The customer service of trading platforms must respond within 24 hours. Binance founder Zhao Changpeng seemingly mentioned entrepreneurial details in last night's communication, revealing his unique control over this fervent industry.

In a Chinese AMA event, Binance founder Zhao Changpeng explicitly stated that he is extremely optimistic about the long-term trend of Bitcoin, believing that the target price of $200,000 will "eventually be reached" and that "there is currently no peak in sight."

He predicts that the crypto "super cycle" starting in 2026 will drive prices far beyond traditional cycle theory expectations. Even with the recent weak market performance, he maintains this judgment.

1. Super Cycle Prediction

● Zhao Changpeng has once again sent a clear signal at a key turning point in the crypto market. He stated on the X platform that a round of crypto asset "super cycle" is brewing, expected to start in 2026. This view sharply contrasts with the traditional four-year halving cycle theory.

In his view, the real bull market phase has not yet started. Due to the Federal Reserve maintaining a tight monetary policy, market participants' enthusiasm is temporarily suppressed.

● The background of CZ's judgment is noteworthy: the U.S. Securities and Exchange Commission has decided to remove cryptocurrencies from its highest priority risk list for 2026. In his view, the market fundamentals are rapidly improving.

● Surprisingly, while expressing optimistic expectations, this industry leader also rarely showed caution. He specifically added in a post on the X platform: "I could also be wrong in my judgment."

This attitude reflects the rational understanding of a seasoned practitioner. Although the expectation of a super cycle has high market consensus, the foundation is not as solid as imagined. Global liquidity policies are subject to change, geopolitical risks remain, and regulatory attitudes are still evolving.

2. The Showdown Between Bitcoin and Gold

In terms of specific asset selection, CZ continues to view Bitcoin as a long-term core asset. He often reminds followers to focus on Bitcoin when the market is dominated by fear, uncertainty, and doubt.

● He shared an observation: Many investors who regret not entering the market earlier often overlook one point: early entrants mostly bought in when the market was filled with fear, rather than chasing prices at historical highs.

● Regarding the future of Bitcoin, CZ holds a more aggressive view than most. He predicts that Bitcoin will eventually surpass gold in total market capitalization. In his view, Bitcoin is a superior financial asset compared to gold.

● According to his logic, based on the market conditions cited in the article, if the total market capitalization of gold remains unchanged, Bitcoin's price would need to rise about 17 times from its current level to achieve this goal. This also explains why he believes that Bitcoin's price "currently has no peak in sight."

3. Collective Opportunities for Altcoins

● Regarding the altcoin market, which has garnered widespread attention, CZ provided a clear and cautious judgment. He stated in the Chinese AMA that the market has cycles, and there will definitely be an "altcoin season" in the future. However, he also emphasized that the scope of "altcoins" is worth discussing. Future public chains and coins with real applications will develop, so there will certainly be an altcoin season, but the range and magnitude remain to be observed.

● This attitude reflects CZ's profound understanding of market operation rules. In his view, large funds first flow into large-cap alternative coins, while small and mid-cap coins follow after liquidity spreads, and meme coins rise last—often trapping retail investors who enter later.

● Unlike the certainty of Bitcoin, choosing in the altcoin space requires more precise vision and timing. CZ specifically pointed out that to be a KOL (Key Opinion Leader), one must first choose the right track, comparing the AI industry and the crypto space: the crypto space relies more on KOLs.

4. Detailed Explanation of Three Core Assets

Among numerous crypto assets, CZ publicly expressed optimism about three specific cryptocurrencies, providing clear reference directions for investors.

● Bitcoin (BTC) as the first choice needs no elaboration, but CZ's holding logic is worth noting. He has repeatedly emphasized the importance of buying when the market is filled with fear, rather than chasing prices at historical highs. This advice has proven particularly valuable in recent market fluctuations.

● BNB (BNB), as the core token of the Binance ecosystem, occupies a special position in CZ's investment portfolio. He recently stated in a post that instead of asking him where the next big opportunity is, it is better to observe where he invests his time, which is interpreted as a strong implicit endorsement of BNB.

● Aster (ASTER) is the third cryptocurrency CZ publicly stated he is buying for the long term, alongside Bitcoin and BNB. He recently disclosed that he personally bought $2 million worth of ASTER. Aster is a multi-chain decentralized perpetual contract exchange and spot DEX, which has quickly become one of the leading protocols in the industry in terms of fee revenue. Observers point out that this protocol has substantial usage activity, rather than merely speculative capital flow.

5. Market Strategy and Risk Reminders

● Despite being confident about the super cycle, CZ shows a pragmatic side in specific operational advice. He clearly stated that he cannot predict the market in the next three to four months, even joking that "the U.S. president might not be able to predict the market in three to four months."

● For novice investors, he offered more cautious advice: he does not recommend new users trade contracts. In his view, the losses caused by the volatility related to contract trading can be significant and are not suitable for inexperienced investors.

● This attitude forms an interesting contrast with his long-term optimistic view of the market. On one hand, he believes in the enormous potential of crypto assets, while on the other hand, he reminds investors to be aware of short-term risks, reflecting his deep understanding of market complexity.

● When discussing the factors behind Binance's success, he shared a detail: In 2017, the exchange's ticket response time was generally two months, while he required Binance's customer service to respond within 24 hours.

6. Institutional Consensus and Divergence

In contrast to the cautious attitude of traditional finance towards Bitcoin, Wall Street's expectations for Bitcoin are also undergoing significant changes.

● As one of Wall Street's most steadfast Bitcoin bulls, Standard Chartered's Global Head of Digital Asset Research, Geoff Kendrick, recently significantly lowered his forecast for this crypto asset. He previously predicted that Bitcoin would reach $200,000 by the end of 2025, but now adjusts it to around $100,000 by the end of the year.

● However, other Wall Street analysts hold more aggressive views. Analyst Tom Lee predicts that Bitcoin could reach $300,000, and Ethereum could reach $20,000.

● The market-driven logic is undergoing subtle changes. Former Goldman Sachs executive Raoul Pal recently suggested that the narrative of Bitcoin's "four-year cycle" may be broken, replaced by a new logic driven by global liquidity.

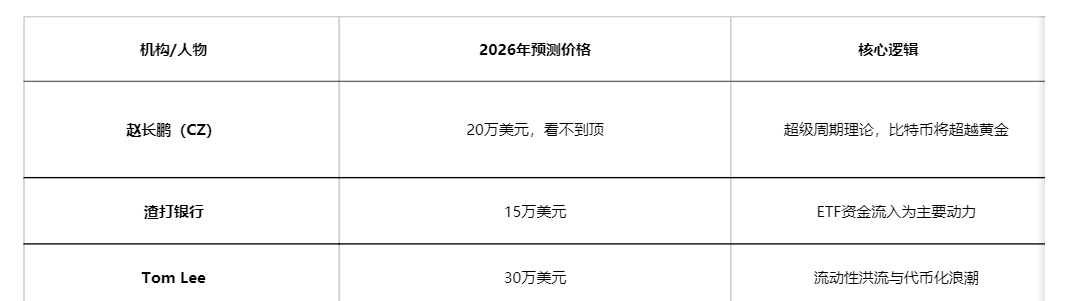

Table: Comparison of Major Institutions' Bitcoin Price Predictions for 2026

Although CZ holds an optimistic view of the market's future, he also reminds investors to remain rational. When even a big player like him emphasizes, "I could also be wrong in my judgment," ordinary investors should ask themselves: Are they following the consensus, or do they truly understand this story?

In the noise of the crypto market, this clear voice is particularly precious. Regarding the arrival of the "altcoin season," he pointed out that the key is to discern which projects have real application rather than relying solely on market speculation.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。