Written by: ChandlerZ, Foresight News

Recently, the Hong Kong government announced through a government gazette that authorities are consulting on the implementation of the OECD's Crypto-Asset Reporting Framework (CARF) and revisions to the Common Reporting Standard (CRS).

It was noted that since 2018, Hong Kong has been automatically exchanging financial account information with partner tax jurisdictions annually under the CRS established by the OECD, allowing relevant tax authorities to use this information for tax assessments and to investigate and combat tax evasion. The future goal is to automatically exchange tax-related information on crypto asset transactions with relevant partner tax jurisdictions starting in 2028, and to implement the revised version of the CRS rules from 2029.

Additionally, starting January 1, 2026, the first batch of the UK and over 40 other countries will implement new crypto asset tax regulatory rules, requiring local crypto service providers to begin collecting user crypto wallet and transaction data in preparation for subsequent cross-border tax information exchanges.

For example, crypto exchanges operating in the UK must start collecting detailed transaction records and complete information for all UK customers. HMRC will use the collected data to cross-check users' tax returns to ensure tax compliance, and violators will face sanctions. Industry insiders point out that this data may be used for identity verification, anti-money laundering, and criminal investigations, which will have a profound impact on the anonymity and compliance environment of the crypto industry.

"Is paying taxes on crypto trading becoming a reality?" A wide-ranging discussion has begun in the market. If Hong Kong reports, will mainland China also report? Will there be tax payments for crypto trading in the future?

What is the CARF Global Taxation Framework?

The Crypto-Asset Reporting Framework is a set of international standards for tax information transparency regarding crypto assets developed by the OECD under the authorization of the G20. Its core purpose is to incorporate crypto asset transactions, which have been difficult for tax authorities to penetrate and are easily transferred across borders, into a standardized information network that can be automatically exchanged between tax authorities. The OECD adopted and published the CARF rules and commentary in 2022, clarifying that its design goal is to collect tax-related information in a unified manner and automatically exchange it annually with the tax residence jurisdictions of taxpayers, thereby reducing the risk of cross-border tax evasion and underreporting of crypto assets.

In the context of CARF, crypto assets are not limited to Bitcoin or Ethereum in a narrow sense; any digital value carrier that can be held and transferred in a decentralized manner without the involvement of traditional financial intermediaries falls within its scope. Its coverage is intentionally made closer to the real market form, including stablecoins, derivatives issued in the form of crypto assets, and some NFTs that may also fall under the observation scope for similar tax risks.

Corresponding to the covered entities, CARF's reporting obligations revolve around market intermediaries that provide key services for transactions and exchanges. The OECD's approach is to anchor compliance at the point most capable of grasping transaction values and counterparty information. Any entity or individual that facilitates or executes relevant crypto asset exchange transactions (including exchanges between crypto assets and fiat currencies, as well as swaps between crypto assets) for clients in a commercial manner may be identified as a reporting crypto asset service provider and bear the obligations of data collection, due diligence, and reporting.

What is the relationship between CARF and the previously discussed CRS?

Understanding CARF cannot be separated from placing it within the larger global tax information exchange system. The recent discussions about the tax payment wave for Hong Kong and US stocks occurred under the mechanism of the Common Reporting Standard (CRS).

Over the past decade, cross-border tax transparency has primarily relied on the CRS standard. Countries require banks, brokers, funds, and other financial institutions to identify account holders who are not tax residents of their country and report key information such as account balances, interest, dividends, and disposal gains to their tax authorities annually, which is then automatically exchanged with the tax authorities of the other country.

China has fully implemented CRS since September 2018, exchanging resident financial account information with over 100 countries and regions. After data reporting, tax authorities issue notifications based on CRS and other data, prompting users to explain their situations and pay taxes.

CRS operates relatively maturely within the traditional financial system, but the trading, exchange, and transfer of crypto assets occur largely outside the banking account system, especially forming an independent value circulation network between centralized trading platforms, custodial wallets, and on-chain transfers, making it difficult to achieve the same level of penetration solely through CRS. CARF fills the gap that CRS originally struggled to cover in the on-chain and crypto asset market structure.

At the same time as launching CARF, the OECD conducted the first round of systematic revisions to CRS. On one hand, it included some electronic money products and central bank digital currencies (CBDCs) into the CRS framework; on the other hand, it adjusted the definitions regarding indirect investments in crypto assets through derivatives or investment vehicles to prevent the market from circumventing information reporting and exchange through product structures. Overall, CARF is responsible for the trading and service provider dimension of the native crypto asset market, while the revised CRS continues to address the related risk exposures that may exist within the financial account system, together forming a more complete automatic exchange puzzle.

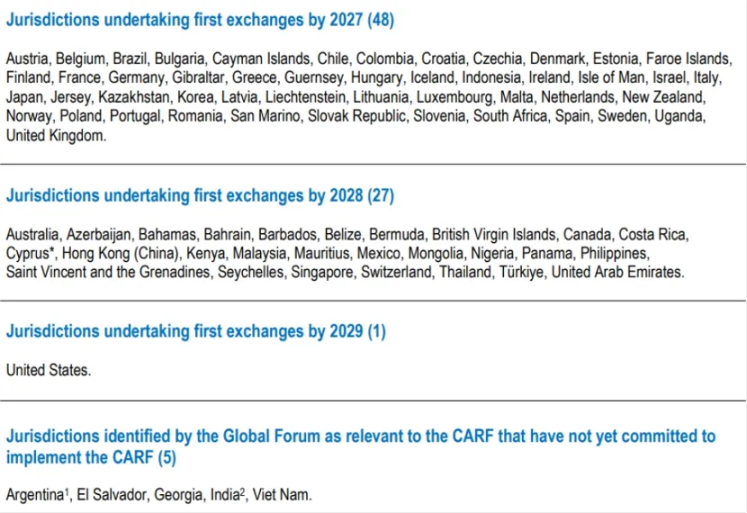

The OECD indicated that after the technical transmission format and supporting guidelines for CARF and the revised CRS are improved, the first cross-border automatic exchanges are expected to start in 2027; prior to this, multiple jurisdictions will first implement domestic data collection and reporting requirements to prepare a data foundation for subsequent cross-border exchanges.

At the EU level, DAC8 was approved by member states in October 2023 and published in the official gazette the same month. Its institutional design is based on the OECD's CARF international standard, aiming to include crypto asset user information in the automatic exchange between member states' tax authorities.

Will mainland China join as well?

As of early December 2025, 76 countries/regions worldwide have committed to adopting CARF. The UK and the EU will be the first to implement this framework (starting data collection in 2026 and the first exchange in 2027); Singapore, the UAE, and Hong Kong will follow closely, planning to collect data in 2027 and fully implement it in 2028; Switzerland has postponed its implementation to 2027 and is still cautiously evaluating the exchange subjects; the IRS's proposal to join CARF is still under internal review.

This means that China is not on the first batch of exchange lists, and CARF data will not be automatically exchanged with Chinese tax authorities through the CARF mechanism.

China has already accumulated mature systems and management experience under the CRS automatic exchange system, indicating that it has the infrastructure to support international standards in terms of legal design, due diligence criteria, data exchange governance, and information security.

The issue is that CARF's compliance anchor primarily falls on regulated crypto asset service providers, while mainland China has long adopted a strict regulatory or even prohibitive approach to virtual currency-related businesses, and there is no licensed trading platform system in the local market that can be regularly incorporated into CARF.

The promotion of CARF in Hong Kong may increase the intensity of tax residence identification and information reporting by crypto service providers in Hong Kong, but this does not automatically mean that the relevant information will naturally flow back to mainland tax authorities. Whether cross-border exchanges occur still depends on whether the mainland chooses to participate and establish exchange relationships with relevant jurisdictions, as well as arrangements regarding data usage restrictions, privacy protection, and technical integration between the two regions.

However, it should also be emphasized that not joining does not mean it can be ignored. Even if not through the automatic exchange path of CARF, cross-border tax information may still circulate under existing tax agreements and international tax administration cooperation frameworks through case requests, joint law enforcement, or other cooperative methods. As major global jurisdictions begin to systematically collect data on crypto asset transactions and transfers, the clues available to tax authorities will become more complete, and the ability to identify cross-border risks will also improve.

For individuals and institutions, the most realistic change is that as long as the main operational paths rely on centralized trading platforms, custodial services, or fiat currency entry and exit, the traceability and record-keeping of transaction data will become increasingly strong, and the compliance exposure will shift from a probabilistic event to a norm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。