Author: Delphi Digital

Compiled by: Hu Tao, ChianCatcher

The highest market capitalization internet companies rarely produce any products. The success of Amazon, Meta, and WeChat lies in their control over the channels of information discovery and distribution. The cryptocurrency industry will be no different.

Today's differentiation is reflected at the application layer. Super apps connect existing lending protocols, trading venues, yield sources, and payment channels into a unified interface.

Expanding fintech product lines typically requires obtaining licenses, making expensive acquisitions, or spending years on research and development. The operation of cryptocurrency, however, is different, as adding features may mean connecting to a protocol that has already self-initiated.

Account abstraction, low-cost rollup execution, and reliable bridging have resolved long-standing user experience issues. Tokenized assets, yield products, lending, and prediction markets are emerging with real use cases that go beyond speculation. Here are the main competitors.

Coinbase

Wall Street is familiar with Coinbase as a trusted ETF asset custodian. Cryptocurrency users know Coinbase as the driving force behind Base and its ever-expanding suite of on-chain products.

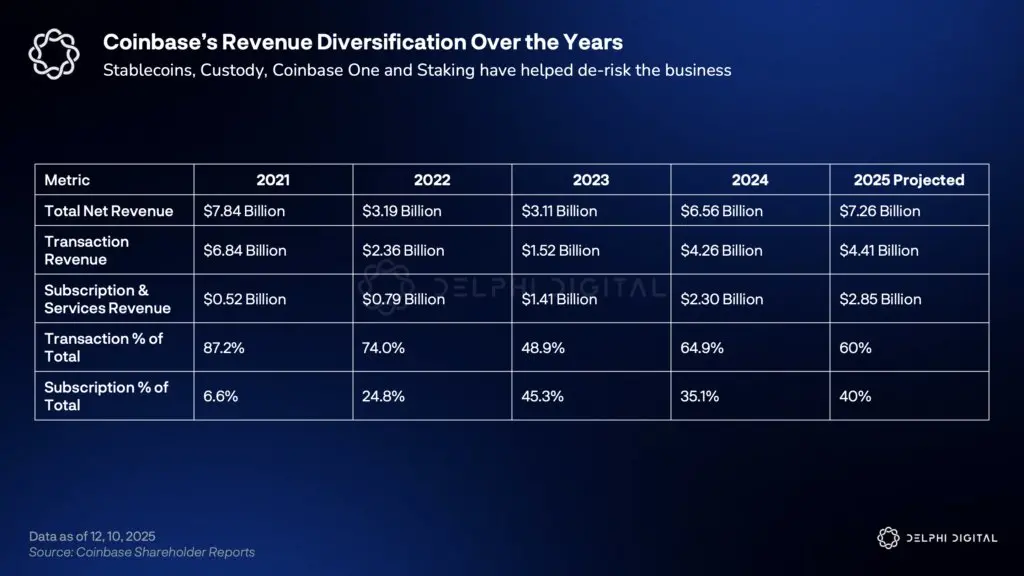

Coinbase initially relied heavily on trading activity as its business model, but it has now diversified. In Q3 2025, stablecoin revenue reached $354.7 million. Revenue related to the dollar reserves held in Circle accounts arrives quarterly, without relying on market activity.

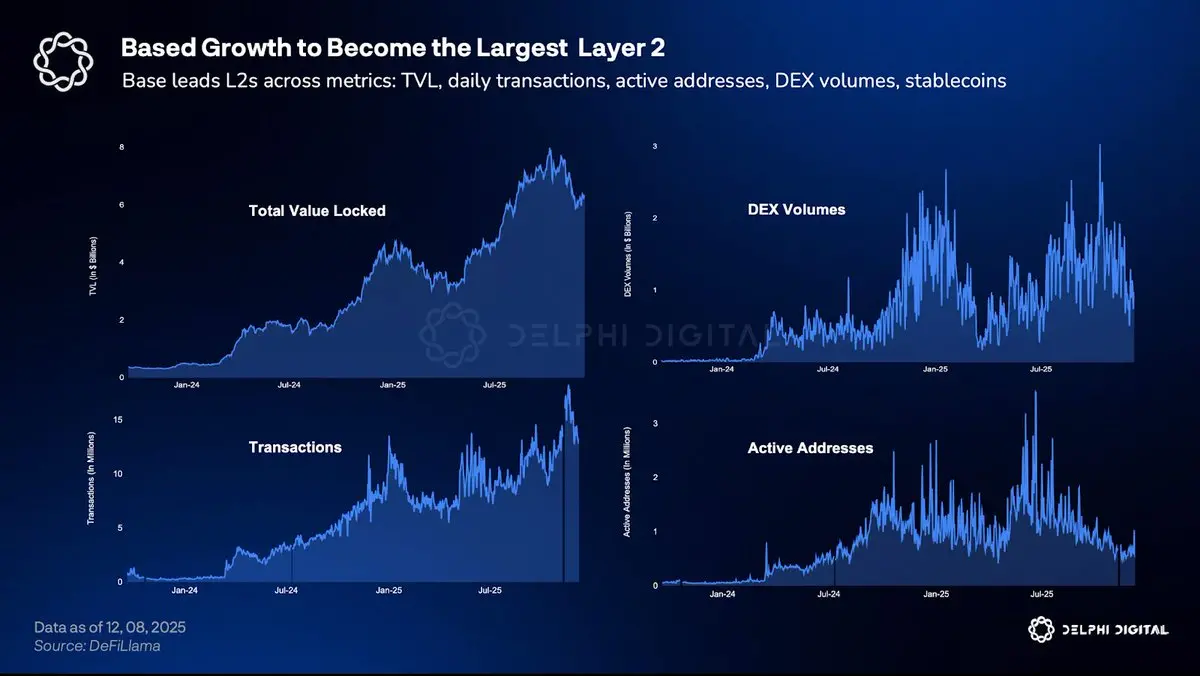

Building on this, Coinbase is constructing an interface layer. The Base App feels more like a content delivery platform than a trading terminal. The underlying rollup platform hosts independent projects, while Coinbase leverages its own influence for promotion. Morpho's total outstanding loans on the Base platform have exceeded $905 million, showcasing the power of compounding. In terms of payments, as AI-driven trading grows, the x402 platform will provide them with proxy payment channels.

Coinbase is also filling strategic gaps through acquisitions. The $2.9 billion acquisition of Deribit has positioned it as a leader in Bitcoin options trading. The $375 million acquisition of Echo marks Robinhood's official entry into the token issuance (IPO) space.

This move is based on the assumption that combining the convenience of custody with permissionless access will yield better results than focusing solely on either model.

Robinhood

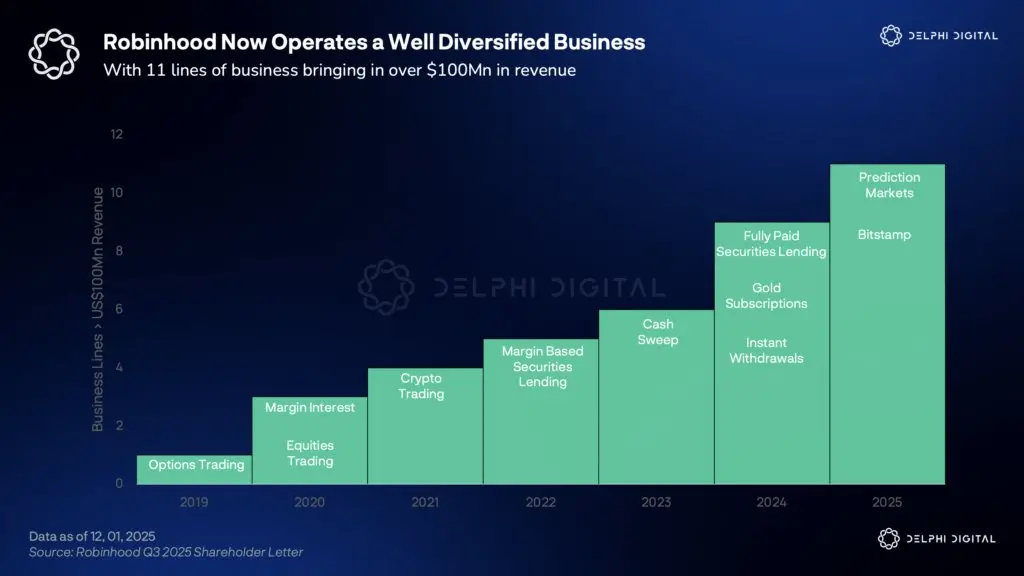

In the past, users needed to open separate accounts for stocks, banking, and digital assets. Funds would be stuck between different platforms and settlement windows. Robinhood integrates this information into one platform. After closing positions, funds can be immediately used for other purposes, such as spending or earning yields.

The subscription model has created a strong user retention mechanism. Gold memberships have grown by 77% year-over-year.

Maintaining access requires keeping assets on the platform. Linked bank cards can reveal user behavior patterns in income, savings, investments, and spending, which help in risk assessment as lending services mature.

International growth primarily comes from blockchain-based securities. Over 400 U.S. publicly traded companies are now open to European users. Although these companies rely on synthetic structures rather than direct ownership, their investments in pre-IPO companies have garnered significant attention. Plans describe eventual settlement through a dedicated aggregation mechanism, which will eliminate overnight waiting periods and remove trading time restrictions.

These plans strike a balance between regulatory credibility and the willingness to rapidly advance emerging fields.

Binance

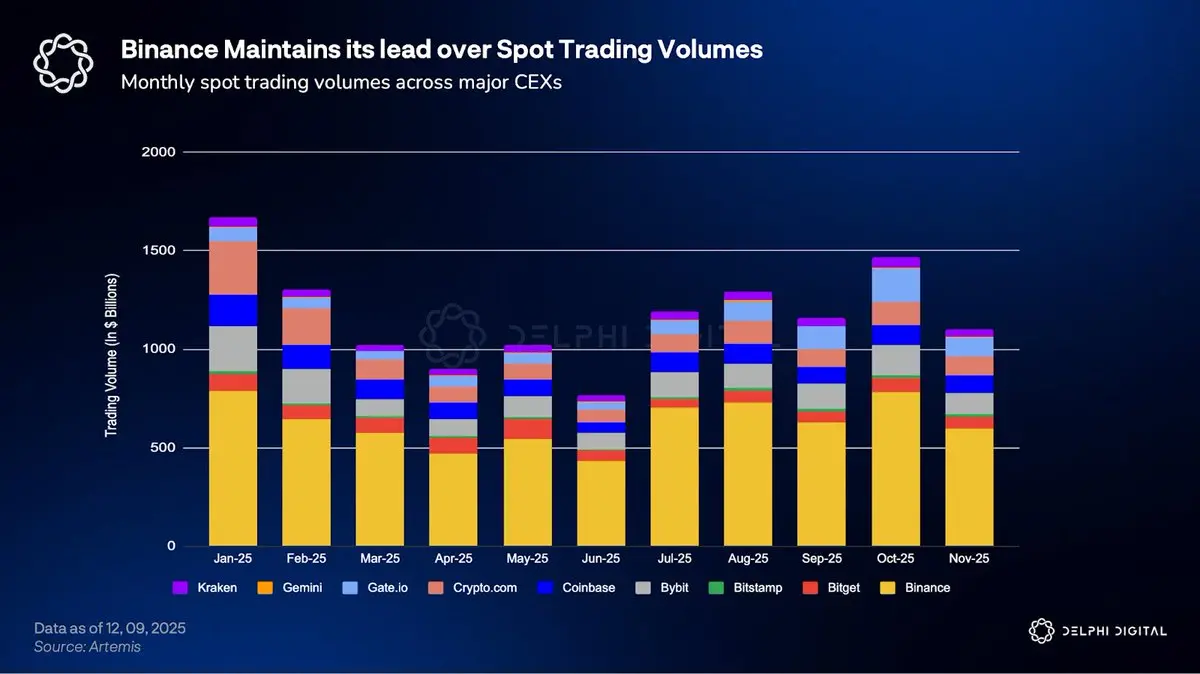

Binance has become the default trading platform for spot and perpetual contracts. As the team identifies and meets user needs, everything else follows. Registered users exceed 270 million. Trading volume reached $7.3 trillion in 2024. Payment processing volume exceeds $250 billion, with over 45 million active users.

Currently, the product encompasses trading for the foundation, merchant and consumer payments, passive income through staking and savings products, self-custody tools for broader ecosystem access, and premium services for large asset allocators.

Their token discovery program showcases the distribution leverage effect. Wallet users can have priority access to new token issuances and receive token rewards. Among the tokens launched through the Alpha test, 18 successfully listed on exchanges. Participants typically buy in at prices below the official opening price of the tokens. It has proven that the user growth achieved through these programs is less costly than traditional advertising.

Each product supports the next. Traders discover yield options, yield earners find payment channels, and wallet users gain usable balances. These services promote each other rather than operate independently.

Kraken

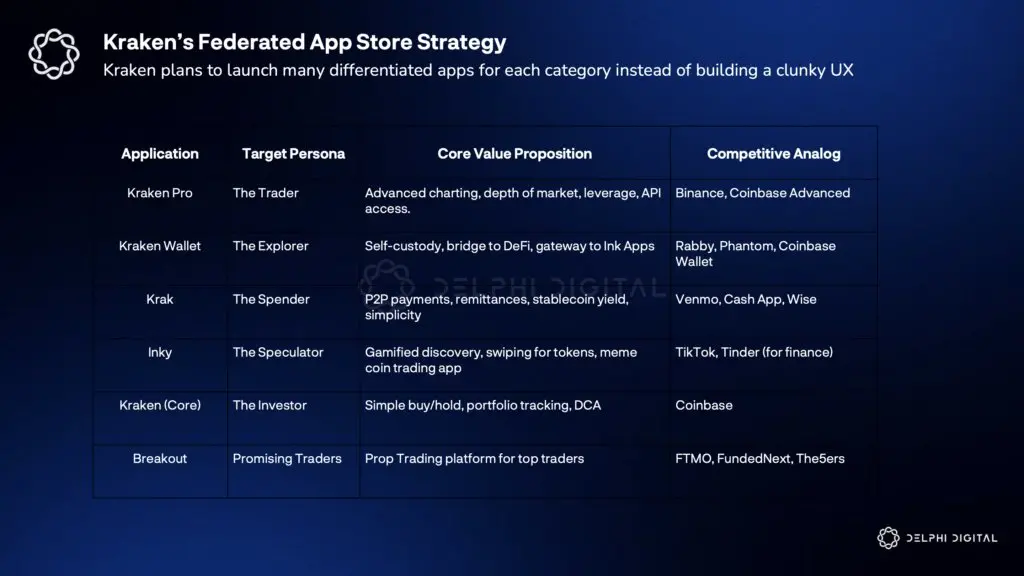

Kraken has noticed that too many features can often confuse users rather than facilitate conversion. Complexity that represents powerful features in some regions may hinder in others. While other platforms seek to unify products, Kraken takes the opposite approach, segmenting user experience while unifying underlying technology.

Inky caters to the needs of impulsive trading through click-based navigation design, aiming to enhance speed. Kraken offers cross-border transfer services, with balances earning approximately 4% annualized yield, and supports globally accepted card payments without conversion fees. The universal rollup functionality allows external developers to build products for existing customers without starting from scratch.

Backed has added tokenized equity features, with issuance exceeding $180 million, and supports external wallets. The $1.5 billion acquisition of NinjaTrader has brought it domestic derivative brand recognition. A well-funded trading platform allows aspiring professionals to trade using company funds after demonstrating their skills.

X

X remains an unknown. The platform hosts important dialogues shaping the development landscape of cryptocurrency, but currently lacks native fund transfer capabilities. Its regulatory approvals cover 38 jurisdictions in the U.S. and have established partnerships with several card organizations. If X commits to providing payment and trading services, given the attention it has already garnered, it will introduce an unpredictable variable.

The interface battle has only just begun. Whoever can become the default interface for cryptocurrency users will win the value of protocol investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。