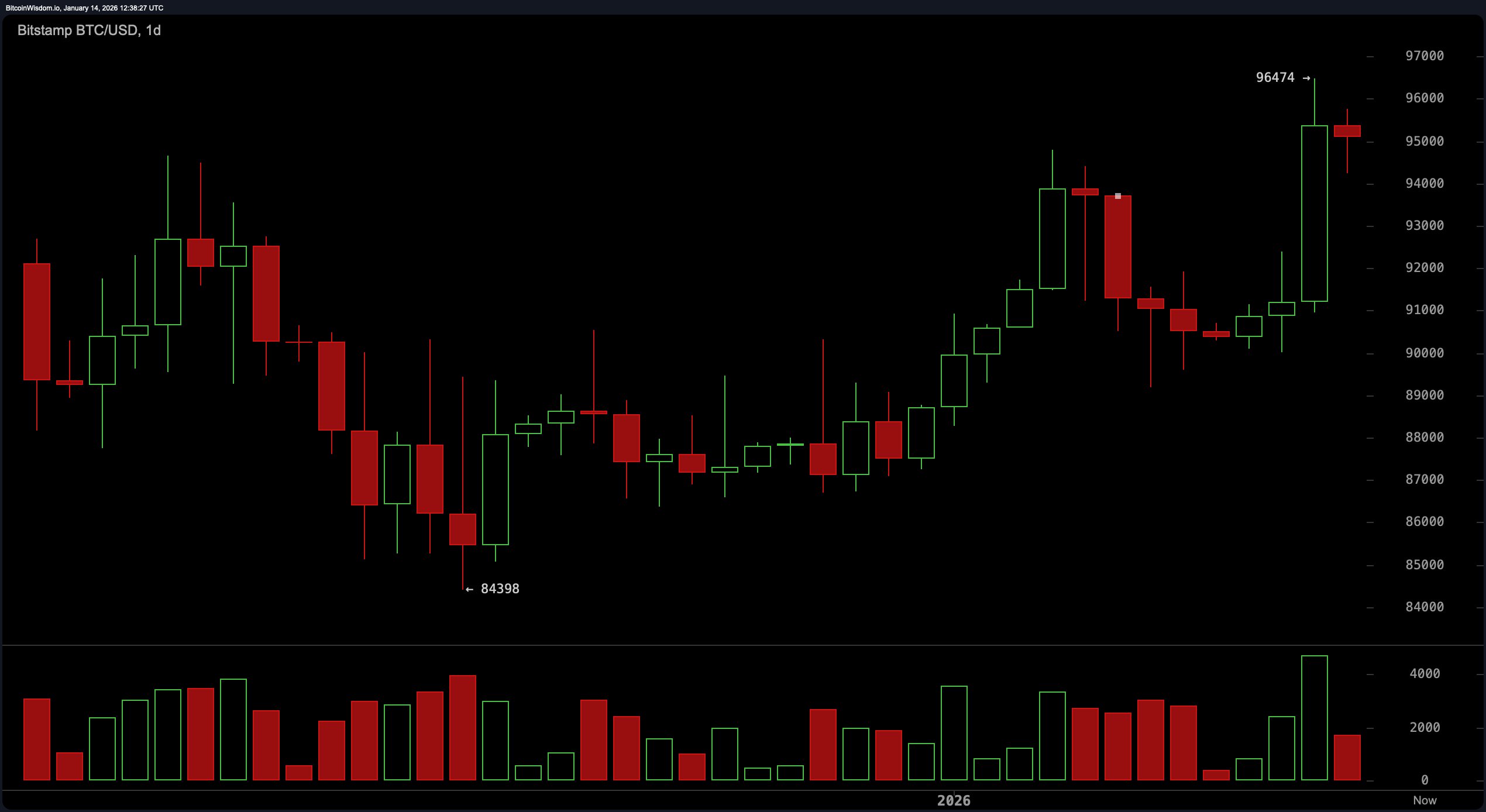

From the daily chart, bitcoin has bounced emphatically off a low of $84,398, climbing with purpose to a recent peak at $96,474. The bullish narrative has been highlighted by a sequence of green candlesticks, though the latest red print hints at a slight stall—momentum fatigue, if you will.

Volume tells its own tale: it surged on the way up but tapered as the red candle emerged, suggesting bulls may be catching their breath before the next sprint.

Zooming into the four-hour chart, bitcoin made a vertical leap from around $89,000, only to hit cruise control just under its recent high. The sideways chop resembles a classic bull flag or consolidation box, which, for pattern-savvy traders, screams “potential continuation.” The breakout setup remains intact: should the price vault over $96,500 with conviction and volume, that next leg toward and beyond $97,000 isn’t off the table. Still, any limp back toward $92,000 will need bullish reinforcement to keep the structure sound.

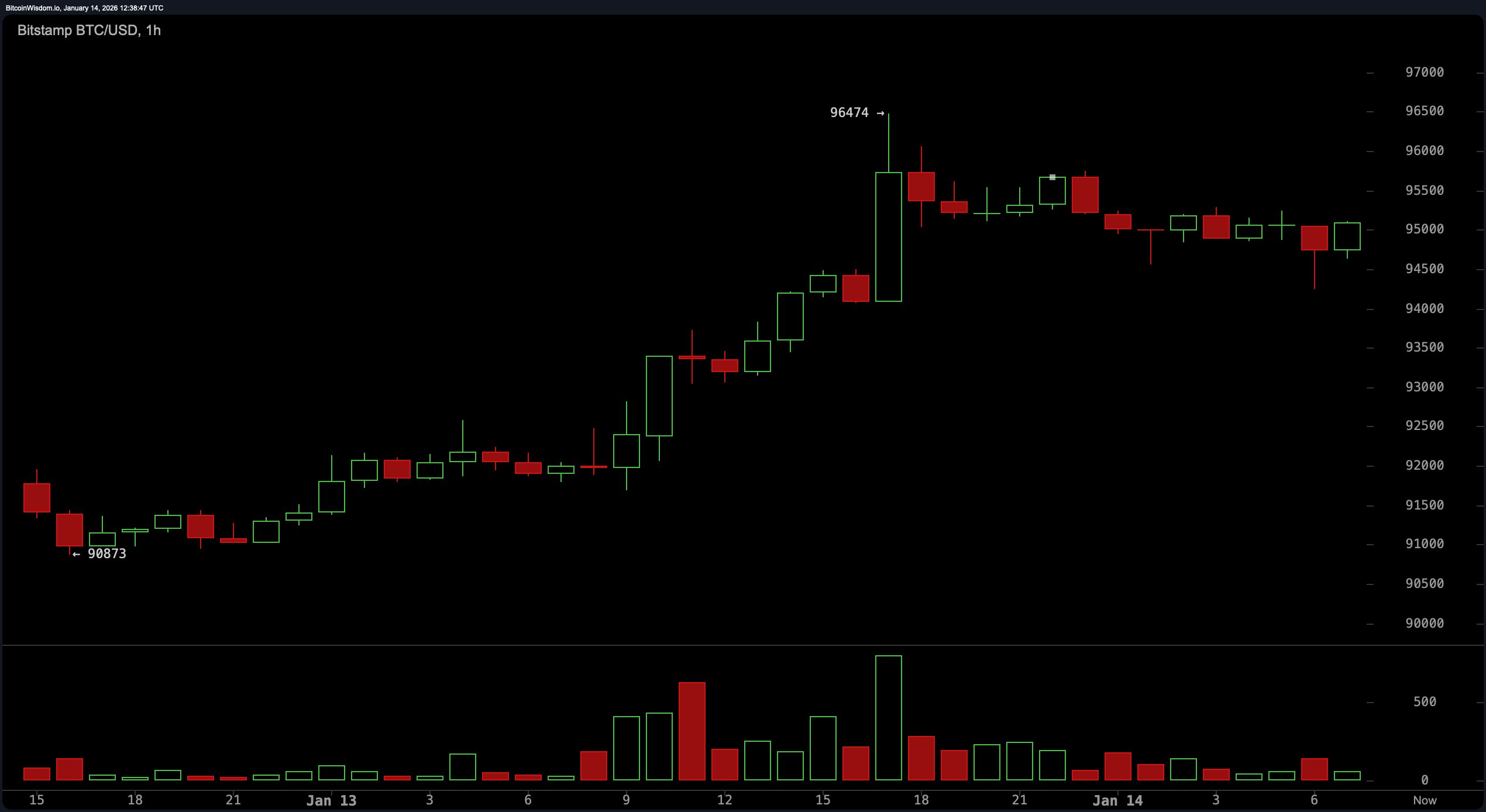

On the one-hour chart, things look slightly more twitchy but still constructive. A sharp rally leading into Jan. 14 pushed bitcoin toward the top of its range, and while red candles have crept in, they haven’t brought panic with them. Short-term support appears well-guarded between $94,500 and $95,000, with no alarming sell volume to suggest deeper downside—yet. Traders with strong nerves and tight stops might eye this level as a potential springboard, so long as $94,000 holds the line.

The oscillators, meanwhile, are keeping their cards close to the chest. The relative strength index ( RSI) at 65, the Stochastic oscillator at 76, and the commodity channel index (CCI) at 170 all read as neutral. The average directional index (ADX) at 29 implies trend strength is moderate but not domineering. Momentum has turned a corner with a value of 3,610, leaning negative, while the moving average convergence divergence ( MACD) level sits at 1,060, maintaining a bullish stance. Translation? Mixed signals from the technical crowd—neither full throttle nor throwing in the towel.

Moving averages (MAs) are where things get spicy. Short-term indicators, like the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods, are all riding below the current price, giving off bullish vibes. However, once you hit the 100 and 200-period moving averages, both EMAs and SMAs flash red: the EMA (100) at 95,959 and SMA (100) at 97,320 suggest overhead friction, while the EMA (200) at 99,572 and SMA (200) at 106,059 reinforce that this rally still has hurdles to clear. For now, bitcoin’s balancing act continues—caught between the thrill of new highs and the gravity of long-term resistance.

Bull Verdict:

If volume returns with force and bitcoin breaks above $96,500, the technical setup supports a renewed push beyond $97,000. Short-term moving averages are aligned in bitcoin’s favor, and the consolidation across charts hints at a bullish continuation. As long as price holds above the $91,000–$92,000 zone, the bulls keep the upper hand.

Bear Verdict:

Despite the upward momentum, the presence of resistance at the 100 and 200-period moving averages cannot be ignored. Oscillators signal caution, and waning volume on recent advances suggests enthusiasm may be tapering. A drop below $91,000 would invalidate the bullish structure and could open the door to deeper retracement toward the $88,000 level.

- What is the current bitcoin price?

Bitcoin is trading at $95,051 as of January 14, 2026. - What is bitcoin’s market cap today?

Bitcoin’s market capitalization stands at $1.89 trillion. - What is the 24-hour price range for bitcoin?

Bitcoin has ranged between $91,820 and $96,474 in the past 24 hours. - Is bitcoin showing bullish or bearish signals?

Bitcoin charts suggest bullish potential, but resistance near $96,500 remains key.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。