Author: Chloe, ChainCatcher

Recently, Venezuelan leader Maduro was arrested. Before mainstream media released the news, a Polymarket account established in late December quietly exited with a 1242% return. This event has led to U.S. Congressman Ritchie Torres introducing the "2026 Financial Prediction Market Public Integrity Act," which attempts to bring traditional financial "insider trading" regulations into the crypto market.

This article will focus on the Maduro incident as a core case to delve into the ongoing controversy of "insider trading" in prediction markets, re-examining whether what we need in decentralized prediction platforms is an absolutely equal casino or an accurate truth engine.

Polymarket's "Prophet" Moment: Accurately Predicting Maduro's Downfall

In January 2026, Venezuelan leader Maduro was confirmed to have been arrested. While global mainstream media were still verifying sources, the data on the decentralized prediction market Polymarket had already provided the answer.

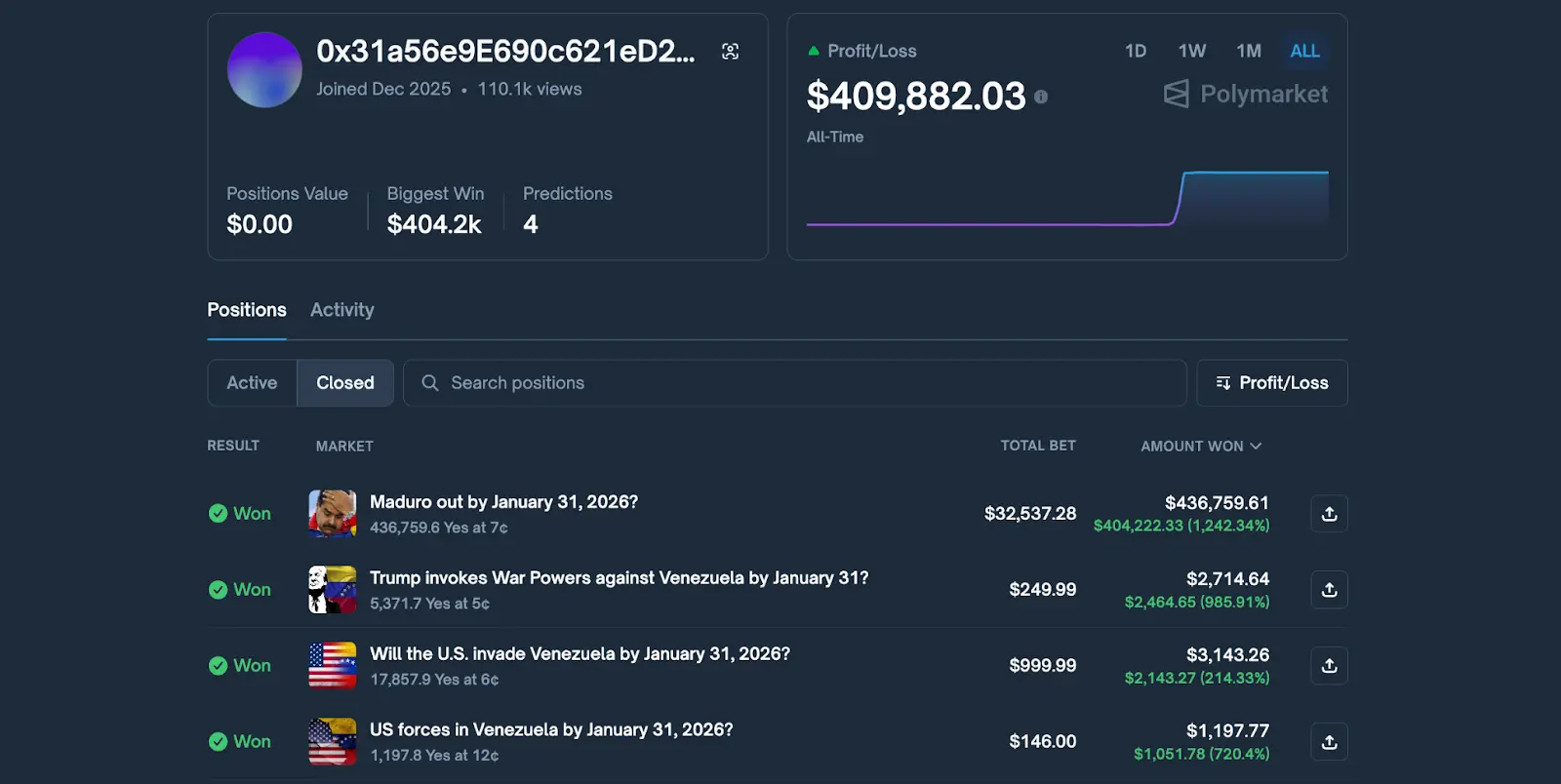

An account created on Polymarket in late December 2025 seemed to have a god-like perspective, accurately predicting the occurrence of the event. This account made four predictions while the market was quiet, all related to whether the U.S. would intervene in Venezuela, with the largest bet being $32,537 on "Maduro will step down before January 31." At that time, the market's expected probability for such an extreme event was only in the single digits, and the account swept in at a very low price of 7 cents.

As news of Trump's confirmation of military action broke early Saturday morning, these contracts skyrocketed to nearly $1 at settlement. The account made over $400,000 in profit in less than 24 hours, with a return of 1242%. This was not an ordinary speculation but a precise strike.

A Mysterious Prophet or Insider Trading?

This massive profit with a god-like perspective quickly became the focus of the community. As discussions heated up, accusations of insider trading followed:

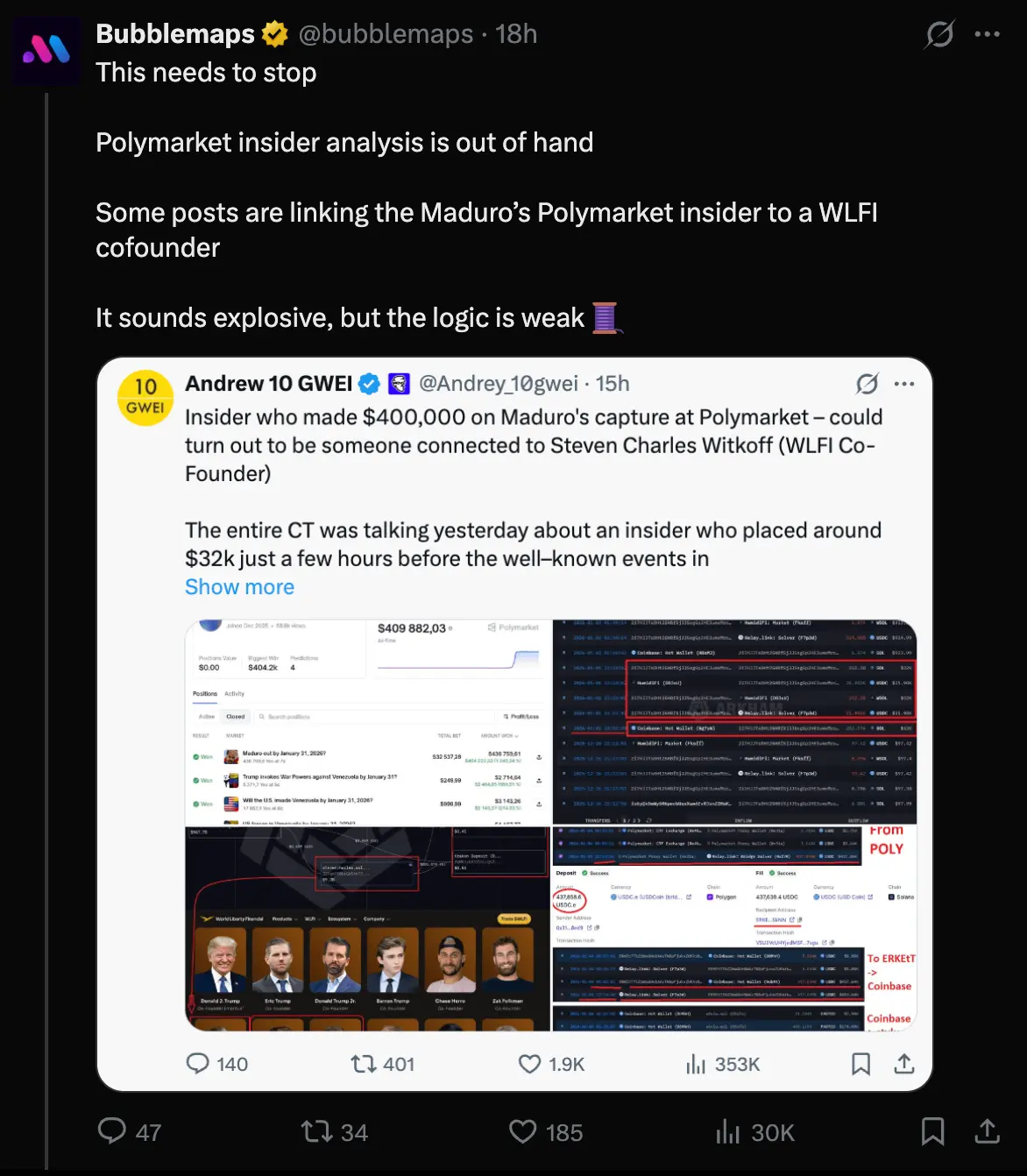

On-chain analyst Andrew 10 GWEI pointed out that the funding path of this account showed a high degree of similarity: 252.39 SOL withdrawn from Coinbase on January 1 matched closely in amount and timing (23 hours apart) with 252.91 SOL deposited into another wallet the previous day, suggesting a possible intermediary break in the chain through the exchange. More controversially, the associated wallet registered domain names like StCharles.sol and had significant transactions with the address of Steven Charles Witkoff, a co-founder of the suspected World Liberty Finance (WLFI). Given WLFI's close ties to the Trump family, this raised strong suspicions: was this an instance of insider trading using information from within the White House?

On-chain analysis platform BubbleMaps subsequently expressed a different viewpoint. They argued that the inference of "similar timing and amounts" was too superficial and pointed out that there were at least 20 wallets on-chain that fit this pattern. Furthermore, Andrew's argument lacked direct evidence of on-chain fund movement, thus there was no reliable evidence linking the Polymarket account to WLFI.

Congressman Proposes Integrity Bill: Aims to Regulate Insider Trading in Prediction Markets

This incident also led to U.S. Congressman Ritchie Torres proposing the "2026 Financial Prediction Market Public Integrity Act," which aims to prohibit federal elected officials, politically appointed officials, and executive branch employees from trading in prediction markets related to government policies using "material non-public information" obtained through their official positions.

However, this bill faces a dual gap in reality. First is the lengthy and variable legislative path; under the complex power dynamics of U.S. politics, such bills often undergo prolonged hearings and interest negotiations, easily becoming texts that are more about political posturing than substantive impact.

Second is the enforcement blind spot in a decentralized environment, where the flow of funds on-chain can easily be obscured by various privacy protocols or complex intermediary mechanisms. Although the bill symbolizes the traditional financial values beginning to formally intervene in prediction markets, attempting to protect retail investors from information harvesting and maintain fair participation rights in the market, we must consider: will this regulatory logic directly applied to decentralized prediction markets create conflicts due to differing core values, potentially leading to market failure?

The Core Value of Prediction Markets and the Paradox of Insider Trading

Returning to first principles, the purpose of prediction markets is to provide everyone with a fair opportunity to profit or to obtain the most accurate predictive results?

Traditional finance prohibits insider trading to protect retail investors' confidence and prevent capital markets from becoming cash cows for the powerful. However, in prediction markets, their core value may be "truth discovery."

Prediction markets are machines that aggregate fragmented information into price signals. If a market about "whether Maduro will step down" prohibits informed individuals from participating, then the price reflection of that market will forever be "guesses from outsiders," rather than "real probabilities," which would undermine the accuracy of prediction markets.

In the Maduro incident, suppose the profit-maker was not an insider but a top information analyst. By tracking abnormal radio signals at the Venezuelan border, private aircraft takeoffs and landings, and even the U.S. Department of Defense's public procurement lists, he could piece together a model predicting military action. Such behavior may be controversial in traditional regulatory views, but under the logic of prediction markets, it represents a highly valuable "information pricing behavior."

One of the missions of prediction markets is to break information monopolies. When various parties interpret vague and delayed government diplomatic language, the price fluctuations in prediction markets are already sending out warnings of the truth to the world. Therefore, rather than calling it insider trading, it is more accurate to say it rewards those who bring hidden information to light through trading, providing the public with immediate risk guidance.

Prediction Markets Are Tools Born to Pursue Truth, Not Fair Trading Venues

The emergence of the "2026 Financial Prediction Market Public Integrity Act" may reflect a regulatory misunderstanding of decentralized prediction platforms. If we pursue a "completely fair" prediction market, we will ultimately end up with a "completely ineffective" prediction market.

The Maduro incident profoundly reveals the true value of prediction markets: it allows hidden truths to be transformed into signals on-chain that everyone can examine through the traces of capital flow. The transparency of blockchain breaks the black box; even if we cannot immediately identify the behind-the-scenes players, when mysterious accounts build positions and probabilities fluctuate dramatically, the market is actually sending signals. This can attract smart money to follow quickly, rapidly leveling the originally unequal information gap, thus transforming "insider" into "public probability."

Prediction markets are not stock markets; they are essentially radars of human collective wisdom. To keep this radar accurate, we must allow for the friction costs that come with information arbitrage to a certain extent. Therefore, rather than attempting to block signals with prohibitions, we should consider positioning prediction markets as tools born to pursue truth, rather than as venues focused on fairness in trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。