Master Talks Hot Topics:

I can roughly predict that today there will be a bunch of people starting to complain that the US stock market has hit a new high, while Bitcoin has dropped back to 90K, claiming that there is no correlation between the US stock market and Bitcoin. To be honest, hearing this kind of talk too often is really annoying.

If you actually watch the market, rather than just looking at headlines, you will find that the S&P 500 did indeed hit a new high during the day, but how did it close? It plummeted down, almost completely giving back the gains from the night before, and the Nasdaq also made a proper correction.

Taking a high point during the day and then questioning Bitcoin is not fair. The crypto market is not something you can directly compare to the US stock market; the scale, liquidity, and participant structure are completely different, and larger fluctuations are the norm in crypto.

When it drops, it drops faster and harder, and when it rises, it does so more vigorously as well. When Bitcoin took off ahead of the US stock market on Monday, why didn’t you come out and say there was a strong correlation?

Moreover, this round of increases is not driven by real liquidity but rather by information stimulation; to put it simply, it’s about expectations being pulled. Once those expectations loosen, prices will take a hit, which is very normal.

Last night’s drop was not a sudden market reversal but rather a disruption caused by the actions of the administration. In order to secure votes, they are clearly getting a bit anxious, targeting defense contractors, imposing limits on institutional home purchases, and PDVSA in Venezuela is not cooperating much either.

All these factors combined will naturally cause risk assets to shake a bit. Looking at the job vacancy data, the outlook is not good; the market is aware that the real shoe to drop is the non-farm payrolls. In this context, if you expect Bitcoin to remain stable, you can only say you are dreaming.

Back to the market, I have previously analyzed this. The range from 80K to 95K is a super large fluctuation box formed after the crash on November 21 last year. The previous period of low volatility could not be maintained indefinitely, and now the increase in volatility is only a matter of time.

This wave reaching around 94.5K is clearly a stop-loss hunt at the upper edge of the range. Those who chased long positions and went all in have all been lured out for a spin, and the orders in the market show that resistance is piled up messily; it would be strange if it didn’t drop.

The key issue lies below, where there is a large chunk of liquidity from 83.5K to 86.3K, which is still lying there untouched. With the market behaving this way, it would be abnormal not to take a bite. If this stop-loss hunt at 94.5K is confirmed, then the price will be pulled down by the liquidity below.

It’s almost a textbook-level movement; to put it simply, conducting stop-loss hunts within a range always sweeps one side, while the other side is the target. Therefore, from my own system's perspective, the current shape actually increases the probability of a stop-loss hunt targeting the previous low at 80.5K.

I would love for it to happen, to sweep clean all the liquidity below. Only in this way, if it really wants to move up later, will the path be smooth; otherwise, there will be hidden dangers along the way. If the price doesn’t drop and is pulled up directly, the first decent resistance above is at 99K.

As for this week, whether you want to admit it or not, the candlestick itself is an adjustment structure. Even if there is good news on Friday, it may spike up at the moment, but it is still easy to fall back. If there is bad news, it might even create a golden pit.

News will only amplify the fluctuations at that moment; it will not change the path that should originally be taken. Those who cannot understand the structure and only focus on news will most likely end up being tossed around, cursing the market, the manipulators, and everything, while never blaming their own lack of understanding…

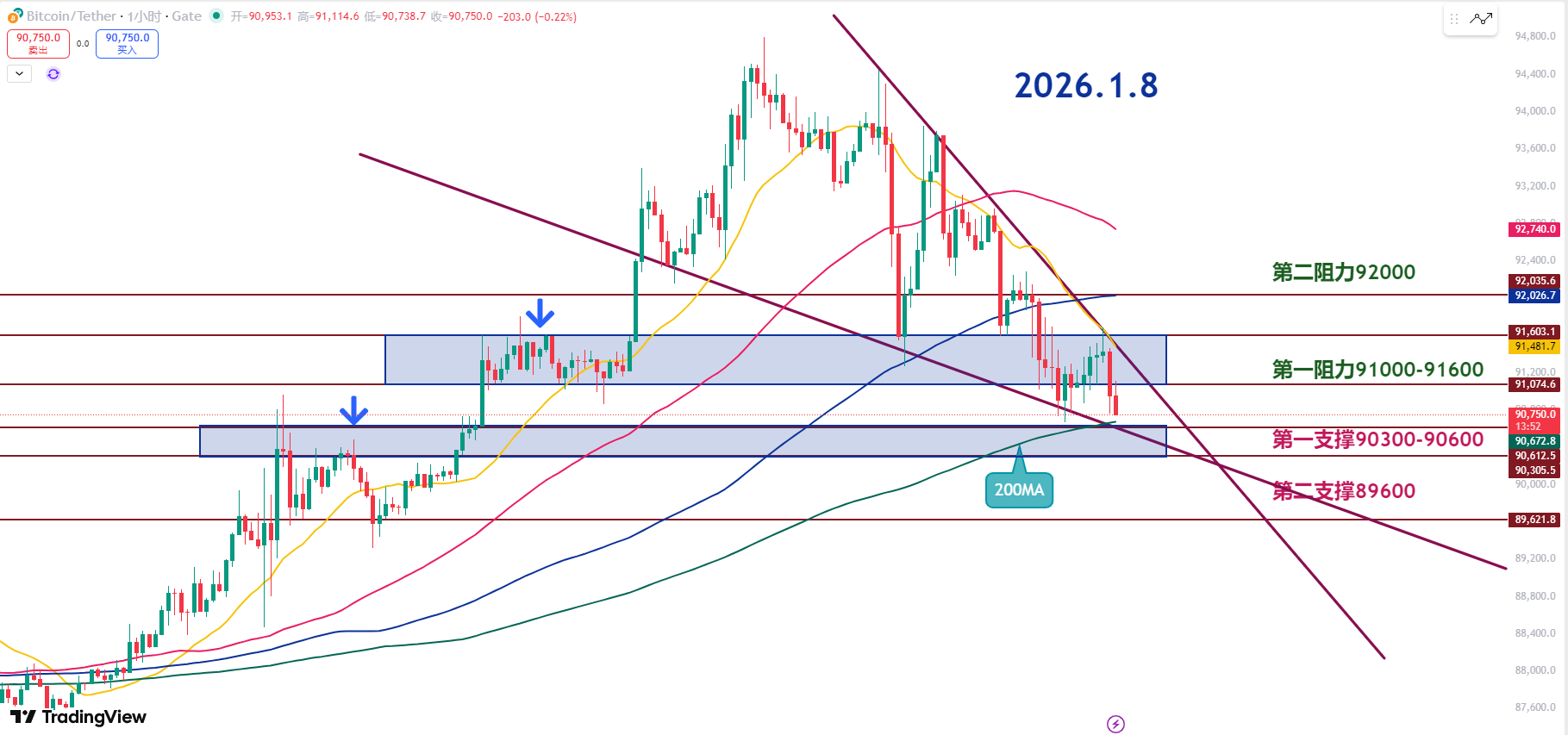

Master Looks at Trends:

After Bitcoin's drop, the current focus can be on the long-term support of the 200MA. The core support trading area is between 90.3K and 90.6K, with 90.5K being the CME gap position, which is a key price level.

The previous upward movement and the fluctuation range of 91K to 91.6K serve as a short-term pressure zone. If it breaks through effectively, the probability of a trend reversal increases. The price has formed a descending wedge structure, which typically shows a short-term trend reversal near the end.

The price lows are moving down, but the RSI lows are rising, forming a bullish divergence, which can only be treated as a technical rebound, not a bottom. If the 200MA is effectively broken, the lower level of 89.6K is a more cost-effective point in the short term.

During the day, the first support zone can be set between 90.3K and 90.6K, with the previous high before the rise at 90.3K, and the CME gap existing near 90.5K.

The first resistance zone of 91 to 91.6K is the consolidation area from January 4 and 5, also a short-term pressure zone. If this range is effectively broken, the probability of a trend reversal will also increase.

The descending wedge is a typical bullish reversal pattern; if the price consolidates above the 200MA, there will also be opportunities for a trend pullback and subsequent upward movement.

1.8 Master’s Band Strategy:

Long Entry Reference: Buy in the range of 89600-90600, Target: 91600-92000

Short Entry Reference: Not applicable at the moment

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, and tomorrow they summarize short positions, making it seem like they "always catch the tops and bottoms," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and stands up to scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to distinguish who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you want to learn more about real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading methods, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has now been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。