This report is written by Tiger Research. What would happen if bridged assets could be utilized? We conducted an in-depth analysis of Katana, a blockchain that never sleeps. It reinvests 100% of on-chain, off-chain earnings and transaction fees back into DeFi.

Key Points

- Most Layer 2 solutions lock bridged assets without utilizing them. Katana deploys these assets into Ethereum lending protocols to generate yields, which are then redistributed as incentives for DeFi protocols.

- Storing assets does not generate any returns. Users must deploy capital into Katana's DeFi protocols to earn additional rewards.

- As of Q3 2025, over 95% of Katana's TVL is actively deployed in DeFi protocols. This contrasts with most chains, where utilization rates range between 50% and 70%.

- Katana reinvests 100% of net sequencer fee revenue into liquidity provision, maintaining stable trading conditions even during market volatility.

1. Why Capital is Idle

What happens to your funds when you cross-chain from Ethereum to Layer 2?

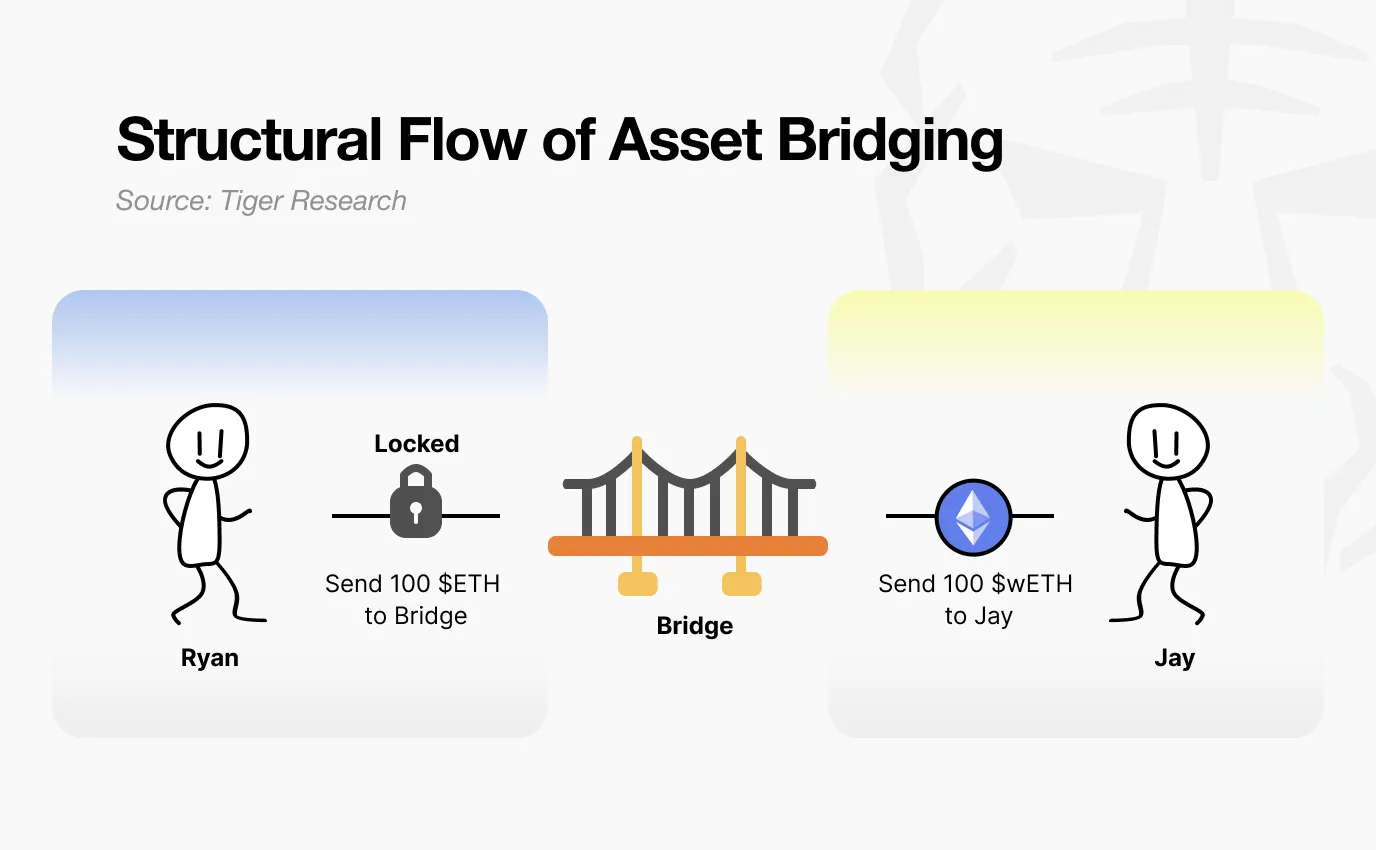

Source: Tiger Research

Most people think their assets are simply transferred. In reality, the process is closer to freezing. When you deposit assets into a bridging contract, the contract holds them. Layer 2 mints an equivalent amount of tokens. You can trade freely on Layer 2, but your original assets on the mainnet remain locked and idle.

Source: Tiger Research

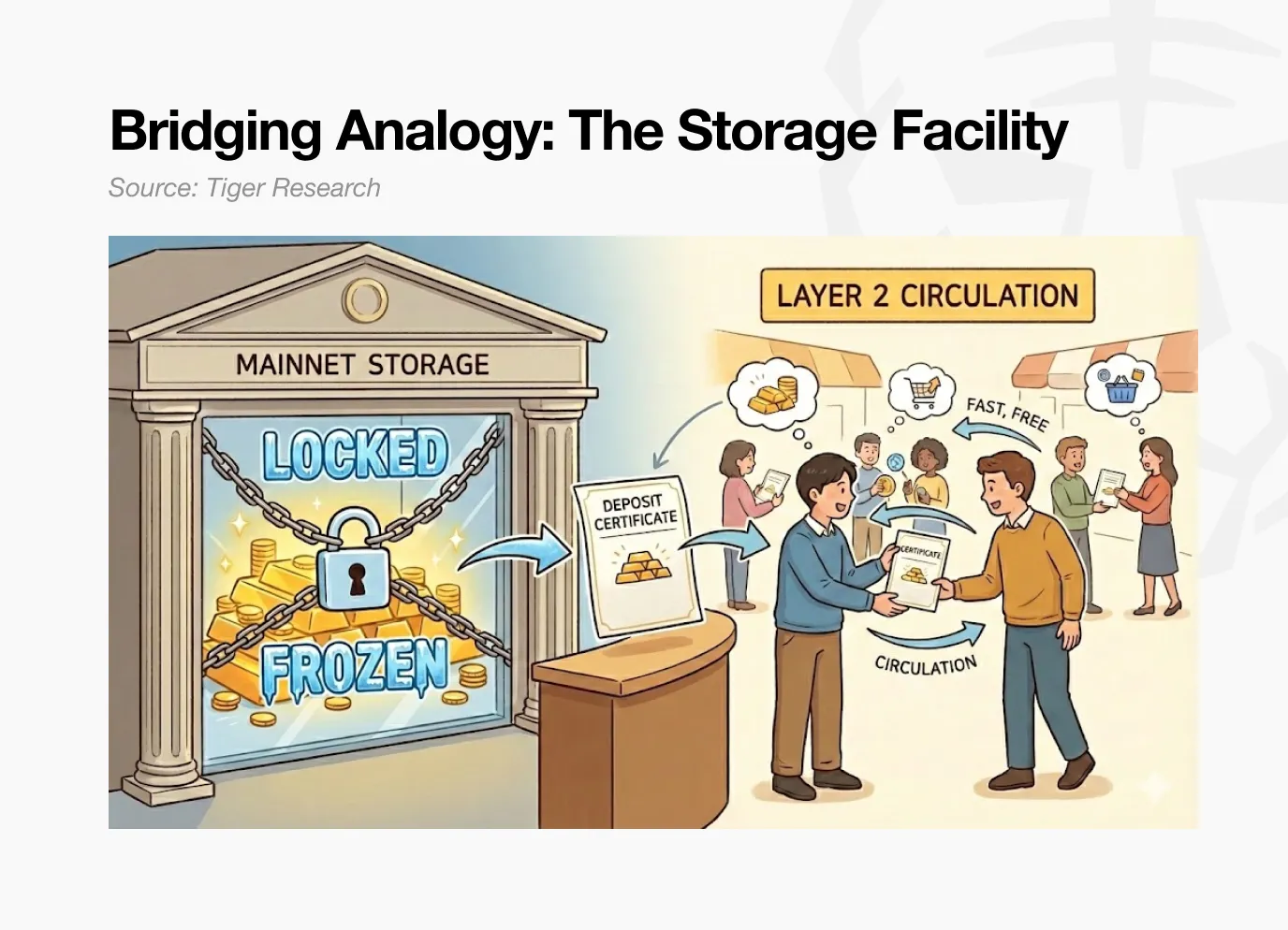

Consider a simple analogy. You store items in a storage facility and receive a withdrawal receipt. This receipt can be transferred to others. However, the items themselves remain in storage until you retrieve them.

This describes how most Layer 2 bridges operate. Assets held in Ethereum custody contracts do not generate any returns. They passively wait until users withdraw them back to the mainnet.

What if bridged deposits on the mainnet could earn DeFi yields while you still enjoy fast, low-cost transactions on Layer 2?

Katana directly answers this question. The capital entering the bridge is not idle. It is put to work.

2. How Katana Activates Capital

Katana activates capital through three mechanisms:

- Cross-chain assets are deployed to Ethereum lending markets to generate yields.

- Transaction fee revenue is reinvested into liquidity pools.

- The native stablecoin AUSD earns U.S. Treasury yields.

External capital is at work, and on-chain capital is also at work. These three mechanisms collectively eliminate idle assets on Katana.

2.1. Vault Bridge

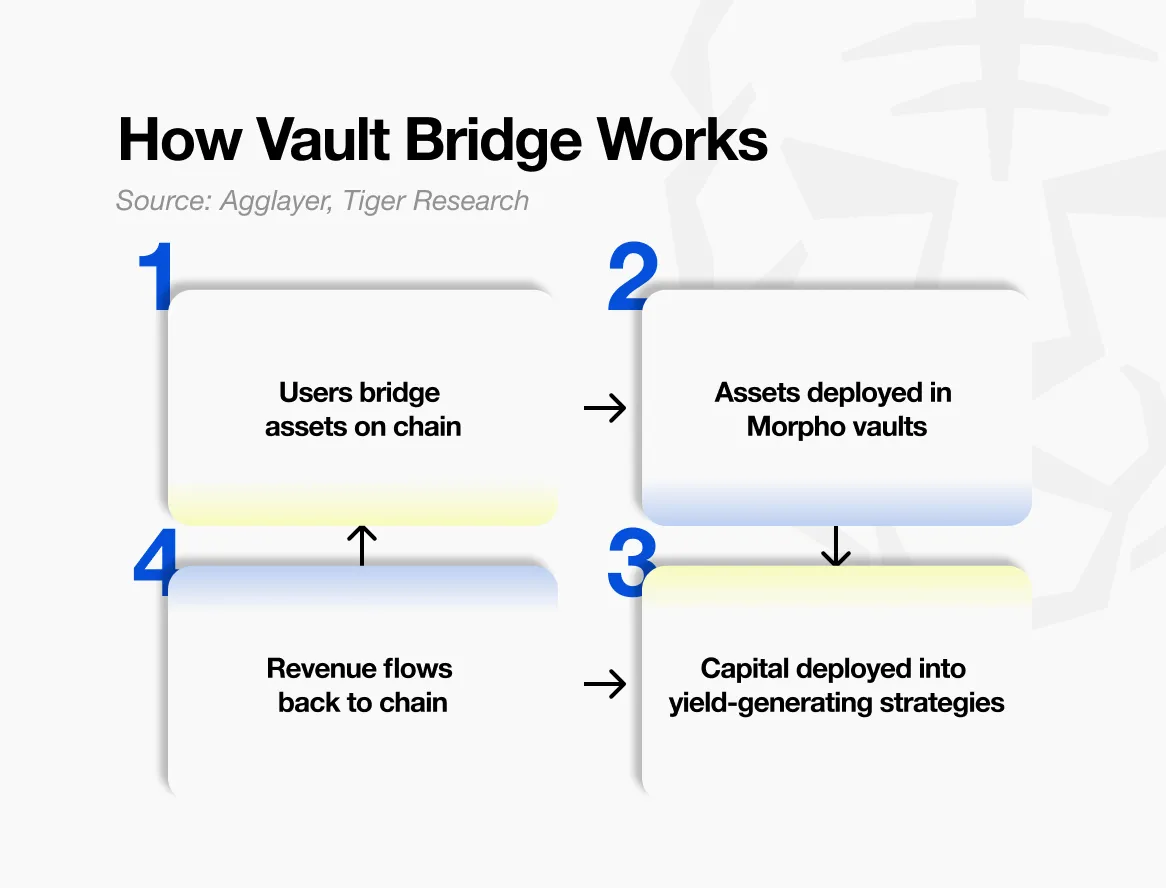

The first mechanism is Vault Bridge. When users send assets to Katana, the original assets remaining on the Ethereum mainnet are deployed to lending markets to earn interest.

Source: Agglayer, Tiger Research

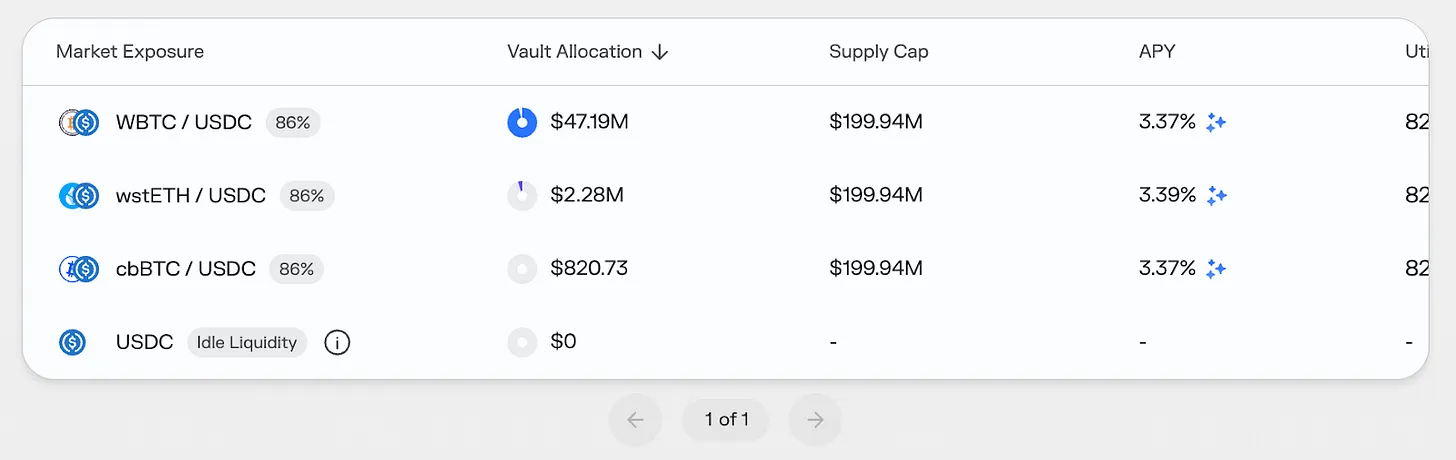

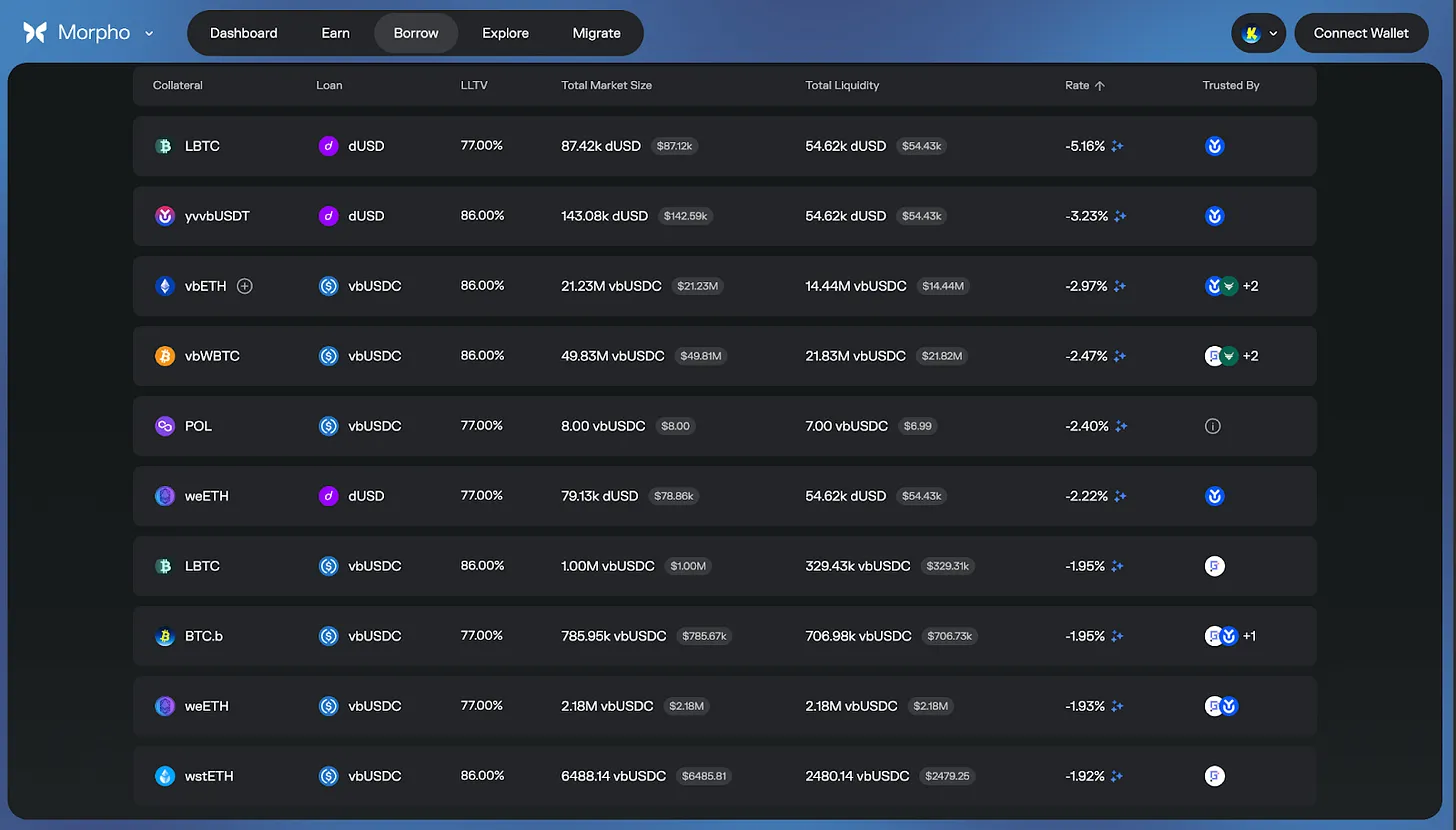

When you cross-chain USDC from Ethereum to Katana, these assets are not simply locked. On the Ethereum mainnet, they are deployed into selected vault strategies of Morpho (a mainstream lending protocol). The generated yields are not directly distributed to individual users but are collected at the network level and then redistributed as rewards to the core DeFi markets on Katana.

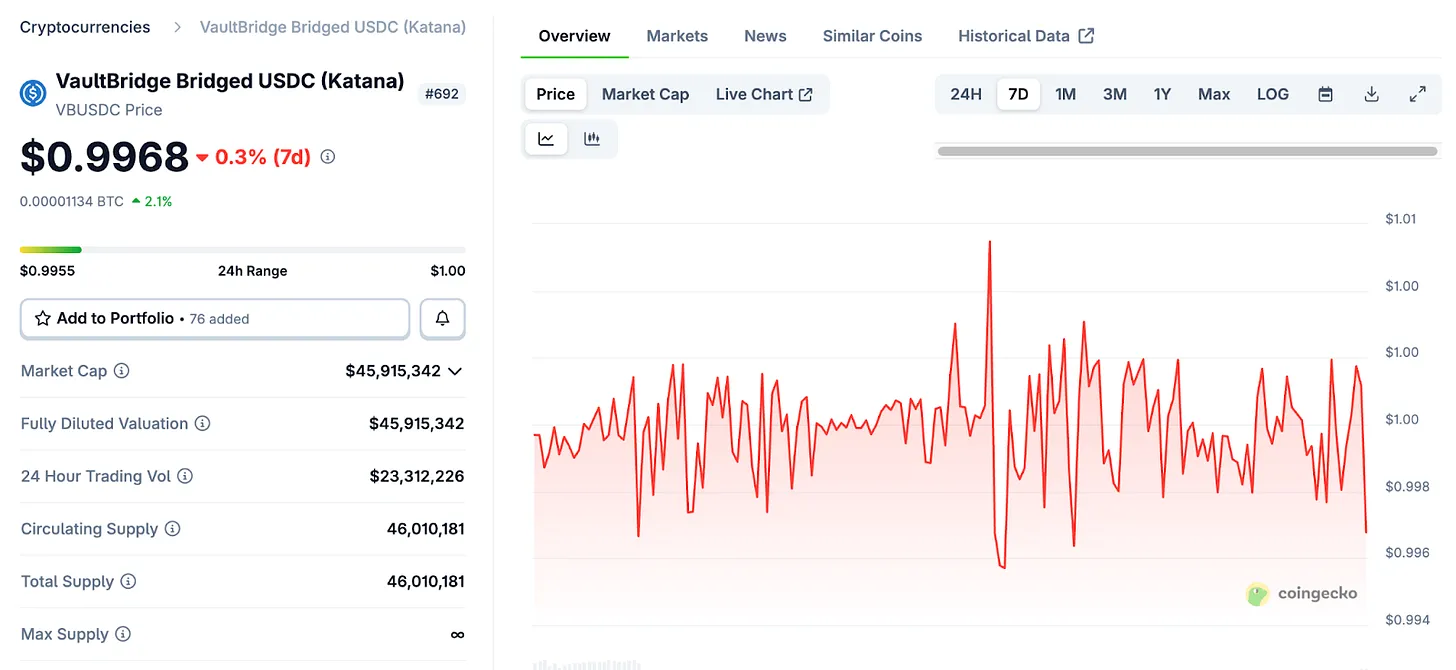

On Katana, users receive corresponding vbTokens, such as vbUSDC. This token can be freely used within Katana's DeFi ecosystem.

It is important to clarify a common misconception. vbTokens cannot be compared to staking derivatives like Lido's stETH. stETH automatically appreciates as staking rewards accumulate.

Source: Coingecko

The mechanism of vbTokens is entirely different. Holding vbUSDC in a wallet does not increase in quantity or price. The yields generated by the Vault Bridge on Ethereum do not flow to individual vbToken holders but rather to Katana's DeFi liquidity pool. These revenues are periodically distributed to the network to strengthen the incentives for the Sushi liquidity pool and Morpho lending market.

Users can only benefit by actively deploying vbTokens. By putting vbTokens into the Sushi liquidity pool or into lending strategies offered by platforms like Yearn, users can earn base yields plus additional rewards from the Vault Bridge. Simply holding vbTokens does not yield any returns.

Katana rewards the active use of assets, not passive holding. Capital that is put to work earns rewards, while idle capital does not.

2.2. Chain-Owned Liquidity (CoL)

The second mechanism is Chain-Owned Liquidity (CoL). Katana collects 100% of net sequencer fee revenue (i.e., transaction processing fees minus Ethereum settlement costs).

The foundation uses this revenue to directly become liquidity providers, supplying assets to the Sushi trading pool and Morpho lending market. This liquidity is owned and managed by the chain itself.

This creates a self-reinforcing cycle. As users trade on Katana, sequencer fees accumulate. These fees are converted into chain-owned liquidity, further deepening the liquidity pools. Slippage decreases, borrowing rates stabilize, and user experience improves. A better experience attracts more users, generating more fees. The cycle continues.

In theory, this structure is particularly effective during market downturns. External liquidity is highly mobile and often withdraws quickly under market pressure. In contrast, chain-owned liquidity is designed to remain in place, allowing liquidity pools to operate continuously and absorb market shocks more effectively.

In practice, this sharply contrasts Katana with most DeFi systems that rely on token issuance to incentivize external capital. By directly maintaining its own liquidity, the network aims for more stable and sustainable operations.

2.3. AUSD Treasury Yields

The third mechanism is AUSD, Katana's native stablecoin. AUSD is backed by U.S. Treasuries, and the off-chain yields generated from these Treasury holdings flow into the Katana ecosystem.

Source: Agora

AUSD is issued by Agora. The collateral backing AUSD is invested in physical U.S. Treasuries. The interest earned from these Treasuries accumulates off-chain and is periodically sent to the Katana network to strengthen the incentive mechanisms for liquidity pools denominated in AUSD.

If Vault Bridge brings on-chain yields, then AUSD brings off-chain yields. These two sources of income are fundamentally different. Vault Bridge yields fluctuate with the conditions of the Ethereum DeFi market, while AUSD yields are tied to U.S. Treasury rates, which are relatively stable.

This diversification allows Katana's income structure to be robust. When on-chain markets are volatile, off-chain yields provide a buffer; when on-chain yields are low, Treasury returns support overall income. This structure spans both the crypto market and traditional finance.

3. Locked Capital vs. Activating Capital

As mentioned earlier, most existing cross-chain bridges choose to simply lock assets for a reason—security. When assets do not move, the system design remains simple, and the attack surface is limited. Most Layer 2 networks adopt this approach. While secure, capital remains idle.

Katana takes the opposite stance. Activating idle assets introduces additional risks, and Katana is very candid about this trade-off. The network does not shy away from risk but collaborates with mature risk management experts in the DeFi space, including companies like Gauntlet and Steakhouse Financial.

Source: DefiLlama

Gauntlet and Steakhouse Financial are seasoned risk management institutions in the DeFi space, experienced in setting parameters for mainstream lending protocols and consulting for top DeFi projects. Their role is similar to that of professional asset management firms in traditional finance, responsible for assessing which protocols capital should be allocated to, determining reasonable position sizes, and continuously monitoring risk exposure.

Source: Morpho

No financial system can provide 100% security, so concerns about residual risk are reasonable.

However, Katana collaborates with top risk management institutions and maintains a conservative treasury structure. An internal risk committee oversees operations. Additional safety measures include multiple protective mechanisms such as liquidity buffers provided by the Cork Protocol.

4. Katana's DeFi Utopia

The current DeFi market faces the problem of liquidity fragmentation. Liquidity pools trading the same assets are scattered across different chains and protocols, reducing execution efficiency, increasing slippage, and lowering capital utilization. Some users profit from arbitrage opportunities arising from these inefficiencies, but most users bear higher costs.

Katana addresses this issue at the system level.

Vault Bridge and chain-owned liquidity concentrate liquidity into core protocols. The result is improved trading execution efficiency, reduced slippage, and stabilized borrowing rates. Most importantly, the yields from idle assets on the Ethereum mainnet are layered onto the base yields, enhancing overall returns.

Source: Morpho

Katana's incentive structure can also significantly lower actual borrowing costs at specific points in time, even creating negative interest rates based on market conditions and reward schemes. This is because the yields from Vault Bridge, CoL, and AUSD are all reinvested into the core market. However, it is important to note that these are incentive-driven results that change with market conditions.

As a result, as of Q3 2025, over 95% of Katana's TVL has been actively deployed in DeFi protocols. In contrast, most chains have capital utilization rates of only 50% to 70%. Ultimately, Katana is building a chain where capital never sleeps, a system that truly rewards actual usage.

Katana never sleeps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。