Author: nico pei

Translation: Jiahua, Chaincatcher

Insights from Private Credit

Fixed-rate lending dominates the private credit space because borrowers need certainty, not because lenders prefer it.

Borrowers—businesses, private equity, and real estate sponsors—primarily care about the predictability of cash flows. Fixed rates eliminate the risk of rising benchmark rates, simplify budgeting, and reduce refinancing risk. This is particularly important for leveraged or long-term projects where interest rate fluctuations may threaten solvency.

In contrast, lenders typically prefer floating rates. Lenders price loans as "benchmark rate + credit spread." The floating structure protects margins when interest rates rise, reduces duration risk, and allows lenders to capture upside when benchmark rates increase. Fixed rates are usually offered only when lenders can hedge interest rate risk or charge an additional premium.

Thus, fixed-rate products are a response to borrower demand rather than a default market structure. This explains a key lesson from DeFi: without a clear and persistent demand from borrowers for interest rate certainty, fixed-rate lending struggles to achieve liquidity, scale, or sustainability.

Who are the Real Borrowers on Aave and Morpho?

Myth: "Traders borrow from money markets to leverage or short."

Most unilateral leverage is achieved through perpetual contracts (Perps), as they offer superior capital efficiency. In contrast, money markets require over-collateralization, making them unsuitable for speculative leveraged trading.

The scale of stablecoin lending on Aave alone is about $8 billion. Who are these borrowers?

Broadly speaking, there are two types of borrowers:

Long-term holders / whales / treasuries: They borrow stablecoins against collateralized crypto assets to gain liquidity without selling assets, thus retaining upside exposure and avoiding liquidation or tax events.

Yield farmers: Borrowing is aimed at leveraging interest-bearing assets (like LST/LRT, stETH) or interest-bearing stablecoins (like sUSDe). Their goal is to achieve a higher net yield rather than unilateral gains from going long or short.

Is There Real Demand for Fixed Rates On-Chain?

Yes—demand is concentrated among institutions collateralizing crypto assets and in yield farming strategies.

Institutions collateralizing crypto assets

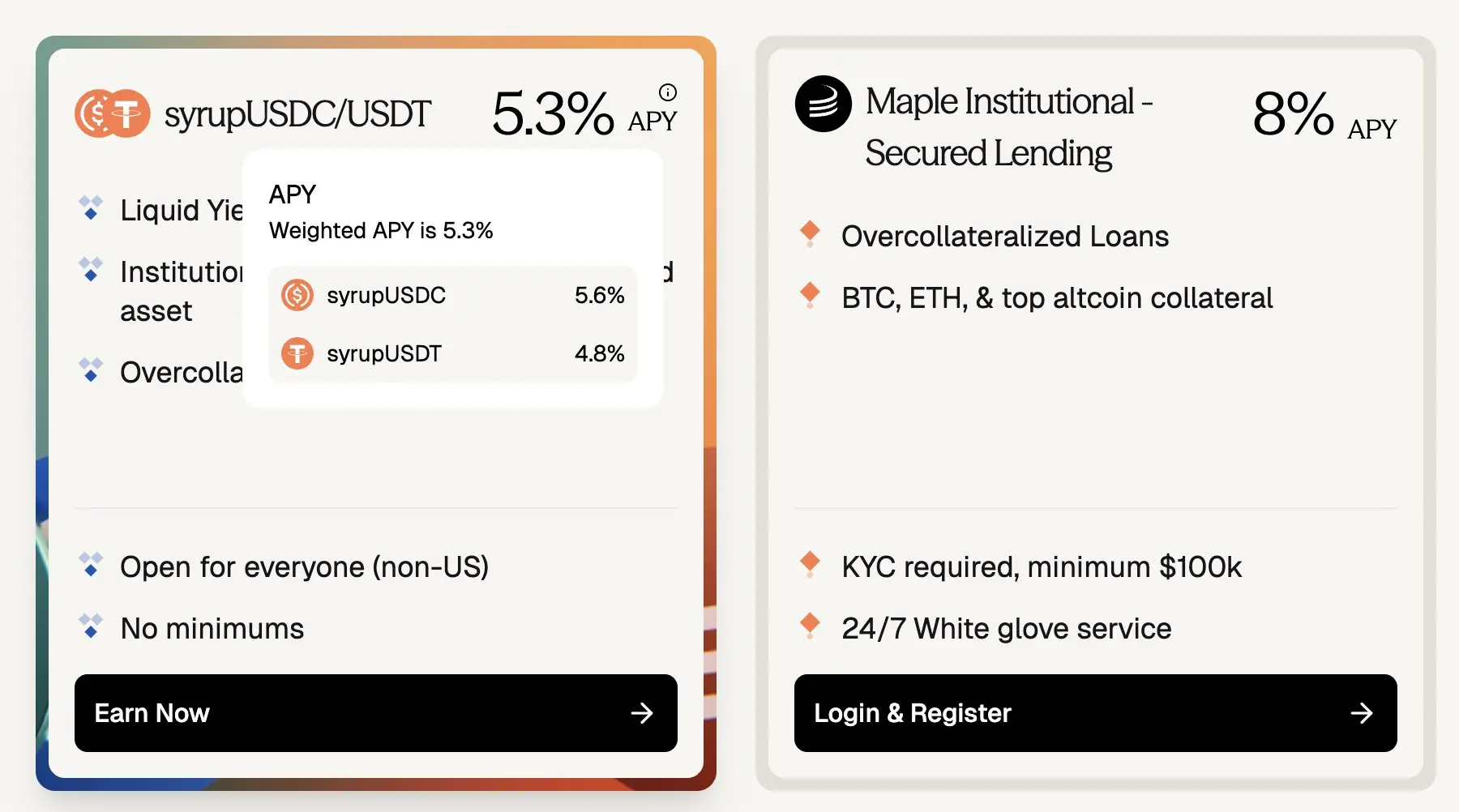

Maple Finance lends stablecoins against over-collateralized loans using blue-chip crypto assets like BTC and ETH as collateral. Borrowers include high-net-worth individuals, family offices, hedge funds, and other participants seeking cost-predictable fixed-rate funding.

Despite Aave USDC's lending yield being around 3.5%, the settlement rate for institutional fixed-rate loans against blue-chip collateral on Maple Finance is about 5.3% to 8% APY—indicating a premium of approximately 180–450 basis points when loans shift from floating rates and terms to fixed.

In terms of market size, Maple's Syrup pool alone has about $2.67 billion in TVL (total value locked), comparable in scale to Aave's approximately $3.75 billion in outstanding loans on the Ethereum mainnet.

(Aave ~3.5% vs Maple ~8%: Fixed-rate, crypto collateral loans have a premium of ~180–400 basis points)

However, it is worth noting that some borrowers choose Maple over Aave to avoid hacking risks. But as DeFi matures and transparency and liquidation mechanisms prove resilient, these past smart contract risks are diminishing. Protocols like Aave are increasingly seen as safe infrastructure, indicating that if on-chain fixed-rate options become available, the premium for off-chain, fixed-rate crypto loans should compress over time.

Yield farming strategies

Despite the demand from yield farmers being in the billions, yield farming strategies are nearly unprofitable due to unpredictable borrowing rates:

While yield farmers profit from fixed-rate income (e.g., PTs), funding yield farming strategies with floating-rate loans introduces interest rate volatility risk, which can suddenly wipe out months of earnings or even lead to losses.

Historical data shows that borrowing rates on Aave and Morpho are anything but stable:

If both borrowing rates and interest-bearing asset rates were fixed, funding risk would be eliminated. Strategies would become easier to execute, positions could be held as expected, and capital could be effectively scaled—allowing yield farmers to confidently deploy funds and pushing the market toward equilibrium.

With over five years of proven security and the development of on-chain fixed income led by Pendle PT, demand for on-chain fixed-rate loans is rapidly growing.

If demand for fixed-rate lending already exists, why hasn't the market grown? Let's take a closer look at the supply side of fixed-rate loans.

Liquidity is the Lifeline of On-Chain Capital

Liquidity means the ability to adjust or exit positions at any time—without lock-up periods—allowing lenders to withdraw capital and borrowers to close positions, retrieve collateral, or repay early without restrictions or penalties.

Pendle PT holders sacrifice some liquidity because Pendle v2 AMM and order books cannot absorb market exits exceeding about $1 million without significant slippage, even in their largest liquidity pools.

What compensation do on-chain lenders receive for giving up this invaluable liquidity? Based on Pendle PT, it is typically 10%+ APY, and during aggressive YT point trading (e.g., usdai on Arbitrum), it can even reach 30%+ APY.

Clearly, crypto loan borrowers cannot afford to pay 10% interest for fixed rates. Without speculating on YT points, this interest rate is unsustainable.

I fully recognize that PTs (Principal Tokens) add an extra layer of risk above core money markets like Aave or Morpho—including Pendle protocol risk and underlying asset risk. PTs are structurally much riskier than the underlying borrowing risks.

However, this remains true: if borrowers do not pay exorbitant rates, asking lenders to give up flexible fixed-rate markets cannot scale. When liquidity is removed, yields must rise significantly to compensate—yet these rates are unsustainable for real, non-speculative borrowing demand.

Term Finance and TermMax are good examples of how fixed-rate markets cannot scale due to this mismatch: few lenders are willing to give up liquidity for low yields, and borrowers do not want to pay 10% APY for fixed rates when Aave rates are at 4%.

Since liquidity is valuable, how can we effectively serve the demand for fixed-rate lending, thus bringing the market to a balance that satisfies both borrowers and lenders?

The Breakthrough: Abandon the Old Thinking of "Peer-to-Peer Matching"

The breakthrough is not to forcibly match "fixed-rate borrowers" with "fixed-rate lenders." Instead, "fixed-rate borrowers" should be matched with "rate traders."

First, most on-chain capital only trusts the security of top protocols like Aave and Morpho and is accustomed to passive asset management.

Therefore, to scale the fixed-rate market, the lender's experience must be identical to their current experience on Aave:

Deposit at any time

Withdraw at any time

Minimal additional trust assumptions

No lock-up periods

Ideally, fixed-rate protocols can directly tap into the security and liquidity of Aave, Morpho, and Euler. Ideally, it is a protocol built on these trusted money markets.

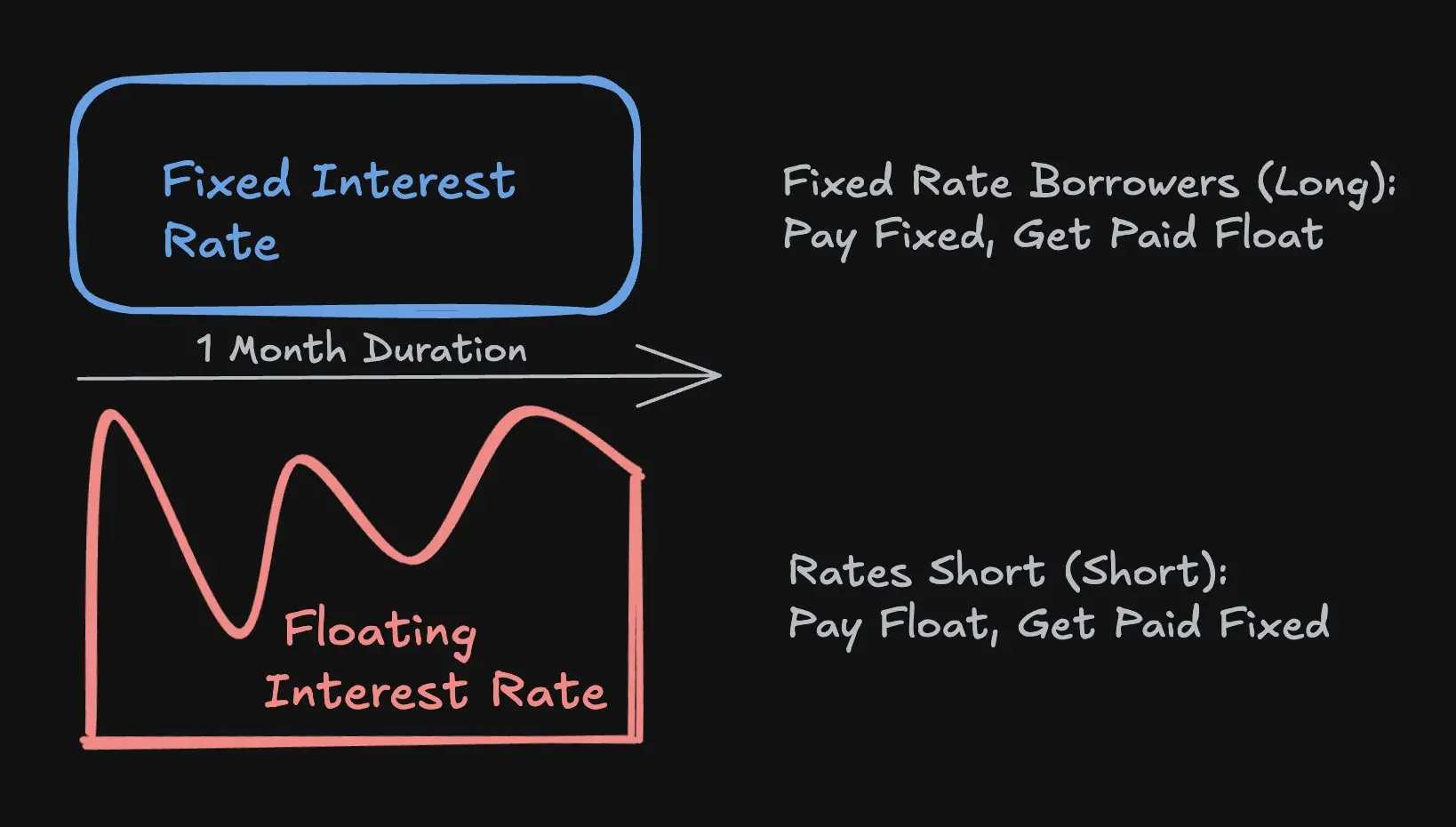

Trading Rates vs. Trading Terms

Second, in fixed-rate loans, borrowers do not need to lock the entire loan term as a fixed duration; they only need to find capital willing to absorb the difference between the agreed fixed rate and Aave's floating rate (such as hedgers or traders), while the remaining funds can be sourced from floating-rate markets like Aave, Morpho, or Euler.

This mechanism is achieved through interest rate swaps: hedgers exchange fixed payments for floating income that fully matches Aave's floating rate, providing borrowers with interest rate certainty while allowing macro traders to express their views on interest rate trends with high capital efficiency (like implied leverage), avoiding the issue of lenders sacrificing flexibility in traditional models, thus facilitating market scaling.

Capital efficiency: Traders only need to deposit margin to secure their interest rate risk exposure, which is far less than the full nominal amount of the loan. For example, for a 1-month term, a $10 million short exposure on Aave borrowing rates, assuming a fixed rate of 4% APY, requires the trader to put in only $33,000—this is 300 times implied leverage, with extremely high capital efficiency.

Given that Aave rates often fluctuate between 3.5% and 6.5%, this level of implied leverage allows traders to trade interest rates like tokens, which frequently move from $3.5 to $6.5, which:

Is several orders of magnitude more volatile than mainstream cryptocurrencies;

Is strongly correlated with mainstream coin prices and overall market liquidity;

And does not use explicit leverage (e.g., 40x on BTC), which is easily liquidated.

For the purposes of this article, I will not elaborate on the differences between implied leverage and explicit leverage. I will save that for another article.

The Path to On-Chain Credit Expansion

I foresee that as on-chain credit grows, the demand for fixed-rate loans will expand, as borrowers increasingly value predictable financing costs to support larger, longer-term positions and productive capital allocation.

Cap Protocol is leading the charge in the field of on-chain credit expansion, and it is a team I am closely watching. Cap enables re-staking protocols, including Symbiotic and EigenLayer, to underwrite insurance for institution-based credit stablecoin loans.

Currently, interest rates are determined by utilization curves optimized for short-term liquidity. However, institutional borrowers value interest rate certainty. As on-chain credit scales, a dedicated interest rate trading layer will become crucial for supporting duration-sensitive pricing and risk transfer.

3Jane is another protocol I am closely monitoring. It focuses on on-chain consumer credit, a segment where fixed-rate loans are crucial, as nearly all consumer credit is fixed-rate.

In the future, borrowers may access services through unique interest rate markets segmented by credit status or asset backing. In traditional finance, consumer credit is typically initiated at fixed rates based on retrospective credit scores, after which loans are sold or priced in the secondary market. Unlike locking borrowers into a single, lender-set rate, on-chain interest rate markets can allow borrowers direct access to market-driven rates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。