Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Saoirse, Foresight News

The cryptocurrency market has started positively in 2026. As I write this memo on January 5, Bitcoin and Ethereum have both risen by 7% this year. Speculative altcoins have seen even greater increases, with Dogecoin rising by as much as 29%.

Can this round of gains continue?

Throughout the holiday season, I have been pondering: what conditions are necessary for cryptocurrencies to achieve a sustained rebound in 2026? I believe there are three major obstacles we must overcome to reach new historical highs. Fortunately, one of these obstacles has already been tackled.

Obstacle 1: Avoiding a Repeat of the "10・11" Crash

On October 11, 2025, the cryptocurrency market experienced the largest liquidation event in history—$19 billion in futures positions vanished in a single day. After the event, many were concerned that this would impact major market makers and/or hedge funds, potentially leading to fatal consequences.

One reason for the difficulty in rebounding in the fourth quarter of 2025 was investors' fears that one of these large institutions might be forced to cease operations, a process that typically requires forced asset sales. These potential sell-offs loomed over the market like a thick fog.

The good news is that if such risk events were to occur, they likely would have already happened by now. While it cannot be completely guaranteed, any institution planning to cease operations would most likely choose to complete the relevant processes before the end of the year. I believe one reason the market was able to rebound at the beginning of this year is that investors have gradually forgotten the impact of the "10・11 event."

Obstacle 2: Smooth Passage of the "CLARITY Act"

The cryptocurrency market structure bill known as the "CLARITY Act" is currently under review in the U.S. Congress. The Senate plans to initiate the "bill amendment review" process on January 15, which includes coordinating the bill drafts submitted by the Senate Banking Committee and the Agriculture Committee, and pushing the final bill into the voting stage. There are still some obstacles, such as disagreements on DeFi regulatory approaches, stablecoin yield rules, and political conflicts of interest. However, as long as the bill can pass the amendment review stage, it will mean a crucial step toward final passage.

The passage of the "CLARITY Act" is vital for the long-term development of the U.S. cryptocurrency market. Without relevant legislation, the current regulatory inclination of agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to "support cryptocurrency development" may reverse with the new government. The passage of this bill will establish the core principles of cryptocurrency regulation in legal form, laying a solid foundation for the future development of the market.

David Sacks, the White House cryptocurrency affairs lead, stated, "We are closer to the bill's passage than ever before." The prediction market platform Kalshi estimates that the probability of the bill passing before May is 46%, and the probability of it passing by the end of the year is 82%. I hold a cautiously optimistic view on this.

Obstacle 3: Stock Market Remains "Reasonably Stable"

The final key factor for achieving a sustained rebound in cryptocurrencies is that the overall stock market must remain stable. We do not need the stock market to enter a frenzied bull market—after all, the correlation between cryptocurrencies and the stock market is not very high. However, if the stock market experiences a significant crash (for example, a 20% drop in the S&P 500), the attractiveness of all risk assets (including cryptocurrencies) will be greatly diminished in the short term.

I cannot claim to have any special expertise in the stock market. While some are concerned about a potential bubble in the artificial intelligence (AI) sector, prediction markets indicate that the probability of an economic recession occurring in 2026 is relatively low, and the probability of the S&P 500 rising in 2026 is about 80%.

Conclusion

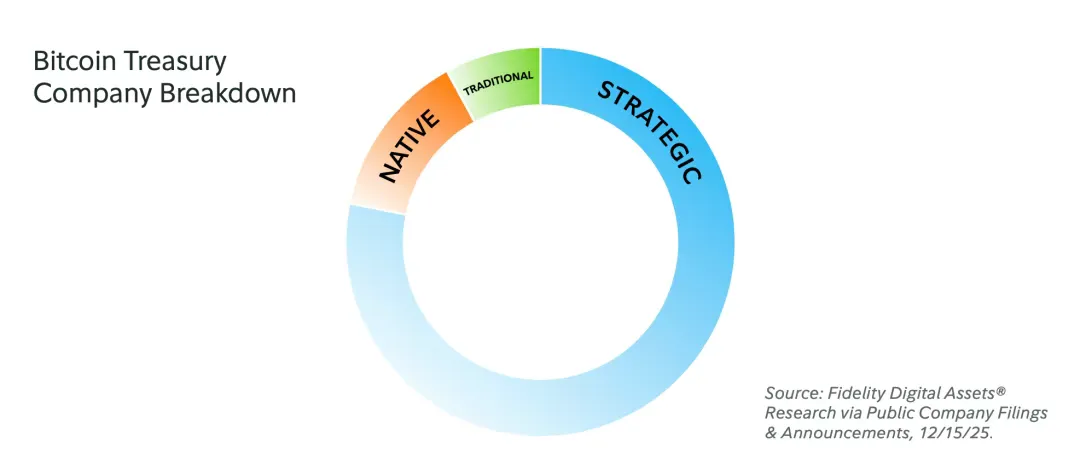

There are many positive factors currently worth noting in the cryptocurrency market: institutional adoption of cryptocurrencies is continuously increasing; the demand for real-world applications such as stablecoins and tokenization is surging; and the benefits of the regulatory trend that began in January 2025 to "support cryptocurrency development" are gradually becoming apparent. If we can achieve the three key objectives mentioned above, I believe this round of gains at the beginning of 2026 will have strong staying power.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。