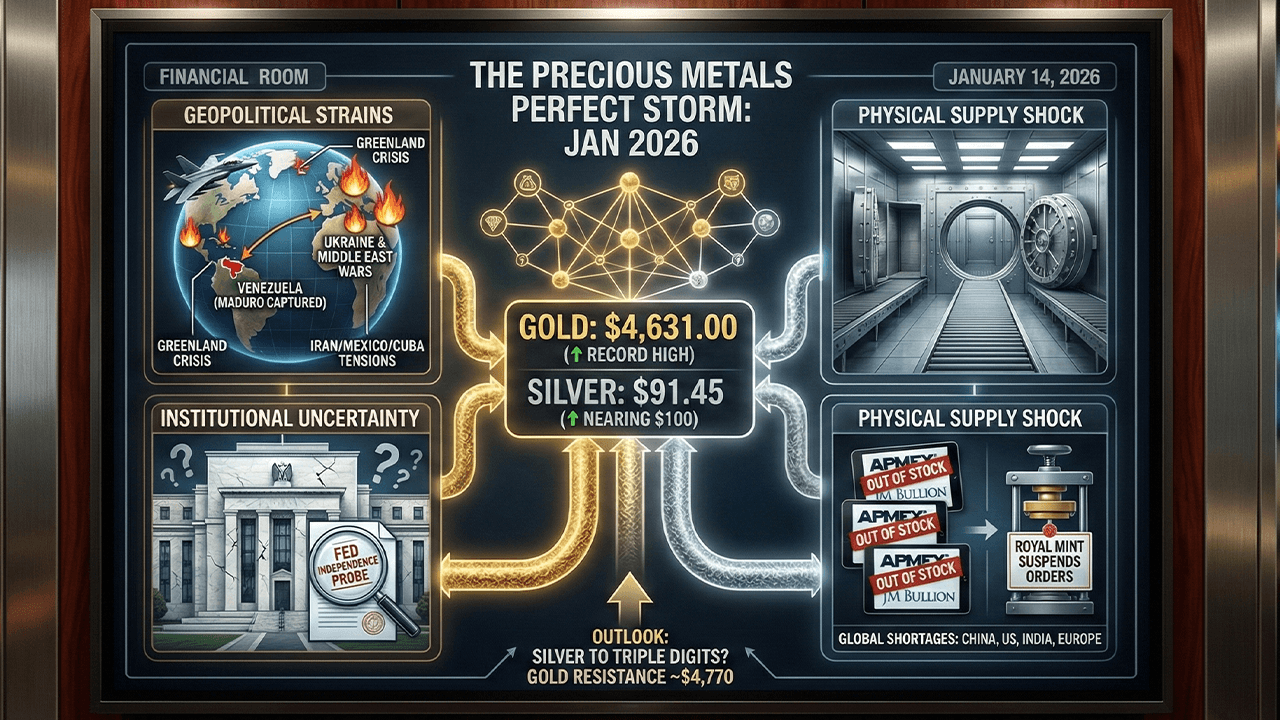

At press time on Wednesday, Jan. 14, 2025, an ounce of fine gold is priced at $4,631, while silver stands at $91.45. The yellow metal gained 0.98% over the past day, while silver climbed another 5.4% against the greenback.

Analysts point to multiple drivers behind gold’s sharp advance, and a report from the World Gold Council (WGC) says the metal is being propelled by geopolitical tremors, according to a report from Kitco’s Ernest Hoffman. “Two weeks into 2026, and gold seems to have weathered the early headwinds of tax loss selling, portfolio rebalancing and precious-metal volatility with three new all-time-highs,” WGC explained.

The nonprofit trade association representing leading gold companies worldwide added:

“And when usually short-lived geopolitical spikes become frequent, they start to embed higher risk premia, benefiting gold.”

Then there are mounting concerns over Federal Reserve independence, as scrutiny of the Fed’s renovation budget has ignited worries about a weakening of its autonomy. Against this backdrop of central bank turmoil, intensifying conflicts and diplomatic flashpoints are driving safe-haven demand.

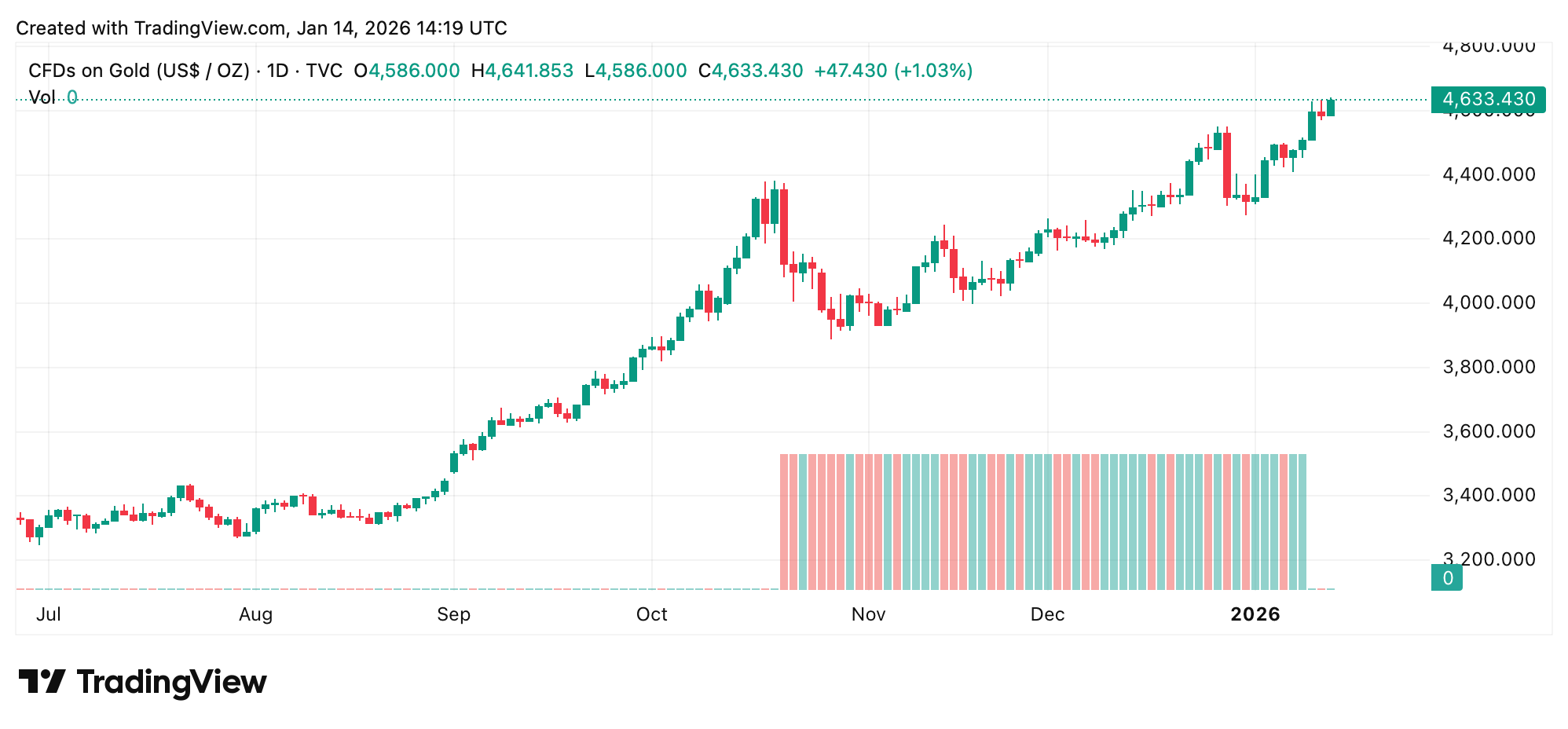

Gold prices on Jan. 14, 2026.

Key catalysts include U.S. military intervention in Venezuela (capturing President Nicolás Maduro), threats directed at Mexico and Cuba, ongoing operations involving Iran, the Greenland crisis, and the continued wars in Ukraine and the Middle East.

Silver has also drawn intense demand, pushing its price close to the $100 threshold. Shortages are being reported worldwide, spanning China, the United States, India, Japan, the Middle East, and Europe. Heavy physical delivery requests have accumulated, lifting physical premiums. The U.S. Mint has delayed the release of certain products, particularly numismatics.

Silver prices on Jan. 14, 2026.

The U.K.’s Royal Mint suspended new orders for silver Britannia coins (and gold equivalents) in late 2025, citing demand that far outpaced available supply. Reports indicate that major dealers such as APMEX, JM Bullion, and SD Bullion saw inventories quickly depleted in early January, resulting in broad sellouts of popular items like 10-ounce, 100-ounce, and 1,000-ounce bars.

This has constrained their ability to secure new stock, with backlogs mounting and “out of stock” notices becoming widespread. Some forecasters expect far higher levels for gold and silver, with silver potentially reaching triple digits in the near term. Kitco’s report, citing the WGC analysts, cautions that gold could encounter firm resistance around the $4,770 level.

Stepping back, the advance in precious metals appears to extend beyond short-term price action and into deeper structural forces. Political risk, institutional uncertainty, and tightening physical supply are shaping investor behavior, keeping gold in focus as a monetary hedge while silver’s dual role as both an industrial input and a store of value continues to draw sustained interest.

Looking ahead, the path for both metals may hinge on how geopolitical tensions evolve and whether supply constraints ease. While analysts warn that gold could face resistance near $4,770, expectations for silver reaching triple-digit prices highlight how acute physical shortages and persistent demand are influencing sentiment as 2026 unfolds.

- Why are gold prices rising in early 2026? Gold prices are climbing as geopolitical tensions, questions around Federal Reserve independence, and tight physical supply boost safe-haven demand.

- Why is silver nearing $100 per ounce? Silver is approaching $100 due to global shortages, heavy physical delivery demand, and widespread sellouts across major bullion dealers.

- Which regions are experiencing silver shortages? Supply constraints have been reported in China, the United States, India, Japan, the Middle East, and Europe.

- What price levels are analysts watching for gold and silver? Analysts are monitoring resistance near $4,770 for gold, while some expect silver to reach triple-digit prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。