Week 1 of 2026 Bitcoin On-Chain Data Changes — Has the Bitcoin Bear Market Arrived?

My conclusion remains that we are not currently in a panic sell-off bear market; most investors still maintain optimism, and the selling volume is not exaggerated. However, due to insufficient liquidity, purchasing power remains weak, leading to a trend of indecision and volatility.

Currently, regarding the price trend of $BTC, I still believe that in the short term, it will primarily be characterized by fluctuations. Yesterday's data clearly showed that while investors have confidence in Bitcoin's long-term prospects, the current purchasing sentiment and liquidity are insufficient to support a significant rise in BTC prices. After all, there are still many investors who are stuck at higher price levels, and the better trend in U.S. stocks may lead some cryptocurrency investors to shift their investments to the stock market.

The main issue we face now is the lack of upward momentum. Therefore, in yesterday's data, I also indicated that from the perspectives of politics, liquidity, and trading volume, the conditions for transitioning to a bull market are not yet met. So, is Bitcoin in a bear market now?

I still do not think so.

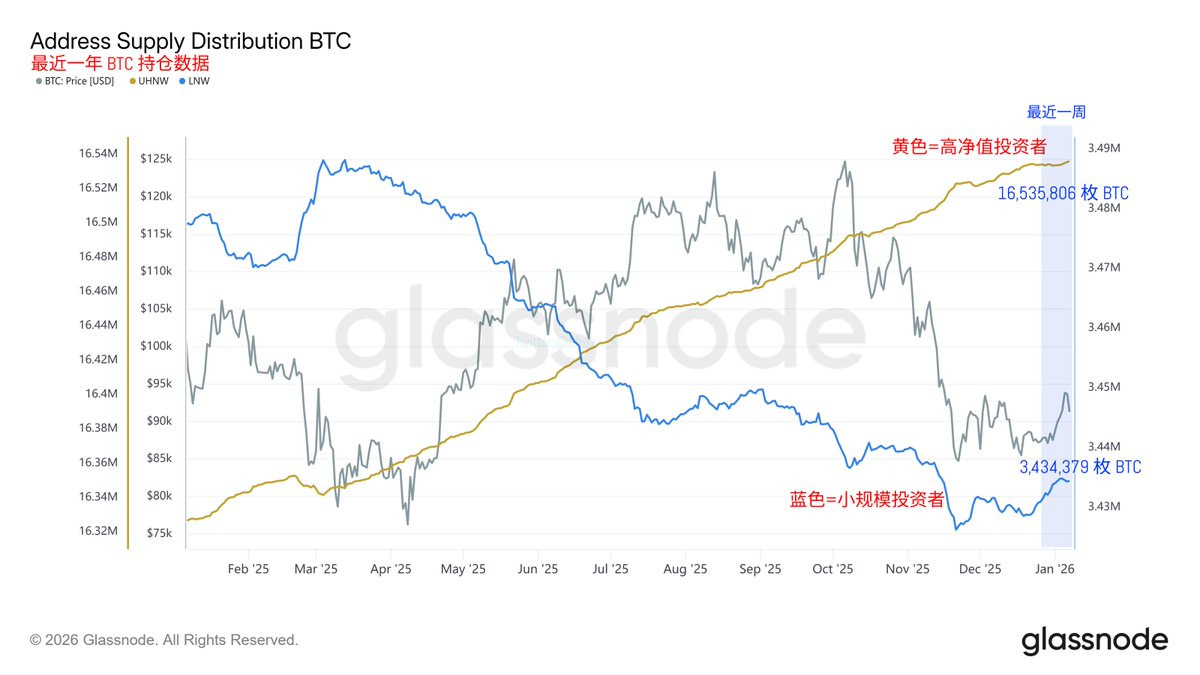

BTC Holding Distribution Over the Past Year

From the data on Bitcoin holding distribution over the past year, it has consistently shown signs of high-net-worth users increasing their holdings while small-scale investors are selling off. In the past week, there has been a slight easing, with high-net-worth investors continuing to accumulate, and small-scale investors also increasing their holdings. Although the price drop of $BTC may lead some small-scale investors to return to a selling trend, it also indicates that small-scale investors are more sensitive to price changes. As long as there is an upward trend in BTC prices, small-scale investors are more likely to chase higher prices.

This also indicates that small-scale investors in the market have funds available; the main reason for not buying is a lack of confidence in short-term price changes. Once favorable conditions are confirmed, small-scale investors will also chase purchases. Not to mention high-net-worth investors.

BTC Held Long-Term Over the Past Year

Moreover, from the holding data of high-net-worth investors, there has been little selling over the past year. High-net-worth investors are gradually becoming long-term holders. Comparing the data of long-term investors, we can see that over the past year, at least 13.88 million Bitcoins have been locked in long-term holdings. Currently, there are still over 14.2 million BTC in a long-term holding state.

This indicates that high-net-worth and long-term holders are not very concerned about short-term price fluctuations and have not shown signs of significant selling. From the data, nearly 600,000 BTC have been released from long-term holding status since July, but if we compare it with exchange data, we can also find that the inventory on exchanges has decreased by over 200,000 during the same period.

BTC Long-Term Holdings and Exchange Inventory Data Over the Past Year

However, looking at the data from the past year, there are still over 300,000 BTC that have transitioned from short-term holdings to long-term holdings. Even with the price decline, this indicates that more investors are treating BTC as a long-term holding strategy and are not participating in market circulation.

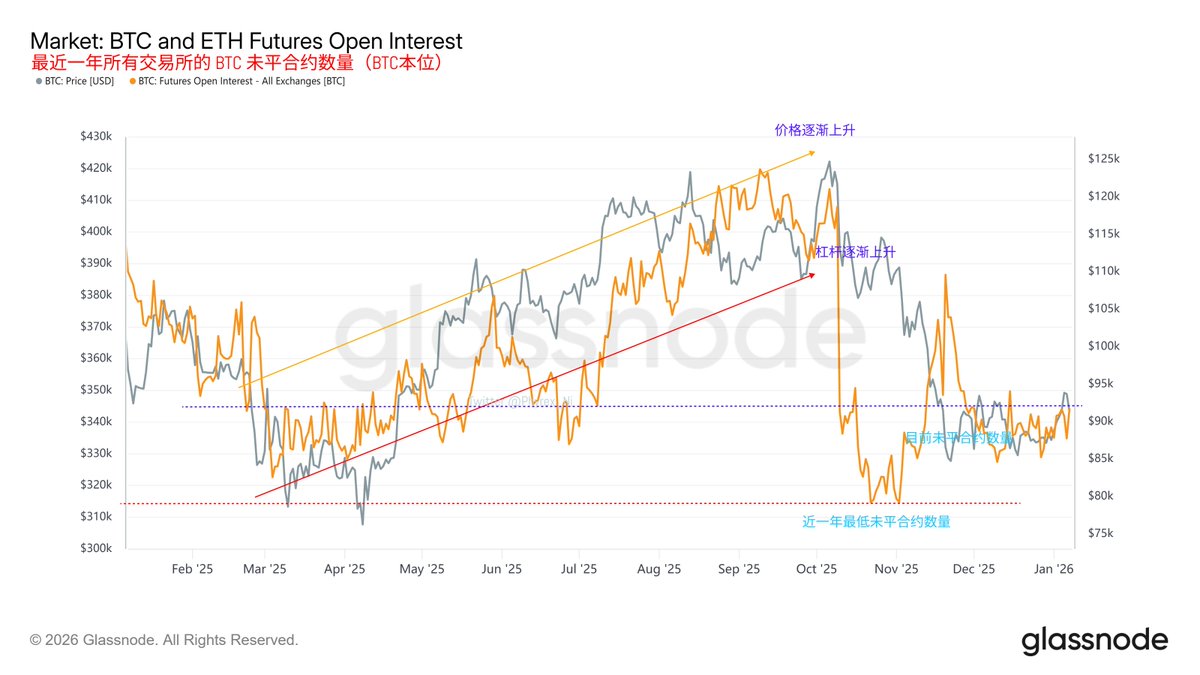

BTC Open Interest Over the Past Year

Additionally, from the data on BTC open interest, it is currently at a relatively low level, indicating that investors are still quite conflicted about the direction and do not have clear signs. For example, when there is a clear indication of an upward or downward trend, open interest typically increases significantly. However, it remains at a low level now, suggesting that investors are still in a tug-of-war between bullish and bearish sentiments.

From my personal perspective, the main narrative currently is still the U.S. monetary policy. Even if the events in Venezuela ultimately affect oil prices, they will still return to the issue of U.S. inflation. If there is no significant change in monetary policy, it is very likely that Bitcoin's price will maintain a volatile trend in a "garbage time" scenario.

This means that BTC's trend is not in a bull market characterized by high liquidity and investor FOMO. There is also no panic selling situation among long-term and high-net-worth investors. The data shows that while a large number of investors remain optimistic (reducing selling), they are not actively buying (insufficient liquidity).

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。