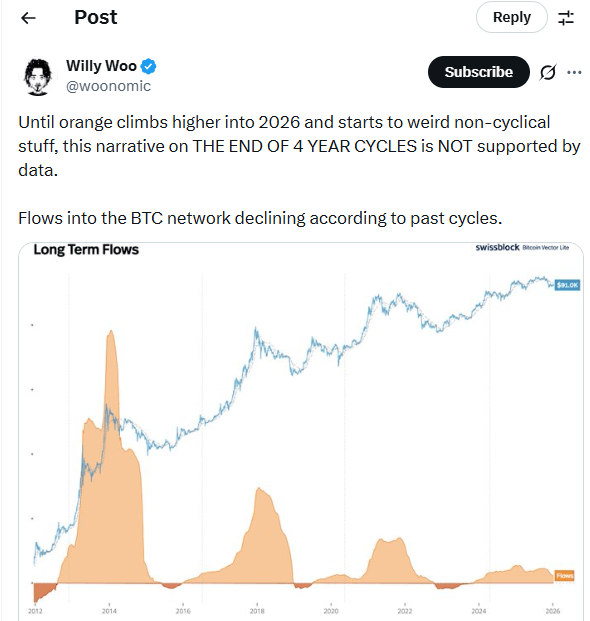

Onchain analyst Willy Woo is pushing back against a growing wave of skepticism regarding bitcoin’s four-year cycle, dismissing the narrative that the pattern has reached its end. According to Woo, the data does not support the “death of the cycle” theory—at least not yet. He argues that until bitcoin’s price action climbs further into 2026 and starts to exhibit truly non-cyclical behavior, the traditional rhythm remains the most accurate model for the market.

To illustrate his point, Woo uses a medical analogy to describe how social media often misinterprets data. He explains that if your heart beats at 70 bpm and drops slightly while you sleep, it does not mean a resting heartbeat no longer exists just because the timing varied. The analyst suggests that while external factors might cause minor deviations in timing or intensity, the underlying pulse of the four-year cycle—driven by supply and demand mechanics—remains fundamentally healthy.

Read more: Is the Bitcoin Four-Year Cycle Broken After 2025’s Unexpected Finish?

Woo’s stance stands in direct opposition to a growing list of industry heavyweights who believe the 2024–2026 period marks a permanent shift in bitcoin’s macro reality. Bitwise Chief Investment Officer Matt Hougan and researcher Ryan Rasmussen have argued that the forces previously driving these cycles, such as the halving and leverage-fueled busts, are significantly weaker than in the past.

These heavyweights believe the massive influx of institutional capital via spot exchange-traded funds (ETFs) is creating a prolonged bull market that lacks the violent 80% crashes of yesteryear, effectively relegating the old cycle to history’s dustbin.

Similarly, experts interviewed by Bitcoin.com News stress that institutional capital flows and ETF demand now shape bitcoin’s trajectory more than miner reward halvings. This shift has created slower, steadier movements rather than the sharp boom-and-bust patterns of earlier cycles. Overall, these experts believe bitcoin has outgrown its halving-driven DNA.

They argue the market is now shaped by institutional adoption and macroeconomic forces, rendering the old four-year cycle obsolete as a predictive model. Instead, they argue bitcoin’s future will likely mirror broader financial markets, with less explosive rallies but greater long-term stability.

Read more: The Death of the 4-Year Cycle: Experts on Bitcoin’s New Macro Reality

Meanwhile, in response to a critic questioning his credibility, Woo denied claims that a hedge fund he presided over collapsed in 2020. “No, that was Murad’s fund,” Woo explained. “My first fund was Crest in 2022; it’s 4 years old and is still operational today having delivered consistent returns. In fact, we run three institutional funds, including SyzCrest in partnership with Syz Banking Group.”

When asked what supports the cycle beyond historical precedent, Woo pointed to two primary drivers: the internal halving supply shock and the four-year global liquidity cycle that determines risk-on/risk-off behavior. “Two impacts: internal halvening supply shock and 4-year global liquidity cycle determining risk on/off,” Woo said, noting that bitcoin has historically led the macro market into risk-off environments. “Three prior times; up for debate is whether the fourth is happening now, which covers 100% of BTC existence.”

Some supporters of his view add that the current federal injection of billions into the market will eventually hit the risk curve, fueling the cyclical expansion Woo expects to continue.

- Is bitcoin’s four‑year cycle really over? On‑chain analyst Willy Woo says the data still supports the cycle’s rhythm.

- Why do some experts call the cycle dead? Institutional ETF flows and macro forces are seen as stronger drivers than halvings.

- What does Woo cite as proof of the cycle? He points to halving supply shocks and global liquidity’s four‑year pulse.

- How does this debate affect investors worldwide? Markets may shift from boom‑and‑bust cycles to steadier, macro‑linked growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。