Liquidity undercurrents, political gambles, and cyclical reconstruction will together compose a new market narrative.

The financial market in 2025 concluded amidst the soaring of traditional assets and the unexpected silence of cryptocurrencies, leaving investors with a core suspense: Does Bitcoin's historic annual decline a year after its halving mean that its old cyclical laws have completely failed?

The lagging of "digital gold" in this round of broad asset appreciation forces the market to focus on deeper driving logic. In 2026, the answer will no longer simply lie in the four-year halving event, but will depend on the complex variations of global macro liquidity, the reshaping of the U.S. political landscape, and the difficult transformation of the crypto market from "narrative" to "infrastructure."

1. Federal Reserve Interest Rate Cuts

● For the crypto market in 2026, the Federal Reserve's monetary policy remains the core variable determining its "water temperature." However, there is a rare and profound divergence between the current market and the Federal Reserve, as well as among major institutions, regarding the future path of interest rates.

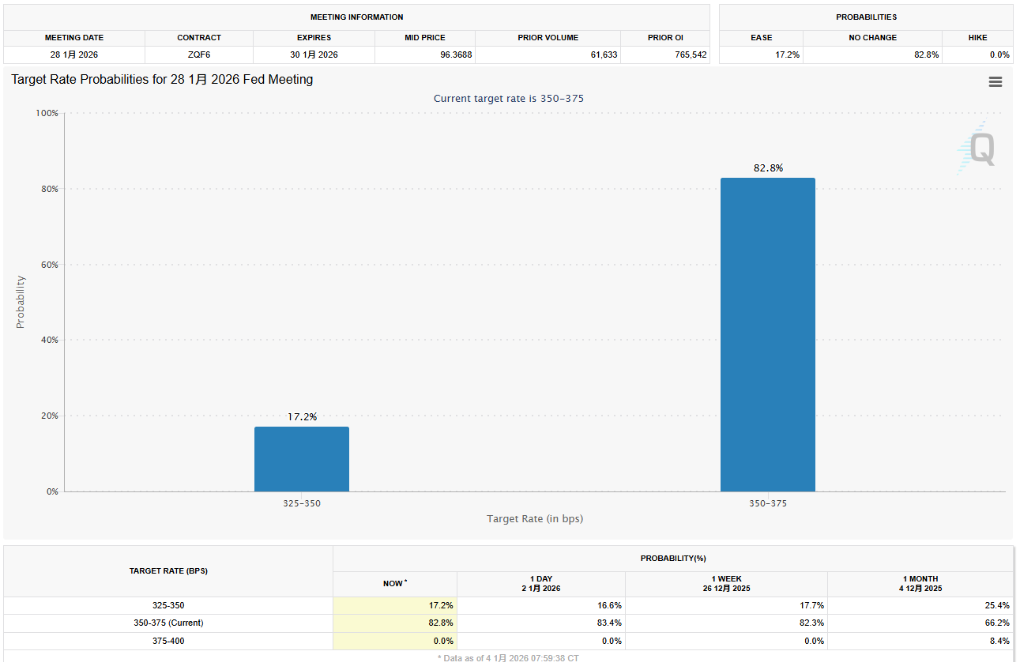

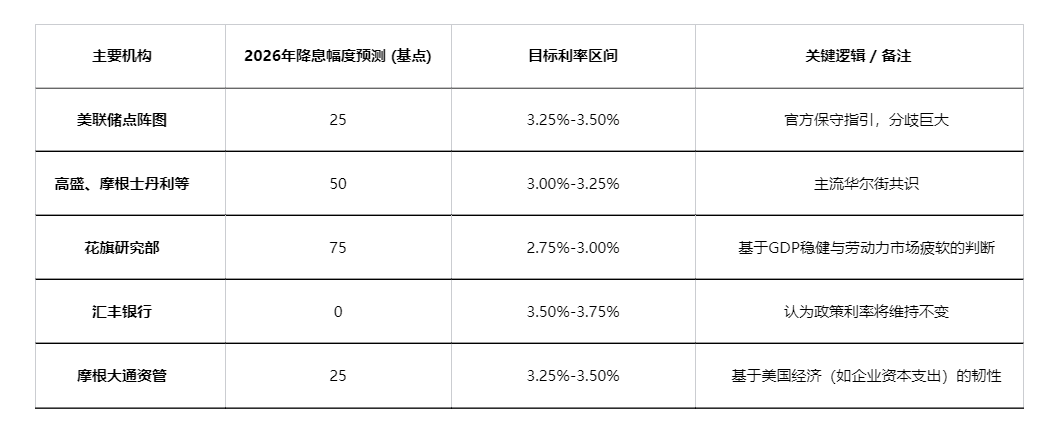

● The Federal Reserve's own guidance tends to be conservative. By the end of 2025, the Fed's dot plot only predicts one rate cut in 2026. However, the market does not buy this. Mainstream Wall Street investment banks like Morgan Stanley, Goldman Sachs, Bank of America, and Wells Fargo generally predict two rate cuts (a total of 50 basis points), bringing the interest rate range down to 3.00%-3.25%.

● More aggressive predictions come from Citigroup, which believes that U.S. GDP growth will remain around 2%, while the labor market continues to weaken, clearing the way for rate cuts, with an expected total cut of 75 basis points in 2026. Additionally, the market bets that June will be a key observation window for rate cuts, as the new Federal Reserve Chair may choose to showcase policy stances at that time.

This divergence highlights the increasing difficulty of balancing dual objectives, where any economic data fluctuation could trigger significant market expectation swings.

● Besides interest rates, every move of the Federal Reserve's balance sheet is also crucial. By the end of 2025, the Fed ended quantitative tightening (QT) and immediately launched a new operation called "Reserve Management Purchases" (RMP), planning to buy about $40 billion in short-term government bonds each month.

The Federal Reserve insists that this is merely a "technical operation" to ensure sufficient liquidity in the banking system, but the market tends to interpret it as a form of "covert easing" or "quasi-quantitative easing."

● The deeper logic of this operation points to structural changes in the modern financial system. The strict regulations of the post-crisis era have made banks' demand for reserves rigid. RMP is, to some extent, an operation the Federal Reserve must undertake to meet this liquidity demand created by regulatory rules.

● A more controversial perspective is the concern of "fiscal dominance." With the U.S. federal budget deficit at a historical high, if a cycle of "massive bond issuance by the Treasury - Fed purchasing through RMP" forms, it will essentially approach the monetization of the fiscal deficit.

● Therefore, for the crypto market, the macro impact from the U.S. in 2026 will be the combined effect of interest rate expectations and balance sheet operations. If the expectations of rate cuts resonate with the liquidity injection from RMP, it will significantly improve the liquidity environment for global risk assets.

2. Japan's Interest Rate Hike and Global Carry Trade Unwinding

If the Federal Reserve's policy is the main valve of global liquidity, then the movements of the Bank of Japan tug at the sensitive nerves of global carry trades. In a global market interest rate cut cycle, Japan is discussing the necessity of continuing to raise rates, a contradiction that reflects the long-term structural dilemmas of the Japanese economy.

● Japan is facing a difficult choice between "saving the bond market" or "saving the yen." On one hand, the Japanese government's debt-to-GDP ratio is as high as about 200%, and a rapid rise in interest rates will lead to a surge in government interest payments, making it difficult for the bond market to bear. Therefore, the Bank of Japan still needs to purchase a large amount of bonds to stabilize the market.

● On the other hand, the yen's exchange rate has fallen to a near 35-year low. Theoretically, raising interest rates should support the local currency, but the "bond purchases" associated with quantitative easing inject liquidity into the market, offsetting the effects of rate hikes, creating a "left hand fighting the right hand" situation. Market observers believe that the Bank of Japan is essentially "sacrificing the yen to save the bond market."

This policy dilemma is directly related to the short-term volatility of the crypto market. Over the past decade, global speculators have favored "yen carry trades": borrowing yen at near-zero costs, converting it to dollars, and investing in high-yield assets like Bitcoin and U.S. stocks.

● Once Japan raises interest rates, the cost of borrowing yen will increase, forcing this massive amount of capital to unwind positions, i.e., selling risk assets like Bitcoin to convert back to yen to repay loans, thus triggering significant market turbulence.

● As we enter 2026, will this scenario repeat? The market has different expectations. First, unlike last year's "sudden attack," the market is somewhat prepared for further rate hikes by the Bank of Japan, and some positions may have been adjusted in advance.

● Secondly, a more critical factor is the Federal Reserve's rate cut pace. If the Fed cuts rates as expected 2-3 times, the interest rate differential between the U.S. and Japan will narrow, reducing the attractiveness of carry trades. At this point, a small rate hike of 0.25% by Japan may be significantly offset.

● Ultimately, the overall direction of global liquidity is more decisive. If the U.S. releases a large amount of liquidity through RMP and potential fiscal stimulus (such as tariff dividends), then the localized siphoning effect brought by Japan's tightening may be drowned in the "tide" of the dollar. However, if the Bank of Japan's rate hike pace exceeds expectations or the Federal Reserve remains inactive, the market may still experience short-term panic triggered by unwinding carry trades.

3. $263 Million Crypto Capital Betting on Midterm Elections

The U.S. midterm elections in November 2026 are events that will more concretely and directly determine the fate of the crypto industry than monetary policy. The industry has tasted success from the 2024 elections and is making unprecedented political investments to consolidate and expand its gains.

● According to Federal Election Commission documents, the crypto industry has raised approximately $263 million for the 2026 midterm elections through super political action committees. This amount is nearly double the largest crypto PAC expenditure in 2024 and even slightly higher than the total expenditure of the entire oil and gas industry in the last election cycle, demonstrating the industry's determination to view political lobbying as a core strategy.

● Behind this massive funding is a clear policy demand. The recent core focus is to promote key legislation such as the "Cryptocurrency Market Structure Act," which aims to clarify the regulatory framework and may assign major regulatory authority to the Commodity Futures Trading Commission (CFTC), which is more friendly to the crypto industry.

● The political strategy of the crypto industry has also seen new changes. Unlike the attempt to create a bipartisan issue in 2024, some newly established political action committees in 2026 are more explicitly aligned with the Republican Party, aiming to help the Republicans consolidate control over Congress.

● Industry executives are frequently and directly interacting with Washington. About 12 top crypto executives have collectively visited Capitol Hill to meet with senior members of both parties. The partisan differences in the discussions are clear: Republicans express more alignment with industry priorities, while Democrats continue to focus on regulatory issues such as the use of cryptocurrencies in money laundering and illegal finance.

● The massive funding is changing the political landscape. Even Democratic lawmakers who have previously criticized the crypto industry are showing subtle softening in their positions, beginning to acknowledge that cryptocurrencies have become part of the U.S. economy.

For the market, the policy game window in the first half of 2026 is particularly critical. The current government may push for stimulative policies before the elections to gain favorable electoral conditions, which could create a favorable environment for risk assets. However, as the November elections approach, uncertainty will sharply increase.

4. From Cyclical Narrative to Infrastructure Value

While responding to the three major external variables, the crypto market itself is also undergoing a profound "coming of age." In 2026, the core logic driving the market may further shift from "cyclical narrative" to "infrastructure value and market structure."

● Bitcoin's four-year cyclical law is being tested. Historically, halving events have been the core narrative driving cycles. However, in this cycle, Bitcoin reached new highs both before and after the halving in 2024. If it strengthens again in 2026, it will substantially challenge the traditional notion of "halving setting the cyclical clock." Institutional analysis indicates that Bitcoin's daily new issuance has dropped to about 450, with an annualized new supply value of about $15 billion.

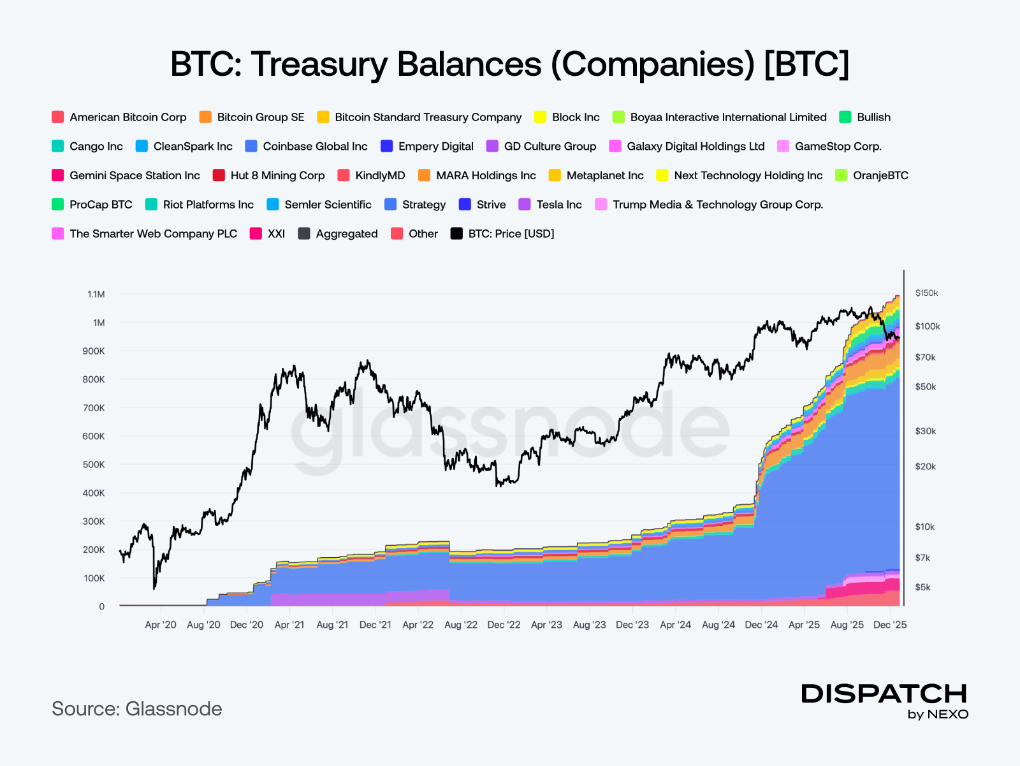

● Whether its price can break through previous highs will heavily depend on whether institutional channels like spot ETFs can continue to absorb this supply. Bitcoin is increasingly becoming a strategic asset on corporate balance sheets. Data shows that corporate holdings of Bitcoin have surged from about 197,000 coins at the beginning of 2023 to over 1.08 million coins, an increase of over 450%.

● The emergence of these long-term holders creates a demand side that is insensitive to price fluctuations, helping to stabilize market volatility and pushing Bitcoin to evolve from a high-volatility speculative asset to a digital reserve asset.

● Stablecoins are quietly becoming the new infrastructure of global finance. Their total supply has grown more than tenfold in five years, surpassing $300 billion. The growth driver is shifting from trading to actual applications such as payments, settlements, and treasury management.

Under favorable regulatory and macro conditions, their circulation may approach or even exceed $1 trillion in 2026, becoming a 24/7 global dollar settlement layer.

● The tokenization of real-world assets (RWA) will move from pilot projects to large-scale issuance. By 2025, the on-chain value of RWA was close to $35 billion. By 2026, as issuance, compliance, and settlement processes further move on-chain, this scale may point to $500 billion or higher. This is not merely for novelty but to make capital more programmable and settlements more continuous.

● The gradual clarity of the U.S. regulatory framework provides a new foundation for the market. The GENIUS Act has come into effect, and the CLARITY Act is also in progress. Against this backdrop, Initial Coin Offerings (ICOs) are quietly returning in a more structured and compliant form, broadening early financing channels.

At the same time, the trading volume of prediction markets has climbed to the billions of dollars level, gradually becoming a tool for pricing the probabilities of real-world events, rather than just a venue for speculation.

The market's gaze is fixed on every meeting of the Federal Reserve building in Washington, the policy statements from the Bank of Japan in Tokyo, and the busy lobbying corridors of Capitol Hill in the United States. The fluctuating probabilities on the CME FedWatch tool, the subtle changes in Japanese government bond yields, and the ever-increasing numbers on political action committee accounts—each signal pulls at the nerves of global cryptocurrency traders.

Only when the tide goes out do we see who is swimming naked, and when the tide rises and falls in unpredictable ways, only then will the ark that can anchor value be truly needed. The crypto market in 2026 is navigating from the turbulent sea of speculation into the deep waters of deep integration with the global macro financial system.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。