Preface

With the popularization of blockchain concepts, virtual currencies have gradually entered the public eye, but they have also been targeted by criminals, becoming a new tool for online pyramid schemes. These criminals use the banners of "blockchain innovation" and "virtual currency appreciation," employing highly provocative phrases like "guaranteed profits," "get rich overnight," and "only rise, never fall" to lure the public into blind investments.

Unlike traditional pyramid schemes, virtual currency network pyramid schemes rely on online platforms, utilizing the decentralized and highly concealable characteristics of virtual currencies as identifiers for the schemes. They use "high returns" as bait, requiring participants to develop downlines through invitation codes, building multi-level organizational structures, and basing returns on the number of recruits, the amount of funds deposited, and the level of hierarchy, making them more concealed, with a wider spread and greater harm.

To help everyone recognize the true nature of such scams and avoid financial risks, the Zero Time Technology Security Team combines industry security practices, focusing on the theme of virtual currency network pyramid schemes, to help everyone dismantle the scam tactics and master identification and prevention skills.

1. Virtual Currency Network Pyramid Scheme Models

The core logic of pyramid schemes has commonalities: the leaders of pyramid schemes usually register shell companies both domestically and internationally, build websites, establish trust under the guise of charity, financial management, and healthcare, and then promote the value of virtual currencies through channels like WeChat, QQ, and offline seminars, encouraging "recruitment" to develop downlines with "high returns." Under the guise of "contract exchanges," these schemes lure investors into opening high-value accounts, using pyramid-style commissions and "partner systems" as high rewards to entice the development of downlines. While appearing to offer high returns, they actually target the principal of investors, often making excuses like "hacker attacks" or "new coin settlements" to escape after illegally gathering funds.

1. Contract Exchange Model

Criminal groups utilize the derivative attributes of virtual currency contract trading to build counterfeit trading platforms and issue platform tokens (used as transaction fees), claiming to provide trading services for mainstream coins like BTC and ETH. In reality, they use "contract exchanges" as a facade to lure investors into opening high-value accounts, enticing them to develop downlines through pyramid-style commissions and "partner systems." While it seems to offer high returns, it actually targets the principal of investors, and after illegally gathering funds, they often escape under excuses like "hacker attacks" or "new coin settlements."

2. Staking Mining Model

Project parties attract participants by claiming "mining rewards in virtual currencies," encouraging them to stake specified mainstream coins at provided project addresses, with staking periods ranging from 3 months to 1 year, during which funds cannot be freely transferred. To extract more funds, project parties inform participants that "the higher the computing power, the more mining rewards," directly linking computing power to "the number of staked coins," "the number of downline recruits," and "the amount staked by downlines." Once sufficient funds are gathered at the project address, the project party will abscond with all the mainstream coins.

3. Financial Wallet Model

Project parties use "virtual currency appreciation services" as a gimmick, building financial wallet apps, issuing air coins/counterfeit coins, exaggerating project prospects, and claiming that participants can earn price differences through "cross-exchange arbitrage." Participants must obtain membership accounts through recommendations from uplines, bind hierarchical relationships, and pay specified virtual currencies as threshold fees to unlock "arbitrage functions," with returns linked directly to the amount deposited and the number of downlines. In reality, the issuance and price fluctuations of platform tokens are controlled by the project party's backend, with profit displays being false numbers, and once the funds reach a certain threshold, they abscond with the money.

4. Smart Contract Model

Criminal groups utilize the smart contract features of DeFi (decentralized finance) to deploy involved smart contracts on the blockchain, packaging them as financial projects to promote high returns within communities. Unlike other models, this type of scam does not involve an app; participants must search for project DApp links through mainstream wallets to participate, with hierarchical relationships bound through participating addresses. Once participants transfer virtual currencies to the project contract address, the suspects can directly control the funds and abscond with the coins.

5. Quantitative Trading Robot Model

Quantitative trading robots are essentially auxiliary trading tools bound to exchange APIs, with no withdrawal permissions, but are exploited by criminal groups as vehicles for pyramid schemes. These apps attract downloads with claims of "intelligent strategies," "24-hour automatic trading," and "low-risk steady profits," requiring new users to hold mainstream coins and transfer them into the app as a participation threshold, earning commission by recruiting others. The platform misleads users by fabricating profit data, while in reality, it has already secretly transferred users' virtual currencies.

2. Core Dangers of Virtual Currency Network Pyramid Schemes

Virtual currency network pyramid schemes not only infringe on personal property but also cause multiple shocks to financial order and social stability:

◆ Irreversible property losses: After pyramid schemes collapse or abscond, virtual currency funds are often transferred to overseas addresses, making tracking extremely difficult, and participants' losses are basically unrecoverable;

◆ Legal risk of involvement: If participants develop downlines to a certain scale, they may become accomplices in pyramid schemes and bear legal responsibility;

◆ Disruption of financial order: Funds flowing out of regulatory oversight can easily breed related crimes such as money laundering and illegal fundraising, impacting the real economy;

◆ Destruction of industry ecology: Scamming under the guise of "blockchain" and "virtual currencies" misleads the public's understanding of blockchain technology, hindering the development of a legitimate and compliant blockchain industry.

Typical Cases

In recent years, virtual currency pyramid scheme scams have frequently occurred, with typical cases serving as a warning: In the 2024 "XX Coin" pyramid scheme case, the criminal group built a virtual currency trading platform, using "staking mining with an annualized return of 30%" as bait, developing over 100,000 downlines, with an involved amount of 230 million yuan. Ultimately, the leader absconded with the funds overseas, leaving most participants with nothing; in the 2023 "smart contract financial management" scam, over 5,000 participants were attracted through a packaged DeFi project, with involved funds of 170 million yuan, which were instantly transferred after being sent to the contract address, and have yet to be recovered.

The commonality of these cases is that they all use "high returns" as the core bait, rely on "recruitment" for hierarchical returns, and ultimately end with "absconding," with the concealability of virtual currencies greatly increasing the difficulty of case investigation and fund recovery.

3. How to Identify Whether It Exhibits Characteristics of a Pyramid Scheme?

◆ Check whether the virtual currency serves as an entry fee for the pyramid scheme, i.e., whether it acts as a payment method for purchasing goods or services;

◆ Pay attention to whether the virtual currency is used by the pyramid scheme organization as a basis for calculating compensation or returns;

◆ Observe whether the virtual currency is used to lure more people into participating in the pyramid scheme;

◆ Examine the profit model, focusing on whether it primarily relies on the investments of participants at various levels to illegally profit, whether the settlement method for participants' earnings is virtual currency, and whether the earnings mainly depend on the number of downlines and the investment amounts of downlines, rather than on the price fluctuations of virtual currencies in the market.

4. Regulatory Policy Red Lines

Our country explicitly prohibits any illegal issuance and trading of virtual currencies and severely cracks down on virtual currency-related pyramid schemes:

◆ In 2021, the central bank and multiple departments jointly issued a notice on "further preventing and addressing the risks of virtual currency trading speculation," clarifying that virtual currencies are not legal tender and do not have the same legal status as legal tender, and that their trading and speculation activities carry significant legal risks;

◆ Article 224-1 of the Criminal Law of the People's Republic of China clearly states that organizing and leading pyramid schemes constitutes a criminal act, punishable by imprisonment of up to five years or criminal detention, and fines; in severe cases, imprisonment of more than five years and fines may be imposed;

◆ Regulatory authorities in various regions continue to carry out special rectifications of virtual currency pyramid schemes, sealing and freezing involved platforms and fund accounts, and pursuing criminal responsibility for relevant responsible persons according to the law.

Conclusion

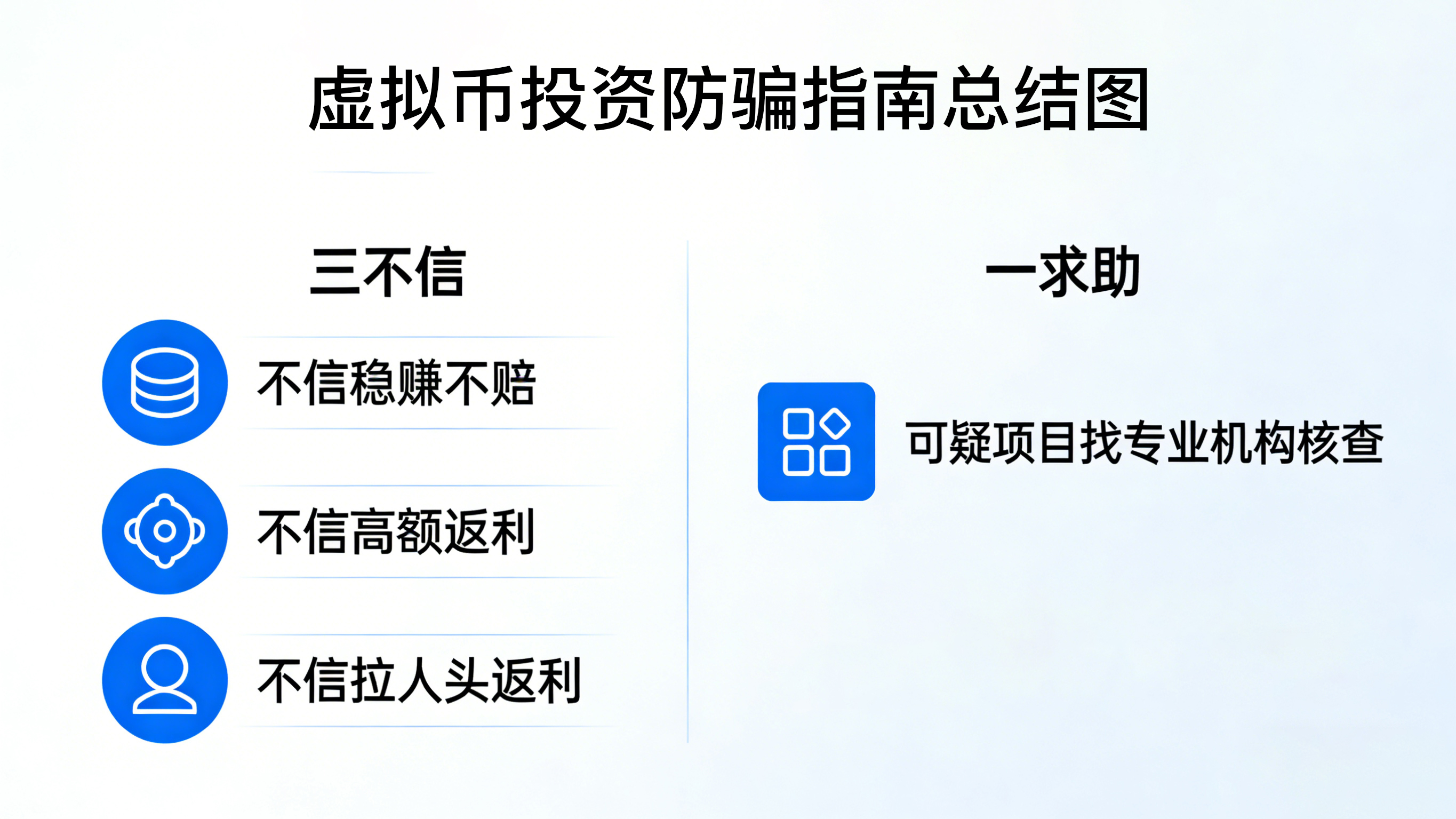

The essence of virtual currency network pyramid schemes is "using the name of new technology to carry out pyramid schemes." Regardless of how complex the packaging is, the core remains "recruitment, hierarchical returns, and fund deception." In the face of various virtual currency investment temptations, remember the basic logic that "high returns must be accompanied by high risks, and guaranteed profits are scams." By maintaining the bottom line of not being greedy and not blindly following, one can effectively avoid most risks.

As a company focused on blockchain security, the Zero Time Technology Security Team is committed to providing security guarantees for the public and enterprises: We can assist in identifying technical vulnerabilities and abnormal fund flows of virtual currency pyramid scheme platforms through blockchain security detection technology; provide free scam consultation services to help everyone analyze the compliance of suspicious projects; and continuously produce security popularization content to enhance the public's awareness of blockchain security. If you encounter suspicious virtual currency investment projects, feel free to contact us at any time to jointly resist illegal financial activities and safeguard property security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。