On January 4, 2026, at 8 AM UTC+8, Bitcoin has once again surpassed the $90,000 mark, with a 24-hour increase of over 1.6%, currently stabilizing above $92,000. This has driven a general strengthening of the cryptocurrency market at the beginning of 2026, with Ethereum recording a 6-day winning streak on the daily chart, breaking through the MA60, and both trading volume and price rising simultaneously. Accompanying the price surge, the net inflow into U.S. spot Bitcoin and Ethereum ETFs in the first two trading days of the new year totaled nearly $1.5 billion, marking a significant reversal from the de-risking phase at the end of 2025. Meanwhile, the situation in Venezuela has escalated, concerns over copper tariffs and rising re-inflation expectations, combined with weakened trading depth during the holiday period, have caused the market to oscillate between FOMO driven by institutional inflows and concerns over high-level corrections.

ETFs and Institutional Inflows as the Main Price Drivers

● In terms of capital inflow pace, the U.S. spot Bitcoin ETF recorded net inflows of $471 million and $697 million in the first two trading days of 2026, while the Ethereum spot ETF saw net inflows of $175 million and $168 million during the same period, totaling nearly $1.5 billion. This indicates that institutional funds are concentrating on increasing their positions in leading crypto assets during the new year's asset allocation window.

● In terms of sustainability, the volume increase of spot ETFs continues the trend of the past few months and corresponds with the previous large-scale increases by listed companies like Metaplanet, collectively reflecting that the de-risking phase that dominated the market at the end of 2025 has largely come to an end. Traditional funds are re-adding Bitcoin and Ethereum to their high-beta risk asset portfolios, with a clear warming of risk appetite.

● From the perspective of institutions and professional participants, liquidity is seen as the core variable of this market cycle. Several market participants emphasize that the current "liquidity power is underestimated," believing that as 2026 is widely viewed as a "year of monetary easing," with expectations of marginal easing in the monetary environments of major economies like the U.S. and China, Bitcoin is being reshaped as a preferred risk asset within the dollar system, likely to share liquidity dividends with U.S. growth stocks and gold in the near future.

Geopolitical Shocks Strengthen the "Digital Gold" Narrative

This price surge is not solely driven by ETF funds; geopolitical and supply narratives are overlapping, reinforcing Bitcoin's "digital gold" attributes. An important narrative circulating in the market is that former Venezuelan President Maduro may have secretly held over 600,000 BTC during his tenure, valued at approximately $60 billion. If this amount is frozen by U.S. sanctions or incorporated into the national strategic reserves by a new government, it would mean that nearly 3% of the circulating supply is locked up long-term. It is important to emphasize that this claim currently mainly comes from social media and KOL opinions and has not been confirmed by authoritative institutions, but its effect on market sentiment is already evident.

Simultaneously, the Venezuelan situation, combined with concerns over copper tariffs and supply tightness, has heightened re-inflation trading sentiment, causing a resonance in traditional commodities and precious metals markets. Gold prices were once pushed to a historical high of about $4,450/ounce, silver saw a daily increase of over 7%, and copper prices broke historical highs, with scarce assets being collectively sought after under the same macro narrative. Bitcoin quickly rebounded from around $89,000 to the $93,000 level during this macro shock, amplifying its correlation with gold, as safe-haven demand and supply disruptions jointly elevated its "digital gold" label. Under the resonance of ETF fund inflows and macro safe-haven sentiment, Bitcoin's path to challenge the $100,000 mark is increasingly interpreted as a cross-asset revaluation experiment centered on "scarcity pricing."

Capital Outflow Drives Altcoins and High-Beta Sectors to Heat Up

As Bitcoin's price approaches the critical trading range of $94,000 to $100,000, some long traders who previously built positions below $90,000 have begun to actively realize profits, choosing to take profits on large long positions at this stage. In their view, the cost-effectiveness of continuing to bet on Bitcoin's unilateral surge at the current price level has significantly decreased compared to the end of 2025, while structural opportunities in the altcoin sector are beginning to emerge, making the risk-reward of "small bets on large outcomes" more attractive.

In specific sectors, Solana ecosystem meme tokens have ignited sentiment first. A trader publicly shared an extreme case of turning a $500 principal into about $1.1 million, becoming a hot topic on social media and attracting a large influx of on-chain funds and speculative trading back into the Solana ecosystem. The increase in on-chain activity and the warming of sentiment have simultaneously driven SOL spot prices to strengthen and rebound, and some market participants expect that the BSC ecosystem may follow suit in the subsequent phase, launching a new round of meme and new coin narratives due to "wealth effect" competitive considerations.

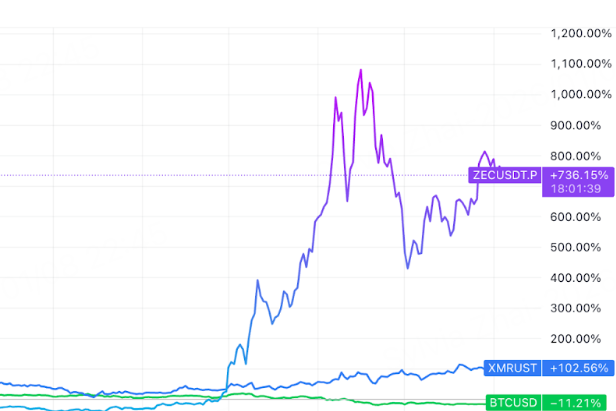

From a longer historical data perspective, various altcoins, including privacy assets, have seen a significant increase in trading volume over the past month. Trading data from exchanges and on-chain activity since Q4 2025 indicate that funds are spreading from core assets like BTC and ETH to more segmented thematic sectors and high-beta targets. Current KOL discussions are increasingly focused on privacy directions and high-volatility altcoins, corroborating the changes in trading structure. This shift from "Bitcoin pricing" to "sector rotation" is forming the second main funding line of this market cycle.

Key Price Zones See Short-Term Tug-of-War Between Bulls and Bears

Bitcoin's current technical and sentiment structure is highly focused around the new phase watershed near $94,000 to $100,000. On the daily chart, BTC is steadily operating above $92,000, with several professional traders choosing to position long below $90,000 and planning to take profits in batches as they approach the $94,000 level, viewing $100,000 as the next key emotional and technical threshold. A successful breakthrough would mean a new price discovery range is opened, and the anchoring effect of historical highs would be partially broken.

Opinions on the short- to medium-term trend are clearly divided. Representative bull figure Tom Lee is publicly bullish, emphasizing the potential for new historical highs within the current cycle, while the path forecast from his fund is relatively conservative, suggesting that BTC may pull back to the $60,000-$65,000 range in the first half of 2026. This combination of "personal bullishness, cautious path" reflects institutions' optimism about long-term structural opportunities while remaining vigilant about short- to medium-term volatility and pullback space.

It is particularly important to note that the current stage is still in the aftermath of global holidays and a trading lull, with low trading volumes in both spot and derivatives markets and limited order book depth. The oscillation within a narrow price range actually hides greater potential volatility risks. Weak liquidity makes "false breakouts" and significant stop-loss/liquidation sweeps more likely, and for leveraged and chasing funds, the price range around $100,000 is both an emotional peak area and a sensitive zone for concentrated risk release.

Emotional Recovery Lags Behind Price Increases, Risk of Emotional Mismatch

From the perspective of sentiment data, the market's internal recovery speed is clearly slower than the price rebound magnitude. Over the past month, the fear and greed index has gradually recovered from the "extreme fear" range, but currently hovers only around 26, still classified as "fear." This means that while prices have significantly rebounded above $90,000, a considerable portion of investors' risk appetite remains cautious and on the sidelines, indicating a significant mismatch between new price highs and emotional recovery. If negative news or amplified volatility occurs subsequently, sentiment may drop more sharply.

On-chain and holding structure data convey different signals. For the first time since July 2025, long-term Bitcoin holders have begun to noticeably slow down their selling pace, marking the end of a months-long trend of reduction. Meanwhile, the accumulation behavior of spot ETFs, listed companies, and other institutional entities is still advancing, with chips accelerating towards strong hands and institutions. This migration of chips from "retail to institutions" enhances the stability of long-term holdings while also increasing the concentration of potential selling pressure at high levels, meaning that once prices adjust, volatility may exhibit characteristics of "slow accumulation, fast reshuffling."

In terms of community sentiment, the overall mood has gradually shifted from the pessimism and fear of late 2025 to a state of cautious optimism. The mainstream view anticipates that the new year effect, combined with the release of institutional liquidity, will drive Bitcoin to open new upward space above $100,000, while also generally incorporating "severe corrections at high levels" into expectation management, leaning towards strategies of phased accumulation, controlling leverage, and diversifying sectors to hedge against potential volatility. FOMO sentiment is beginning to emerge, but there is still a distance from full-blown enthusiasm, leaving room for the market to continue evolving while also laying the groundwork for sudden corrections.

Three Key Observational Coordinates Before Hitting $100,000

Looking ahead to the upcoming critical phase, whether Bitcoin can successfully stabilize above $100,000 and how this breakthrough will reshape the pricing of broader risk assets will mainly depend on the evolution of three main lines. First, whether the continuous net inflow of ETFs can be sustained; if the current daily inflow of hundreds of millions of dollars continues, spot buying will continue to provide solid support for prices. Second, whether macro safe-haven and re-inflation trading will continue, including the situation in Venezuela, supply disruptions in commodities like copper, and inflation expectations; these factors will determine the strength of the "digital gold" narrative. Third, whether Bitcoin can effectively stabilize after breaking through $100,000, and through the "wealth effect" and diffusion of risk appetite, drive a new round of rotation in altcoins and high-beta sectors.

In an optimistic scenario, if geopolitical risks and inflation expectations continue to rise in the first quarter of 2026, while the regulatory environment does not change dramatically, funds are expected to continue spreading towards privacy sectors, Solana/BSC ecosystems, and other thematic lines while stabilizing the market value of core assets like BTC and ETH. This round of increase may evolve from "Bitcoin-dominated price recovery" to a "mid-term market covering multiple sectors," with both time dimensions and participation breadth exceeding the scope of short-term rebounds.

However, risk scenarios also need to be clearly incorporated into trading and allocation frameworks. If ETF net inflows significantly slow down or even show stage net outflows, or if macro-level policy tightening and geopolitical "black swan" events occur, under the premise of highly concentrated chips at high levels, the extent of price pullbacks may far exceed current market intuitive expectations. The previously suggested $60,000 to $70,000 range from multiple institutions is a potential pullback window that needs to be taken seriously. For investors, a more reasonable strategy at this stage is to acknowledge the optimistic expectations driven by liquidity and macro factors while pre-setting multiple scenarios, maintaining flexibility in positions and leverage, and ensuring that once the market turns, there is still enough space and time for risk control and reallocation.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。