In 2025, Antalpha continued to advance the systematic construction of its business structure and platform capabilities as it reached important milestones in its listing process. The company focuses on Bitcoin-related financial services, steadily progressing in key areas such as mining finance, product expansion, reserve asset-related layouts, and standardized operations in the capital market, while simultaneously expanding its business boundaries and organizational capabilities.

With the optimization of the company's governance structure and the implementation of multiple strategic initiatives, Antalpha's platform characteristics have gradually become clearer. By reviewing its annual operational performance and strategic progress, the company aims to provide investors and the market with a more structured perspective to understand its current development stage and the foundation for medium- to long-term growth.

01 Financial Performance and Capital Structure

Continuous Growth in Q3, Steady Expansion of Business Scale

In the first three quarters of 2025, the company maintained continuous growth in revenue, profit, and asset structure, with an overall positive trend in business development.

Steady Revenue Growth, Continuous Improvement in Profitability

As of September 30, the company achieved a cumulative operating revenue of approximately $51.67 million in the first three quarters, a year-on-year increase of about 52%.

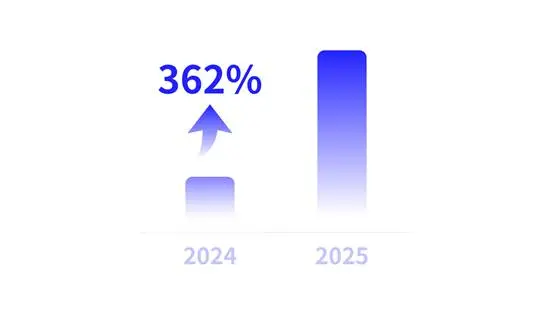

Alongside revenue growth, profitability has significantly improved, with a cumulative net profit of $9.15 million in the first three quarters, a year-on-year increase of 235%. The cumulative net profit under non-GAAP standards reached $12.62 million, a year-on-year increase of 362%. Additionally, adjusted EBITDA reached $14.75 million, a year-on-year increase of 280%, with an adjusted EBITDA margin of 29%, significantly up from 11% in the same period last year, reflecting ongoing improvements in business structure optimization and operational efficiency.

The number of institutional clients increased by 28% year-on-year, and the TVL (calculated on a rolling 12-month basis) per client grew by 55%, as Antalpha continued to attract larger and higher-quality clients.

Growth in Platform Lock-up Scale, Accelerated Management Scale Expansion Driven by Business, Increased Contribution from Platform Business

From the asset structure perspective, the company's core business TVL continued to expand. By the end of the third quarter, the platform's TVL reached approximately $2.36 billion, a year-on-year increase of 60%. Notably, the scale of computing power loans and supply chain finance-related products grew significantly by 76%. As of the end of the third quarter of 2025, Antalpha provided financing for 77.1 EH of computing power capacity, accounting for about 7-8% of the global Bitcoin computing power. The TVL related to the technology platform increased by approximately 51% year-on-year, further enhancing the contribution of platformized and structured business to the overall scale.

02 Business Layout and Product Expansion

Continuing to Deepen Bitcoin Financial Services, Solidifying Core Platform Positioning

Antalpha has always centered its operations around the Bitcoin ecosystem, continuously providing diversified financing solutions for mining companies and other professional institutional clients. In terms of loan products, the company has been expanding services such as mining machine loans, electricity loans, and collateralized lending, maintaining stable operations and risk control. In supply chain finance, it continues to serve upstream and downstream hardware and custodians, forming a broad financial support network. At the same time, the company is innovating in gold-backed products, launching a hybrid collateral structure in conjunction with XAU₮ to further enrich its overall asset portfolio.

Launching "RWA Hub" and Expanding Cross-Asset Service Models

In 2025, leveraging its platform resource integration capabilities, Antalpha launched the RWA Hub, connecting traditional physical assets (such as gold) with on-chain financial structures. The first batch supports XAU₮ as the underlying asset and opens up modules including asset management, collateral liquidation, and risk control to external partners, enhancing liquidity and the extensibility and collaborative efficiency of financial services across asset scenarios.

03 Capital Operations and Strategic Cooperation

Antalpha Completes Initial Public Offering (IPO)

In May 2025, Antalpha officially listed on the NASDAQ global market under the stock code "ANTA," raising approximately $56.7 million (with the underwriters fully exercising their over-allotment option). This IPO marks a new phase for the company in the international capital market, further solidifying Antalpha's global positioning in the Bitcoin ecosystem financial services sector and providing the company with more robust capital support to continue expanding its cross-regional business and product system.

Deep Participation in Aurelion Construction: The First NASDAQ-Listed Company with Tether Gold as Core Reserve Asset

In October 2025, Antalpha completed a strategic acquisition of Prestige Wealth Inc. and facilitated its renaming to Aurelion Inc. Following the completion of the transaction, Aurelion Inc. became the world's first NASDAQ-listed company focused on Tether Gold (XAU₮) as a reserve asset, with the stock code AURE. Antalpha invested $43 million in Aurelion Inc. as a cornerstone investor and led its $100 million PIPE private financing. This transaction is an important part of Antalpha's treasury strategy, promoting the digital holding and cross-regional allocation of physical gold assets within a compliant framework, and further enhancing the company's risk resistance capabilities in the context of inflation, exchange rate fluctuations, and uncertainties in the cryptocurrency market.

04 International Market Expansion and Client Structure Upgrade

In 2025, Antalpha made significant progress in global client expansion, continuously focusing on high-quality institutional clients and enhancing the resilience and counter-cyclical capabilities of its business. The company deepened important collaborations in the Middle East and Southeast Asia markets, effectively strengthening the regional resilience and counter-cyclical capabilities of its business.

The company also iterated its client management mechanism, transitioning from a general product provider to a more customized and professionally deep strategic partner, establishing dedicated service teams for different client tiers to enhance client stickiness and overall satisfaction.

05 Talent System Construction and Organizational Capability Enhancement

In response to post-IPO governance requirements and global operational needs, Antalpha accelerated its organizational capability construction in 2025: at the headquarters level, it clarified a dual-driven structure centered on "product line + regional market," enhancing horizontal collaboration efficiency and vertical execution depth.

At the same time, the company introduced several talents with international backgrounds in key positions, strengthening the global configuration of technology, risk control, and compliance sectors, while also promoting the construction of a mid-level management team to ensure the continuous and stable operation of the business amid multi-regional expansion.

Conclusion: Building the Depth of Long-Termism

2025 is a pivotal year for Antalpha. By continuously solidifying its financial product capabilities, expanding service asset boundaries, and achieving structural upgrades through the capital market, the company has preliminarily established a capability map for a cross-asset platform.

Looking ahead to 2026, Antalpha will continue to focus on three paths: international compliance implementation, deepening core client relationships, and upgrading platform technology. At the same time, the company will continue to enhance its investor relations management capabilities to serve global investors with higher transparency and a more complete governance system.

About Antalpha

Antalpha is a leading fintech company focused on providing financing, technology, and risk management solutions for institutional clients in the digital asset industry. Antalpha offers Bitcoin supply chain and margin loans through the Antalpha Prime technology platform. Through this platform, clients can initiate and manage their digital asset loans, as well as monitor collateral positions with near real-time data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。