XRP’s price behavior can appear calm even as underlying stress builds within its holder base. Blockchain analytics firm Glassnode shared on social media platform X on Jan. 19, 2026, that XRP is quietly repeating a market structure last seen in early 2022, with rising tension beneath the surface.

The firm wrote:

“The current market structure for XRP closely resembles that of February 2022.”

“Investors active over the 1W–1M window are now accumulating below the cost basis of the 6M–12M cohort. As this structure persists, psychological pressure on top buyers continues to build over time,” the firm added.

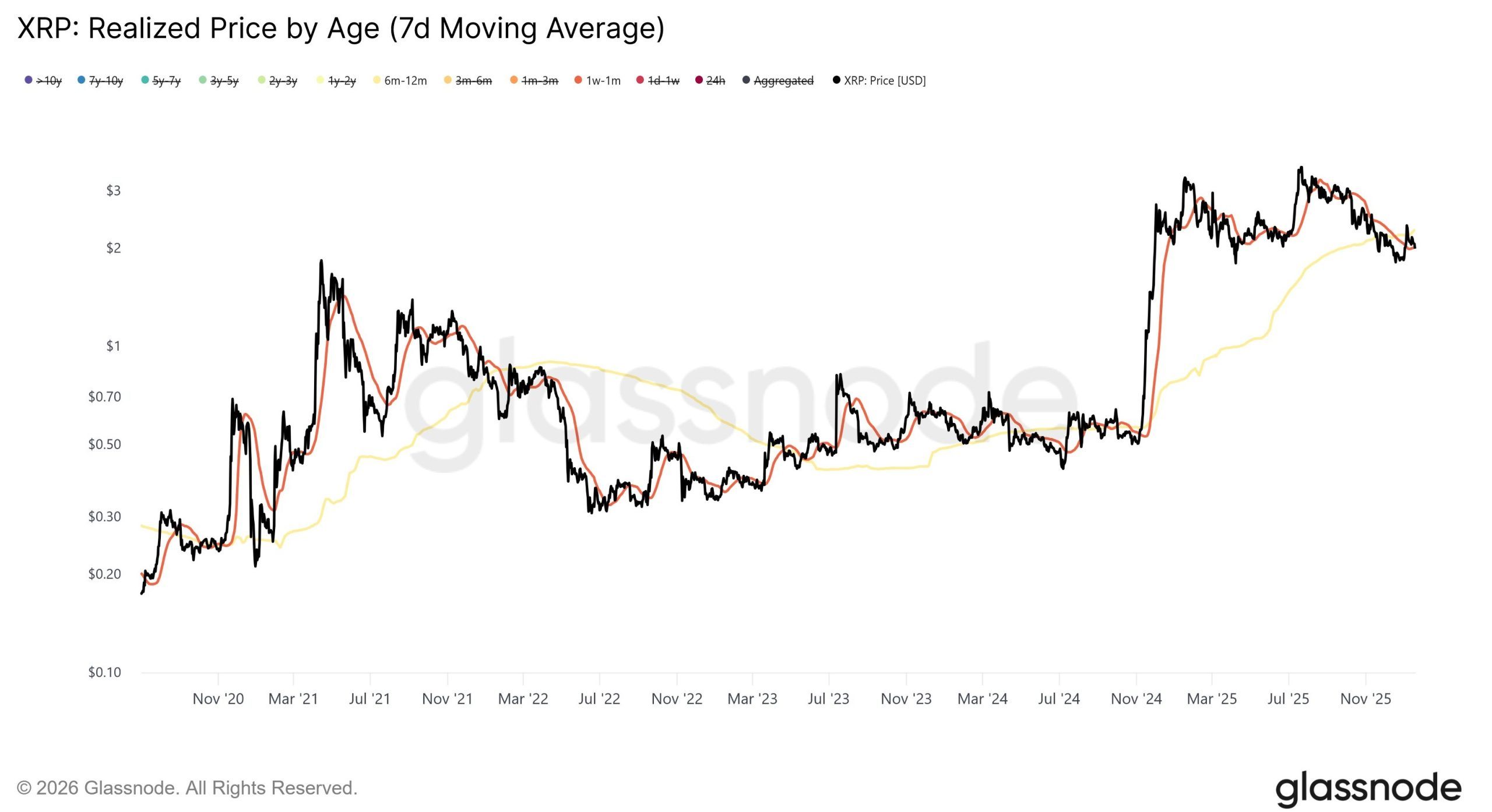

The post was accompanied by a chart illustrating XRP’s realized price by age cohorts, showing short-term holders increasingly positioning at lower realized levels than investors who entered months earlier. The visualization reinforced the presence of supply rotation rather than aggressive distribution, as newer participants absorbed liquidity while longer-duration holders remained underwater. Such configurations often develop during prolonged consolidation, when spot prices move within a narrow range and volatility remains compressed. In prior cycles, similar setups coincided with extended periods of indecision, gradually reshaping participation as conviction shifted toward recent entrants.

Read more: XRP Holds Technical Footing as Ripple’s Expanding Global Regulatory Footprint Strengthens Bullish Narrative

As the structure continues, Glassnode explained that sustained psychological strain among top buyers can shape behavior well before price reacts. In a separate post shared on X on Nov. 24, Glassnode noted:

“The $2.0 level remains a major psychological zone for Ripple holders. Since early 2025, each time XRP has retested $2, investors have realized $0.5B–$1.2B per week in losses.”

The firm added that this pattern “underscores how heavily this level influences spending behavior.” The observation aligns with the earlier cost-basis analysis, suggesting that repeated tests of key psychological levels intensify loss realization and suppress sell-side confidence. Comparable conditions in earlier XRP cycles preceded both sharp downside moves and renewed expansions, depending on liquidity and sentiment across crypto markets. While the accompanying chart focused on realized price by holding duration, the broader takeaway reflects an onchain principle observed across digital assets, where cost-basis stress and psychological thresholds jointly influence risk tolerance, participation, and eventual market resolution.

- Why is XRP’s current market structure important for investors?

Glassnode data shows XRP is repeating a 2022-style setup where short-term holders accumulate below long-term cost bases, signaling hidden stress that can precede major price moves. - What does supply rotation mean for XRP’s price outlook?

Supply rotation suggests newer investors are absorbing liquidity from older holders rather than mass selling, often occurring during long consolidations before volatility expands. - Why is the $2 level a critical psychological zone for XRP holders?

Repeated retests of $2 have triggered $0.5B–$1.2B in weekly realized losses since early 2025, reinforcing it as a key stress point influencing investor behavior. - How could cost-basis stress impact future XRP performance?

Rising psychological pressure on underwater holders can suppress selling short term but historically has led to sharp breakouts or breakdowns once sentiment and liquidity shift.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。