This week, in the East 8 Time Zone, the on-chain address 0xd4d has been revealed to have two massive holdings: approximately 2.5 months ago, it received 56.12 million ENA, and the latest transaction involved receiving 465,000 HYPE through Galaxy Digital OTC, which is approximately 10.32 million USD at current prices. With ENA having retraced about 62% from its peak and showing a paper loss of nearly 15.44 million USD, this combination of "old position massive loss + new position aggressively built" has quickly sparked market debates about whether the whale is rebalancing or hedging risks. It is important to emphasize that currently, the on-chain data only provides verifiable facts such as chip flow and market cap changes, while opinions on the true strategy and intent remain highly divided.

Continuous Actions from ENA to HYPE

● Timeline Overview: According to publicly available on-chain data, address 0xd4d received a large amount of 56.12 million ENA approximately 2.5 months ago, valued at about 24.76 million USD at that time; recently, this address received 465,000 HYPE through Galaxy Digital OTC, corresponding to a dollar value of about 10.32 million USD, forming a parallel holding pattern of "old position ENA + new position HYPE."

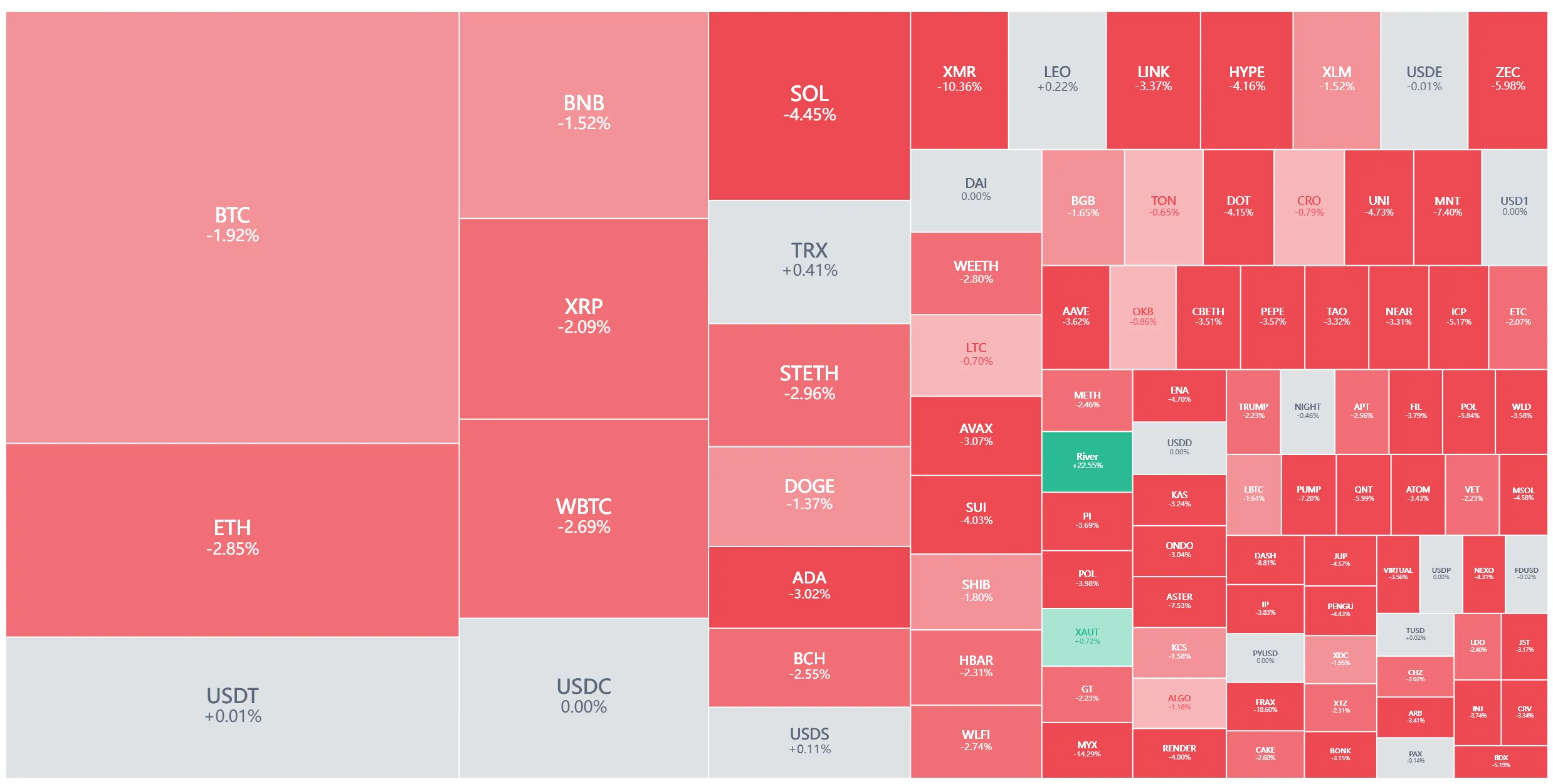

● Value Comparison: The volume difference between the two receptions is significant. The value of ENA at the time of entry was close to 25 million USD, far exceeding the current 10 million USD scale of HYPE; however, as the price of ENA has dropped about 62% from its peak, its market cap has fallen to about 9.32 million USD, creating a contrasting comparison of "shrinking old position against rising new position."

● Monitoring Tags: Due to the large single transaction amount and high asset concentration, address 0xd4d has long been listed as a key monitoring target by multiple on-chain analysis platforms. Its large ENA holdings and the recent HYPE reception path have been continuously tracked, dissected, and visualized, making every move subject to market scrutiny under a "magnifying glass."

● OTC Path Confirmation: Briefing shows that the on-chain path for receiving HYPE is clearly marked as completed through Galaxy Digital OTC, indicating that the chips were not directly matched in the secondary market but were concentrated into the 0xd4d address through over-the-counter bulk distribution. While the counterparty and details have not been disclosed, the OTC source has been noted on-chain.

Pressure from ENA's Paper Loss of 15.44 Million USD

● Decline and Shrinkage: According to briefing data, ENA has dropped about 62% from its peak approximately 2.5 months ago, and this decline is directly reflected in the on-chain market cap of address 0xd4d—its holding of 56.12 million ENA has shrunk from about 24.76 million USD at entry to the current 9.32 million USD, resulting in a significant evaporation of market value.

● Details of Paper Loss Scale: Based on the above data, the address has a paper loss of about 15.44 million USD on its ENA position, roughly aligning with the "price retracement of about 62%." For a single asset exposure, this level of retracement not only signifies a substantial absolute amount but also indicates that the capital curve has endured strong volatility impacts over a short period.

● Market Interpretation Voices: Some media have cited that "the address has incurred a 62% loss on ENA," suggesting that this poses considerable psychological and risk management pressure for any participant, regardless of capital size. Some observers speculate that the subsequent HYPE position may relate to "rebalancing, hedging, or reconstructing the portfolio," but this remains at the level of external interpretation.

● Holding and Curve Impact: Continuing to hold ENA with an existing paper loss of about 15.44 million USD means that the address has chosen to endure a longer period of market cap volatility and capital retracement. The "drag effect" on the capital curve during the retracement period will persist; on the other hand, if it does not stop loss or reduce its position at low levels, the profit and loss elasticity during subsequent rebounds will also be amplified, making the overall strategy outcome highly dependent on ENA's future performance.

OTC Bulk and New Coin Distribution Structure

● New Listing and OTC Trajectory: The briefing notes that HYPE is a newly listed token, and its listing phase coincided almost simultaneously with the OTC bulk distribution involving Galaxy Digital. On-chain records show that large amounts of HYPE chips were concentrated and transferred out through Galaxy Digital marked addresses, then transferred into several wallets, including 0xd4d, exhibiting typical characteristics of "over-the-counter matching + on-chain distribution."

● OTC Activity Profile: According to PANews, "Galaxy Digital's recent OTC trading activity has significantly increased," corroborated by multiple large transfers of HYPE on-chain, outlining the current reality that institutions prefer to facilitate large transactions through OTC channels—especially during the new coin phase—to avoid directly impacting the weak secondary market order book.

● Differences Between OTC and Secondary Market: Receiving HYPE through OTC, compared to directly buying in the secondary market, has the biggest advantage in controlling price impact and information exposure—bulk chips are distributed at agreed prices off-market, avoiding price spikes caused by continuous order book sweeps, while also delaying the moment when the market "understands" the transaction completion.

● Bulk Model and Position Building Efficiency: For large addresses like 0xd4d, the bulk trading model allows for quickly establishing a position of about 10.32 million USD without significantly raising the order book. A single or a few on-chain transfers can complete asset delivery, which can significantly reduce slippage costs and improve execution efficiency compared to gradually buying in the secondary market over a long period.

Risk Exposure of HYPE and ENA Combination

● Common Risk Paths: Without speculating on the true strategy of 0xd4d, common risk management paths for institutions or whales facing significant paper losses on a single asset include: maintaining the original position while observing and hedging with other assets, gradually reducing positions to recover liquidity, or increasing assets related to the original position but with differentiated risk factors to reconstruct the portfolio. These are general strategic frameworks for reference.

● Amount and Proportion Comparison: Currently, the market cap of the ENA position is about 9.32 million USD, with a paper loss of about 15.44 million USD; the newly built HYPE position is about 10.32 million USD. In absolute terms, the current values of the two are similar, with HYPE slightly higher than ENA; however, in terms of historical investment, the capital invested in ENA is far greater than that in HYPE, making the former's "sunk cost" heavier in the capital curve, while the latter resembles a recent addition to risk exposure.

● Market Views and Boundaries: Some believe that with ENA losses reaching about 62%, increasing HYPE "may be a measure to diversify risk." However, it is essential to emphasize that such statements are essentially based on external interpretations of observed results and are not confirmations from the trading counterpart or the address itself. They should not be regarded as definitive conclusions about true strategies, nor should they be extrapolated as replicable investment logic.

● Correlation and Volatility: From an asset portfolio perspective, if HYPE and ENA exhibit high correlation in price trends, sector drivers, or liquidity sources, then the new HYPE exposure may rise and fall alongside ENA in the same market environment, amplifying overall volatility rather than diminishing it; if there are differences in their beta exposures, there may be opportunities for partial hedging in different market phases. Current data dimensions are limited and insufficient to provide quantitative conclusions about the price correlation between the two.

On-Chain Demonstration Effect and Following Risks

● Behavioral Amplification and Emotion: Large addresses like 0xd4d, once marked and continuously pushed by multiple data platforms, will have any increase or decrease in their positions rapidly amplified on social media, easily interpreted by retail investors as "smart money actions," leading to a following impulse. This secondary dissemination from on-chain behavior to emotional amplification often reinforces the market's short-term herd effect.

● Secondary Market Feedback Path: After the exposure of ENA and HYPE chip structures, the typical short-term response path in the secondary market includes: increased trading volume, rapid adjustments in order book listings, and concentrated fermentation of social media opinions. Whether it is the "massive paper loss" label on ENA or the "new position takeover" narrative on HYPE, both may drive additional price volatility and emotional premiums around these event nodes in the short term.

● Boundary Between Facts and Inferences: Currently, the only verifiable facts on-chain are the chip flow, transaction volume, and approximate scale of paper gains and losses; however, there is a lack of public evidence supporting the true strategy, risk preferences, or even identity background of 0xd4d. Confusing these inferences with established facts can lead to excessive speculation about the behavior of a single address, thereby amplifying interpretative errors.

● Subsequent Observations and Risk Points: If one chooses to continue tracking this address, key indicators include: whether ENA and HYPE positions show further large increases or decreases, whether there are synchronous capital migrations across assets or protocols, and the subsequent flow of Galaxy Digital-related OTC addresses. The potential risk lies in the fact that once the address changes its strategy or conducts internal capital adjustments, external observers often can only passively see the results afterward, unable to know the direction in advance, making following behavior significantly lagging and asymmetric.

Whales Have Not Provided Answers, Data Provides Boundaries

The currently confirmable boundaries are very clear: we can only ascertain the chip flow, entry price range, and approximately 15.44 million USD paper loss scale of address 0xd4d on ENA and HYPE, while we cannot confirm the true strategic intent and risk preferences behind it. The increased activity of Galaxy Digital OTC and its role in HYPE distribution also need to be continuously tracked through on-chain data and public information, rather than replacing evidence with emotional narratives. For ordinary investors, a more prudent approach is to view such whale behaviors as samples to understand how capital operates on-chain and the structure of risk exposure, rather than treating them as blindly replicable "signal sources." Following without complete information and professional risk management tools often means assuming asymmetric risks.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。