Author: Cosmo Jiang, General Partner at Pantera Capital

Translation by: Hu Tao, ChainCatcher

The year 2025 was not primarily driven by fundamentals in the cryptocurrency market. Factors such as macroeconomics, positioning, capital flows, and market structure were the dominant forces—especially for assets outside of Bitcoin.

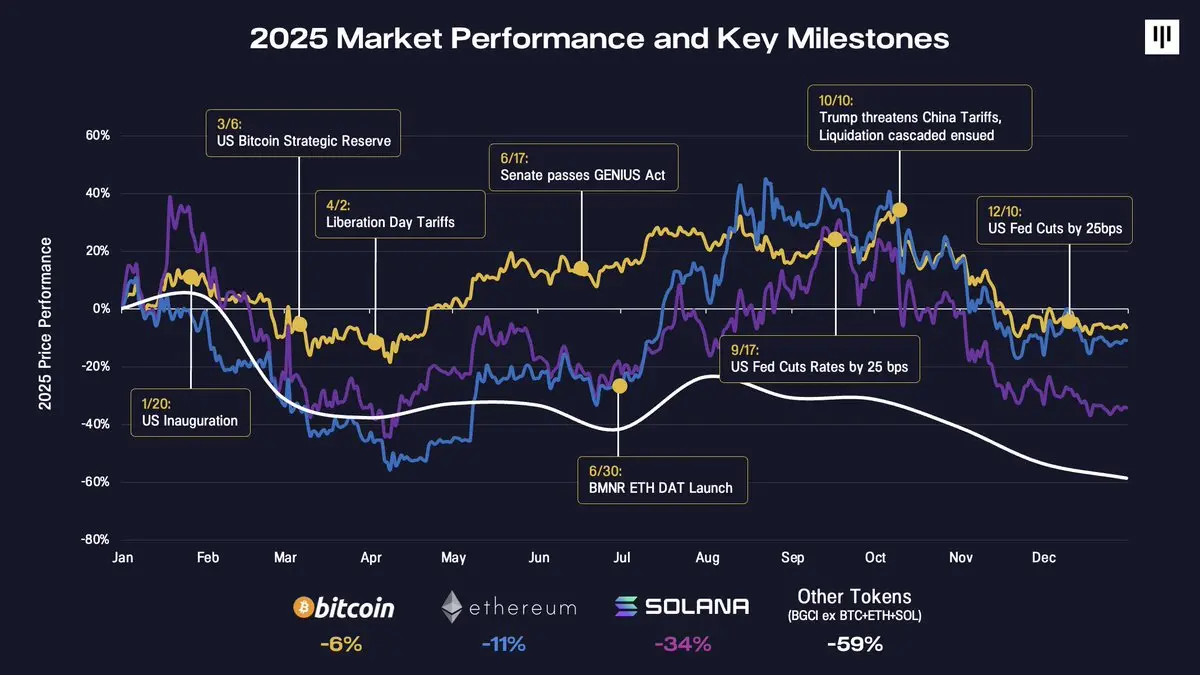

Reflecting on the major macroeconomic and policy turning points of this year helps to understand why market movements felt so disjointed.

The U.S. presidential inauguration at the beginning of the year ultimately proved to be a typical "sell the news" event and an early warning signal of market volatility. In the following months, market risk appetite fluctuated repeatedly—from optimism over the announcement of the U.S. strategic Bitcoin reserves to new pressures from "Liberation Day" tariffs. By mid-year, some constructive progress was made, including the passage of the GENIUS Act, the rise of digital asset treasuries (DAT) like Bitmine Immersion, and the Federal Reserve beginning to cut interest rates, which stabilized market sentiment over the following months.

The fourth quarter marked a decisive turning point, with multiple challenges emerging in succession. The sell-off on October 10 triggered the largest liquidation cascade in cryptocurrency history—surpassing even the Terra/Luna collapse and FTX liquidation—wiping out over $20 billion in nominal positions. The market needed time to digest this shock. Meanwhile, significant marginal buyers (DAT) throughout the year began to exhaust their incremental purchasing power. Seasonal pressures exacerbated this downward momentum, including tax loss selling (especially in the ETF and DAT space), portfolio rebalancing, and systematic CTA fund inflows towards the end of the year.

Bitcoin saw a slight decline by the end of 2025, down about 6%. Ethereum fell approximately 11%. Subsequently, the performance of other tokens deteriorated sharply. Solana dropped 34%, while the broader token market (BGCI, excluding BTC, ETH, and SOL) fell nearly 60%.

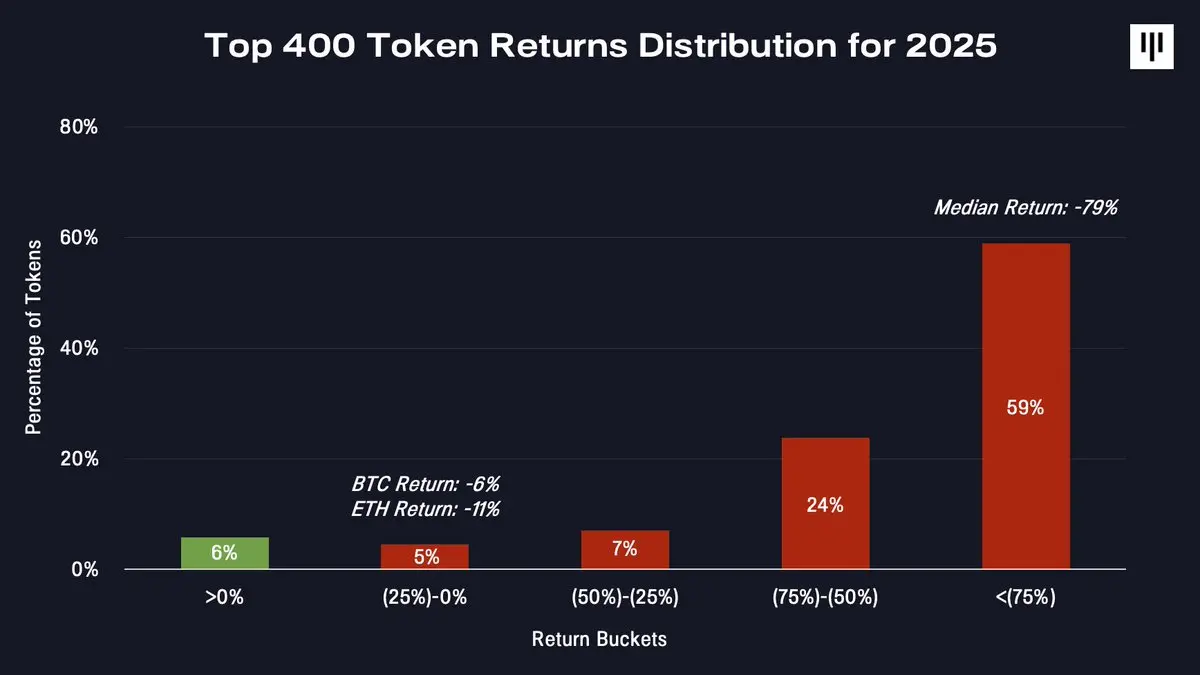

This was an exceptionally narrow market. When examining the return distribution across the entire token market, this dispersion becomes even more apparent.

Only a very small number of tokens generated positive returns. The vast majority of tokens experienced significant declines—the median token fell by 79%.

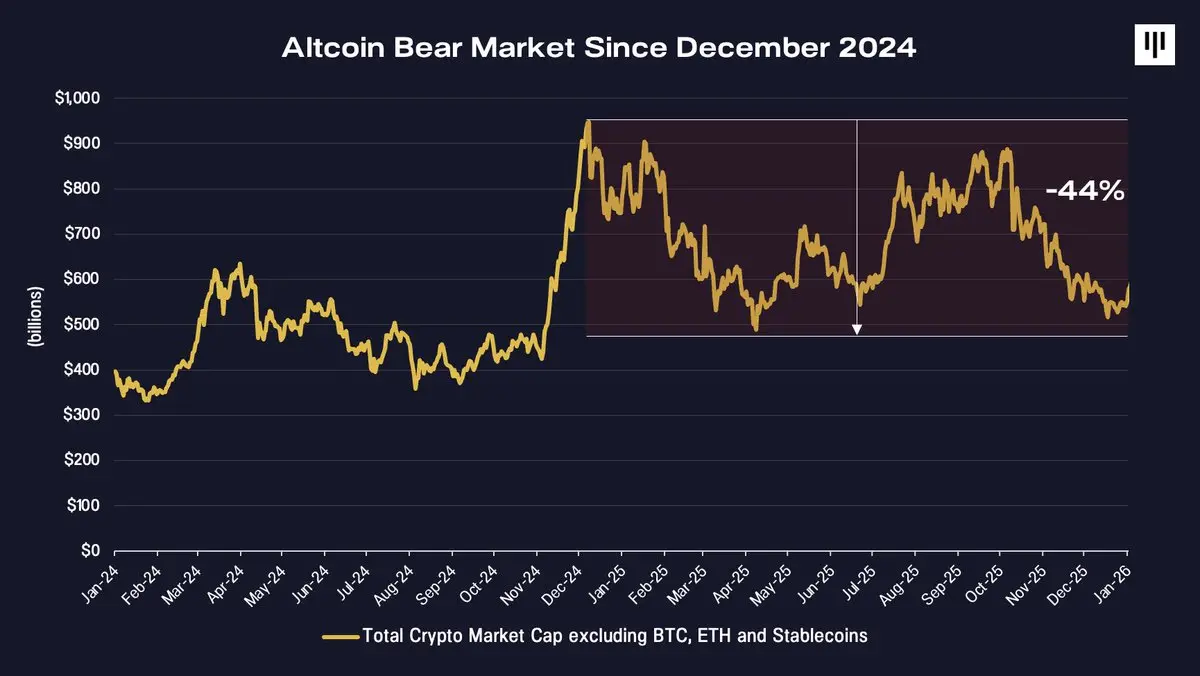

A Year-Long Bear Market for Altcoins

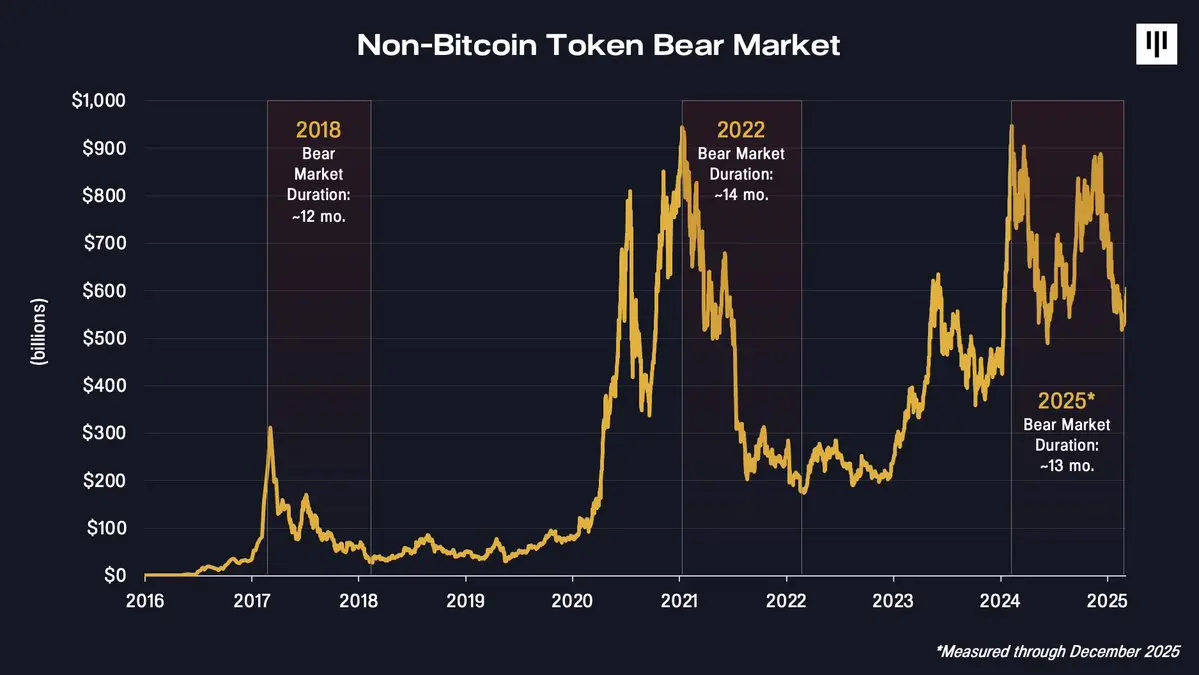

Perhaps the most underestimated reality of 2025 is that the non-Bitcoin token market has actually been in a bear market since December 2024.

The total market capitalization of cryptocurrencies, excluding Bitcoin, Ethereum, and stablecoins, peaked at the end of 2024 and has since continued to decline—down about 44% by the end of 2025. From this perspective, while Bitcoin appeared to perform well at least at certain times during the year, it was a continuation of a bear market for other cryptocurrencies.

Portfolios heavily invested in small and mid-cap tokens performed poorly structurally.

The divergence between Bitcoin and the broader token market reflects their fundamental differences. Bitcoin benefits from a single, well-known concept—digital gold—and increasingly from mechanical demand from institutions such as sovereign nations, governments, ETFs, and corporate finance departments. In contrast, other tokens represent a heterogeneity of disruptive technologies, with lower barriers to entry, less institutional support, and more complex value capture mechanisms.

This divergence is very evident in price.

Structural Headwinds Facing Token Issuance

In 2025, various factors intensified the overall pressure on the token ecosystem.

1. Value Accumulation and Investor Rights

One of the trickiest challenges is the unresolved issue of value accumulation. In traditional stock markets, shareholders have clear legal rights to claim cash flows, corporate governance, and residual value. In contrast, tokens often rely on protocol-level mechanisms that safeguard value through code rather than legally enforced by government institutions.

This year, several high-profile cases highlighted this tension, especially in situations where token ecosystems were acquired or restructured without providing direct compensation to token holders, such as Aave, Tensor, and Axelar. These events triggered strong reactions in the market, even shaking confidence in relatively robust token economic systems.

In this context, the performance of digital asset stocks outperformed tokens, benefiting from clearer value capture pathways, as investors sought defensive investments.

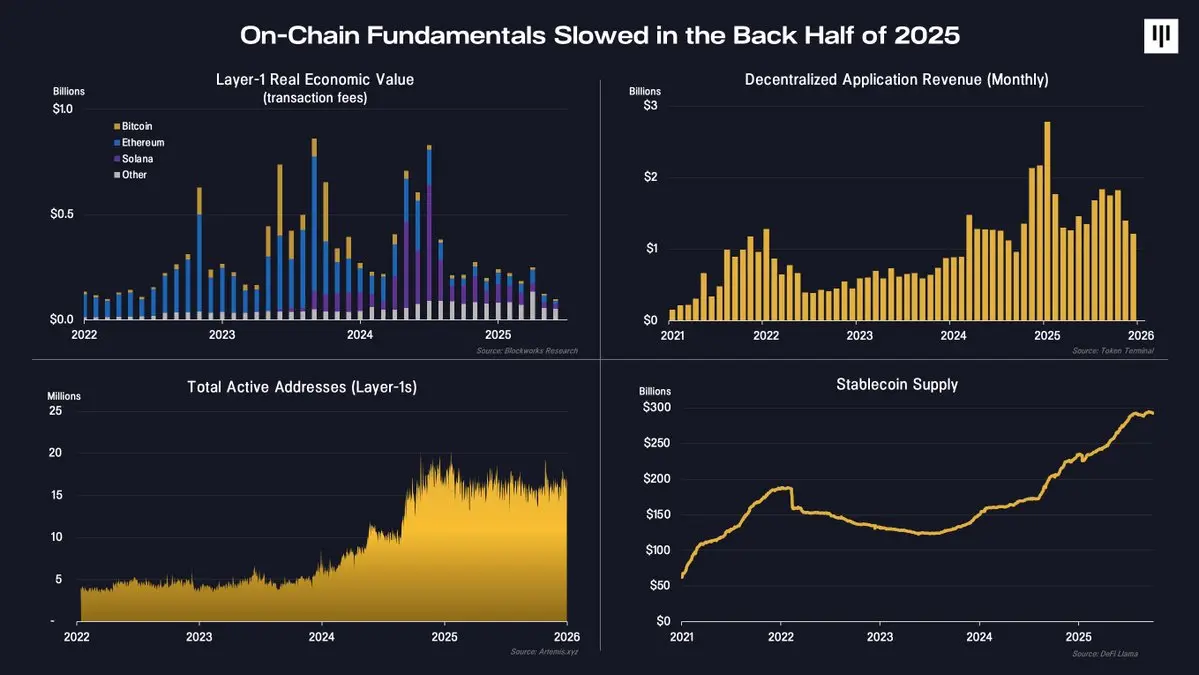

2. Decrease in On-Chain Activity

In the second half of the year, on-chain fundamentals also weakened.

Key metrics, including Layer 1 blockchain revenue, decentralized application fees, and active addresses, showed a slowdown in blockchain activity. Notably, the supply of stablecoins continued to grow, indicating that blockchain applications in payments and settlements are still increasing. However, most of the economic value associated with stablecoins flowed to off-chain equity-type enterprises rather than token-based protocols.

In reality, the foundational layer of usage still exists, but marginal pro-cyclical activity has declined. This shift directly impacted token price trends.

3. Rotation of Speculative Capital

Ultimately, the flow of funds reversed. The marginal capital supporting the broader token ecosystem has historically been dominated by speculative retail investors. Although the adoption rate of institutional investors continues to grow, their funds remain primarily concentrated in assets offered in ETF form, including Bitcoin, Ethereum, and the upcoming Solana launch at the end of the year.

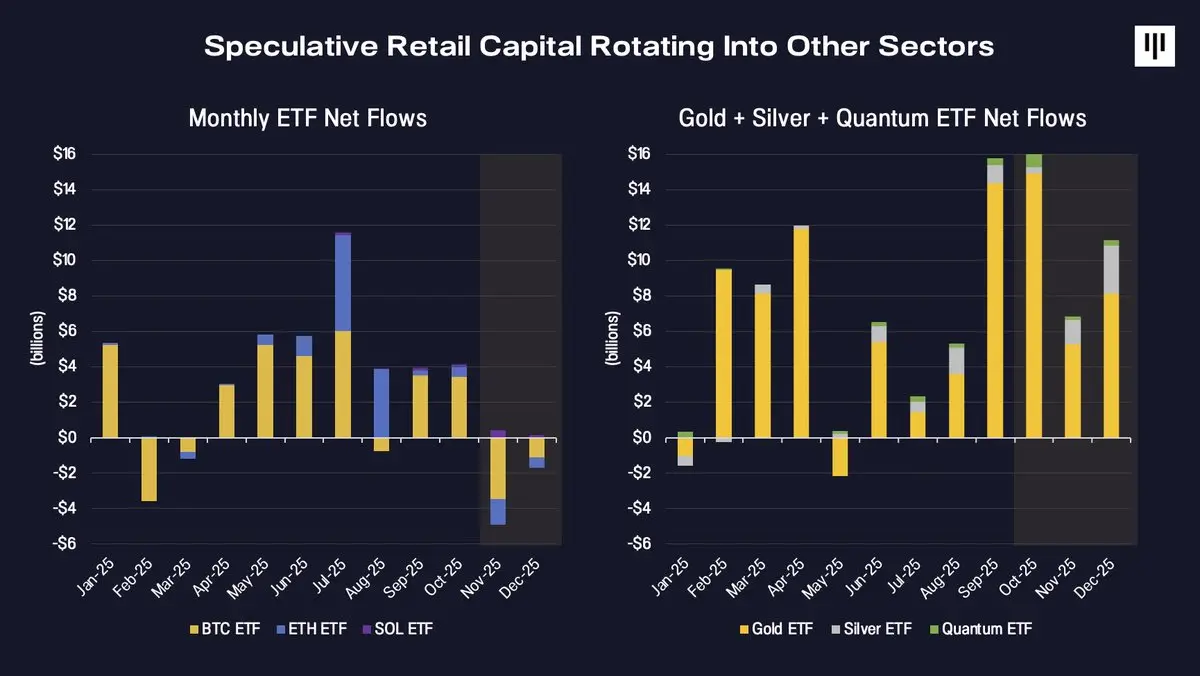

In 2025, speculators' attention shifted to other areas.

Significant inflows into ETFs focused on gold, silver, and emerging thematic trades like quantum computing occurred, while inflows into digital asset ETFs slowed and turned negative later in the year. This rotation of funds coincided with a deterioration in the breadth of the token market, further exacerbating the downward momentum.

Sentiment, Positioning, and Historical Context

By the end of the year, market sentiment had compressed to historically surrender-related levels.

The Fear and Greed Index reached its highest level since the FTX collapse, marking a period of intense market tension. Meanwhile, perpetual futures funding rates declined, indicating reduced leverage and a decrease in speculative excess behavior.

Seasonal factors also played a role. Historically, December is typically a weak month for Bitcoin and the broader cryptocurrency market, with tax loss selling, portfolio rebalancing, and liquidity constraints creating mechanical pressures unrelated to fundamentals.

Importantly, from a longer-term perspective, the current duration of the non-Bitcoin decline aligns closely with previous cycles.

The bear markets of 2018 and 2022 lasted about 12 to 14 months. From the peak at the end of 2024, the current decline is also within the same range. This does not guarantee that the market has bottomed, but it does indicate that the market has experienced a considerable amount of time and price compression.

Why the Landscape May Start to Improve from Here

Despite the challenges of 2025, there are several reasons to maintain an optimistic outlook for the future.

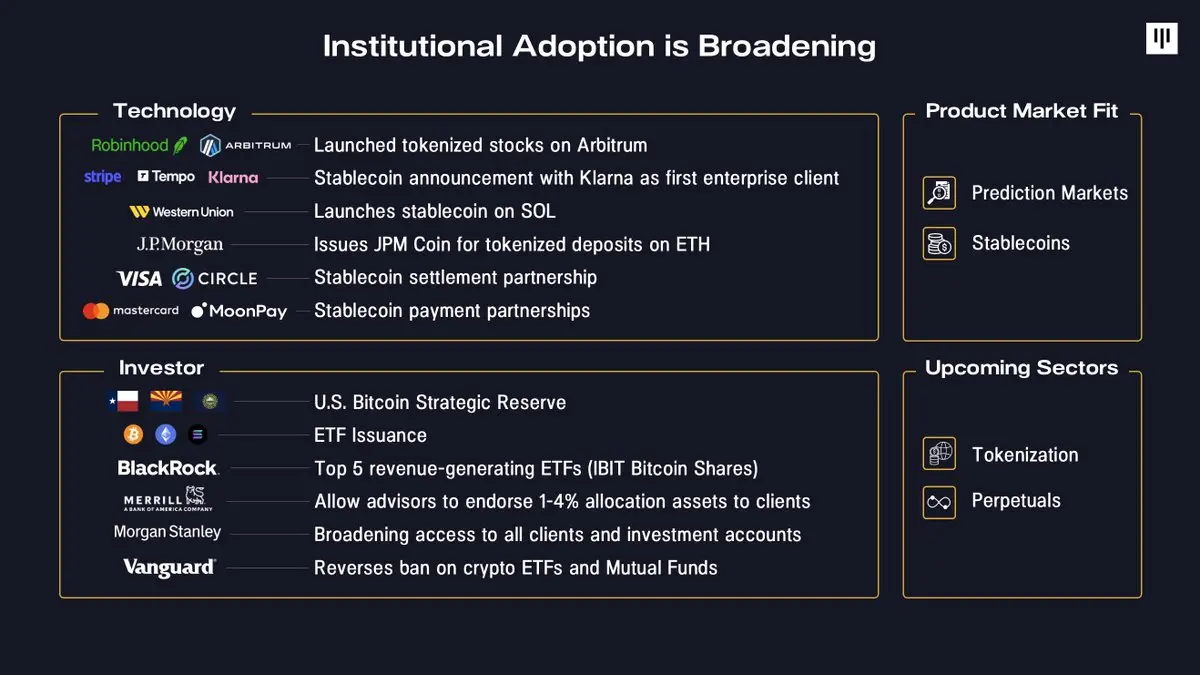

First, the scope of institutional adoption of blockchain technology continues to expand. Companies are increasingly integrating blockchain into their core products—from Robinhood launching tokenized stocks to Stripe developing stablecoin infrastructure, and JPMorgan tokenizing deposits. On the capital front, sovereign reserves have been established, and major brokerages, retirement platforms, and large asset management firms have significantly lowered participation barriers.

Second, the product-market fit is becoming increasingly clear. Stablecoins and prediction markets stand out as prominent use cases for 2025, gaining widespread attention and adoption, while broader tokenization and perpetual futures are also showing initial signs of product-market fit.

Third, the macroeconomic environment is favorable. The U.S. economy remains robust, with wage growth outpacing inflation and corporate profits expanding. As the Federal Reserve halts quantitative tightening, liquidity conditions are improving. The decline in long-term yields, coupled with loose monetary policy, has historically favored risk assets, including digital assets.

Finally, the penetration rate of digital assets remains very low. As Tom Lee from Bitmine noted: currently, only 4.4 million Bitcoin addresses hold Bitcoin worth over $10,000, while the number of traditional investment accounts globally reaches 900 million. According to a Bank of America survey of institutional investors, 67% of professional investment managers still have not invested in any digital assets. Even a slight change in asset allocation over time represents a significant source of potential demand.

Conclusion

The year 2025 was a challenging one for most participants in the token market, characterized by extreme market dispersion, strong performance of mainstream tokens, and continued weakness in tokens outside of Bitcoin. However, this year also facilitated the adoption of institutional investors, clarified product-market fit, and compressed the valuations of most tokens in the ecosystem.

After enduring a year-long bear market, a strong recovery in the overall fundamentals of the token market may present investment opportunities. As market sentiment fades, leverage decreases, and the significant price revaluation of the past recedes, forward-looking investment positioning seems increasingly asymmetric—provided that fundamentals stabilize and market breadth recovers. Historically, market turmoil often lays the groundwork for the next phase of growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。