Written by: Bootly

The carnival comes quickly and goes even faster—this has almost become a fixed script for Chinese memes on BSC.

As the crypto market enters a "high beta" phase again in early 2026, meme coins, as the most volatile and emotionally charged asset class, have once again become the focus of capital games.

According to CryptoQuant, the share of meme coins in the altcoin market has risen to 3.2%, setting a new historical high. In this context, the meme battlefield is clearly divided into two:

On one side is Solana, which has built a "culture-driven" meme ecosystem with its fast transactions, mature toolchain, and self-growing community culture.

On the other side is BSC, which relies on the influence of key figures like CZ and He Yi, the support of exchanges, and the unique hype atmosphere of the Chinese-speaking community to quickly ignite an "emotion-driven" market.

Two chains, two meme survival logics, also reflect two completely different market pulses.

Principles and Mechanisms

Behind these two ecosystems is actually a divergence that began with the underlying design of the two chains.

Solana is based on a hybrid consensus mechanism of Proof of History (PoH) + Proof of Stake (PoS), emphasizing extreme performance: the average transaction confirmation time is about 0.4 seconds, with single transaction fees as low as $0.005–0.01.

This near "instant settlement" experience makes Solana a natural breeding ground for high-frequency trading and emotional diffusion.

On Solana, the meme gameplay is closer to "productized issuance." Represented by pump.fun, projects complete early price discovery by binding curves and "graduate" to mainstream DEXs once the hype reaches a threshold. This mechanism encourages rapid trial and error, leading to the emergence of representative meme coins like BONK and WIF that originated from community memes.

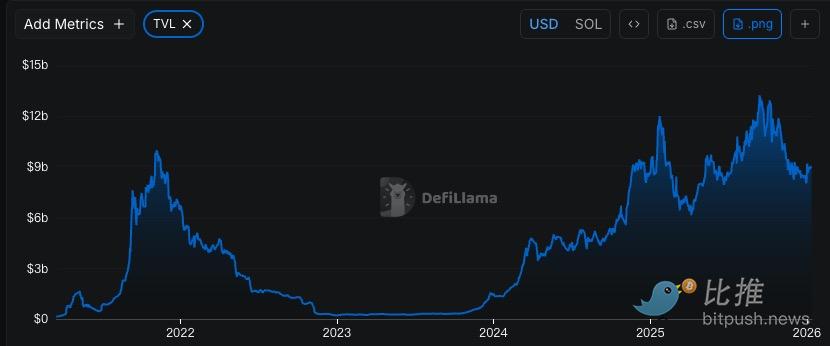

As of now, the TVL of the Solana ecosystem is approximately $9.0014 billion, still leading among meme-related public chains.

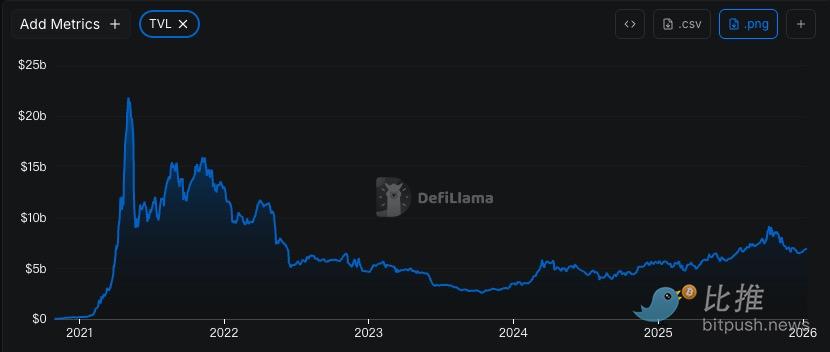

In contrast, BSC opts for compatibility and stability. Its EVM architecture inherits Ethereum's development habits, and with the support of the Binance ecosystem, while transaction costs are slightly higher, they remain within an acceptable range. Meme issuance on BSC is more direct—usually skipping complex price curves and directly establishing liquidity pools on DEXs like PancakeSwap, making it more suitable for projects that rely on a single narrative to quickly gain momentum. Currently, BSC's TVL is about $6.0932 billion, slightly lower than Solana.

Gameplay Collision: Community Consensus vs. Event-Driven

The differences in mechanisms also shape completely different player behaviors.

On Solana, the vitality of memes depends on the "spreadability of the meme." Narratives often ferment from X (formerly Twitter), attracting attention through community remixes and meme fission. Some projects may overlay elements like AI and NFTs to extend their lifecycle, but high freedom also means a high elimination rate—data shows that over 98% of meme projects on Solana ultimately go to zero, with the survivors often being those that truly form cultural recognition.

BSC's gameplay is closer to "event-driven." Market movements are often ignited by key figures like CZ and He Yi, characterized by straightforward narratives, concentrated emotions, and rapid price increases, but sustainability is often limited. Under the dense interactions of the Chinese-speaking community, projects can easily achieve price explosions in a short time, but once the hype fades, funds can quickly withdraw.

Data Comparison

Through real-time data monitoring from Dexscreener as of the writing of this article (January 12, 2026), we can clearly see the "character" of the two ecosystems:

Turnover Efficiency: High-Frequency PvP vs. Whale Stock Games

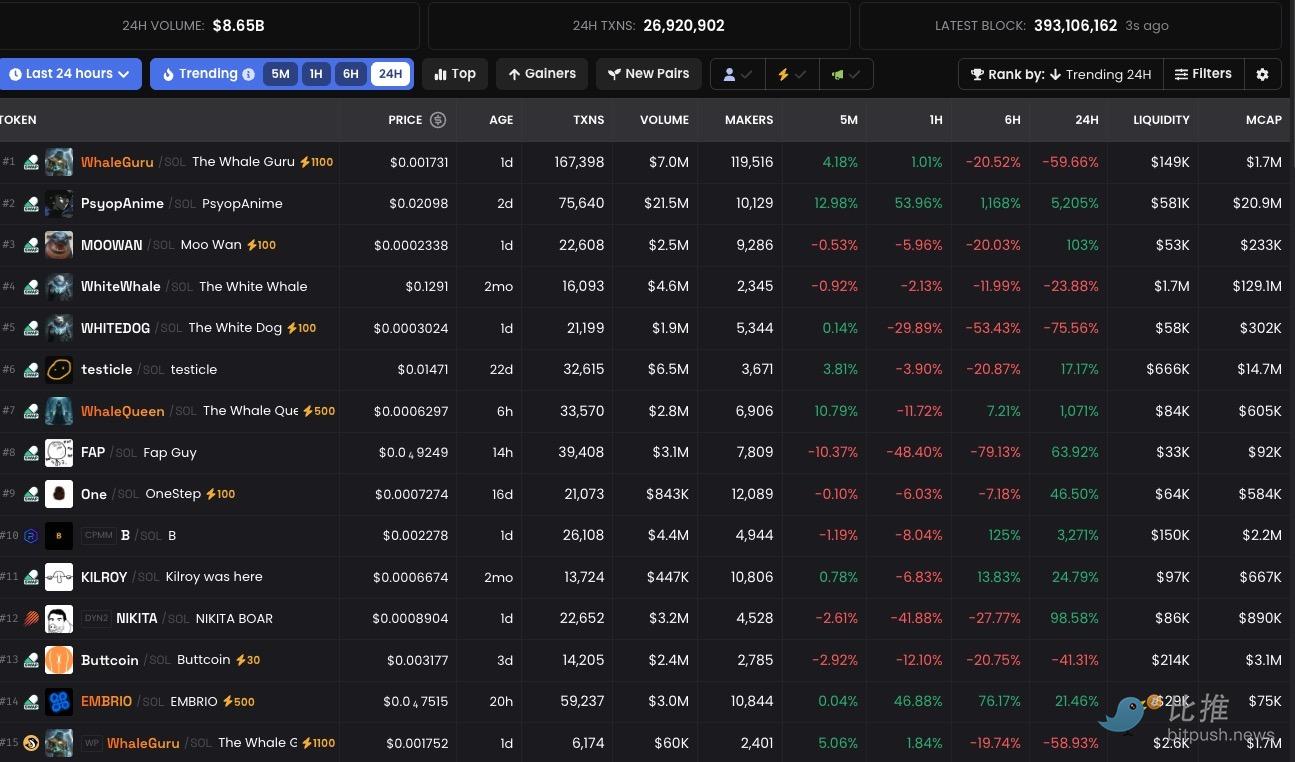

Solana (King of Turnover): 24-hour trading volume of $8.65B, supported by 26.92 million transactions.

The average transaction amount on Solana is extremely small, with the chain filled with millisecond-level sniper bots. Each popular token has over 110,000 participants (Makers). This extreme PvP environment means that capital flows very quickly, lacking sedimentation.

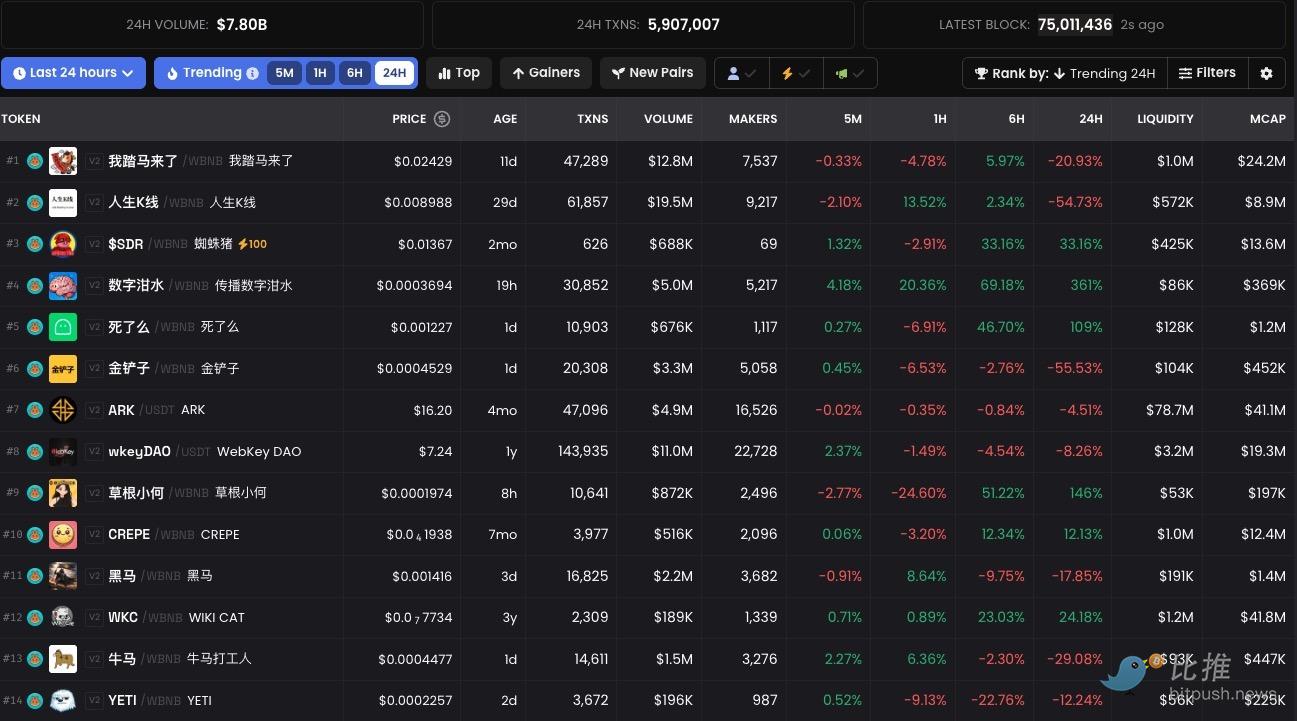

BSC (Whale Concentration Camp): 24-hour trading volume of $7.80B, with only 5.9 million transactions.

The average transaction amount on BSC far exceeds that of Solana. For example, the popular coin "I’m Coming" had only about 7,500 participants within 24 hours, indicating that BSC is more dominated by a "whale community," with a concentrated chip structure, making market movements more directional when they occur.

Token Creation Days (Age): Harvesters vs. Reservoirs

Solana (Very New): The top 15 list is almost dominated by tokens "born within 24 hours" (such as WhaleGuru, MOOWAN, NIKITA, etc.). This reflects Solana's strong traffic explosion capability and extremely short narrative lifespan, with capital constantly searching for the next "5-minute" opportunity.

BSC (Relatively "Long-Lived"): The list includes WKC, which has survived for 3 years, wkeyDAO for 1 year, ARK for 4 months, and "I’m Coming" for 11 days. This proves that BSC's meme tokens are relatively resilient; once a community or "power narrative" is formed, they can sediment for a longer time.

Market Capitalization (MCAP) Distribution:

Solana:

Super Blue Chips: WhiteWhale has a market cap of $129.1M, far ahead.

Long Tail: Except for the top four, market caps quickly drop below $1M (such as FAP, EMBRIO only have tens of thousands to hundreds of thousands of dollars). This indicates that Solana's traffic is extremely biased towards the top "survivors," with the remaining 99% being also-rans.

BSC:

Strong Middle Force: Among the top 15 tokens, 7 have market caps exceeding $10M (such as ARK, I’m Coming, wkeyDAO, SDR). This "olive-shaped" structure indicates that BSC funds are more inclined to cluster around already successful mid-sized projects, providing relatively higher safety.

Who Can Go Further?

It is not difficult to see that Solana's commercial value lies in "infrastructure empowering culture." It attracts global retail investors with extremely low thresholds; although it is heavily bubble-prone, its efficiency in decentralized innovation makes it more resilient over the long term.

On the other hand, BSC's business logic is "opportunistic amplification." It quickly injects liquidity using centralized leverage, connecting to the Asian market. However, this logic also exposes a fragile side: when the hype fades or "core figures" fall silent, the ecosystem can easily fall into a "vacuum period" where memes struggle to survive through community autonomy without official endorsement.

As KOL miragemunny observed: "BSC is currently a phase of flash speculative trading, while Solana's meme culture and toolchain are the result of years of accumulation."

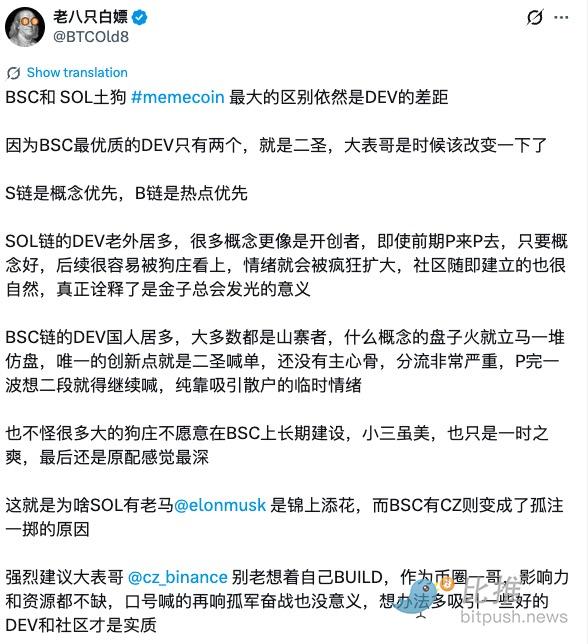

Chinese KOL Lao Ba Zhi Bai Piao (@BTCOld8) bluntly stated that BSC needs to attract more developers rather than relying solely on the rotation of hot topics.

In 2026, the meme track may enter a new stage of "emotional, liquidity, and toolchain overlap."

For investors, the key may not be to judge which chain is "guaranteed to win," but to understand the completely different rhythms of the two ecosystems: on Solana, it’s about probability and algorithms, while on BSC, it’s about another kind of "human relationships."

However, in the end, in the world of memes, the narrative determines how high one can fly, while liquidity determines how long one can survive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。