Author: Ignas

Compiled by: Baihua Blockchain

A year ago, I wrote "The Truth and Lies of the Crypto Market in 2025."

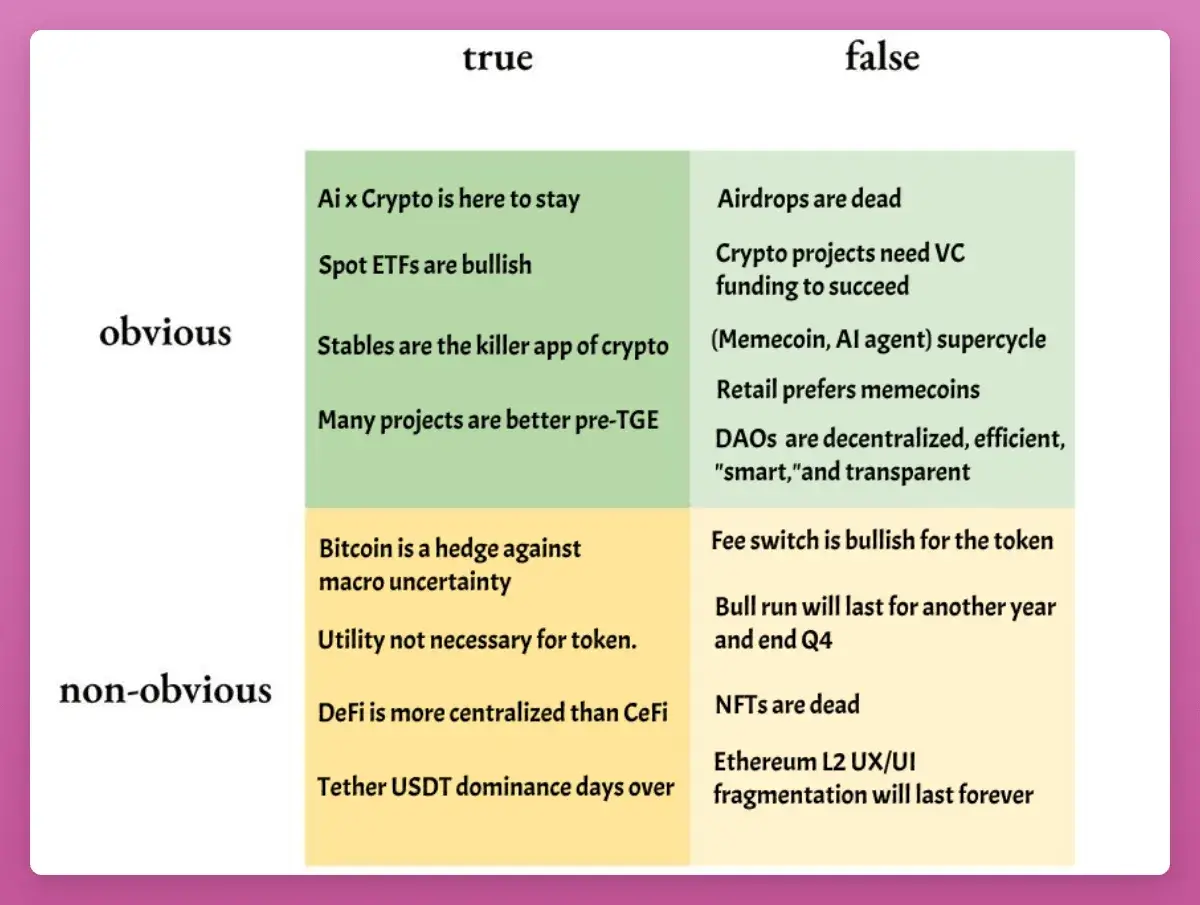

At that time, everyone was sharing higher Bitcoin price targets. I wanted to find a different framework to discover where the public might be wrong and to make differentiated layouts. The goal was simple: to find ideas that already exist but are ignored, disliked, or misunderstood.

Before sharing the 2026 version, here’s a clear review of what truly mattered in 2025. What did we get right, what did we get wrong, and what should we learn from it? If you don’t examine your own thinking, you’re not investing; you’re just guessing.

Quick Summary

- "BTC peaked in the fourth quarter": Most people anticipated this, but it seemed too good to be true. As a result, they were right, and I was wrong (and paid the price for it). Unless BTC skyrockets from now on and breaks the 4-year cycle pattern, I concede this round.

- "Retail investors prefer memecoins": The fact is, retail investors don’t prefer cryptocurrencies at all. They bought gold, silver, AI stocks, and anything but cryptocurrencies. The super cycle of memecoins or AI agents has not materialized either.

- "AI x Crypto remains strong": Mixed results. Projects continue to deliver, the x402 standard keeps evolving, and funding continues. However, tokens failed to maintain any upward momentum.

- "NFTs are dead": Yes.

These are easy to review. The real insights lie in the following five larger themes.

1. Spot ETFs are a floor, not a ceiling

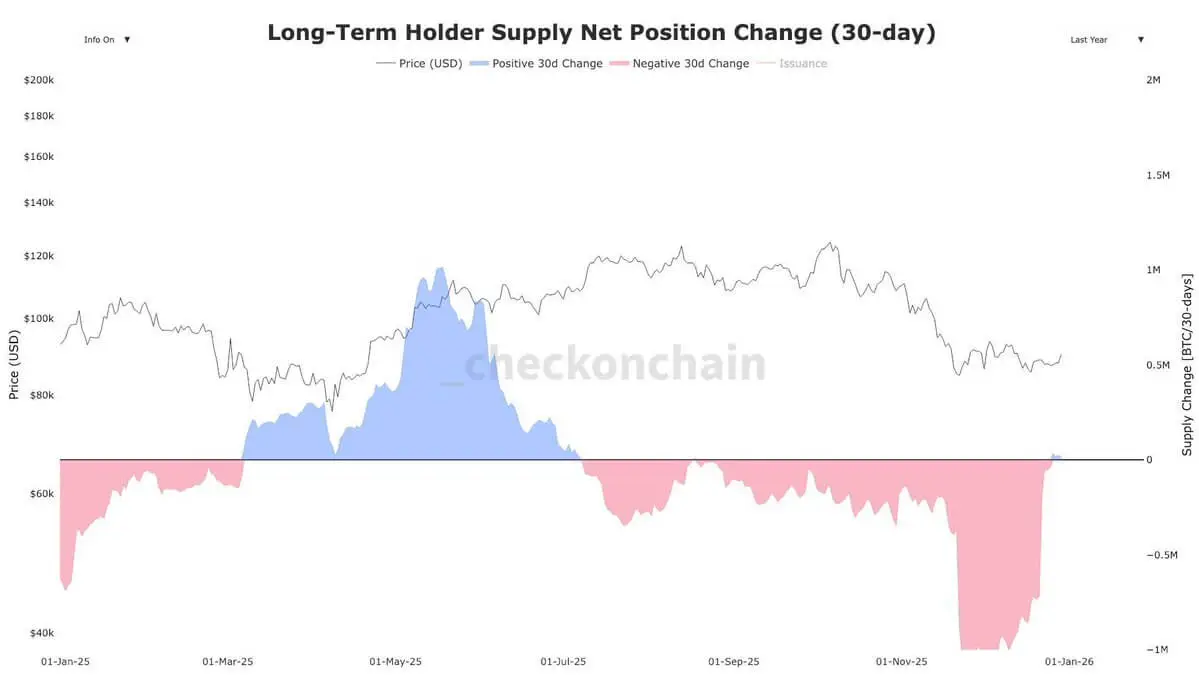

Since March 2024, long-term Bitcoin holders (OGs) have sold approximately 1.4 million BTC, worth about $12.117 billion.

Imagine how bloody the crypto market would be without ETFs: despite the price drop, the inflow of funds into BTC ETFs remains positive ($26.9 billion).

The approximately $95 billion gap is precisely why BTC has underperformed compared to almost all macro assets. There’s nothing wrong with BTC itself; it doesn’t even require delving into unemployment rates or manufacturing data to explain—it's just the "great rotation" of large holders and "4-year cycle believers."

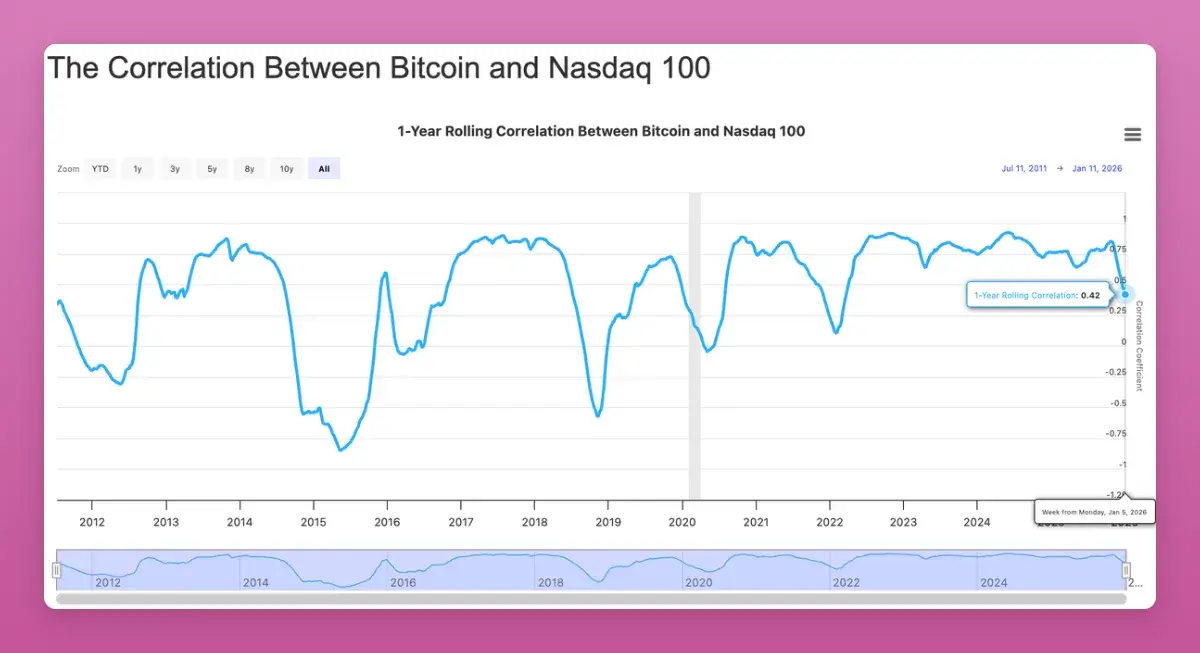

More importantly, Bitcoin's correlation with traditional risk assets like the Nasdaq has dropped to its lowest since 2022 (-0.42). While everyone hopes for an upward breakout in correlation, in the long run, as a non-correlated investment asset sought by institutions, this is bullish.

There are signs that the supply shock has ended. Therefore, I dare to predict the BTC price in 2026 will be $174,000 (equivalent to 10% of gold's market cap).

2. Airdrops clearly "haven't" disappeared

The crypto community (CT) again claims that airdrops are dead. But in 2025, we saw nearly $4.5 billion in large airdrop distributions:

- Story Protocol (IP): ~$1.4B

- Berachain (BERA): ~$1.17B

- Jupiter (JUP): ~$7.91M

- Animecoin (ANIME): ~$7.11M

The change lies in: fatigue from points, stronger witch detection, and downward valuation. You still need to "sell upon receiving" to maximize profits.

2026 will be a big year for airdrops, with heavyweight players like Polymarket, Metamask, and Base (?) preparing to issue tokens. This is not a year to stop clicking buttons, but a year to stop blind betting. Airdrop "farming" requires focused heavy bets.

3. Fee Switch is not the engine for price increases, but a floor

My prediction is: the fee switch will not automatically drive up token prices. The revenue generated by most protocols is insufficient to support their massive market caps.

"The fee switch does not affect how high a token can rise, but rather sets a 'floor price.'"

Observe the projects ranked by "holder income" on DeFillama: except for $HYPE, all high-income sharing tokens have outperformed ETH (although ETH is now the benchmark everyone is trying to challenge).

Surprisingly, $UNI. Uniswap finally flipped the switch and even burned $100 million worth of tokens. UNI initially surged 75%, but then retraced all its gains.

Three insights:

Token buybacks set a price floor, not a ceiling.

Everything in this cycle is about trading (refer to UNI's surge and retracement).

Buybacks are just one side of the story; you must consider selling pressure (unlocking), as most tokens remain in low circulation.

4. Stablecoins occupy the mind, but "proxy trading" is hard to profit from

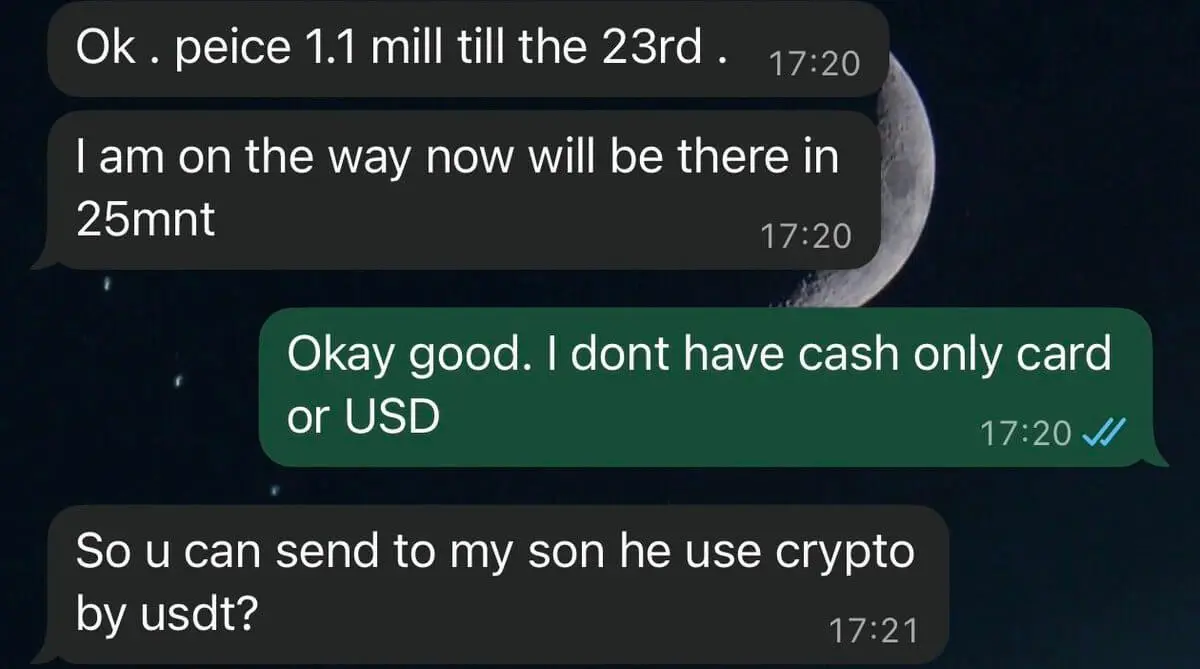

Stablecoins are entering the mainstream. When I rented a motorcycle in Bali, the other party even requested payment in USDT on TRON.

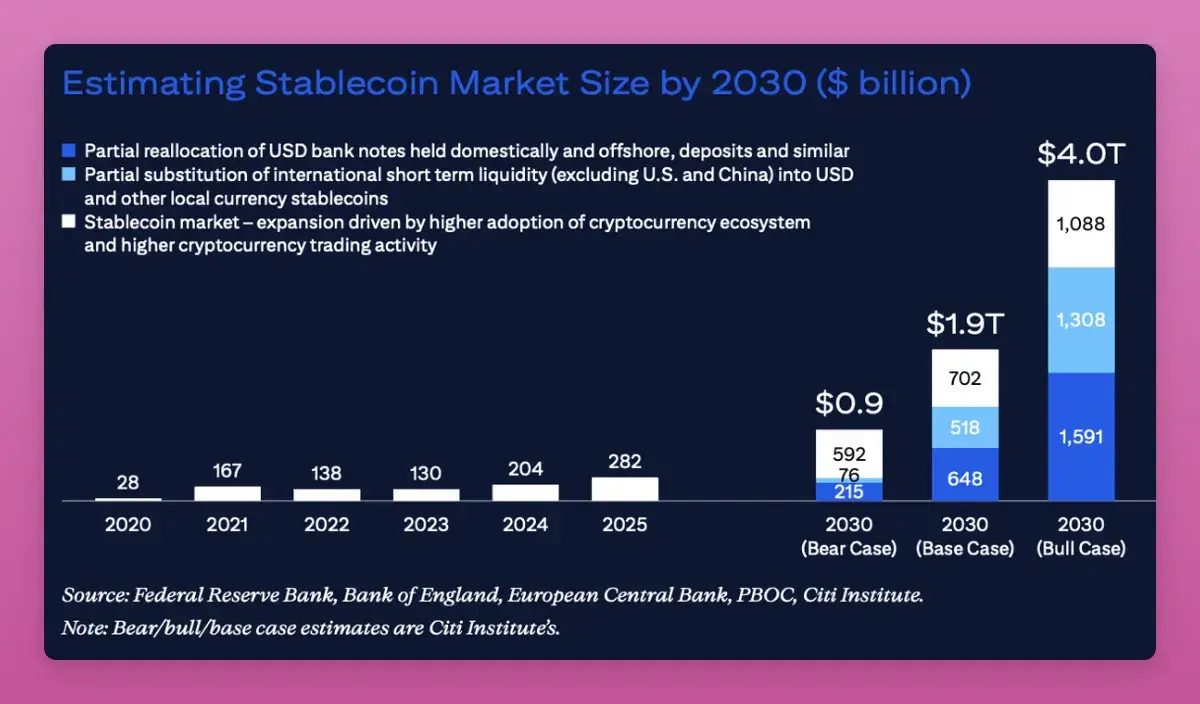

Although USDT's dominance has dropped from 67% to 60%, its market cap is still growing. Citibank predicts that the market cap of stablecoins could reach $1.9 trillion to $4 trillion by 2030.

In 2025, the narrative shifted from "trading" to "payment infrastructure." However, trading stablecoin narratives is not easy: Circle's IPO retraced all its gains after a surge, and other proxy assets have also underperformed.

One truth of 2025 is: everything is just trading.

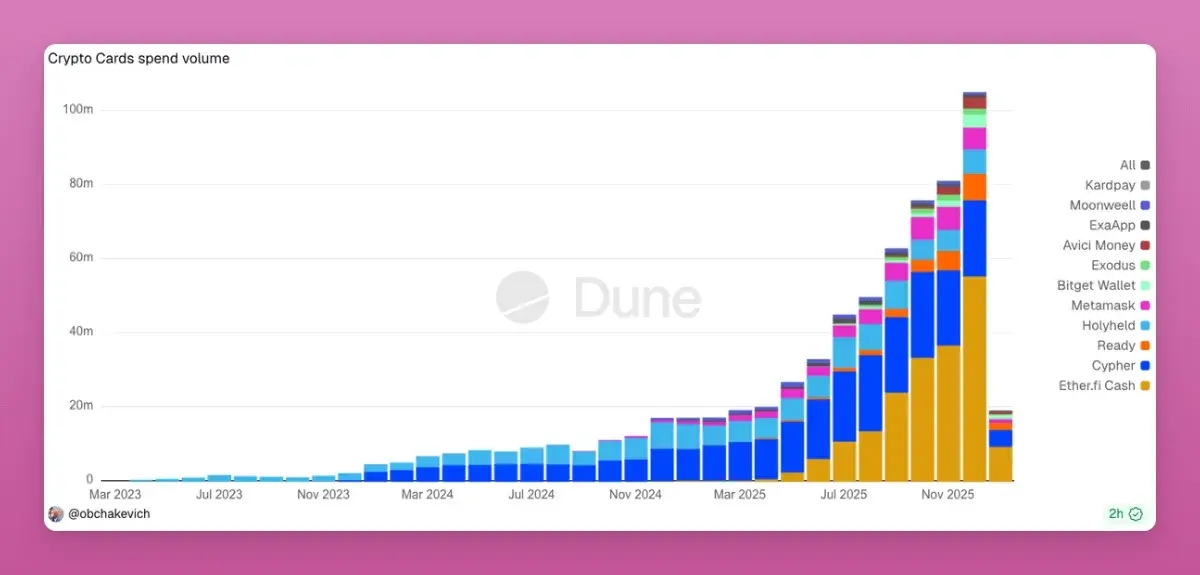

Currently, crypto payment cards are booming due to their convenience in circumventing strict AML requirements from banks. Every swipe of the card is a transaction on-chain. If direct peer-to-peer payments that bypass Visa/Mastercard emerge in 2026, it will be a thousandfold opportunity.

5. DeFi is more centralized than CeFi

This is a bold statement: DeFi's business and TVL concentration are higher than traditional finance (CeFi).

Aave holds over 60% of the borrowing market share (in contrast, JPMorgan only holds 12% in the U.S.).

Most L2 protocols are unregulated multisigs worth billions.

Chainlink almost controls all value predictions in DeFi.

In 2025, the conflict between "centralized equity holders" and "token holders/DAOs" became apparent. Who truly owns the protocol, IP rights, and revenue streams? Aave's internal disputes show that token holders' rights are less than we imagine.

If "labs" ultimately win, many DAO tokens will become uninvestable. 2026 will be a key year for aligning equity with token holder interests.

Conclusion

2025 proved one thing: everything is about trading. The exit window is extremely short. No token possesses long-term conviction.

As a result, 2025 marks the death of the HODL (hold on for dear life) culture, DeFi has transformed into on-chain finance, and with the improvement of regulations, DAOs are shedding the disguise of "pseudo-decentralization."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。