Author: Climber, CryptoPulse Labs

The headquarters of the New York Stock Exchange (NYSE) is located at 18 Broad Street, New York City, New York, on the south side of the turn on Wall Street.

This is also the center of global financial trading, which has produced countless genius traders. It has inspired many films and TV shows, such as "Wall Street," "The Big Short," "The Wolf of Wall Street," "Barbarians at the Gate," and more…

The NYSE was founded in 1792 and has developed into the largest stock exchange in the world. Except for weekends and scheduled holidays, the trading hours of the NYSE are from 9:30 AM to 4:00 PM. This has led many traders and investors to lament why this exchange cannot be open for a few more hours to allow them to earn more money.

However, it is precisely the strict and regulated exchange system that has allowed approximately 2,400 companies to be listed here, maintaining its position as the largest stock exchange in the world for many consecutive years.

As of the end of last year, the total market capitalization of the entire U.S. stock market was estimated to be about $67.8 trillion, but the total market capitalization of companies listed on the NYSE was about $44.7 trillion, accounting for over 65%!

Additionally, among the 30 companies in the Dow Jones Industrial Average, 24 are listed on the New York Stock Exchange. This illustrates its long-standing significance.

Today, the NYSE is attempting to launch a brand new digital trading platform: allowing tokenized securities, 24/7 on-chain settlement trading, and stablecoin deposits and withdrawals, pending regulatory approval.

Why is the NYSE doing this? Is it just a gimmick or a new blueprint? Let’s take a look at its more than 230-year history; perhaps we can find insights into this new round of transformation.

1. Origins: From Street Trading to Institutional Foundation

Going back to 1792, just 16 years after the Declaration of Independence was issued in the United States.

At that time, 24 stockbrokers gathered under a sycamore tree on Wall Street in New York and signed the Buttonwood Agreement.

The core of the agreement was not to establish an exchange but to establish rules for alliance trading. For example, brokers would prioritize trading with each other, unify commissions, avoid vicious competition, and those who defaulted would be kicked out of the circle.

Its essence is somewhat like a monopolistic and self-regulating credit alliance, which is very similar to the whitelist of today’s DeFi projects and the logic of node consensus.

Thus, this can be considered an early form of private matchmaking trading, and the choice to sign the agreement under the sycamore tree was not for ceremonial purposes, but mainly because they could not afford to rent a fixed trading venue.

At that time, trading usually took place in cafes, on the streets, or under trees, and trading would stop when the weather in New York was bad, so like farmers, they had to rely on the weather for their trades; on rainy days, trading volume would significantly decrease.

This private club-style trading method at the time became the starting point for the system of today’s strongest exchange in the world.

2. The Industrialization Wave: The Frenzied Growth of Capital

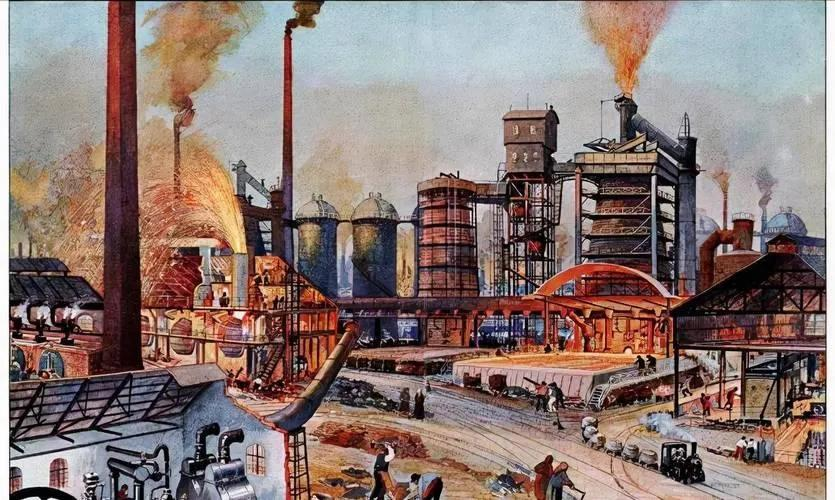

With the arrival of the industrial age, the NYSE gradually began to become the central bridge of American capital.

This period roughly spans from 1860 to 1914, leading up to the eve of World War I.

The industrial revolution directly spurred a wave of companies going public, with industries such as railroads, steel, oil, and electricity generating a massive demand for financing. Iconic companies born during this time include Standard Oil, U.S. Steel, General Electric Company, and more…

However, during this period, the exchange also underwent institutional reforms, such as introducing fixed trading hours, clarifying listing rules, and establishing an "open outcry" system.

Nevertheless, this made the trading floor resemble a "fighting scene," and until electronic trading emerged, the NYSE relied heavily on vocal market activity.

Brokers relied on shouting prices, where gestures were more important than words; pushing and yelling were daily occurrences, leading to some even damaging their vocal cords permanently. There were rumors that some brokers would eat raw eggs to protect their voices.

Thus, during this period, although the trading methods at the NYSE were still relatively "primitive," it played the role of the "heart" of American industrial capital, continuously supplying "blood" for the progress of industrial civilization and modern social civilization.

At the same time, the prosperity brought by the industrial revolution established the NYSE's status as a global financial center, where countless wealth myths unfolded, and many ordinary shareholders realized their wealth dreams. It seemed that everything was developing in the most beautiful direction, with paradise just around the corner.

3. The Great Depression: The NYSE is "Remodeled"

After World War I, the United States became the world's factory and capital center. The rapid economic development ushered the public into the stock trading era, with stocks entering middle-class households, and newspapers, cafes, and barbershops all "recommending stocks." Stocks were seen as a safe savings product.

During this period, leverage was rampant, allowing investors to buy large amounts of stock with just a 10% margin. Meanwhile, banks, brokerages, and trust companies lowered their thresholds to provide financial support to investors.

The U.S. experienced the so-called "Roaring Twenties," with Irving Fisher even declaring that "stock prices have taken root on an eternal high ground," which was a typical example of the "illusion of financial prosperity."

In 1929, the Great Depression struck, marking the most severe global economic recession before World War II.

That year also saw the most severe stock market crash in U.S. history, giving rise to terms like "Black Thursday," "Black Friday," "Black Monday," and "Black Tuesday," which are painful reminders of Wall Street's stock market.

The NYSE became the core stage where the financial bubble burst and panic was amplified; on the day of the crash, some people actually jumped from buildings, leading the NYSE to install protective barriers afterward.

The crash directly exposed issues such as insider trading and market manipulation within the financial market, severely damaging the NYSE's credibility.

U.S. regulatory authorities had no choice but to undertake a structural reconstruction of the financial system, such as the mandatory disclosure of information under the Securities Act of 1933 and the establishment of the SEC in 1934 to regulate the NYSE and separate commercial banks from investment banks…

As a result, the NYSE truly transformed from a "casino" into an "institutional capital market," becoming a national-level financial infrastructure.

4. The Information Revolution: Electronic Technology in the Globalization Era

Entering the 1980s, electronic information technology developed rapidly, and the wave of globalization intensified.

At this time, the NYSE still adhered to the manual market-making system, but the expansion of trading volume and scale had made this "aging" exchange system unable to keep pace.

The slow trading speed, high costs, and unsuitability for high-frequency and algorithmic trading provided an opportunity for the rise of NASDAQ. The NYSE also felt the threat of "disruption" for the first time.

With the massive influx of international capital and an increasing number of foreign companies seeking to go public in the U.S., the NYSE urgently needed to transform and find opportunities for breakthroughs.

Soon after, the NYSE began to fully implement electronic trading services and transformed itself from a membership-based organization into a publicly traded company, ultimately becoming part of many listed companies.

Subsequently, to better develop, the NYSE merged with Euronext and began its journey towards internationalization.

In 2013, the NYSE was acquired by the Intercontinental Exchange (ICE), becoming a core asset under ICE.

Despite the frequent changes in ownership, the NYSE's technology, derivatives, and clearing capabilities have significantly improved. It has evolved from merely a stock trading hall into a comprehensive entity that integrates financial infrastructure, data, clearing, and regulatory compliance platforms.

5. Digital Transformation: Financial On-Chain and Tokenization

The 2008 subprime mortgage crisis swept the globe, leading to a crisis of trust in sovereign governments and currencies, and Bitcoin emerged as a result.

In the following years, blockchain technology developed rapidly, and the cryptocurrency industry flourished. Despite facing various crackdowns, mainstream finance's acceptance of this emerging market has been increasing day by day.

Today, the rise of crypto assets, stablecoins, and RWA (real-world assets on-chain) continuously impacts traditional financial systems and trading methods. Traditional financial institutions are gradually realizing that they should not completely reject or eliminate the blockchain industry but rather tame and take over it.

As a 230-year-old institution, the NYSE has repeatedly integrated into the waves of technological industries, whether during the industrial revolution, technological revolution, digital revolution, or AI revolution… In every new technological trend in society, the NYSE has not chosen to ignore or withdraw. Similarly, this time in the era of cryptocurrency is no different.

Thus, the NYSE has chosen a strategic shift, actively exploring new trading systems such as stock tokenization, on-chain settlement, and 24/7 trading, while deepening its ties with government regulation and ensuring compliance.

Conclusion

The NYSE's development into the world's largest exchange is not merely the result of the financial market's nurturing but a composite product of American national power, industrial expansion, regulatory capacity, and technological evolution.

Behind each upgrade of the NYSE lies a crisis of survival. Each upgrade has made it more competitive, establishing it as the dominant exchange globally.

This time, the NYSE is determined to turn blockchain into the new underlying clearing technology of Wall Street. The goal remains singular: to reconstruct the traditional model of stocks and continue to hold the global capital order in its hands.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。