Is today's decline over, or will it continue to drop tomorrow?

The answer is at the forefront:

Today's tariff reaction is the first phase. Whether it will continue to drop depends on whether there will be an escalation of tariffs or countermeasures from Europe and the United States tonight to tomorrow, as well as whether the Supreme Court can respond quickly. If there are no further stimulating news, then a rebound is possible; however, if Trump continues to provoke the market, the probability of a continued decline tomorrow will not be low.

Main text:

This is probably the most concerning issue for most friends. First, we need to clarify the reasons for the decline. This time, the drop in $BTC has two main reasons, the biggest being Trump's tariffs on Greenland-related countries. The tariffs imposed by the U.S. have triggered countermeasures from Europe, and the U.S. intends to continue retaliating on top of Europe's countermeasures. The last time we saw such "spats" was during the U.S.-China tariff war in April.

If this really happens, the situation may be more serious than it was with China because, compared to China, U.S. imports from Europe are more significant. The export structure from Europe to the U.S. is also closer to the consumer end, ranging from auto parts, luxury goods, pharmaceuticals, chemicals to high-end manufacturing. Any increase in tariffs on these sectors will directly reflect on U.S. domestic inflation expectations.

PS: According to U.S. Census data, as of October 2025, the U.S. imported approximately $266.3 billion worth of goods from China and about $537.9 billion from the EU, with EU imports exceeding those from China by more than double.

More critically, Europe has more than just reciprocal tariffs in its arsenal. The countermeasures being discussed in Europe even include tougher "toolbox or counter-coercion measures," which could push the situation from trade friction to geopolitical issues, leading to a sharp contraction in market risk appetite.

The second reason is that the CLARITY Act, which cryptocurrency enthusiasts were looking forward to, has been paused under the leadership of Coinbase's CEO. The core controversy is that the draft tends to prohibit earning income solely from holding stablecoin balances, which would suppress the growth and commercialization path of stablecoins like USDC within the U.S. system. The market originally expected the bill to be implemented quickly to end regulatory uncertainty, but it has turned into "key points delayed + internal industry division," resulting in investors pulling back valuation premiums and withdrawing expected favorable leverage.

So, "Is today's decline over, or will it continue to drop tomorrow?" My conclusion is:

First, whether the tariff news continues to escalate. Will the targets expand? Will the pace of increasing the 10% tariff to 25% be accelerated? Will there be statements like "200% tariffs on French wines" that further stimulate volatility? If escalation occurs, the probability of a continued decline tomorrow will be high.

Second, whether Europe's response is to avoid escalation or to retaliate immediately. There are indeed voices within Europe trying to avoid escalation, and the market is concerned about whether Europe will restart or introduce a tariff countermeasure list for goods worth €93 billion. Of course, if Europe does not intervene in the Greenland issue, tariffs may end immediately, and the probability of a market rebound will be very high.

Third, the attitude and pace of the U.S. Supreme Court. The reason this round of tariffs is viewed by the market as a geopolitical risk is fundamentally due to the unclear legality and boundaries, especially after Trump repeatedly used tariffs as a diplomatic weapon. Whether the court will impose clearer restrictions on the extension of presidential tariff powers will directly affect market expectations regarding this matter.

If the Supreme Court can quickly signal that the tariffs are illegal, the market will quickly adjust and rebound. However, if the Supreme Court remains silent or endorses Trump's IEEPA tariffs, the market will likely assume that tariffs can be long-term and normalized, which will have a greater impact on risk markets.

Even at the trading level, the "Supreme Court" can be treated as a switch for favorable or unfavorable news. If any clear procedural milestones appear soon (whether to accept, whether to expedite, whether to release restrictive wording), even without a final ruling, it will marginally improve risk appetite. Conversely, if silence continues or the White House adopts a tougher stance, the market will tend to continue deleveraging and lowering risk appetite.

Therefore, my personal view is that we need to keep a close eye on news and attitudes regarding tariffs from Europe and the U.S. If there is a continued escalation, then the market's decline may not be over. However, if either side softens or if the U.S. Supreme Court makes a clear statement, then a market rebound may come faster. As for the CLARITY Act, the help it can provide is currently very limited. If there is no escalation of contradictions, the likelihood of the market maintaining a sideways trend is still relatively high.

PS2: Yes, you read that right, the conclusion is either up or down, or it could be sideways. You might scoff at this, but if you understand a bit, you wouldn't think that way. There is no certainty in this world; telling you that tomorrow will definitely rise or fall is the most irresponsible thing. What I do is outline the factors that influence the market, so you can identify them.

PS3: You let AI write one, let’s see.

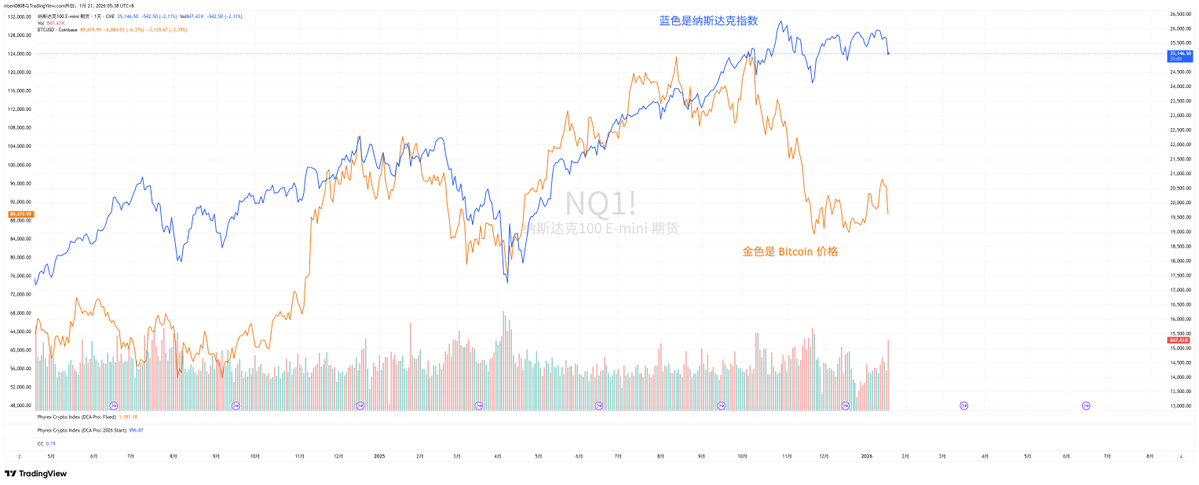

Additionally, this also reminds us of the correlation between Bitcoin and U.S. stocks; movements in U.S. stocks generally reflect on $BTC. Moreover, Bitcoin is essentially an amplifier of U.S. stock sentiment.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。