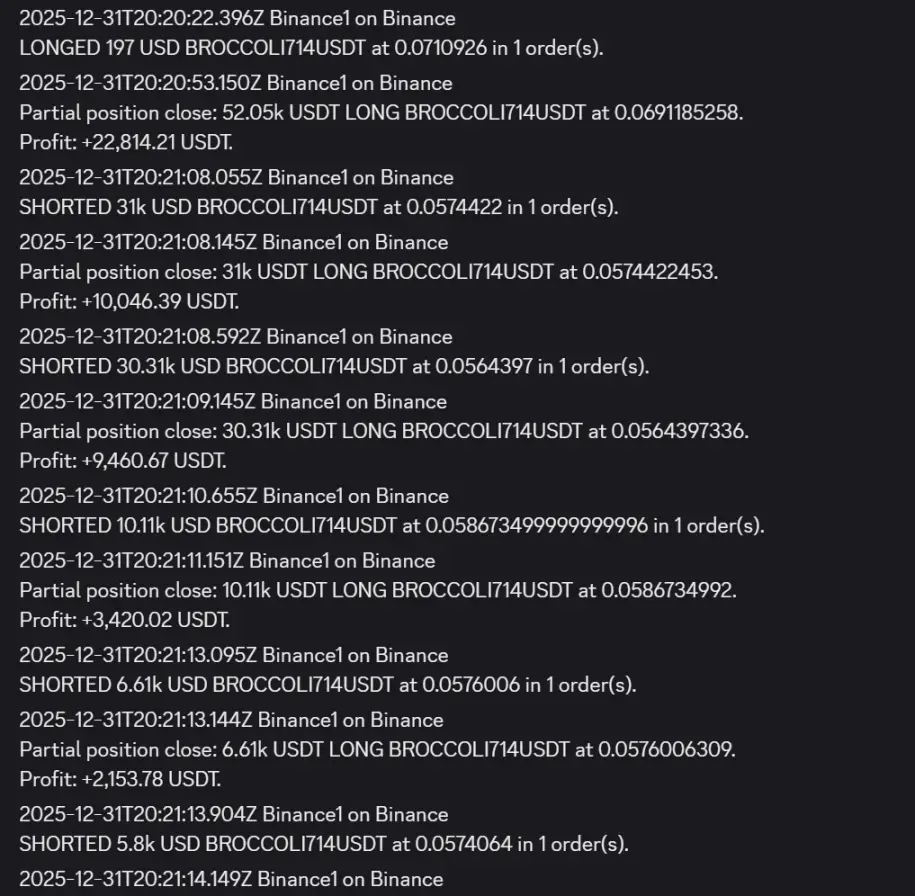

Outcome: Ultimately, they successfully increased their long position by $200,000 at a cost of $0.046. Then, as the price rose to a peak, they liquidated their early position and the additional long position in batches, resulting in a profit of approximately $1.5 million.

Source: The trader's platform account tweet

The trader believes that once Binance's risk control department intervenes to restrict the abnormal account and cancel orders, BROCCOLI714 will immediately crash.

Signal: At 4:21, some buy orders were canceled and then bought back, pushing the price up to $0.15 USDT; at 4:31, some buy orders were withdrawn; at 4:32, the $26 million buy order completely disappeared and was not re-listed.

Action: Judging that the abnormal account had been restricted, they immediately opened a $400,000 short position near $0.065 USDT.

Exit: The price subsequently crashed as expected, ultimately closing near $0.02 USDT, again profiting over $120,000.

Source: The trader's platform account tweet

Trader's "Cultivation"

The trader's impressive operation during the BROCCOLI714 incident was not merely luck, but a comprehensive reflection of multiple abilities.

Infrastructure capability: A well-developed alert system and high-speed trading terminal.

Market understanding: The ability to quickly identify abnormal behavior from the order book depth anomalies.

Risk control awareness: In extreme market conditions, not only seeing opportunities but also clearly understanding the timing of risk control intervention, thus completing a smooth transition from long to short.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。