Source: RootData

Recently, RootData launched a survey regarding the listing decision-making process of cryptocurrency exchanges, collecting 313 valid responses. The participants included Listing BDs, researchers, and members of listing committees, and the results have been compiled into a research report for reference.

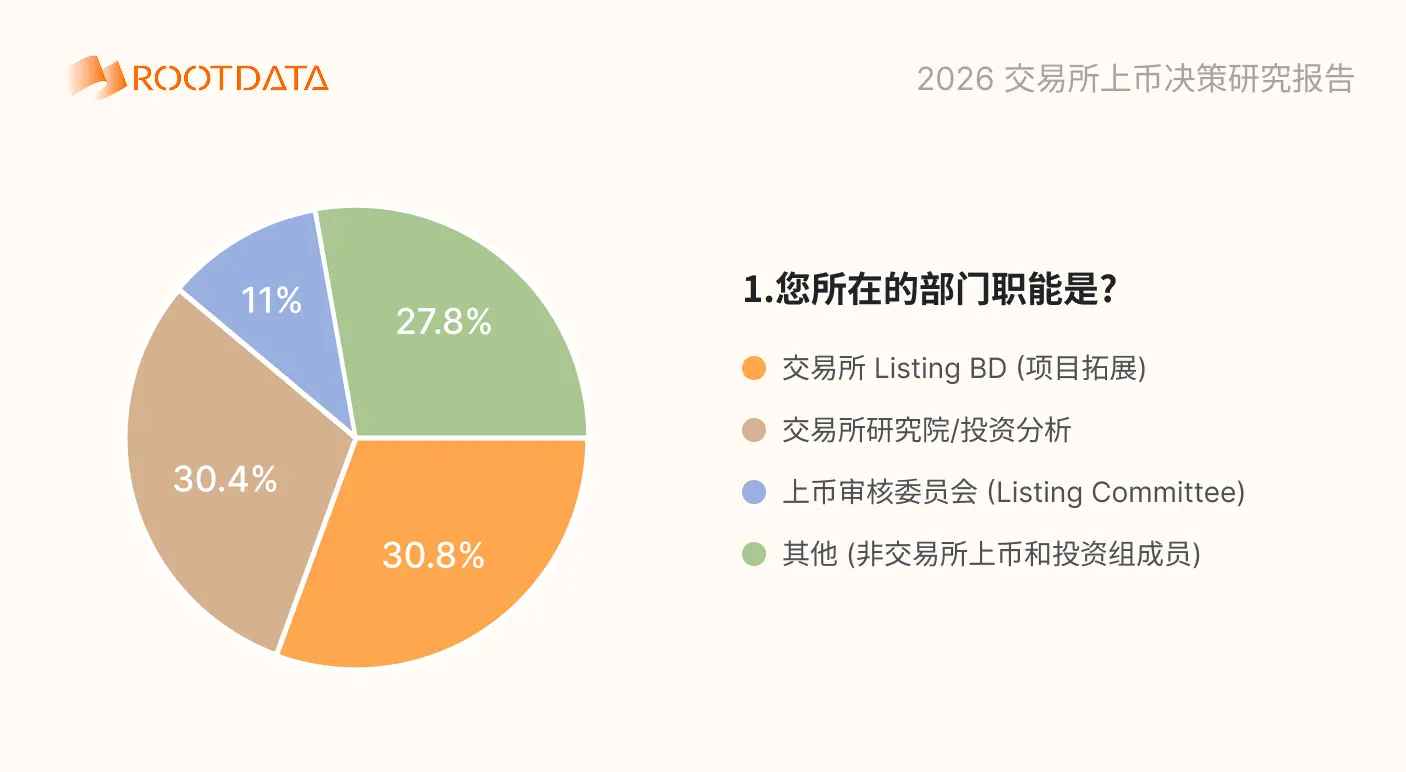

Respondent Profile: Covering Frontline Practitioners and Decision-Makers in Listing

Over 69% of respondents are directly involved in or make decisions regarding listing work. The participants are mainly concentrated in the roles of exchange Listing BDs and research/investment analysis, serving as the "value discovery" and "access control" departments of exchanges, facing immense pressure in processing information.

Decision-Making Pain Points: Fragmented Data and Delayed Updates

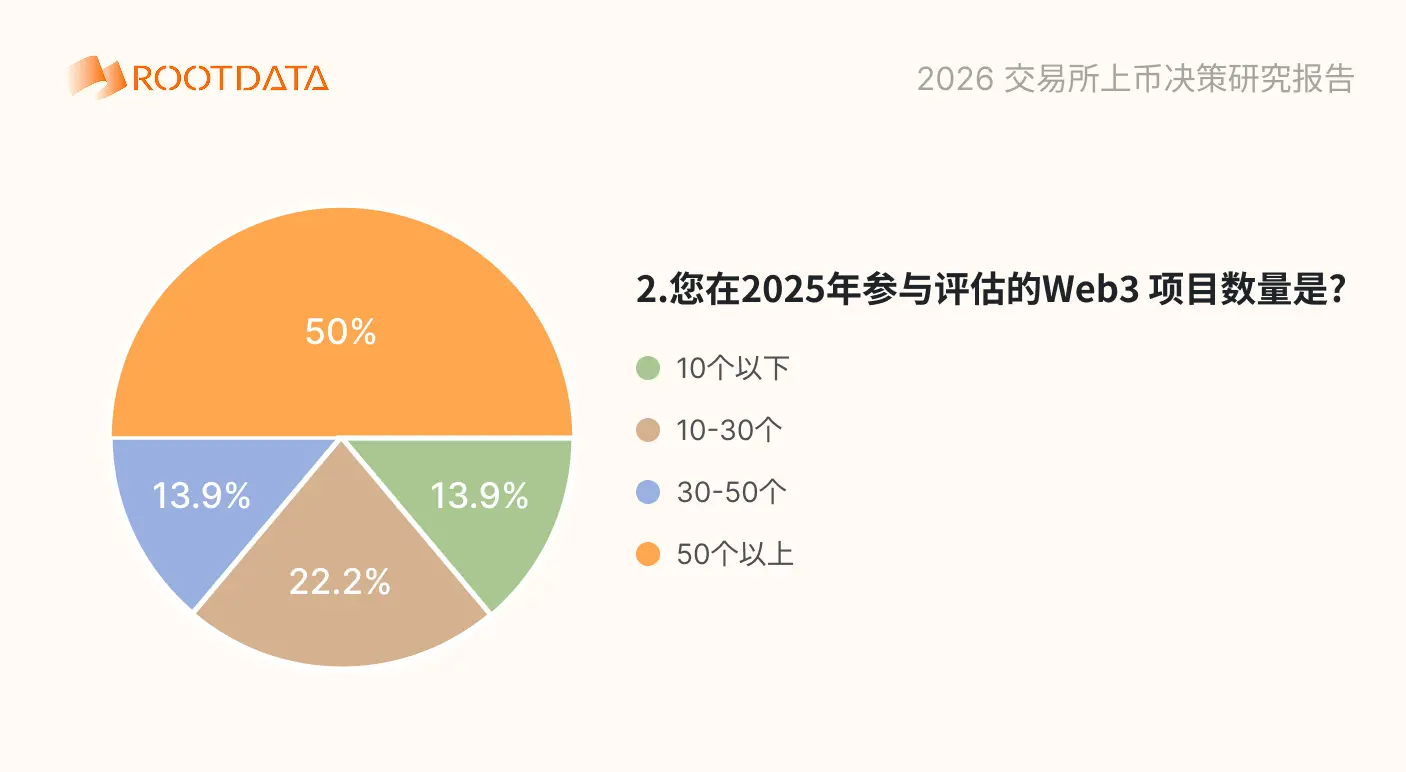

About 50% of respondents evaluate more than 50 projects annually, placing decision-makers in a state of severe "information overload." Among the vast number of projects, only those providing structured and transparent data can significantly reduce the cognitive costs for decision-makers. This indicates that "transparency" has become one of the crucial indicators for projects to stand out within a very short evaluation window.

Distribution of Core Job Responsibilities

Due diligence and decision-making are highly overlapping functions. This means that data platforms are no longer just auxiliary tools but have integrated into the decision-making chain.

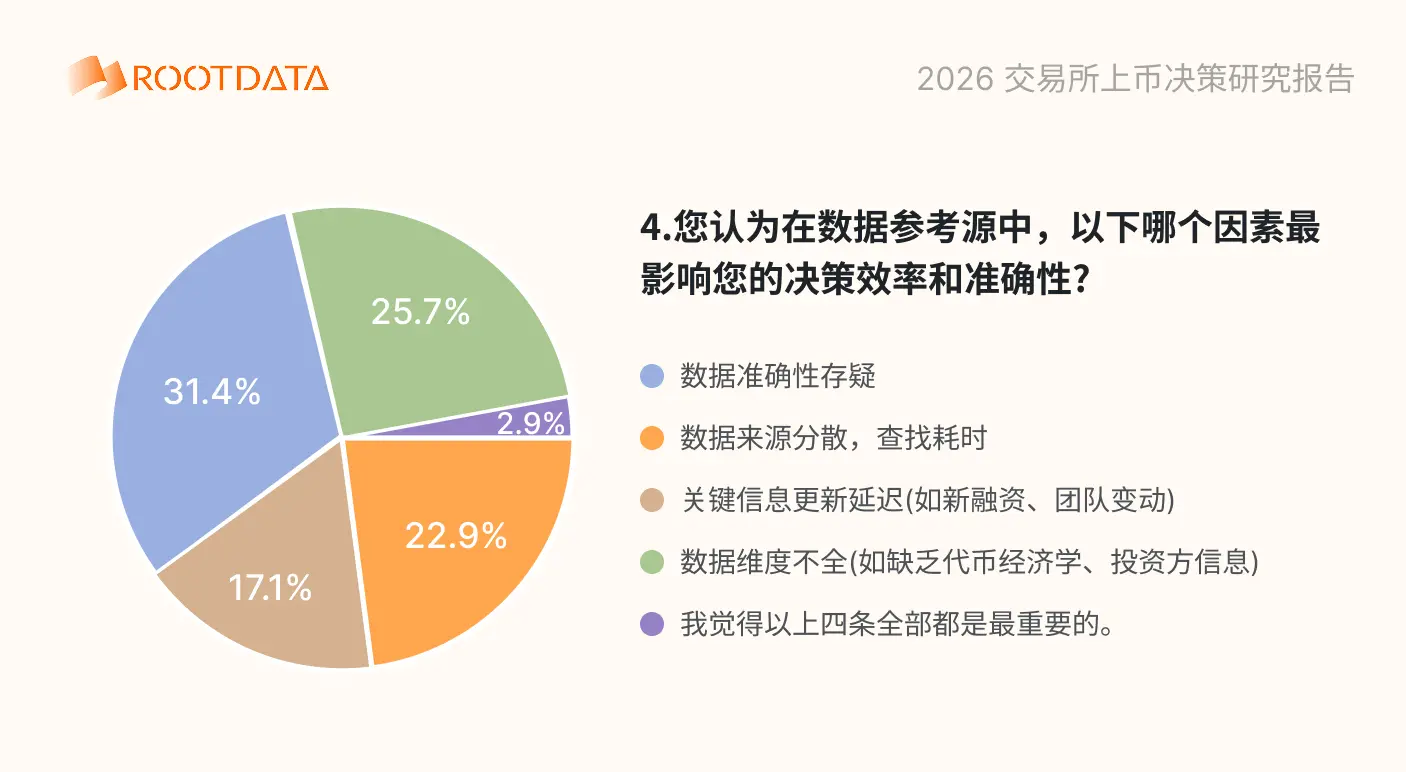

"Stumbling Blocks" to Decision-Making Efficiency

"Trust costs" are the most expensive hidden costs for exchanges. Uncertainty in data can lead to repeated backtracking in the decision-making process. As compliance trends further strengthen, the accuracy and effectiveness of asset information disclosure will become significant factors affecting the listing cycle of exchanges.

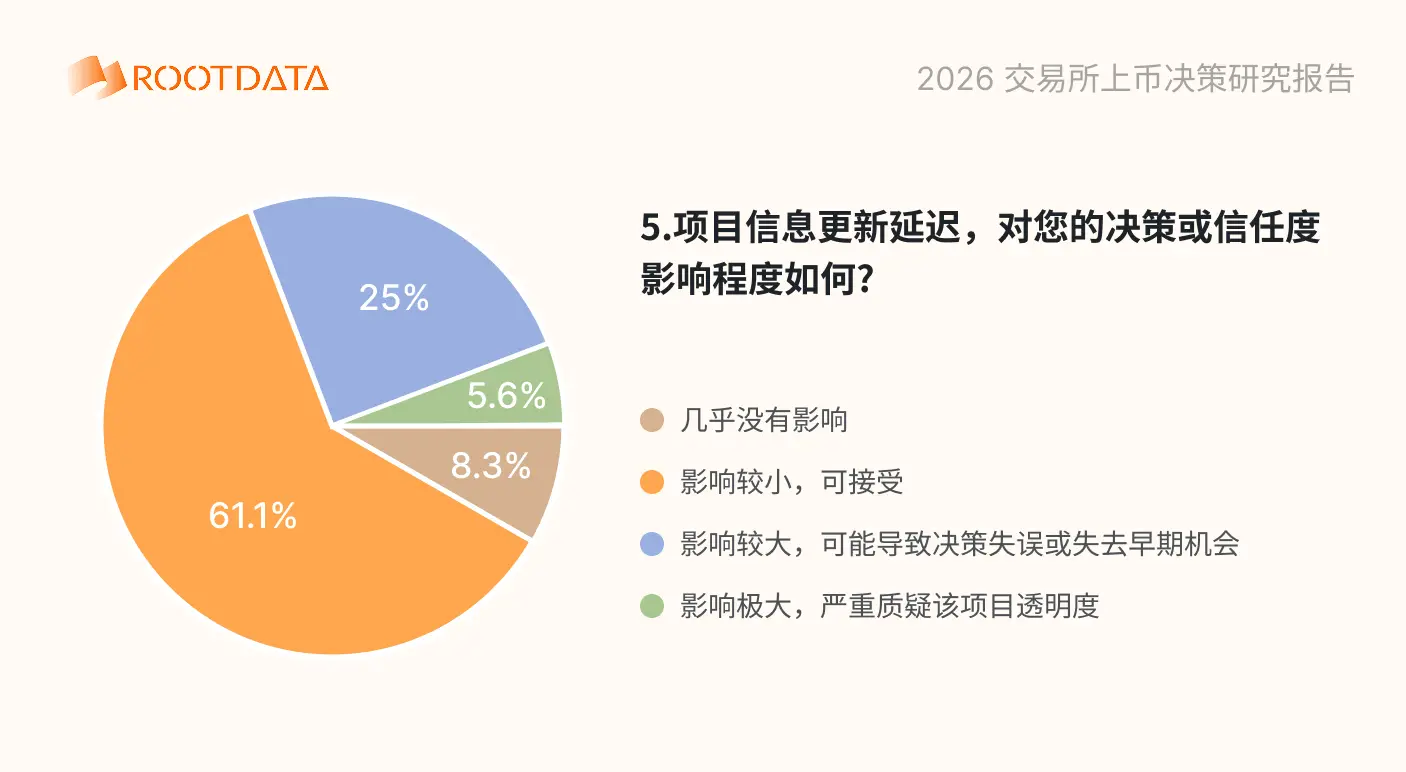

"Hidden Deductions" from Data Delays

Over 30% of respondents believe that delays have a significant or very significant impact, potentially leading to decision errors, missed opportunities, and even doubts about project transparency. Even though 60% of respondents superficially find it "acceptable," the lag in project information updates may implicitly deduct points in the listing evaluation.

Handling of Outdated Information

50% of respondents indicated that if the project data is not transparent, it would trigger the exchange's "defensive due diligence," extending the review time. 16.7% of respondents explicitly stated they would halt the review process or even directly reject the project's listing application.

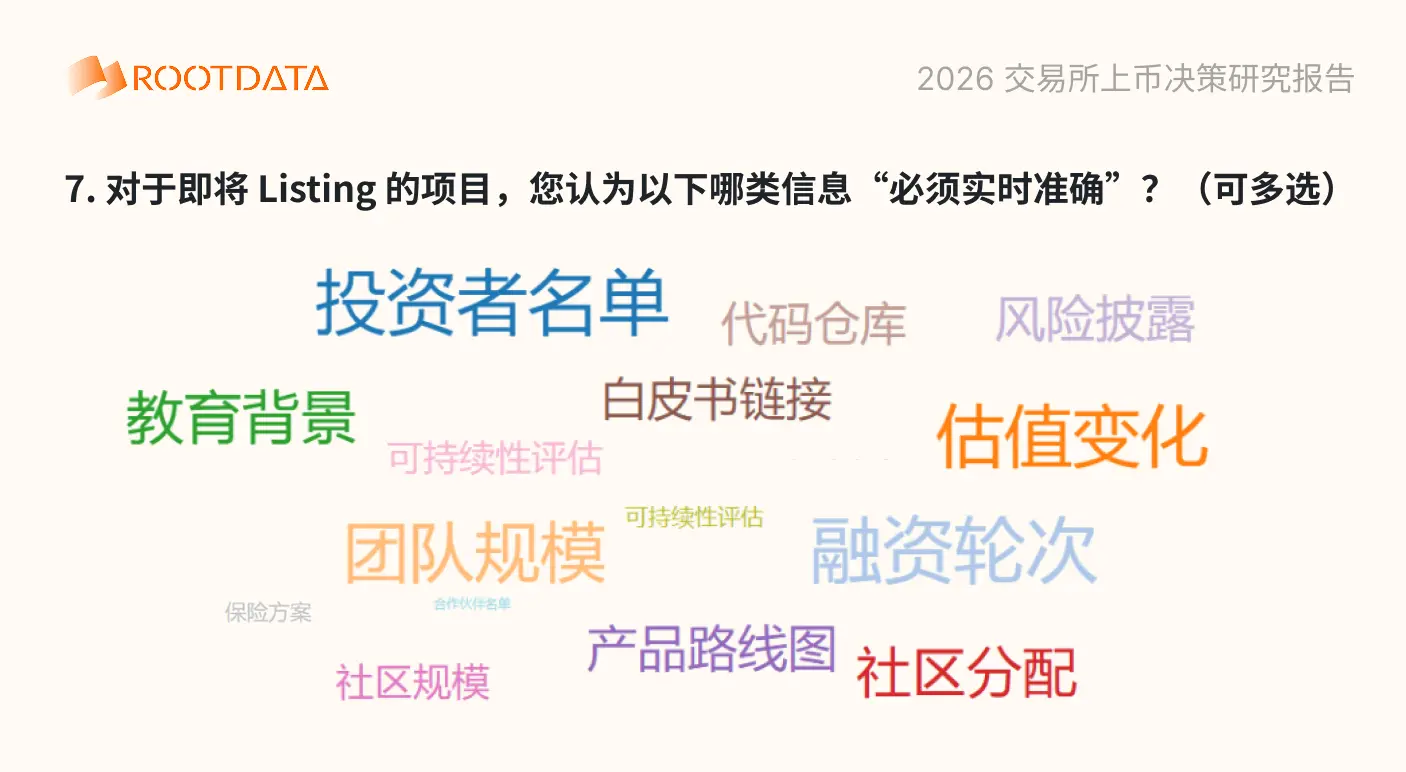

"Essential Course" for Listing Review

The historical evolution of assets such as institutional investors, valuation, teams, and product roadmaps forms the credit foundation of Web3 projects. In reality, this information is also very easy to falsify, so over half of the respondents indicated that they greatly need third-party data platforms to help cross-verify information.

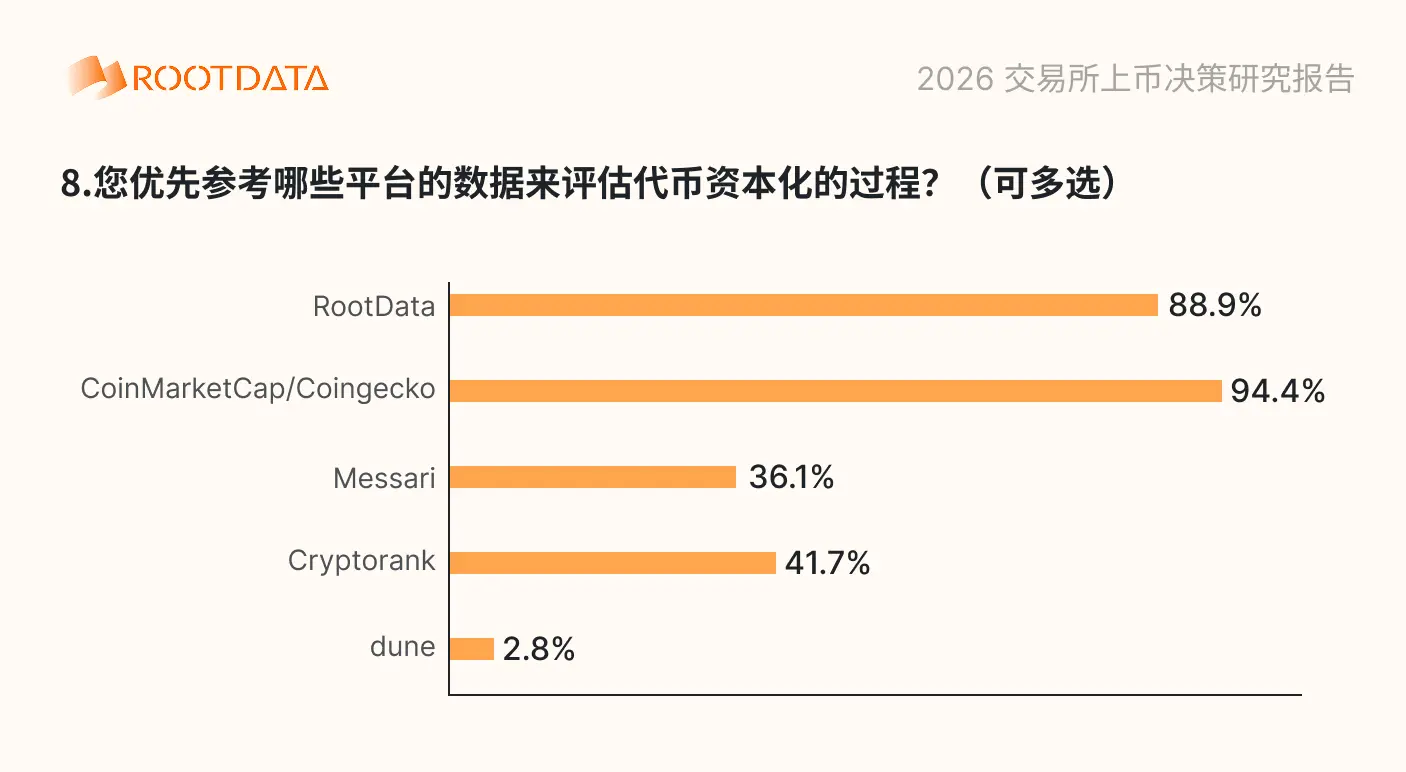

Preferred Data Platforms

88.9% of respondents stated that they would choose to reference RootData's data, making it an essential tool for exchange listing teams. This is particularly evident for projects with low token capitalization (mainly first TGEs or those not listed on major global cryptocurrency exchanges). This high penetration rate indicates that the data structure and quality control established by RootData for Web3 projects are becoming industry standards. For projects with very high token capitalization, 94.4% of respondents would choose Coingecko or Coinmarketcap for data cross-verification.

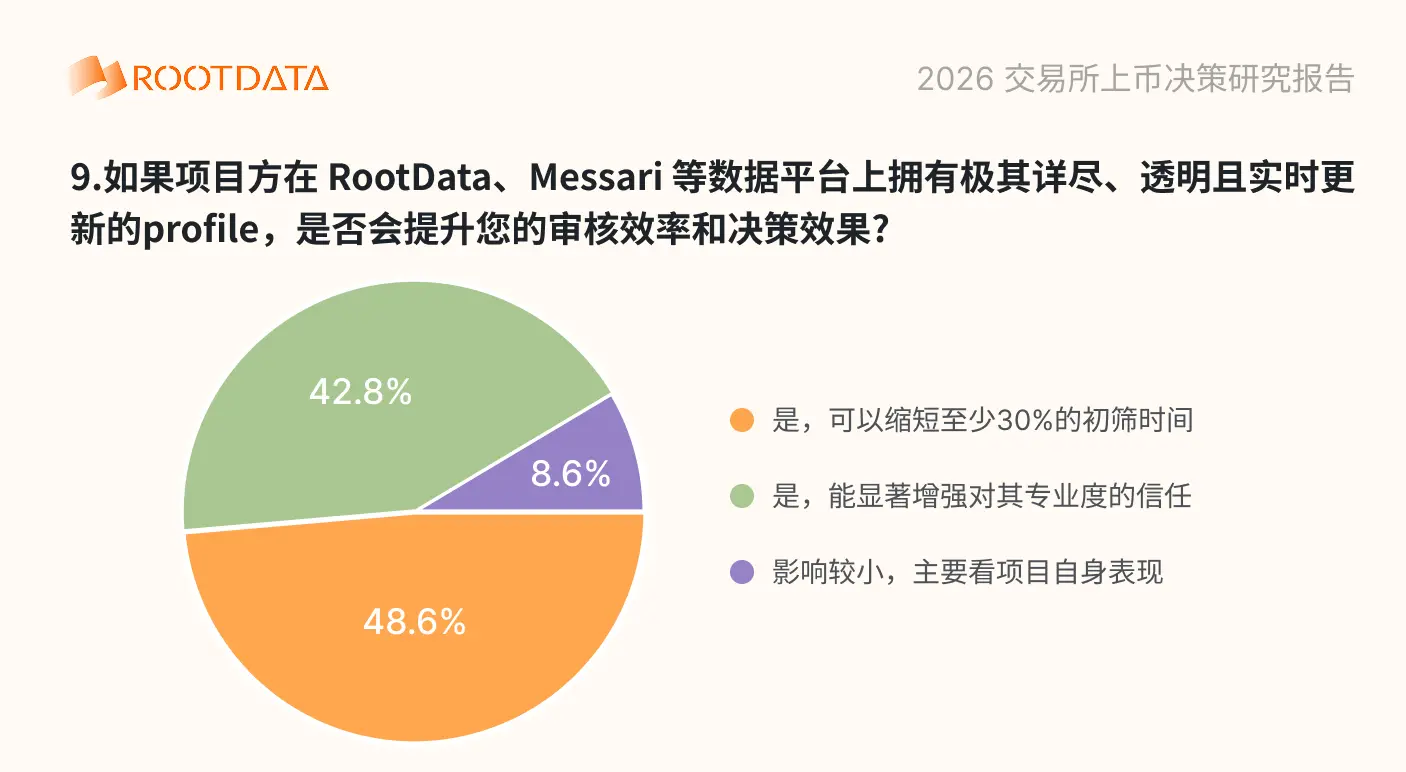

Acceleration Effect of Detailed Project Information

91.4% of respondents clearly stated that being included in authoritative third-party data platforms like RootData and Crunchbase with detailed information would significantly improve listing efficiency and favorability, potentially increasing review efficiency by at least 30%.

The Role of Data Platforms in Web3 Development

Only 2.7% of respondents believe that projects do not need to focus on data transparency. As one of the most mysterious aspects of the industry, over 80.6% of users agree that data platforms are very important for their listing decisions. This further indicates that whether a project values data information disclosure will directly affect its capitalization effectiveness and efficiency.

Conclusion

The survey results reflect that more than half of the professionals in exchange listing departments view project information transparency as a crucial aspect of the listing review process, especially regarding institutional investors, valuation, teams, and product roadmaps. The sufficient transparency of information on third-party data platforms can effectively accelerate the review process (by over 30%), while the review cycle for low transparency projects will be prolonged.

In the current state of industry development, many projects are trapped in the dilemma of "issuing tokens leads to price drops," causing users to lose trust in the vast majority of cryptocurrency projects. The reasons include not only the lack of highlights and reliable business models in the projects themselves but also many projects being in a "black box" state due to information opacity. The disclosure status of core project information has become one of the key factors affecting its capitalization progress and effectiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。