The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smoke bombs!

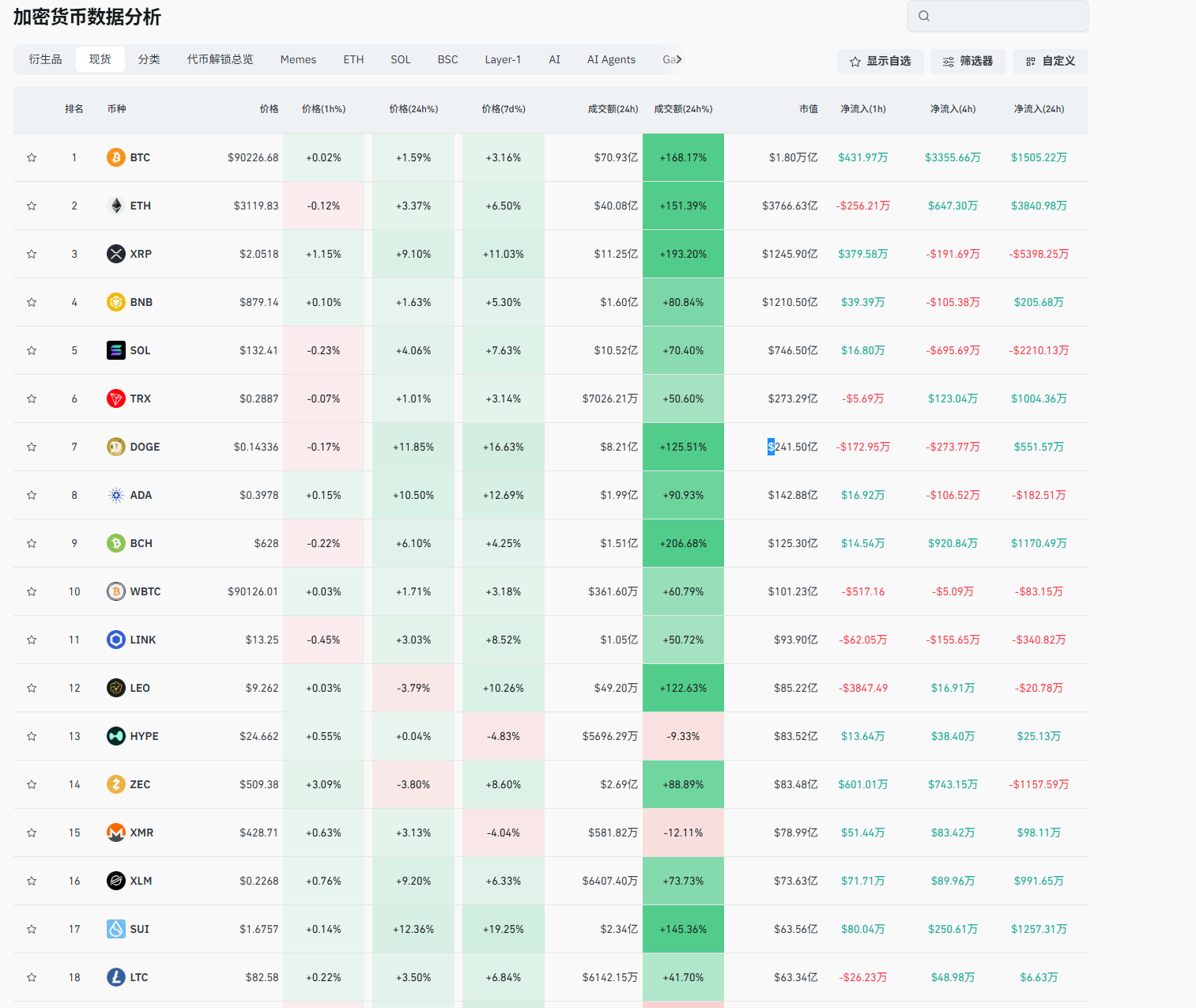

Finally, we have seen a market rebound, and this strength shows signs of breaking through. The first cryptocurrency to rise in this market surge is DOGE, so most users are using small coins as their judgment indicators. Lao Cui also agrees with this viewpoint, as the trading volume surged more than 20 times within ten minutes, and yesterday's trading volume also broke 4 times. The market surge over the past two days has been primarily driven by DOGE. Therefore, the definition of this market surge is naturally based on DOGE. This has also led many friends to criticize Lao Cui, feeling that Lao Cui has a biased view towards DOGE holders and is not objective enough in viewing the cryptocurrency. Here, Lao Cui clarifies that he is not looking for new highs for DOGE; he does not believe it will not grow again. The high point of 0.74 will not provide an exit opportunity for everyone, so for users holding at high positions, the best way out is to break even as soon as possible.

Many friends are holding prices mostly above 0.5, spending a long time holding, and the maximum return can only maintain a break-even state. Even if everyone buys in now, the maximum return is only 2-3 times. Instead of buying this type of cryptocurrency, it would be better to choose ADA or even XRP. First of all, the biggest flaw in the viewpoint of not supporting new highs is the hype; the current market has issued nearly 130 billion DOGE, with circulating data over 120 billion, while the current total market value of DOGE is 24.1 billion. If it sets a new high, even if it is 1U, it would mean the market value would reach around 140 billion. This would surpass TRX, SOL, BNB, and XRP. Who do you think among these four cryptocurrencies could be replaced? DOGE, whether in terms of application scenarios or processing speed, has a certain technical gap compared to these four, and it does not have an advantage in quantity. Its emergence is merely for Musk's grand vision; do not believe that DOGE will become the currency of Mars, even if Mars colonization begins, it is not a place you can go.

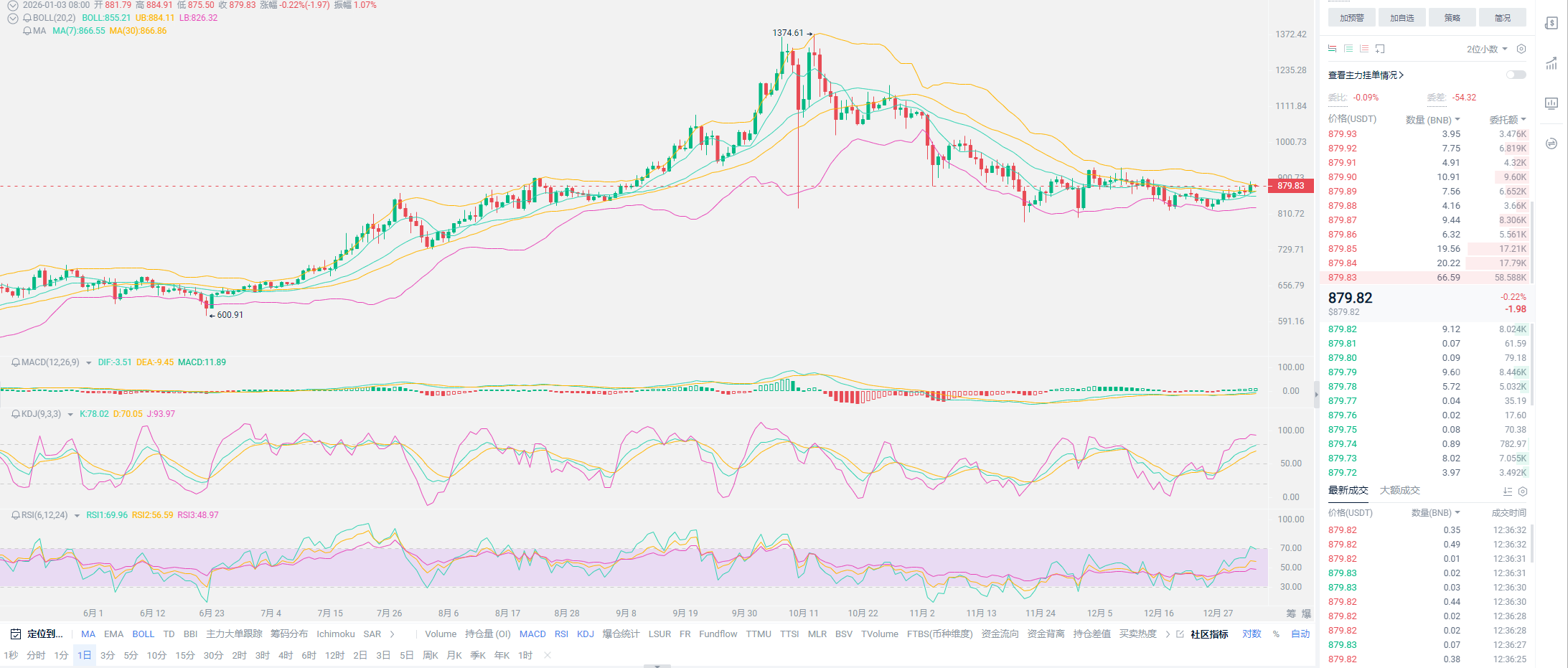

Lao Cui finds it hard to believe that some people actually believe Musk's statements; he himself does not dare to mention this concept again, as it is merely a promotional phrase. If you view DOGE from a speculative perspective, this coin is worth trying; it can double or triple before you exit, and it can indeed bring you profits. However, holding it long-term is not a good choice. Such breakthrough phenomena will occur in the market, and most cryptocurrencies are also rising; with the existence of altcoin season, we need to see if this growth can break through. Lao Cui has previously mentioned that for altcoins to reach new highs, they must break away from Bitcoin's trend and establish an independent market, which would signify the arrival of altcoin season. This current trend relatively aligns with this indication, and instead, altcoins are moving along with BTC. This is also beneficial for BTC, as it no longer has to bear the pressure of being the leader alone; everyone should keep an eye on the pressure points.

Looking back at this market, you might think that Lao Cui has identified the pressure points very clearly. BTC has reached the 90945 position and is once again under strong pressure; according to this theoretical approach, it proves that as long as we break through the pressure, we need to replan the next round of trends. Even if the market breaks through, there will still be a pullback, but as long as it breaks the position, a new pattern will form. Lao Cui's thinking is inherently based on a bullish mindset to respond to all trends; in a bullish situation, Lao Cui will not go for short positions. This long position has been called for nearly two weeks, and those who can hold it have likely gained some profits. Users who have already taken profits should not enter the market today; first, observe the breakthrough situation. If it continues to fluctuate within our previous estimated range, take a day to see how the trend develops. Try to maintain a bottom-fishing strategy; the points Lao Cui provided were around 87000 a week ago, and it took about a week to take profits, which is within an acceptable range.

To summarize, yesterday's news: BlackRock deposited 1134 BTC and 7255 ETH into Coinbase (the large deposit may not be a dump but rather a strategy to push Coinbase to the top position globally, aligning with American strategy; don't overthink it), by 2025, South Korea's cryptocurrency outflow is expected to reach 110 billion USD due to strict trading regulations; JPMorgan: the appeal of stablecoins is increasing as investors seek a friendly regulatory environment. Lao Cui interprets these two pieces of news together because they align with our previous estimates; strict trading regulations will only deter investors. Regarding a friendly regulatory environment, the American definition is strict for themselves while hoping others are lenient; this is a problem the U.S. needs to solve in 2026. There is no need for internal strife; in the current financial environment, the U.S. still holds a dominant position. The last piece of news: Trump stated that tariffs are key to national security, which means he could go crazy at any time.

Lao Cui concludes: After the New Year, we are about to enter the end of the year. Everyone should protect their wallets and not be deceived. I also want to reiterate that Lao Cui does not accept platforms; please do not look for Lao Cui for recruitment. Lao Cui only engages in legitimate business; if you find Lao Cui, he only wants to expose information, not to become material. Additionally, many peers are watching Lao Cui's actions, whether they are newcomers or veterans; do not ask Lao Cui for groups. Everyone should focus on their own work; Lao Cui does not do group chats! Whether you share, copy, or reference, Lao Cui has no other thoughts; he only seeks to make a living, which is understandable. However, after you reference, do not flaunt in front of Lao Cui; Lao Cui is not foolish. Many platforms have protection mechanisms, and the backend can see it. I only hope that everyone can use Lao Cui's materials for legitimate purposes. Lao Cui does not accept any advertisements or other business collaborations; if there is a need, Lao Cui will notify everyone.

Judging by linear trends, currently, apart from BTC, all cryptocurrencies show signs of breaking out of their ranges; especially ETH seems to have stabilized at the 3100 position, so the only variable may lie with BTC. As long as BTC does not stabilize above the 91000 mark, do not blindly enter long positions. Once it stabilizes, it means that a variable is coming, and the entire market will experience different trends. Moreover, this main upward wave may occur in January and continue until the end of interest rate cuts. After Bitcoin breaks through, the next pressure point will be around 94500; as long as it breaks through, it will signal the arrival of a new bull market. The best response at this stage is for users who have not entered the market previously to wait. For those who have already entered, today you can discern the trend; everyone can directly ask Lao Cui, who will always be watching the market. The trend of ETH has already emerged, stabilizing at 3100, and the next step is to see the challenge for new highs. Today, it is impossible to make a judgment on future trends; let's wait for tomorrow's article!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。