Key Points

The total market capitalization of cryptocurrencies is $3.19 trillion, down from $3.22 trillion last week, a decrease of 0.9% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.4 billion, with a net outflow of $681 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.43 billion, with a net outflow of $68.57 million this week.

The total market capitalization of stablecoins is $30.81 billion, with USDT having a market cap of $18.66 billion, accounting for 60.56% of the total stablecoin market cap; followed by USDC with a market cap of $7.46 billion, accounting for 24.21%; and DAI with a market cap of $5.36 billion, accounting for 1.73%.

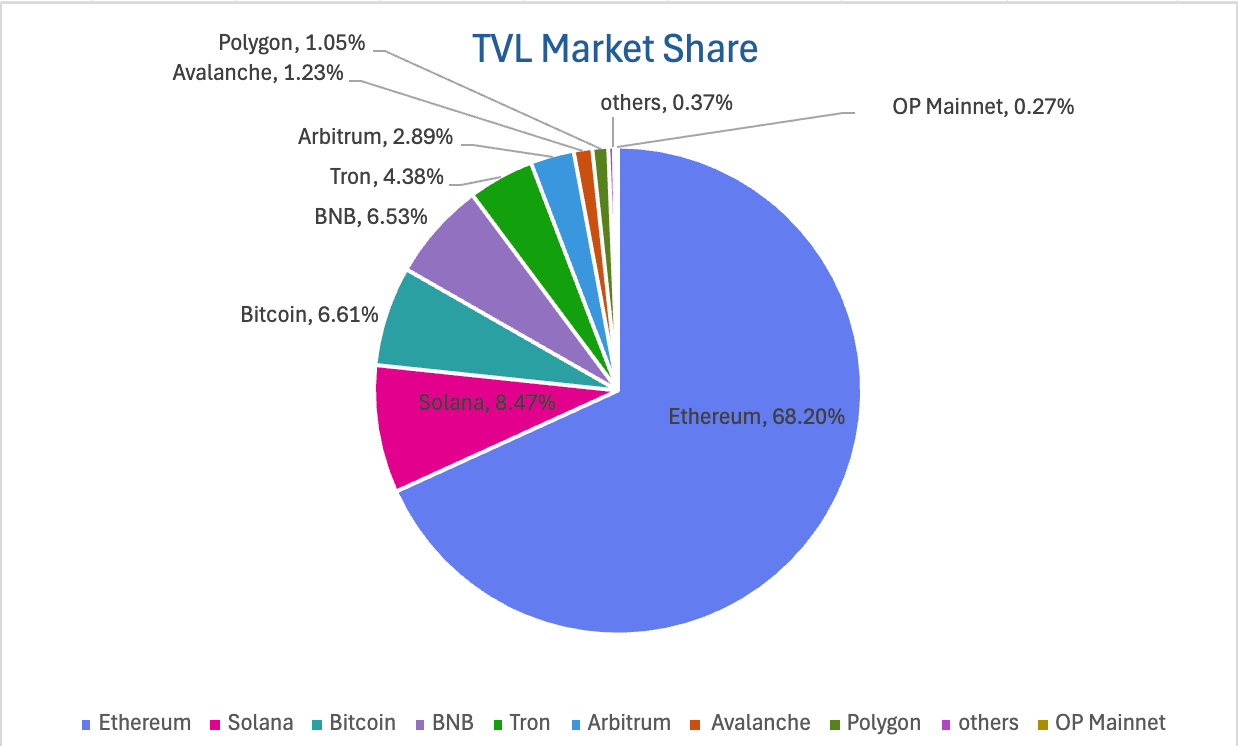

According to data from DeFiLlama, the total TVL of DeFi this week is $123.9 billion, down from $124.3 billion last week, a decrease of about 0.32%. By public chain, the top three chains by TVL are Ethereum at 68.2%; Solana at 8.47%; and Bitcoin at 6.61%.

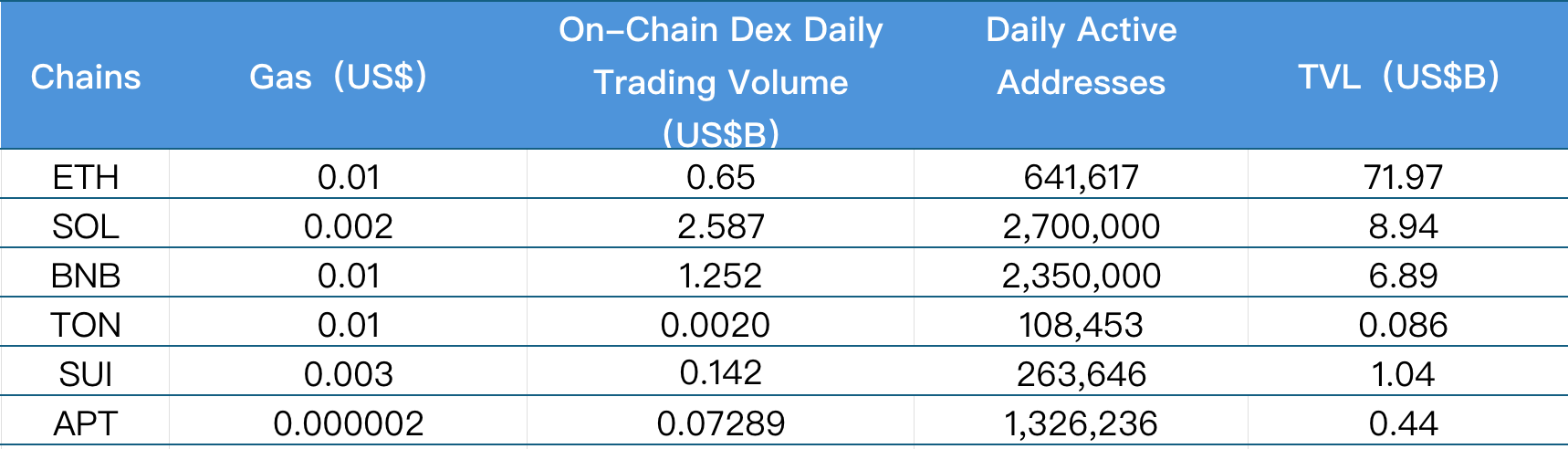

In terms of on-chain data performance this week, only BNB Chain (+47.29%) and Aptos (+4.31%) saw an increase in daily trading volume, while other chains experienced declines, with Solana (-40.53%), Ethereum (-39.25%), and Ton (-33.33%) showing relatively large drops; transaction fees remained relatively stable, with Ethereum, BNB Chain, and Ton remaining flat, while Aptos saw a slight increase of 4.21%, and Solana (-6.9%) and Sui (-10.39%) experienced declines. In terms of daily active addresses, only Solana (+29.81%) and Ethereum (+8.09%) saw growth, while Sui declined by about 55.84%, and Aptos (-11.54%) and BNB Chain (-7.11%) also saw decreases; overall, TVL fluctuations were limited, with Ethereum (-0.97%) and Ton (-4.07%) experiencing slight declines, while other chains saw slight increases.

New Project Focus: Block Security Arena is an AI-driven security infrastructure platform focused on the Web3 space, building a "closed-loop" security ecosystem by integrating AI technology, practical exercises, and educational systems to help developers and security researchers enhance smart contract security capabilities. Ubyx is a global stablecoin clearing system designed to allow anyone, regardless of location, to deposit stablecoins from multiple issuers and various currencies into existing bank or fintech accounts and exchange them at face value for fiat currency, transforming stablecoins from traditional crypto assets into digital cash equivalents. JPEG.fun is a Web3 native social prediction interactive gaming platform where players can bet and compete around daily themed photos, winning prize pools by betting on specific images and competing for the highest bets, integrating social interaction, community participation, and on-chain settlement mechanisms to create a fun and engaging new cultural entertainment experience.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance Status

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

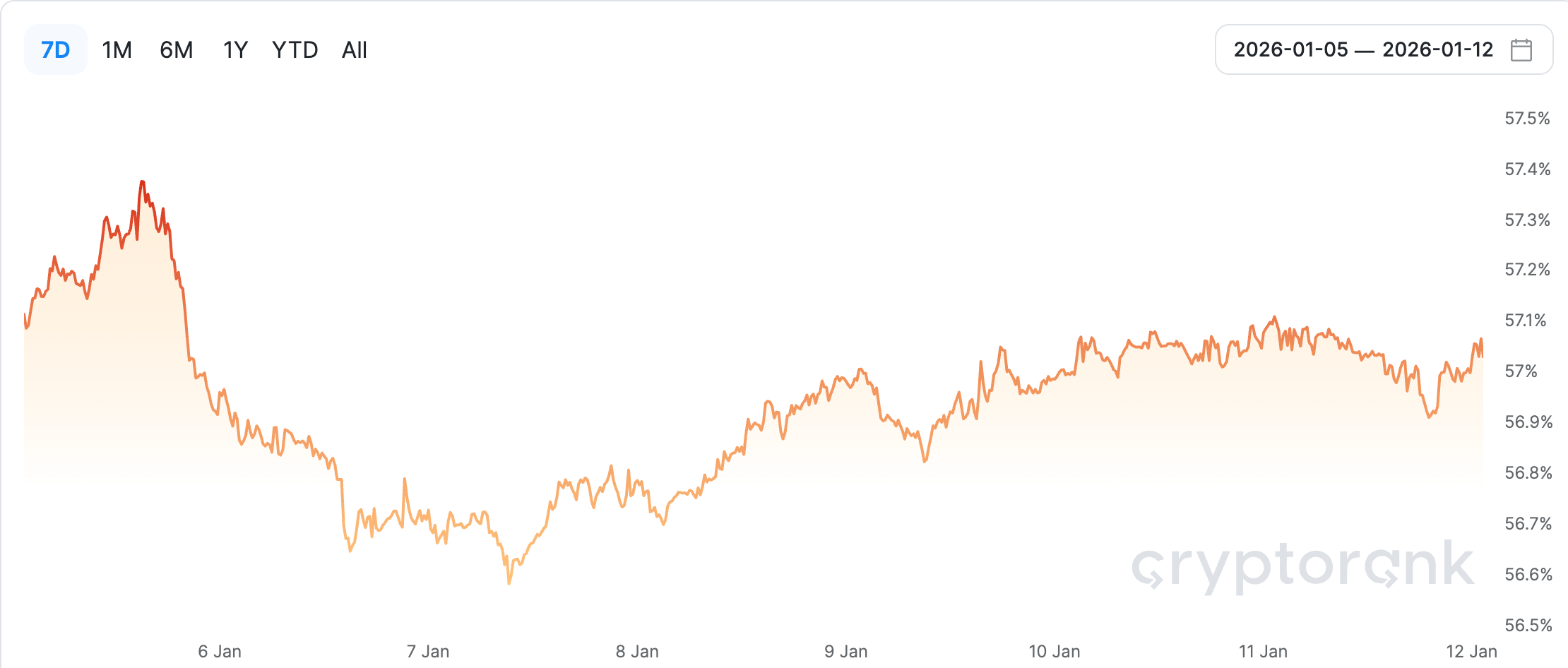

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

The global total cryptocurrency market cap is $3.19 trillion, down from $3.22 trillion last week, a decrease of 0.9% this week.

Data Source: Bitcoin dominance from cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of January 11, 2026

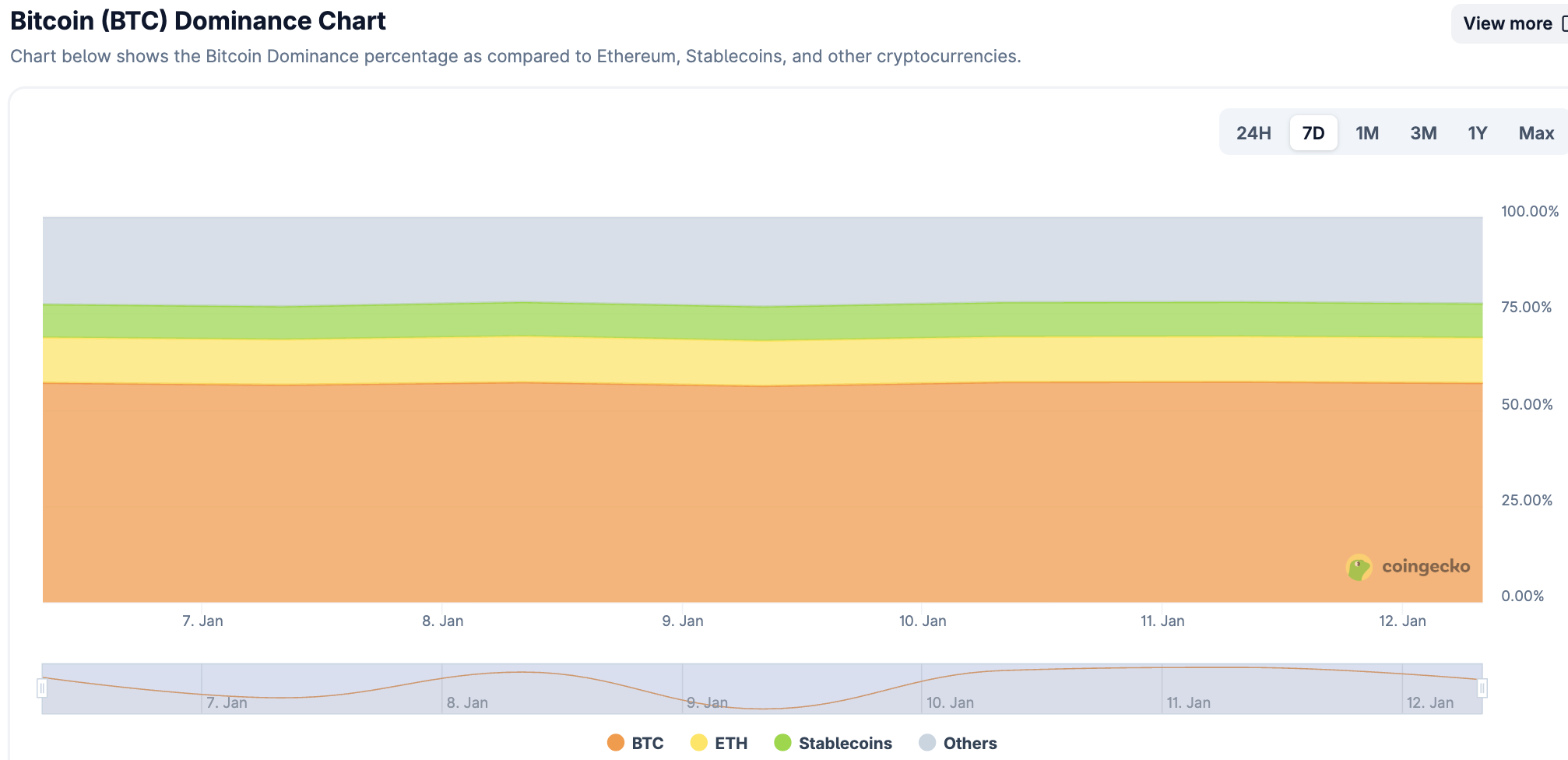

As of the time of writing, the market cap of Bitcoin is $1.82 trillion, accounting for 57.1% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $30.81 billion, accounting for 9.65% of the total cryptocurrency market cap.

Data Source: coingecko, https://www.coingecko.com/en/charts

Data as of January 11, 2026

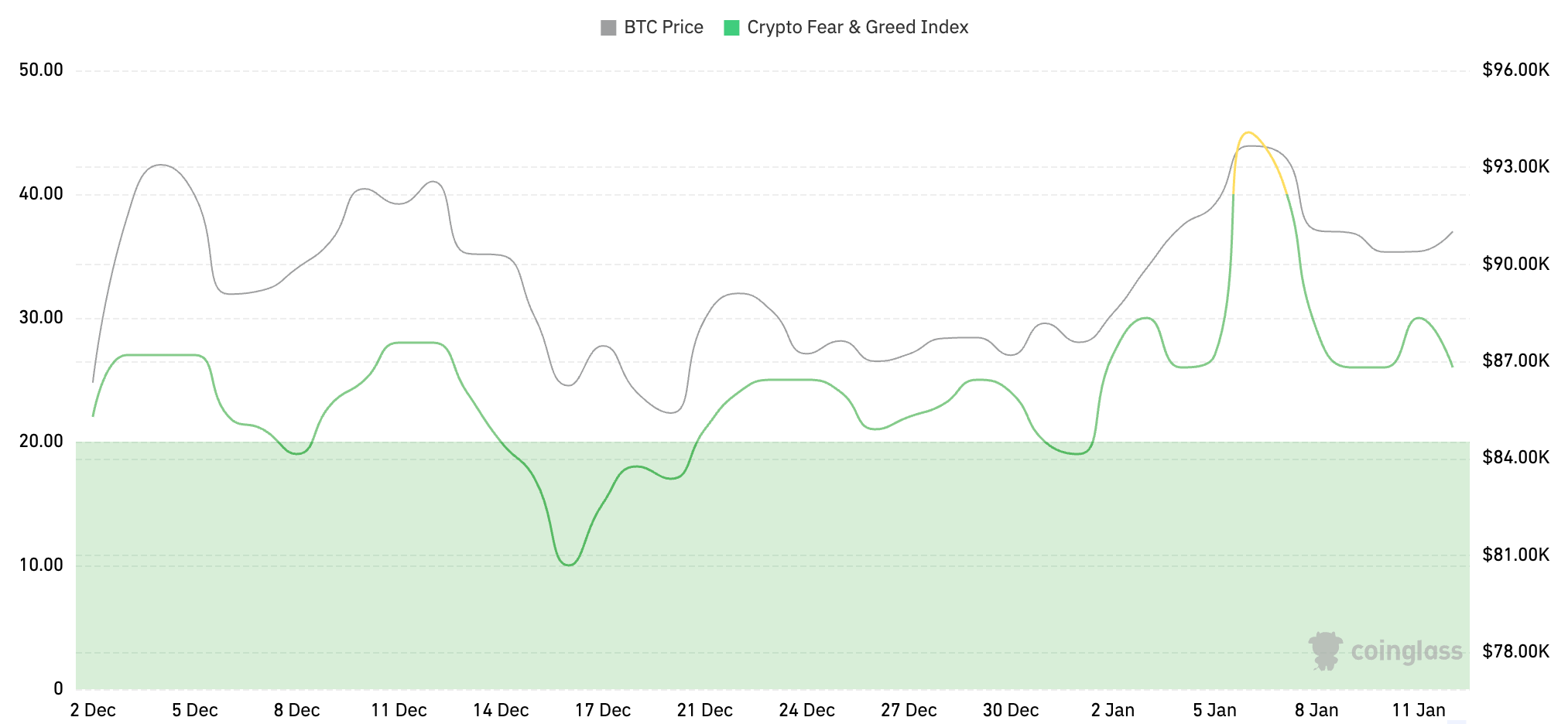

2. Fear Index

The cryptocurrency fear index is 26, indicating fear.

Data Source: coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 11, 2026

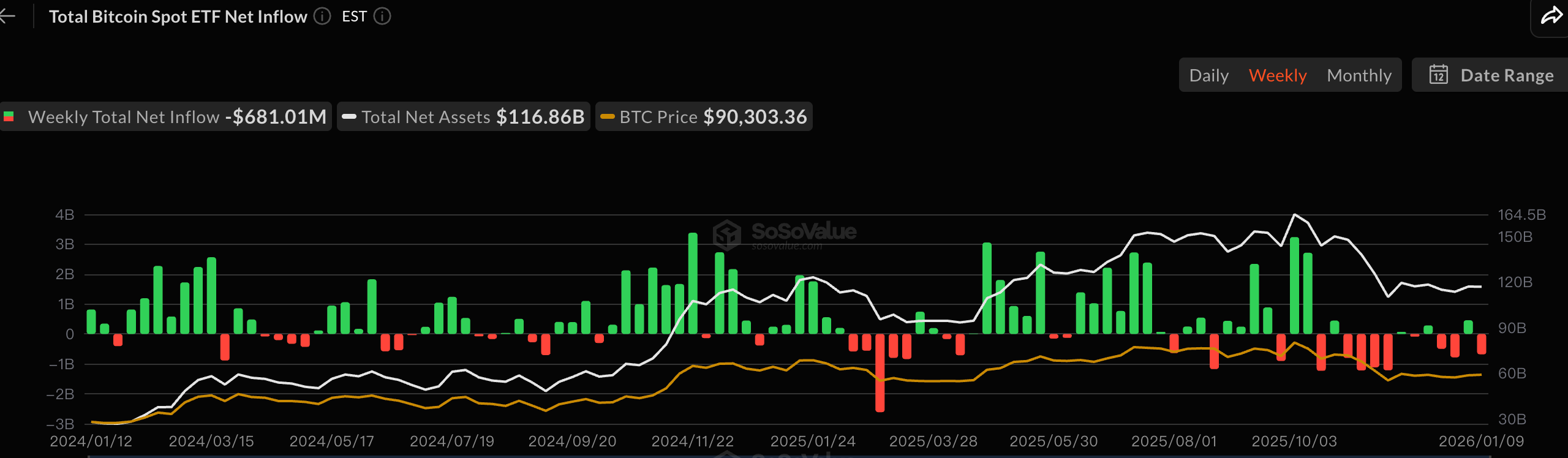

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.4 billion, with a net outflow of $681 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.43 billion, with a net outflow of $68.57 million this week.

Data Source: sosovalue, https://sosovalue.com/zh/assets/etf

Data as of January 11, 2026

4. ETH/BTC and ETH/USD Exchange Rates

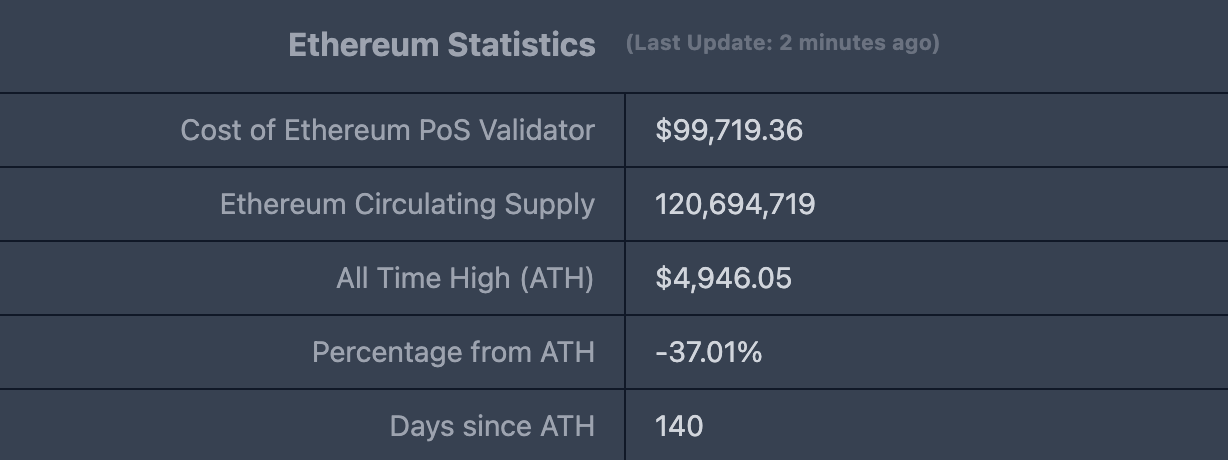

ETHUSD: Current price $3,116.79, all-time high $4,878.26, down approximately 37.01% from the all-time high.

ETHBTC: Currently at 0.034207, all-time high 0.1238.

Data Source: ratiogang, https://ratiogang.com/

Data as of January 11, 2026

5. Decentralized Finance (DeFi)

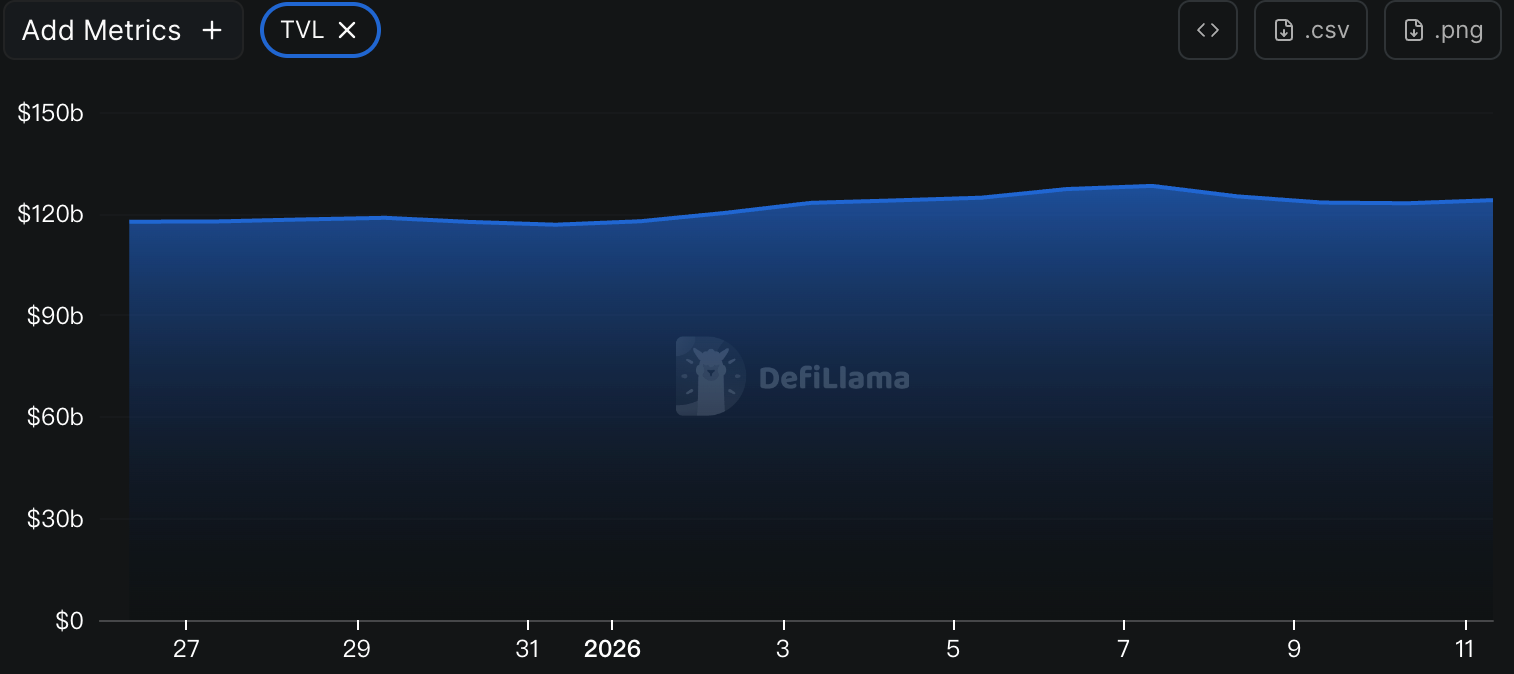

According to data from DeFiLlama, the total TVL of DeFi this week is $123.9 billion, down from $124.3 billion last week, a decrease of about 0.32%.

Data Source: defillama, https://defillama.com

Data as of January 11, 2026

By public chain, the top three chains by TVL are Ethereum, accounting for 68.2%; Solana, accounting for 8.47%; and Bitcoin, accounting for 6.61%.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of January 11, 2026

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1s including ETH, SOL, BNB, TON, SUI, and APTOS.

Data Source: CoinW Research Institute, DeFiLlama, https://defillama.com

Data as of January 11, 2026

On-chain Dex daily trading volume and transaction fees: On-chain Dex daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of on-chain Dex daily trading volume, this week only BNB Chain and Aptos saw increases of 47.29% and 4.31%, respectively; other chains experienced declines, with Solana (-40.53%), Ethereum (-39.25%), Ton (-33.33%), and Sui (-21.11%). Regarding transaction fees, this week Ethereum, BNB Chain, and Ton remained flat compared to last week; Aptos saw a slight increase of 4.21%; while Solana and Sui decreased by 6.9% and 10.39%, respectively.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, this week only Solana (29.81%) and Ethereum (8.09%) saw increases, while other chains experienced declines, with Sui seeing the largest drop of 55.84%, followed by Aptos and BNB Chain with declines of 11.54% and 7.11%, respectively, and Ton slightly down by 0.33%. In terms of TVL, changes across chains this week were minimal. Ethereum and Ton saw slight declines of 0.97% and 4.07%, respectively; while other chains saw slight increases, including Sui (4.75%), Solana (2.24%), BNB Chain (1.04%), and Aptos (0.91%).

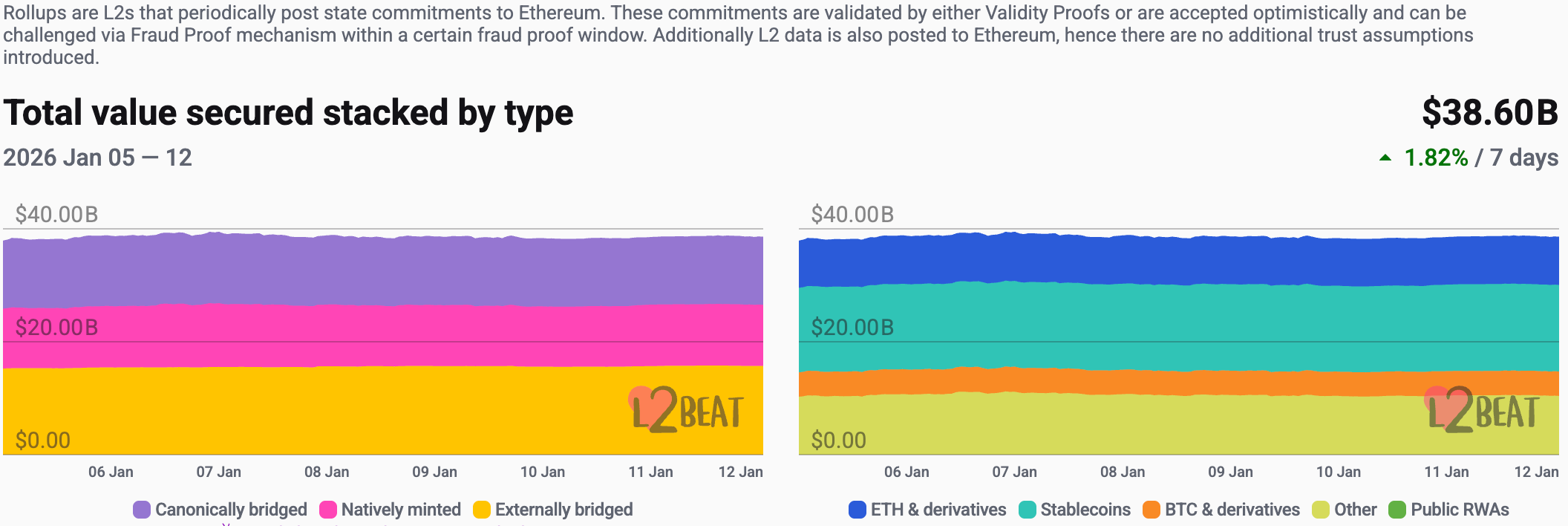

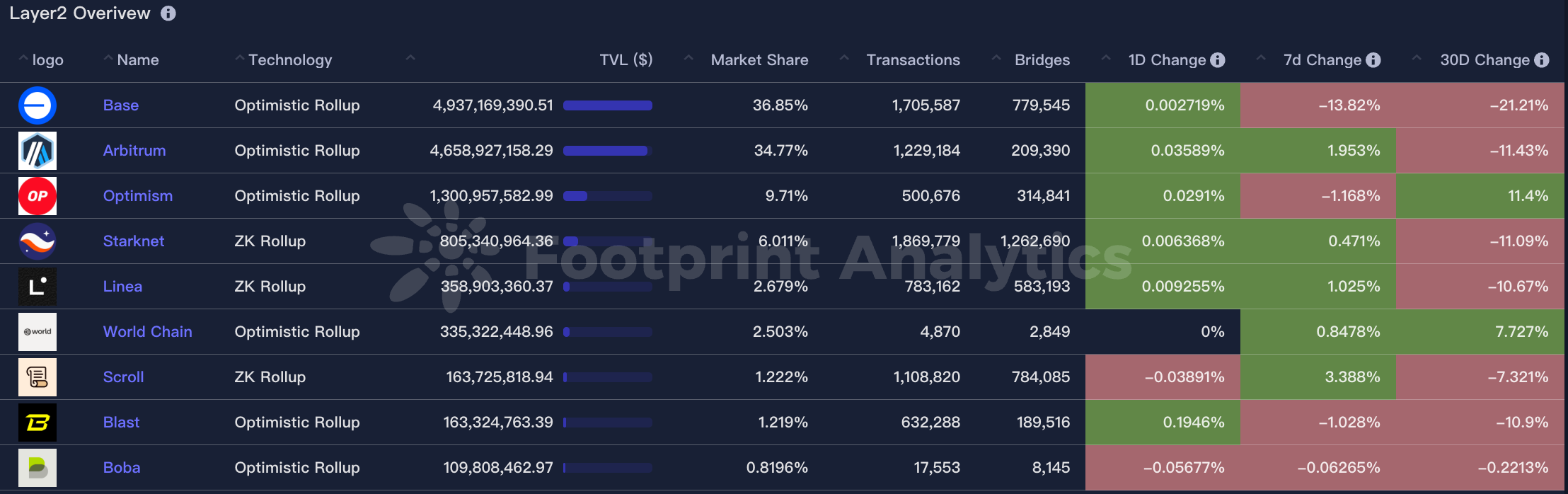

Layer 2 Related Data

According to L2Beat data, the total TVL of Ethereum Layer 2 is $38.6 billion, an overall increase of 1.82% from last week ($37.91 billion).

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of January 11, 2026

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77%, respectively. Base's market share has decreased slightly over the past week, while Arbitrum has seen a slight increase.

Data Source: footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of January 11, 2026

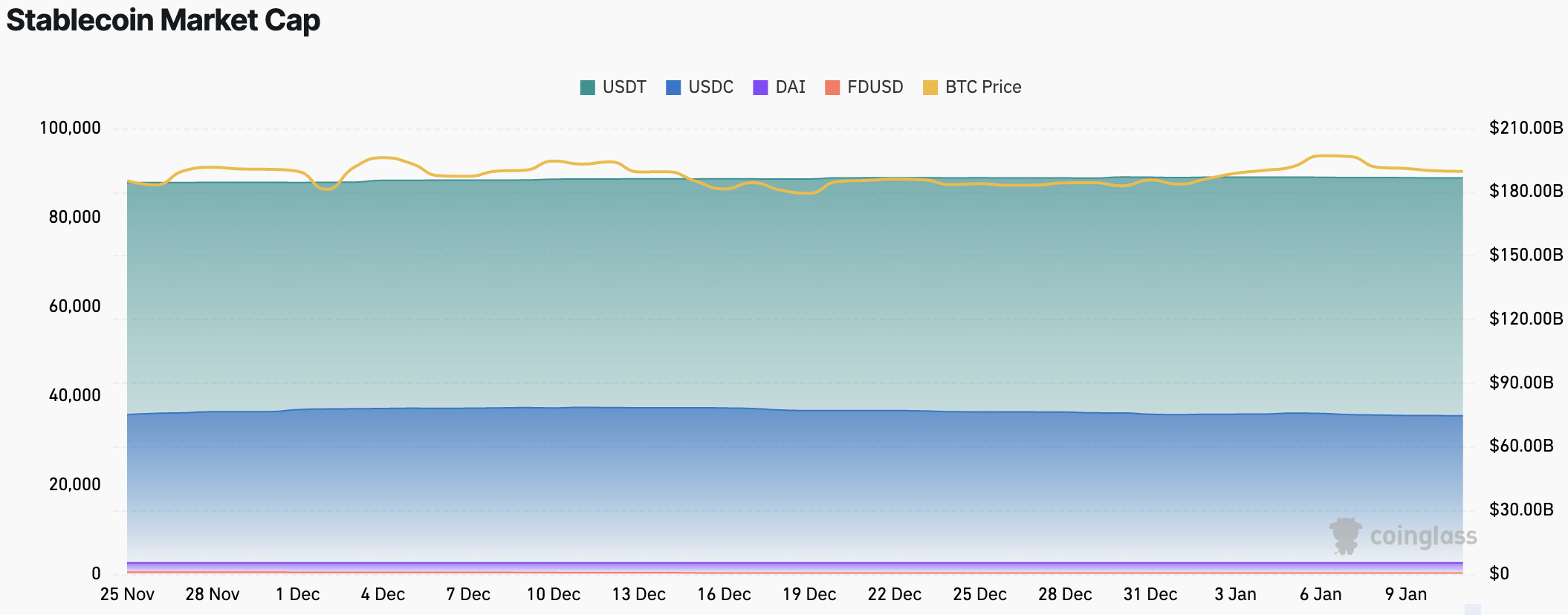

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market cap of stablecoins is $30.81 billion, with USDT having a market cap of $18.66 billion, accounting for 60.56% of the total stablecoin market cap; followed by USDC with a market cap of $7.46 billion, accounting for 24.21%; and DAI with a market cap of $5.36 billion, accounting for 1.73%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of January 11, 2026

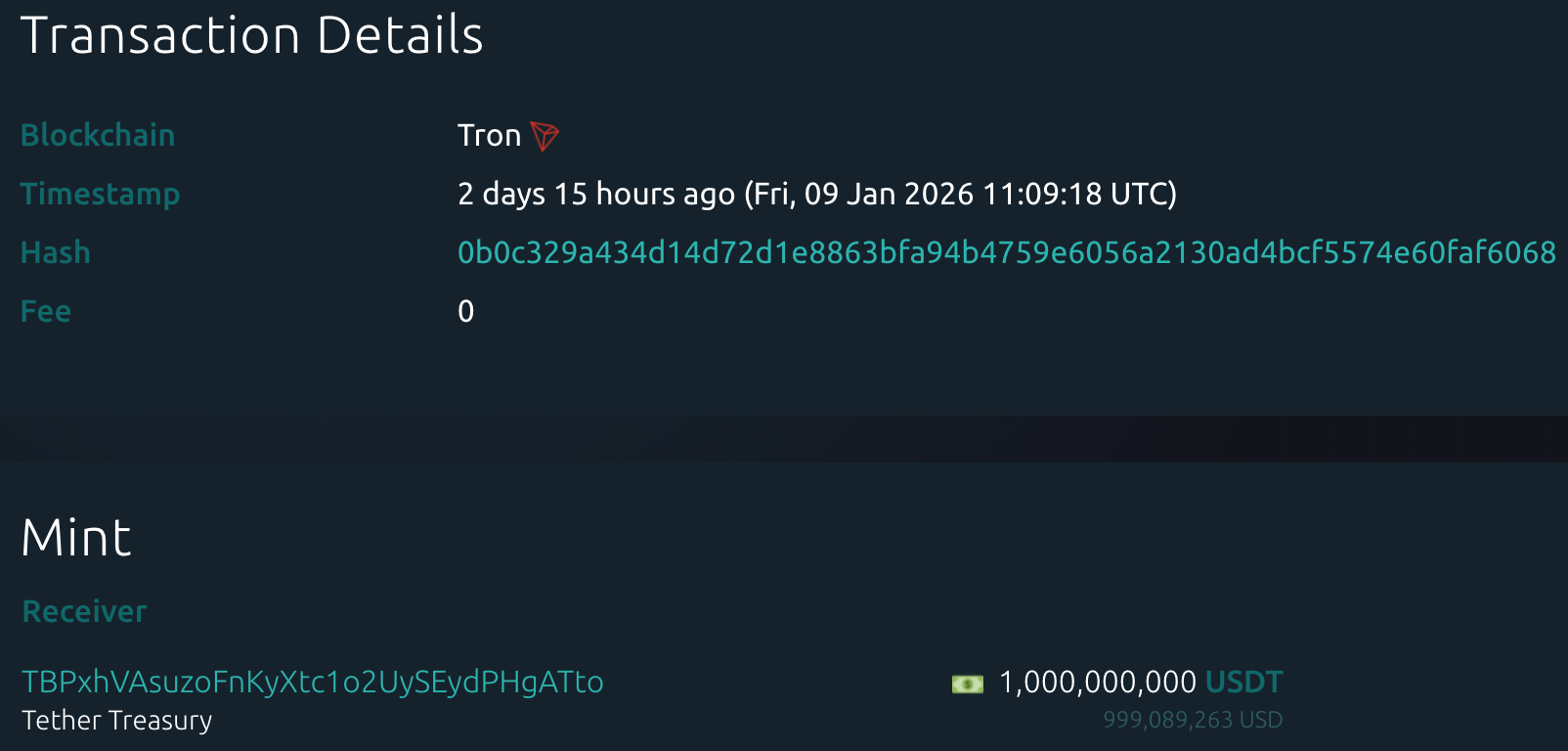

According to Whale Alert data, this week USDC Treasury issued a total of 1.74 billion USDC, and Tether Treasury issued a total of 1 billion USDT this week. The total issuance of stablecoins this week was 2.74 billion, an increase of 27.79% compared to last week's total issuance of 2.11 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of January 11, 2026

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

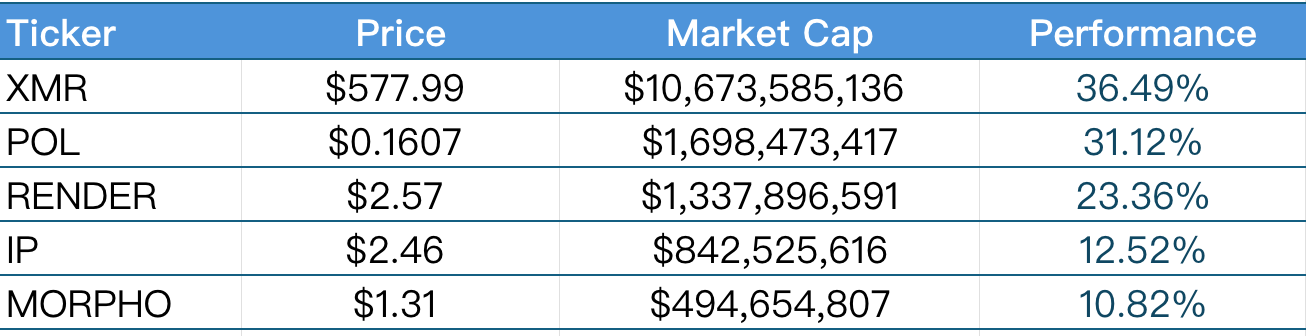

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of January 11, 2026

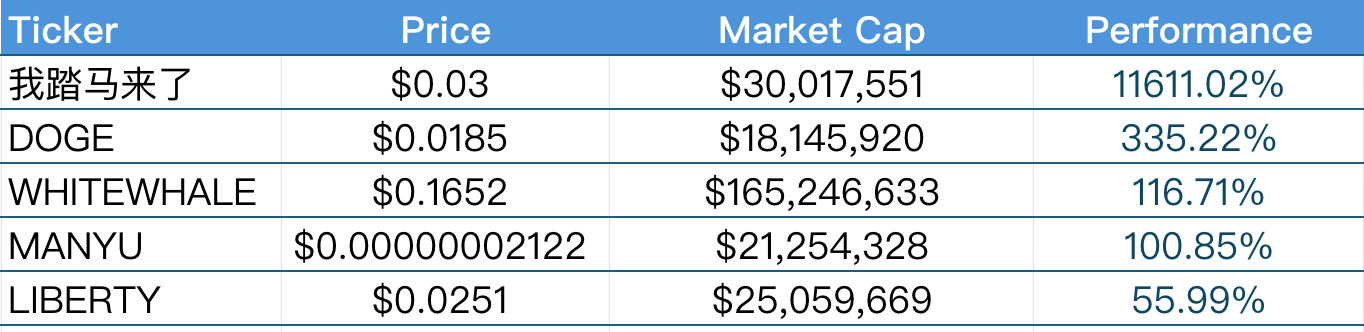

The top five meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of January 11, 2026

2. New Project Insights

Block Security Arena is an AI-driven security infrastructure platform focused on the Web3 space, building a "closed-loop" security ecosystem by integrating AI technology, practical exercises, and educational systems to help developers and security researchers enhance smart contract security capabilities. The platform offers core features such as an AI security academy based on RAG (Retrieval-Augmented Generation) technology, attack simulation challenges in a Docker sandbox environment, an AI auditing assistant for developers, and a token risk radar, allowing users to learn, practice, test, and apply security knowledge while providing automatic risk detection and security analysis tools for smart contracts. BSA aims to connect project parties with white-hat hackers through incentive mechanisms, gradually developing into a decentralized security response center to alleviate the shortage of Web3 security talent and risk protection challenges.

Ubyx is a global stablecoin clearing system designed to allow anyone, regardless of location, to deposit stablecoins from multiple issuers and various currencies into existing bank or fintech accounts and exchange them at face value for fiat currency, transforming stablecoins from traditional crypto assets into digital cash equivalents. It addresses the integration issues between multiple issuers, multi-chain, and multi-currency through a regulated clearing network, supporting compliant exchange channels while retaining decentralized and on-chain peer-to-peer payment functions, building an interconnected ecosystem for traditional financial institutions, stablecoin issuers, users, and developers to promote stablecoins as a widely accepted payment method.

JPEG.fun is a Web3 native social prediction interactive gaming platform where players can bet and compete around daily themed photos, winning prize pools by betting on specific images and competing for the highest bets, integrating social interaction, community participation, and on-chain settlement mechanisms to create a fun and engaging new cultural entertainment experience. The project initially started as a pixel art NFT platform, which gradually evolved into a gameplay centered around image guessing and interaction, connecting users and communities through decentralized betting and reward mechanisms, making JPEG.fun not only a gaming experience but also exploring new forms of interaction between culture, creativity, and the crypto world.

III. Industry News

1. Major Industry Events This Week

ZenChain (ZTC) completed its token generation event (TGE) on January 7, 2026, and announced its complete token economic model on January 6. The total supply of ZTC is 21 billion, with 7% explicitly allocated for airdrops, primarily targeting early testnet participants, ecological contributors, and active users. The official confirmation states that the airdrop will adopt a claim mechanism, but specific snapshot and claim times have not yet been announced, with detailed rules expected to be released around the mainnet launch in the first quarter of 2026.

On January 8, 2026, the Web3 wallet brand SafePal natively integrated the decentralized stablecoin staking protocol Morpho Vaults in its latest V4.10.6 version. At the same time, SafePal and Morpho jointly launched the Walletdrop airdrop event (January 8, 2026 – February 7, 2026, UTC 9:00). Participants in Morpho staking within SafePal Earn have the chance to win one of 500 limited Morpho × SafePal co-branded hardware wallets and enjoy exclusive benefits, while sharing a total reward pool of $5,000 in MORPHO tokens; the event also includes an additional reward mechanism unlocked for every 200 retweets of X/Twitter posts. Participation in staking must be done within SafePal Earn, and rewards will be distributed to eligible participants according to the rules after the event concludes.

Brevis (BREV) conducted its token generation event (TGE) on January 6, 2026, UTC, and opened trading, with approximately 250 million (25%) BREV entering the circulating market for the first time. In terms of airdrops, from December 17 to 19, 2025, airdrop activities targeting specific product holders allocated approximately 15 million BREV (about 1.5% of the total supply) to eligible users. Additionally, the project has been gradually allowing users to earn points (Sparks) through the "Proving Grounds" community program since October 13, 2025; these points will affect future airdrop allocation eligibility, and the airdrop registration entry has been announced and will soon be launched. Brevis is a project based on a zero-knowledge proof (ZK) off-chain computing engine, aimed at enhancing the scalability and efficiency of smart contracts and decentralized applications. Its native token, BREV, has a total supply of 1 billion, used for paying computation fees, staking rewards, governance, and other purposes.

2. Major Events Coming Next Week

Fogo will launch its token generation event (TGE) on January 13, 2026 (UTC) alongside its mainnet, with the FOGO token starting to circulate and unlocking the first batch of supply. Regarding airdrops, Fogo has canceled its planned token presale and converted the corresponding 2% of tokens into community airdrops, with a total of approximately 6% of tokens allocated to the community at the mainnet launch (about 1.5% will be distributed directly on the day of TGE). Airdrop eligibility is primarily based on the previous Fogo Flames points system and testnet participation behavior, with the snapshot already completed; specific claiming methods will be announced simultaneously with the mainnet launch. The project itself is a high-performance Layer-1 blockchain based on SVM (Solana Virtual Machine) and utilizing the Firedancer client, with the core goal of achieving higher throughput, lower latency, and stronger execution performance while ensuring decentralization, providing underlying infrastructure support for high-frequency trading and complex on-chain applications.

Infinex (INX) conducted an INX token sale from January 3 to 6, 2026, selling approximately 5% of the total supply, and plans to complete its TGE (token generation event) in late January 2026, with the specific date to be confirmed by an official announcement. Tokens sold are default locked for one year but allow for early unlocking at a higher valuation during TGE. Regarding airdrops, Infinex has not announced a universal free airdrop plan for all users but has distributed INX token vouchers or reward eligibility to early users through previous community activities like Craterun; these rewards will be exchanged for INX tokens according to the rules after TGE or mainnet launch.

The Web3 wallet Rainbow has officially launched its native token $RNBW, with a total supply of 1 billion tokens, and has announced its token economic design. The TGE (token generation event) is scheduled for February 5, 2026 (UTC), at which time approximately 20% of the supply, including airdrops, will be unlocked, with 15% allocated for airdrops. The airdrop portion will primarily be realized through the Rainbow Points rewards program, where users can accumulate points by performing on-chain operations (such as swapping, bridging, NFT activities, inviting others, etc.) within the Rainbow wallet. These points will be converted into RNBW tokens at TGE according to the official ratio. Currently, the airdrop snapshot and claiming details have not been announced, and users need to continue using Rainbow and accumulate points to increase their share of future airdrop allocations.

3. Important Financing Events Last Week

Boings.ai announced the completion of approximately $30 million in seed round financing, led by Honey Capital, with participation from LandScape Capital, Hotcoin Labs, Starbase, and Go2Mars Labs. Boings.ai is a Web3 value collaboration network aimed at empowering "super individuals" to instantly convert personal skills into on-chain value. The platform is built on the BNB Chain and supported by the 402 protocol. The funding will be used for global expansion, ecological growth, and the development of an AI-driven matching engine. (January 5, 2026)

Babylon announced the completion of $15 million in financing, led by a16z Crypto (the crypto investment arm of Andreessen Horowitz), with the valuation not publicly disclosed. The funds were invested through a16z in the form of Babylon's BABY tokens, aimed at advancing its Bitcoin-native collateral and lending infrastructure, with plans to integrate with the lending protocol Aave in the second quarter of 2026 to test and launch Bitcoin-native collateral functionality. Babylon is committed to building Bitcoin-native staking and trust-minimized financial infrastructure, aiming to enable Bitcoin to serve as an on-chain collateral asset in the decentralized finance space while maintaining its security and energy cost-free characteristics. (January 7, 2026)

The global AI-driven digital finance and payment infrastructure platform PhotonPay announced the completion of several tens of millions of dollars in Series B financing, led by IDG Capital, with participation from GL Ventures, Enlight Capital, Lightspeed Faction, and Shoplazza. Blacksheep Technology served as the exclusive financial advisor. The new funds will be used to deepen the deployment of the global payment network, upgrade the technology architecture, and accelerate global business expansion and compliance layout. PhotonPay is a global AI-driven digital financial infrastructure platform aimed at solving integrated payment and fund flow issues, empowering enterprises' global business growth through secure, compliant, and efficient underlying architecture and intelligent technology. (January 9, 2026)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Babylon: https://babylonlabs.io/

Block Security Arena: https://www.blocksecx.com/

Ubyx: https://www.ubyx.xyz/

JPEG.fun: https://jpeg.fun/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。