January 2026 has been anything but dull when it comes to long-dormant bitcoin wallets finally stretching their legs after years of silence. Case in point: on Jan. 10, a mega whale from the 2010 era resurfaced for the first time since bitcoin’s early days, unloading 2,000 bitcoin by sending them straight to Coinbase.

After that maneuver, a fair batch of dormant bitcoin sprang back to life after years of radio silence, though most of the action involved transfers worth 50 BTC or less. Still, on Jan. 13, one long-sleeping wallet holding 136.30 BTC finally budged, shifting its coins for the first time since March 5, 2014. Three days later, btcparser.com logged a far heftier player making its presence known, moving a hefty 1,087.29 BTC—valued at $103.8 million using Jan. 17 exchange rates.

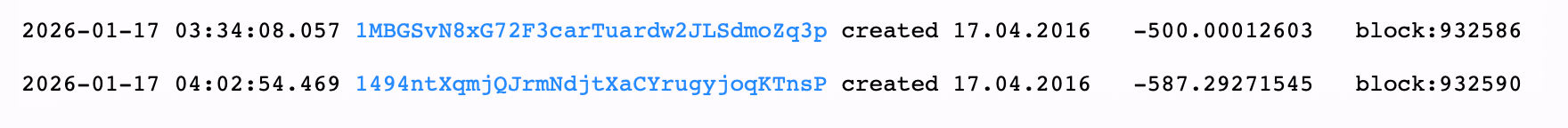

The two P2PKH wallets from 4-17-2016. Image source: Btcparser.com.

That flurry traced back to two wallets, both created on April 17, 2016, with one holding 500 BTC and the other 587.29 BTC. The 500 BTC cleared at block 932586, while the 587.29 BTC landed shortly after at block height 932590. The 587.29 BTC sat in a P2PKH (Pay-to-Public-Key-Hash) wallet and was shifted into a fresh Taproot (P2TR) address.

From there, 300 BTC peeled off to a new P2TR address, while 287.29260474 BTC took a separate route into another P2TR wallet. As of 11:30 a.m. Eastern time, both piles remain parked in their new P2TR homes. The 500 BTC followed a similar script, moving from P2PKH into a consolidated P2TR wallet before splitting into two separate addresses. In that case, one recipient received a tidy 0.10000000 BTC, while the change address absorbed 499.90003619 BTC.

Also read: Bitcoin’s Hashrate Slips Below 1 Zettahash After Months at Record Power

Just like before, every last satoshi has stayed put since the transfers wrapped up. This move could simply reflect routine consolidation or escrow preparation ahead of a potential sale, a pattern commonly seen when sizable holdings are routed to custodians or over-the-counter (OTC) desks. For now, the reshuffling reads less like panic and more like housekeeping—old coins changing clothes rather than changing hands.

As bitcoin flirts with six figures, the awakening of decade-old wallets always adds another layer to the market’s intrigue. Whether these movements signal eventual distribution or simple operational tidying remains unclear. What is clear is that price proximity to $100,000 or more tends to move even the most patient holders, reminding observers that dormant supply can reenter circulation quietly, deliberately, and without drama as cycles repeat over time.

- Why did the 1,087 BTC whale move funds now?

The transfer likely reflects wallet consolidation or preparation for custody or OTC services as bitcoin trades near $100,000. - How old were the wallets involved in the 1,087 BTC transfer?

The wallets were created in April 2016 and had been inactive for more than nine years. - Were the 1,087 BTC sent to an exchange?

No, the bitcoin were moved into new Taproot addresses and remain unspent. - Does this whale activity signal immediate selling pressure?

Not necessarily, as similar movements often represent internal restructuring rather than active distribution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。