The week ended on a more cautious note for crypto ETFs, with investors pulling back from bitcoin after several strong sessions. Risk appetite softened, and while some assets managed to stay afloat, momentum clearly slowed across the board.

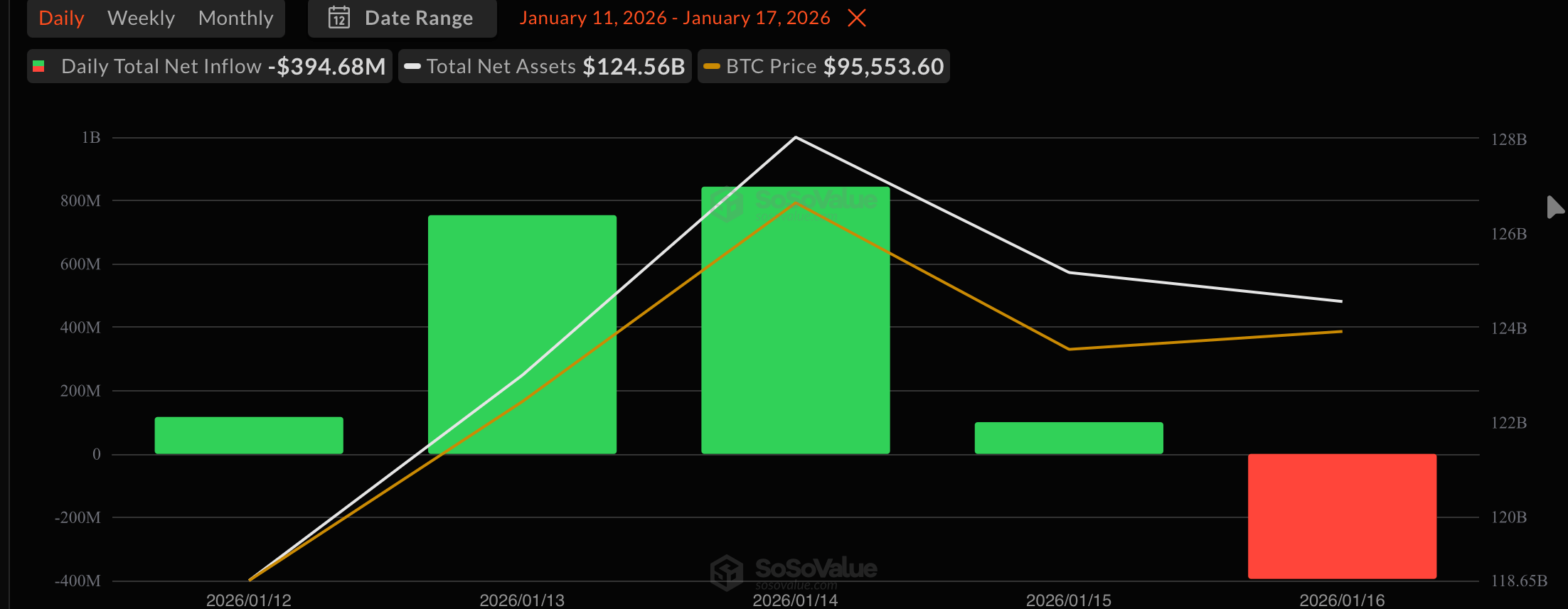

Bitcoin ETFs recorded a $394.68 million net outflow, ending their recent inflow streak decisively. Fidelity’s FBTC led the retreat with a $205.22 million exit, followed by Bitwise’s BITB at $90.38 million and Ark & 21Shares’ ARKB with $69.42 million in outflows. Grayscale’s GBTC also shed $44.76 million. Blackrock’s IBIT was the lone bright spot, attracting $15.09 million, though it was far from enough to offset broader selling pressure. Total value traded reached $3.60 billion, while net assets edged lower but remained steady at $124.56 billion.

Red Friday for Bitcoin ETFs after four days of green in the week totaling over $1.7 billion

Ether ETFs narrowly stayed in positive territory, posting a $4.64 million net inflow. Blackrock’s ETHA brought in $14.87 million, countering a $10.22 million exit from Grayscale’s ETHE. While modest in size, the green close marked another day of resilience for ether products. Trading volume totaled $1.19 billion, with net assets holding firm at $20.42 billion.

XRP ETFs saw little movement, recording a marginal $1.12 million inflow. The entire addition came from Franklin’s XRPZ, signaling selective interest rather than broad participation. Total value traded stood at $14.08 million, and net assets stabilized at $1.52 billion.

Read more: Bulls Exhausted? Bitcoin Momentum Fades as ETF Buying Frenzy Slows

Solana ETFs slipped slightly, ending the day with a $2.22 million net outflow. Grayscale’s GSOL led the exits with $1.92 million, while 21Shares’ TSOL saw $725,810 leave the fund. A small $425,000 inflow into Fidelity’s FSOL helped cushion the decline but couldn’t flip flows positive. Trading activity reached $34.58 million, with net assets steady at $1.21 billion.

In summary, Friday’s session marked a clear pause in the recent rally. Bitcoin absorbed the bulk of the selling pressure, ether narrowly extended its streak, and both XRP and solana reflected a market shifting into a lower-conviction, wait-and-see mode heading into the next trading week.

- Why did Bitcoin ETF inflows reverse on Friday?

Investors took profits after a multi-day rally, triggering a sharp $394.68 million net outflow from Bitcoin ETFs. - Did Ether ETFs remain resilient despite broader weakness?

Yes, Ether ETFs stayed marginally positive with a small inflow, signaling continued but cautious demand. - What happened to XRP and Solana ETFs at week’s end?

Both saw low-conviction moves, with XRP barely positive and Solana slipping slightly into outflows. - What does this mean for near-term crypto market sentiment?

The mixed flows suggest momentum is cooling and investors could be entering another wait-and-see phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。