At the beginning of 2026, the market did not welcome an optimistic start of emotional recovery; instead, it faced a renewed escalation of geopolitical risks. Political friction, regional instability, and changes in international relations are continuously transmitting new pressures to the global market through energy prices and financial conditions. Against the backdrop of slowing growth and declining inflation, these non-economic factors are becoming important variables that influence market rhythms.

In this environment, the cryptocurrency market has not shown an "independent trend" but has clearly integrated into the macro narrative. Since the beginning of the year, Bitcoin has risen approximately 5.2%, Ethereum has increased about 6.4%, and Solana has seen a rise of about 8.6%. Price fluctuations are highly consistent with risk appetite, interest rate expectations, and exchange rate changes, indicating that digital assets are operating as macro-sensitive assets.

As key macro data and policy events in January unfold, the market will enter a concentrated verification period. Whether cryptocurrency assets continue to maintain a high correlation with macro variables will become an important observation point for judging the market structure and funding behavior at the beginning of 2026.

TL;DR Quick Summary

- Geopolitical risks and energy market fluctuations are setting the tone for early 2026.

- Inflation continues to decline, but growth momentum in different sectors shows significant divergence.

- Interest rate levels, real yields, dollar trends, and liquidity remain core variables for cross-asset pricing.

- January's market focus is on inflation data, employment reports, corporate guidance, and major central bank meetings.

- The cryptocurrency market has become highly "macro-oriented," with price performance more closely following changes in interest rates and risk appetite rather than a single crypto narrative.

From Inflation to Policy: Three Main Lines of the January Macro Environment

Entering 2026, the market's focus is not on the emergence of new narratives but on the verification of existing judgments. Although inflation has significantly declined from previous peaks, policymakers remain cautious; economic growth has not been interrupted, but the marginal weakening of the manufacturing and labor markets is gradually becoming evident. At the same time, geopolitical risks are continuously injecting new uncertainties into the market through energy prices, trade routes, and exchange rate fluctuations.

In such an environment, the importance of single data points is decreasing, replaced by the overall trends presented by the data. Investors are trying to answer three key questions: Is the decline in inflation sufficient to bring about more flexible monetary policy? Can the slowdown in growth remain "orderly"? Will external shocks change the current path? January is the time window for these judgments to be concentrated and tested.

_The current market is mainly influenced by three forces: _

- Policy Uncertainty: Major central banks are nearing the end of the tightening cycle, but the subsequent path still heavily depends on data performance.

- Divergence in Growth Structure: Consumption and tech investment remain resilient, while manufacturing activity and hiring intentions continue to cool.

- Geopolitical Pressure: Energy prices and major currencies are highly sensitive to political events, which inversely affect inflation expectations.

Overall, January is a "verification period." The market is confirming whether the decline in inflation is sustainable and whether the economic slowdown remains within a controllable range, rather than evolving into a more severe downturn.

January Macro Event Calendar: Key Time Points Affecting Multiple Assets

- Early Month Growth Signals: Manufacturing and services survey data provide the first clear reading of the global economy at the end of 2025. These data often amplify market expectations in the low liquidity environment at the beginning of the year and influence pricing direction before central bank meetings.

- Mid-Month Inflation Focus: With the release of consumer price data, inflation becomes the core of market discussions. The data will help investors determine whether the decline in inflation continues or shows signs of stagnation, often triggering synchronized fluctuations in interest rates, the dollar, stock markets, and digital assets.

- Earnings Season and Forward Guidance: The corporate earnings season begins in January. Compared to historical performance, management's guidance on demand, costs, and investment plans for 2026 is more influential. Given the high valuation levels, statements from the tech and financial sectors are particularly critical.

- End-of-Month Policy Signals: As the end of the month approaches, the Federal Reserve meeting becomes the market's focus. Even if the policy rate remains unchanged, the wording of the statement and the tone of the press conference may reshape monetary policy expectations for the coming quarters.

Overall, January's macro calendar includes several important events that simultaneously affect stocks, bonds, exchange rates, and cryptocurrency assets. Early month data sets expectations, mid-month inflation readings test those expectations, while central bank communications ultimately determine how the market prices and adjusts positions.

January Market Rhythm Breakdown: What to Watch Each Week?

First Week (January 1–5): Reopening After Holidays and Emotional Fluctuations

After the holiday, the market reopens in a low liquidity environment, making prices more sensitive to geopolitical dynamics and changes in the energy market. Position adjustments at the beginning of the year often lead to significant volatility and emotional reactions.

- Key Events: OPEC+ policy signals, U.S. ISM Manufacturing PMI (January 5)

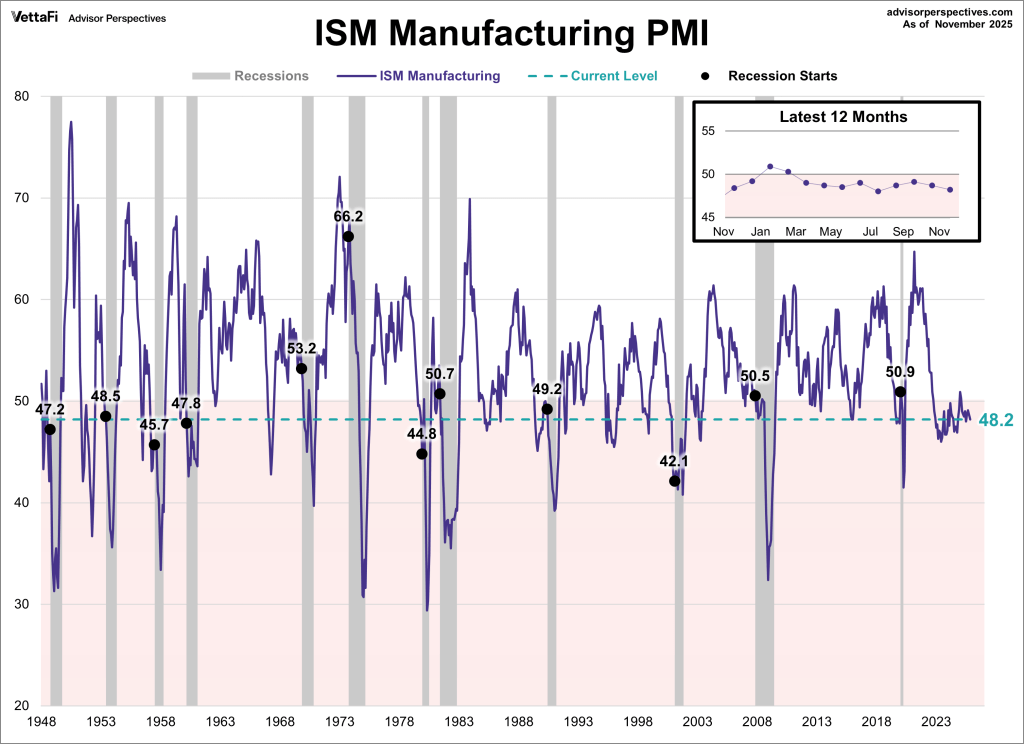

- Core Indicators: PMI level (previously 48.2, below 50 for the fifth consecutive month), new orders, input costs, crude oil price reactions

Observation Focus: Whether the manufacturing sector continues to be in contraction territory (market consensus around 48–49) or shows signs of stabilization. In a low liquidity environment, even a slight improvement towards 50 may trigger a short-term rebound in risk assets; conversely, weak data will further reinforce the narrative of economic slowdown.

The ISM Manufacturing PMI does not have a fixed threshold that reliably indicates a recession. Historically, economic recessions can occur when the PMI is above 50 or below 50. Compared to absolute values, its trend is more meaningful: during past recessions, the PMI almost always enters a sustained contraction, while in non-recession periods, it mostly remains in the expansion range. (Advisor Perspectives)

The ISM Manufacturing PMI does not have a fixed threshold that reliably indicates a recession. Historically, economic recessions can occur when the PMI is above 50 or below 50. Compared to absolute values, its trend is more meaningful: during past recessions, the PMI almost always enters a sustained contraction, while in non-recession periods, it mostly remains in the expansion range. (Advisor Perspectives)

Second Week (January 6–10): How Do Employment Data Affect Interest Rate Expectations?

Market focus shifts to economic momentum and employment-related indicators, which have a direct impact on interest rate expectations.

- Key Events: U.S. ISM Services PMI (January 7), U.S. Non-Farm Payroll Report (January 9)

- Core Indicators: Services PMI (previously around 52.4, expected around 51–52), new jobs added (previously around 64,000), unemployment rate (around 4.6%), wage growth

Observation Focus: Whether the services sector continues to cool while maintaining expansion. If new jobs fall within the 50,000–75,000 range, it will confirm a gradual cooling of the labor market, favoring a strengthening of easing expectations; if wage growth remains strong, it may raise interest rate pressures again and support the dollar.

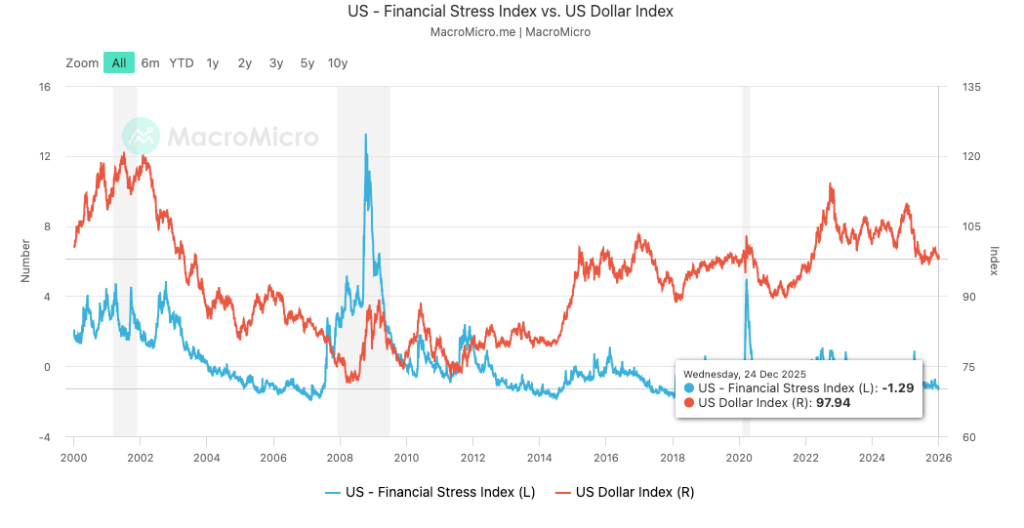

When the U.S. Dollar Index (DXY) is at 97.94 and the Financial Stress Index is at -1.29, data shows the dollar remains strong while systemic financial stress is low, reflecting a stable liquidity environment and overall smooth operation of financial markets. (MacroMicro)

When the U.S. Dollar Index (DXY) is at 97.94 and the Financial Stress Index is at -1.29, data shows the dollar remains strong while systemic financial stress is low, reflecting a stable liquidity environment and overall smooth operation of financial markets. (MacroMicro)

Third Week (January 13–17): Inflation Verification Period and Corporate Confidence Window

This is the most market-sensitive week of the month, with inflation data and earnings season coinciding.

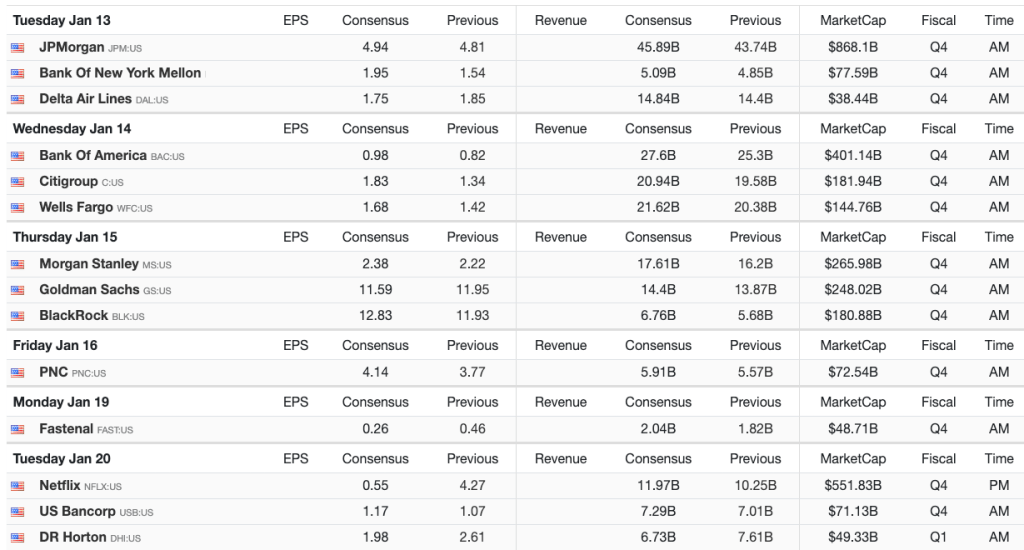

- Key Events: U.S. CPI inflation data (January 13), Q4 earnings season begins (JPMorgan JPM, Bank of America BAC, Citigroup C, Wells Fargo WFC, BlackRock BLK)

- Core Indicators: CPI year-on-year (previously around 2.6%, expected around 2.4–2.6%), core CPI (previously around 3.1%, expected around 3.0–3.1%), services inflation, housing costs, corporate forward guidance

Observation Focus: Whether inflation continues its slow decline trend or shows signs of stagnation in services and housing-related components. At the same time, guidance from large banks and asset management firms will provide early clues for the credit environment, market activity, and corporate confidence at the beginning of 2026.

The January earnings calendar shows that large U.S. companies will successively announce their Q4 results, with large banks disclosing earnings first, providing early signals for the credit environment and overall market health. Subsequently, earnings from companies like Delta Air Lines, Netflix, and DR Horton will further reflect trends in consumption, travel, and real estate sectors. (Trading Economics)

The January earnings calendar shows that large U.S. companies will successively announce their Q4 results, with large banks disclosing earnings first, providing early signals for the credit environment and overall market health. Subsequently, earnings from companies like Delta Air Lines, Netflix, and DR Horton will further reflect trends in consumption, travel, and real estate sectors. (Trading Economics)

Fourth Week (January 20–24): Global Policy Signals Come into View

Important U.S. data decreases, and market attention shifts to overseas policies and international situations.

- Key Events: Bank of Japan policy meeting (January 22–23), global policy and geopolitical dynamics

- Core Indicators: Yen trends, Japanese government bond yields, Bank of Japan forward guidance wording

Observation Focus: Whether the Bank of Japan releases any signals for policy normalization. Even minor changes in wording may strengthen the yen and spill over to global bond markets and risk assets through interest rates and exchange rates.

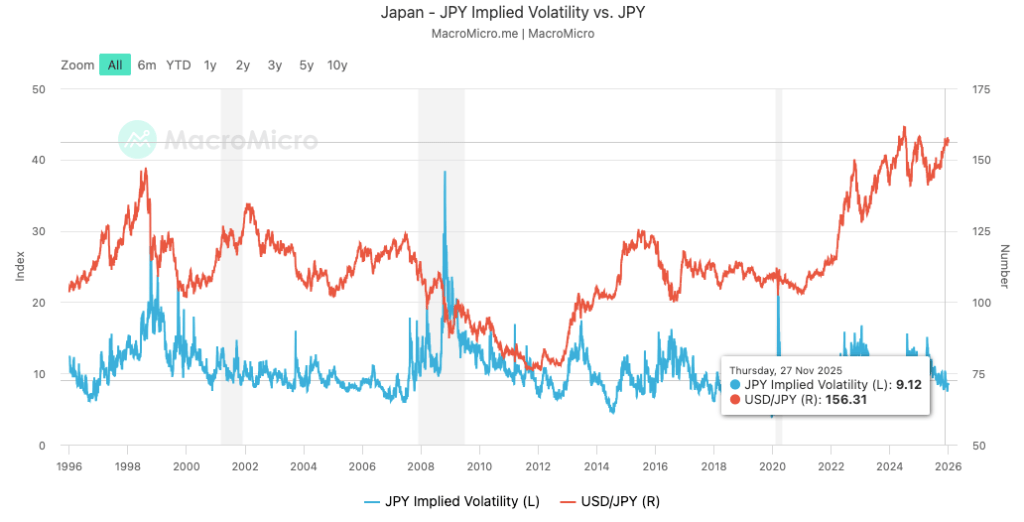

The USD/JPY exchange rate rises to 156.31, reflecting the continued weakness of the yen, while the implied volatility of the yen is only 9.12, indicating that this trend is more of an orderly adjustment driven by policy rather than severe fluctuations caused by market pressure. (MacroMicro)

The USD/JPY exchange rate rises to 156.31, reflecting the continued weakness of the yen, while the implied volatility of the yen is only 9.12, indicating that this trend is more of an orderly adjustment driven by policy rather than severe fluctuations caused by market pressure. (MacroMicro)

Fifth Week (January 27–31): Federal Reserve's Tone and Earnings Season Conclusion

The end of the month brings the most critical market catalyst combination for January.

- Key Events: Federal Reserve policy meeting (January 27–28), earnings reports from major tech companies, U.S. PCE inflation data (January 30)

- Core Indicators: Federal Reserve statement tone, policy guidance (interest rates remain in the 4% mid-range), real yields, core PCE (previously around 2.6%, expected around 2.4–2.6%)

Observation Focus: Whether the Federal Reserve continues to emphasize a patient stance or begins to signal the possibility of further easing in 2026. Combined with the performance of end-of-month earnings, this week often determines the directional consensus of the market before entering February.

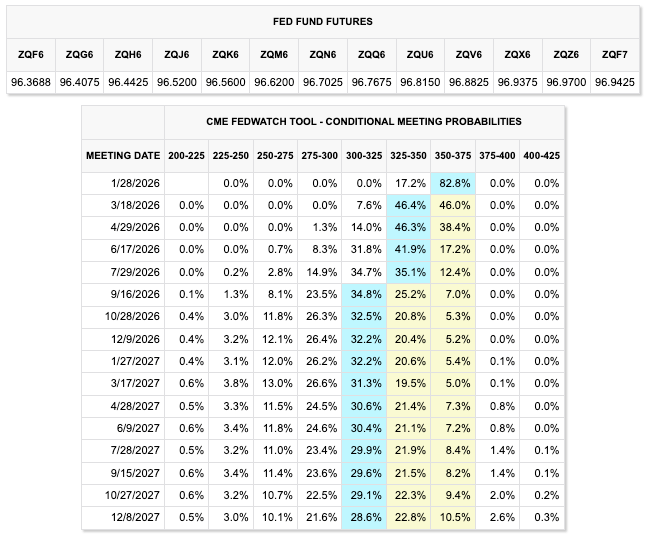

CME FedWatch data shows that the market believes there is an 82.8% probability that the Federal Reserve will maintain interest rates in the 350–375 basis points range on January 28, reflecting a strong consensus among investors for a policy hold in the short term. (CME FedWatch Tool)

CME FedWatch data shows that the market believes there is an 82.8% probability that the Federal Reserve will maintain interest rates in the 350–375 basis points range on January 28, reflecting a strong consensus among investors for a policy hold in the short term. (CME FedWatch Tool)

The Macroization of the Cryptocurrency Market: How Are Mainstream Assets Priced?

Entering 2026, the cryptocurrency market is exhibiting a more restrained yet healthier operational state. Market pricing is no longer primarily driven by short-term news or a single narrative but more reflects changes in the macro environment that global capital flows depend on.

- Bitcoin(BTC): Bitcoin has been trading in the range of approximately $87,500–$88,000 at the beginning of the year and rose above $91,000 in early January, with a cumulative increase of about 3–5% since January 1. Rather than viewing this as the start of a new trend, it is more appropriate to see it as a consolidation phase following a significant correction in 2025. Currently, BTC is oscillating mainly in the $88,000–$95,000 range, with the market waiting for inflation data and monetary policy signals to provide clearer guidance for the next phase.

- Ethereum(ETH): Ethereum's overall trend remains in sync with Bitcoin but has slightly outperformed during the risk appetite recovery phase. Since the beginning of the year, the combined net inflow into Bitcoin and Ethereum ETFs has exceeded $640 million, reflecting a return of institutional funds and further reinforcing ETH's positioning as an asset with both macro sensitivity and yield attributes, closely related to its price performance, staking yields, and DeFi activity.

- Solana(SOL): Solana continues to exhibit higher beta characteristics, achieving more significant percentage gains during periods of improved risk sentiment and capital rotation towards high-volatility assets, amplifying the overall market's changes in risk appetite.

In addition to price performance, regulatory progress in major jurisdictions and increased institutional participation are gradually shaping the medium- to long-term structure of the cryptocurrency market. However, in the short term, market pricing remains highly anchored to macro variables. Inflation data, central bank communications, and exchange rate trends continue to be the core driving factors for capital allocation and position adjustments in January.

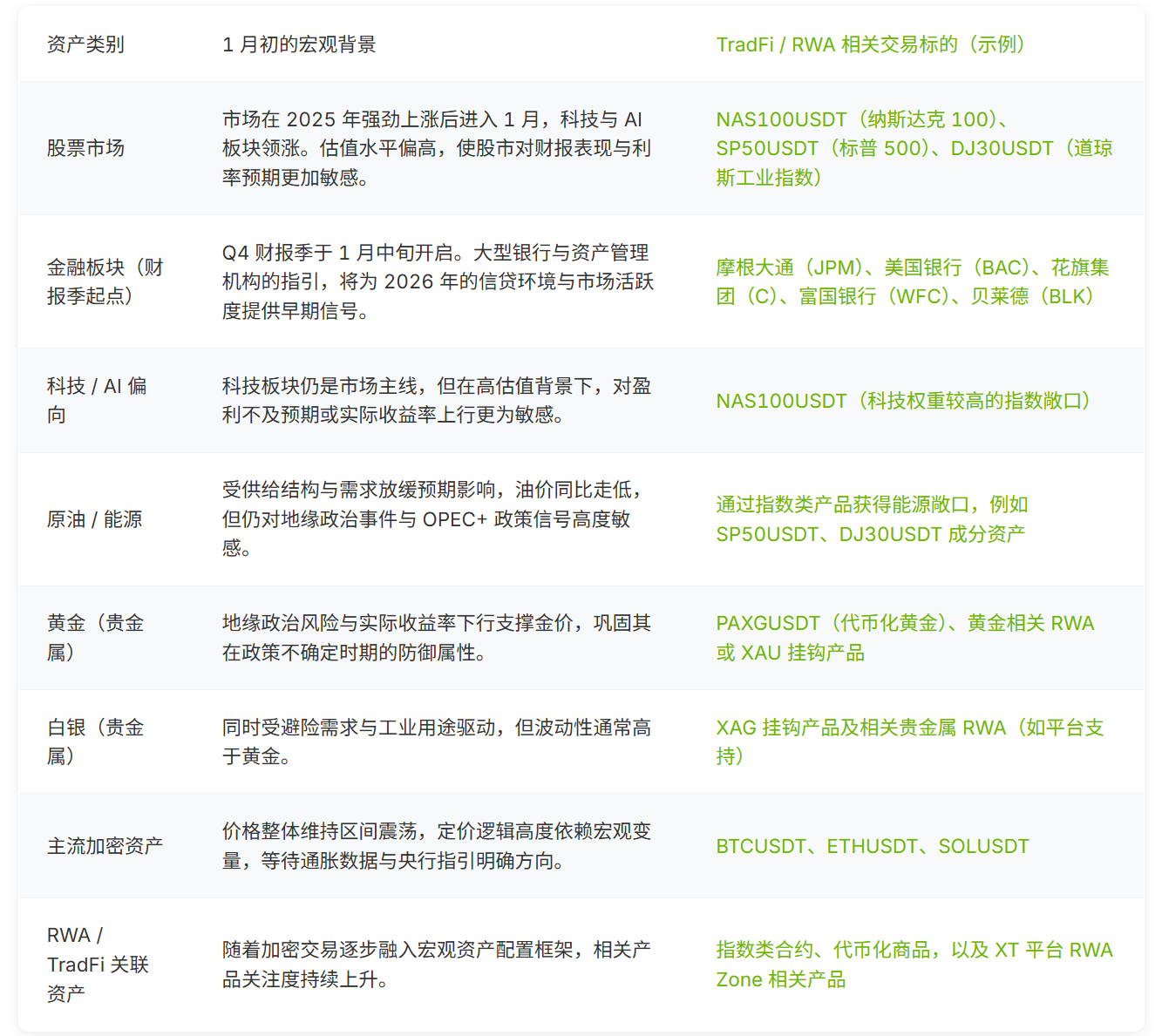

Where is the Current Market Positioned? Multi-Asset Overview

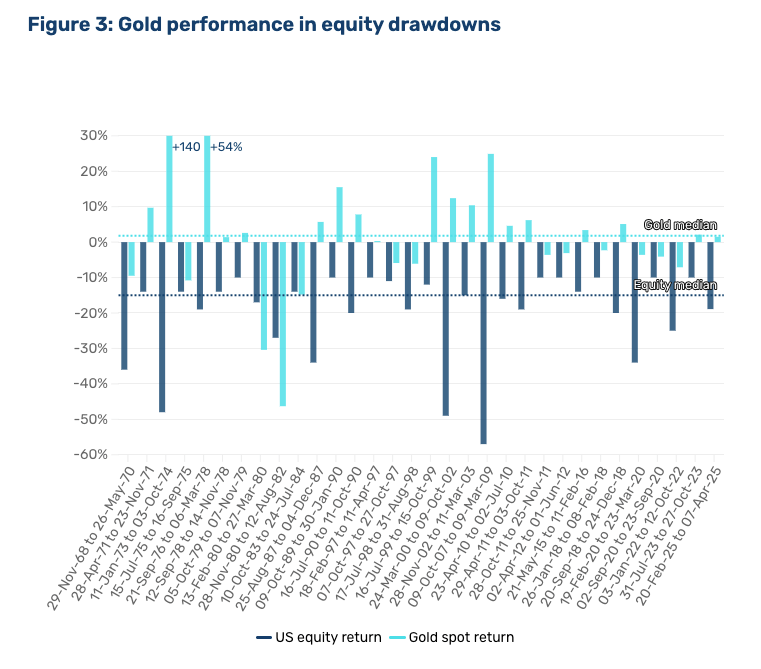

During significant pullbacks in major stock markets, gold often manages to remain relatively stable or even record gains, while the U.S. stock market shows a noticeable decline, further reinforcing gold's role as a hedging tool in investment portfolios and a buffer asset against downside risks. (Man Group)

During significant pullbacks in major stock markets, gold often manages to remain relatively stable or even record gains, while the U.S. stock market shows a noticeable decline, further reinforcing gold's role as a hedging tool in investment portfolios and a buffer asset against downside risks. (Man Group)

Risk Scenario Simulation for Early 2026

Baseline Scenario: Gradual Decline in Inflation, Market Range-Bound

Inflation continues to decline at a moderate pace, with major central banks maintaining a patient stance, resulting in the market operating within a range, although there will still be periodic fluctuations around key data releases.

Upside Scenario: Inflation Cools Faster Than Expected, Policy Signals Are Dovish

If inflation declines faster than market expectations or central banks release more accommodative policy signals, falling real yields and improved risk appetite may drive a rally in stocks and cryptocurrency assets.

Downside Scenario: Sticky Inflation or Policy Shock

If inflation remains strong, geopolitical risks escalate, or central banks unexpectedly adopt a hawkish stance, risk assets will face pressure. In this scenario, the dollar strengthens, and volatility in the cryptocurrency market significantly increases.

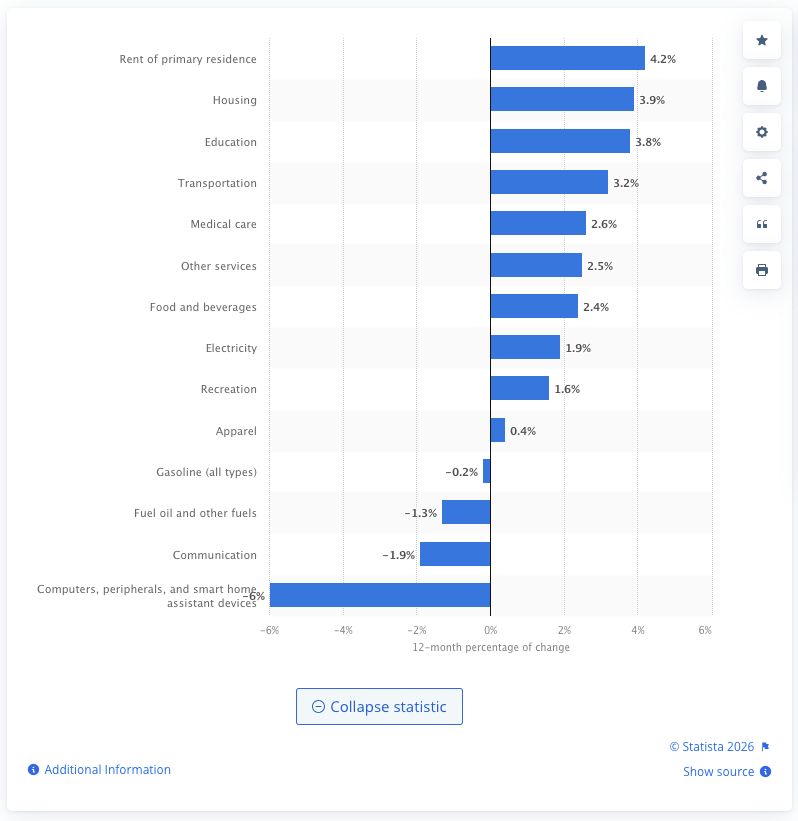

The year-on-year changes in the U.S. Consumer Price Index (CPI) in January 2025 show that rent and housing-related expenditures have increased significantly, while prices in several categories of goods have decreased. (Statista)

The year-on-year changes in the U.S. Consumer Price Index (CPI) in January 2025 show that rent and housing-related expenditures have increased significantly, while prices in several categories of goods have decreased. (Statista)

January Macro and Market FAQ

1. Why is January so important for the market?

Because the market performance at the beginning of the year often influences position layouts and expectations for the following months.

2. What data should be closely monitored in January?

U.S. inflation data, employment-related indicators, and forward guidance in corporate earnings reports.

3. How significant is the Federal Reserve's role this month?

Even without adjusting interest rates, the Fed's statements and wording can significantly drive market fluctuations.

4. Why do cryptocurrency assets respond to inflation data?

Inflation affects interest rate levels and dollar trends, both of which directly determine the liquidity environment in the market.

5. Does Bitcoin still have hedging properties?

In some scenarios, yes, but short-term trends often still correlate with risk assets.

6. Do traders need to expect higher volatility?

Yes, especially around important data releases and policy events.

Further Reading

- XT Double Festival Carnival Officially Launched, $2,000,000 in Rewards Fully Distributed

- X Legends Futures Competition Ranking Strategy: How to Efficiently Accumulate Trading Volume to Compete for a $5 Million Prize Pool

- Top 5 Layer 1 Blockchains to Watch in 2026: The Mainline Evolution from DeFi to RWA

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now with over 12 million registered users, operating in more than 200 countries and regions, with an ecosystem traffic exceeding 40 million. XT.COM cryptocurrency trading platform supports over 1,300 quality coins and 1,300 trading pairs, providing spot trading, margin trading, futures trading, and other diversified trading services, equipped with a secure and reliable RWA (real-world assets) trading market. We always adhere to the philosophy of "Exploring Crypto, Trusting Trading," committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。