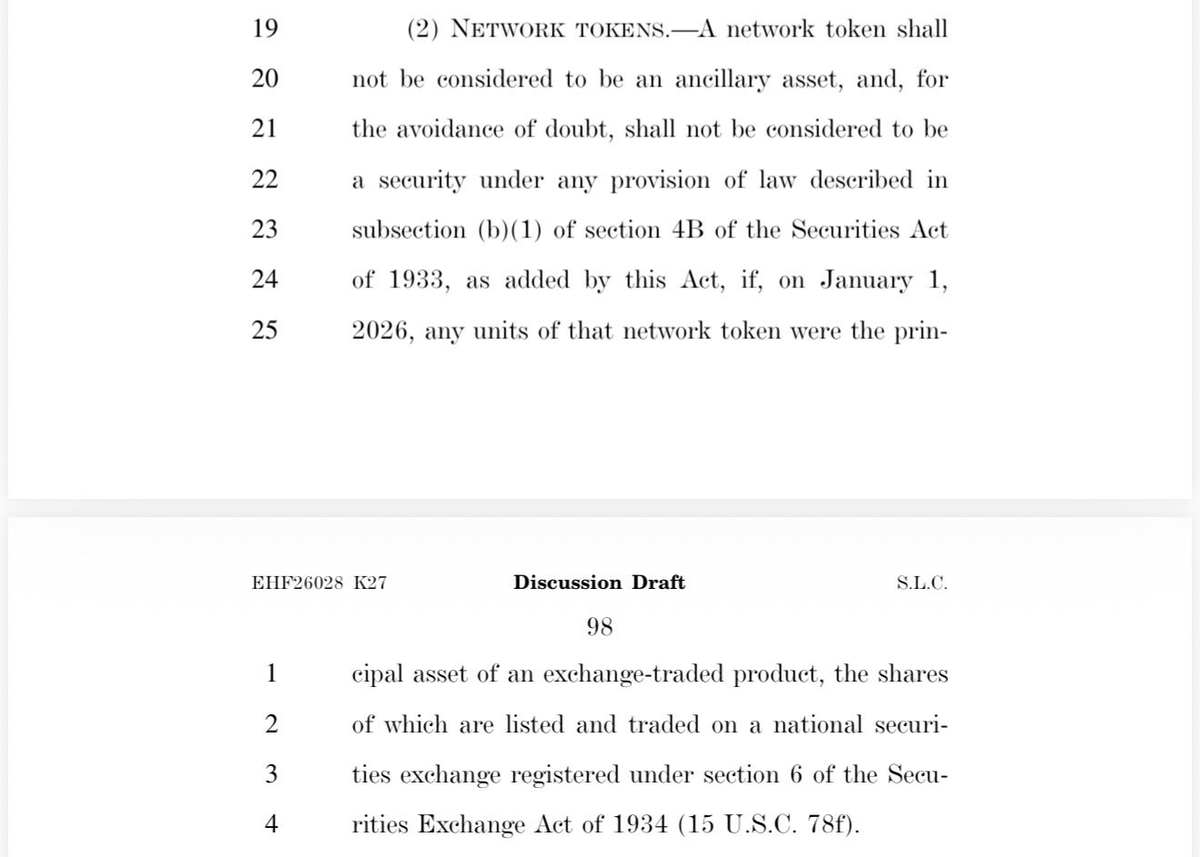

There is an important piece of information in the draft of the Senate Banking Committee's Market Structure Bill, which clarifies that a certain category of "Network Tokens" will not be considered securities under specific conditions.

If a Network Token is the "primary asset" of a compliant exchange-traded product (such as an ETF or ETP) as of January 1, 2026, then that Network Token will be explicitly excluded from the legal definition of "securities."

Interpretation: This mainly refers to the spot ETFs that have successfully launched. The ETFs that have successfully launched before January 1, 2026, include the three assets $BTC, $ETH, and $SOL, as well as CME futures.

It also includes $DOGE, $HBAR, $LTC, and $XRP (not sure if I missed any).

If this bill passes, it means that these cryptocurrencies will no longer be considered securities.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。