Bloomberg Intelligence Senior Commodity Strategist Mike McGlone shared on social media platform X on Jan. 10 an analysis of bitcoin’s tightening technical structure, highlighting prolonged consolidation, suppressed volatility, and growing downside risk as markets approach a potential inflection point.

He said:

Bitcoin’s $84,000-$94,000 cage since November points to an impending breakout for the tip of the risk-asset iceberg. Which direction may define 2026, and I see risks skewed to the downside.

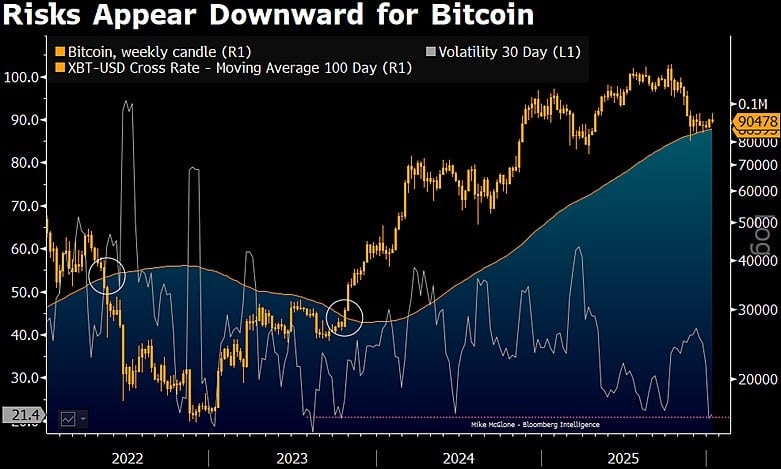

The accompanying image shows BTC repeatedly stalling around its 100-week moving average, failing to establish sustained upside momentum. The chart also plots 30-day volatility compressing toward multiyear lows, a condition historically associated with sharp repricing rather than prolonged stability. Visual markers reference prior cycles, including 2022, when similar volatility compression preceded deeper drawdowns across crypto markets.

“Risks Appear Downward for Bitcoin” Chart shared by Bloomberg strategist Mike McGlone

Read more: Bloomberg’s Mike McGlone Warns of Market ‘Hurricane’ in 2026

McGlone framed the setup as a continuation of the “Peak Bubble” warnings he issued throughout 2025, even as bitcoin surged to roughly $126,000 in October and market sentiment turned euphoric. Moving into early 2026, his analysis has shifted toward what he calls the “Great Reversion,” a phase in which stretched assets gravitate back toward long-term equilibrium.

His X post continued:

The graphic of bitcoin hovering on its 100-week moving average for almost two months, alongside 30-day volatility dropping to multiyear lows, highlights my top theme for 2026: a bull market for volatility.

Within that framework, he maintains that BTC’s most likely path trends toward a $50,000 “enduring pivot,” while acknowledging a tail risk of a decline toward $10,000 if a recession triggers a 2008-style liquidity drain. He has also pointed to the widening divergence between gold and bitcoin, viewing gold’s climb in early 2026 as a preemptive warning that deflationary forces are pressuring high-beta assets such as crypto.

- What is Mike McGlone signaling about bitcoin’s current price structure?

McGlone warns that BTC’s prolonged consolidation between $84,000 and $94,000 with compressed volatility suggests an impending breakout with downside risks dominating for long-term investors. - Why is suppressed volatility in bitcoin a concern for investors?

Historically, multiyear-low volatility in bitcoin has preceded sharp repricing events, often resulting in significant drawdowns rather than sustained stability. - What downside targets does Bloomberg Intelligence see for bitcoin in 2026?

McGlone identifies $50,000 as a likely long-term equilibrium level for bitcoin, with an extreme recession-driven scenario potentially pushing prices toward $10,000. - How does gold’s performance factor into the bearish bitcoin outlook?

The widening divergence as gold rises while BTC stalls is viewed as a deflationary warning signal, indicating pressure on high-risk assets like crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。