The price of gold has historically surpassed the $5000 per ounce mark for the first time, while Bitcoin has fallen over 10% from its recent highs, indicating a profound shift in global asset allocation towards risk aversion.

In terms of silver, the price has also broken through $106 per ounce for the first time, nearly quadrupling the silver price from five years ago.

1. Market Milestone

● On January 26, 2026, during the Asian trading session, the international spot gold price historically broke through the $5000 per ounce threshold, reaching a high of $5045.6 during the session. This breakthrough occurred just over 100 days after gold first crossed the $4000 mark, setting a new record for the speed of increase in the global gold market.

● At the same time, spot silver also strengthened, with a high of $106.56 during the session, an increase of over 2%.

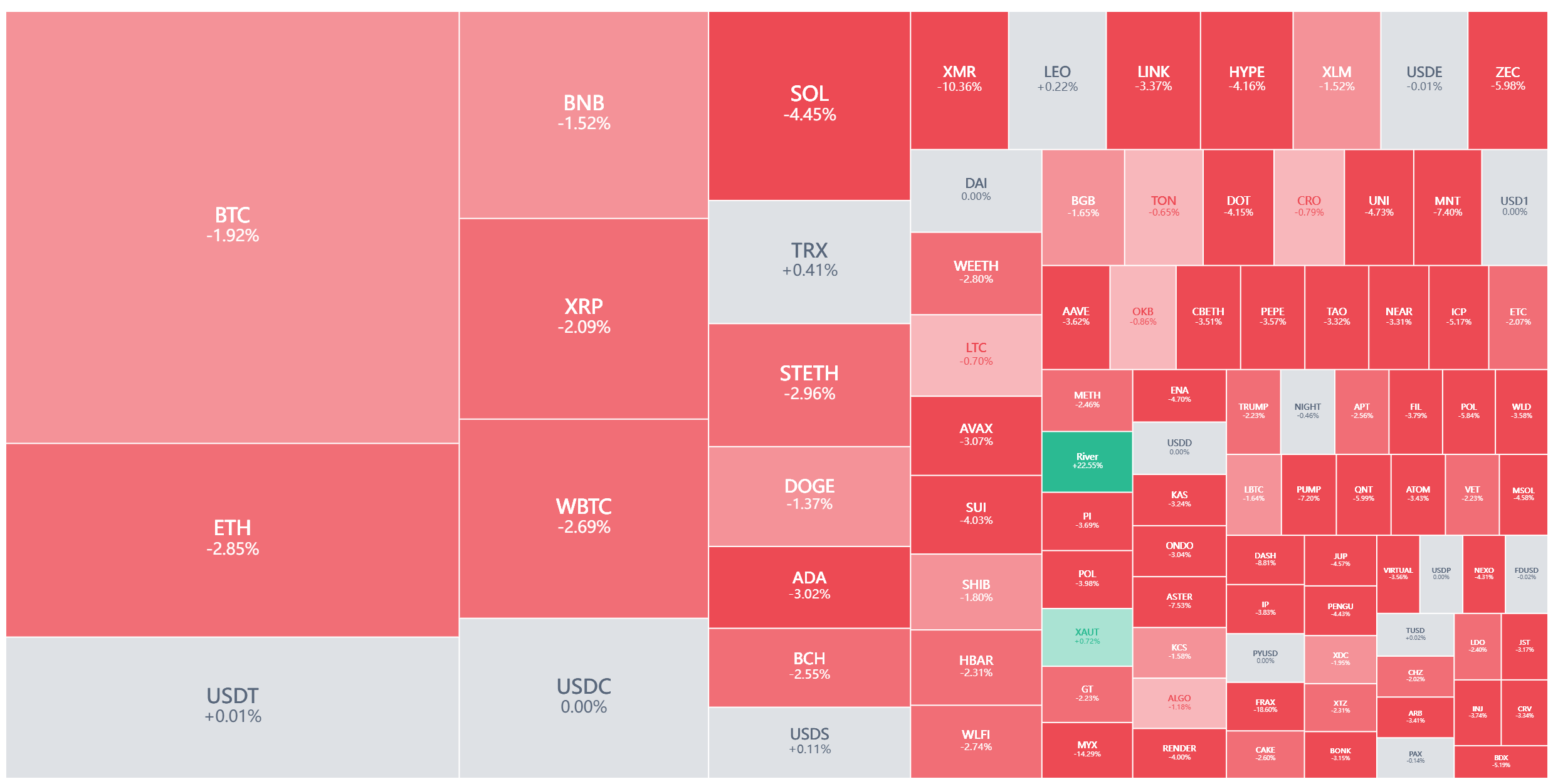

● In stark contrast to the hot market for precious metals, Nasdaq index futures expanded their decline to 1.1% on Monday morning, while S&P 500 index futures fell by 0.75%. Bitcoin has retreated about 10% from its recent highs, currently hovering around $90000.

2. Multiple Driving Factors Behind Precious Metals Surge

Market analysts generally believe that gold's breakthrough of $5000 is not only a historical high in price but also signifies a deep structural change in global asset allocation logic.

● The instability of the fiat currency system has become the core reason supporting the rise of precious metals. On one hand, the ongoing dispute between U.S. President Trump and the Federal Reserve continues to undermine the credibility of the dollar, while the erosion of the Fed's independence, combined with the accelerated expansion of U.S. fiscal and government debt, has propelled the de-dollarization process.

From a global market perspective, great power competition has increased distrust between nations and regions, further accelerating this process.

● The continuous gold purchasing behavior of central banks constitutes the fundamental demand for gold. Since the Western freezing of Russian foreign exchange reserves in 2022, global central banks have begun to significantly increase their gold holdings, a trend that is expected to remain high in 2026.

● A report from the World Bank indicates that gold ETF inflows surged sharply in the first quarter of 2025, pushing investment demand to its highest level since 2022.

● Geopolitical tensions and economic uncertainty have created a breeding ground for risk aversion. In 2025, global trade tensions highlighted the vulnerability of key mineral supply chains, while in 2026, geopolitical conflicts, resource nationalism, and supply security issues have collectively heightened attention to the metal markets.

● The weakening dollar and low real interest rate environment also provide favorable conditions for the non-yielding asset of gold. OANDA's senior market analyst pointed out that expectations for long-term interest rate cuts by the Fed, the weakening dollar, and the surge in geopolitical risks have collectively pushed precious metals to new record highs.

3. Unique Market for Silver

The recent rise in silver has shown characteristics of both correlation and divergence with gold. As of the time of writing, spot silver has increased by over 2%, reaching a high of $106.56 per ounce during the session.

● The alternative effect of silver as "the people's gold" has become evident. As gold prices have become unattainable for many, silver has become a convenient way to access the prosperity of precious metals. Paul Williams, Managing Director of Solomon Global, stated that the upward momentum of silver will continue to be driven by sustained industrial demand and growing interest from retail investors.

● Industrial demand and supply shortages constitute a dual driving force for silver's fundamentals. Silver plays a key role in clean energy and artificial intelligence infrastructure, while long-term supply shortages further solidify its bullish foundation.

● In terms of industrial demand, green technologies such as solar energy and electric vehicles, as well as artificial intelligence, will continue to drive demand for silver.

● The high volatility characteristic brings both returns and risks. Given silver's volatility, prices can easily fluctuate by 10% within a day, the higher the price, the greater the potential volatility. Michele Schneider, Chief Market Strategist at MarketGauge, stated that she has taken profits on half of her positions, believing that silver has the potential to reach $150 per ounce.

4. Bitcoin's Weak Performance and the Shadow of the "Four-Year Cycle"

In stark contrast to the strength of traditional precious metals, the leading digital currency Bitcoin has recently shown weak performance. Bitcoin has recently fallen 10% from its high of $98000 due to tariff concerns, currently hovering around $90000.

● Jan Van Eck, CEO of VanEck, pointed out that Bitcoin's current decline stems from investors taking protective measures to avoid traditional bear market years.

● The four-year cycle theory and profit-taking pressure have become short-term shackles for Bitcoin. Van Eck emphasized that over the past decade, Bitcoin has experienced a major negative year every four years, and 2026 happens to be another negative year. This has led investors to take profits early in anticipation of a market downturn.

● Concerns about the Fed's policies and independence also affect the crypto market. Tom Lee, founder and research head of Fundstrat, warned that the market may face a "painful" decline in 2026, with tariff tensions, Fed independence, and the new chairman being the main factors.

These concerns not only affect traditional markets but also put pressure on risk assets like Bitcoin.

5. Institutional Divergence and Market Outlook

● In the face of historic price breakthroughs, market institutions show significant divergence regarding the future trends of precious metals. Daniel Hynes, Senior Commodity Strategist at ANZ Bank, believes that after a strong performance in 2025, the outlook for gold and silver remains optimistic before 2026.

● Several institutions have provided specific target price levels. A report from UBS commodity strategists indicates that gold prices will rise to $5000 per ounce by September 2026, and if political or economic turmoil intensifies around the U.S. midterm elections, gold prices could even be pushed up to $5400.

● JPMorgan predicts that gold prices will reach $5055 per ounce in the fourth quarter of 2026 and further rise to $5400 by the end of 2027. Cautious voices also exist. The precious metals price forecast report from Heraeus recently mentioned that gold, silver, and platinum group metal prices may show a downward trend in the first half of 2026.

● The World Bank also warned that the surge in precious metals may temporarily come to an end, with 2026 potentially being a peak period of "high-level stability," after which the market may return to rationality. As gold breaks through $5000, Wall Street's concerns about Bitcoin's four-year cycle and the volatility of silver have simultaneously emerged.

As gold and silver continue to set historical records driven by central bank purchases and risk aversion demand, Bitcoin finds itself trapped in the worries of the "four-year cycle" curse.

The market is reassessing the risk-hedging properties of different assets, and the deep-seated force driving this change—distrust in the traditional financial system—is likely to continue shaping the global asset allocation landscape for years to come.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。