Author: momo, ChainCatcher

In 2026, the recovery of the crypto market began with Chinese memes. "I'm coming" ignited the trend, with a single-day peak increase of over 420% after launching on Gate Alpha.

Subsequently, a large number of Chinese memes quickly emerged. On the Gate Fun platform, over 6,000 Chinese meme tokens were created and launched in less than a month, with projects like "Open Sesame," "Meme Coin," and "Confucius" all achieving multiple-fold increases in a single day.

Recently, while the Chinese meme market has entered a correction phase, unlike before, mainstream exchanges like Gate have launched contracts and ETF leverage products for leading Chinese meme coins early on, allowing for quick and low-threshold shorting during the first round of corrections. This means that the dynamics surrounding memes are evolving from a one-sided chase for gains to a complete trading cycle of long and short confrontations.

So, what new characteristics does this round of the Chinese meme market present? And why has Gate become one of the key battlegrounds affecting the liquidity of meme assets?

1. The Shift from Occasional Memes to Fixed "Narratives"

For a long time, meme coins were dominated by Western English memes like Doge and Pepe. However, starting in October 2025, a batch of Chinese memes emerged intensively, ranging from "Binance Life," "Financial Freedom," "Haki Mi," to early 2026's "I'm coming," "Life K-Line," and "Old Man." Chinese memes have evolved from sporadic highlights to a stable segment in the meme market.

Compared to Western memes, the advantage of Chinese memes lies in their precise capture of local sentiments. The self-deprecating trading of "Binance Life," the class imagination of "Financial Freedom," and the highly localized expressions of symbols like "I'm coming" and "Dark Horse" create stronger resonance and dissemination efficiency, which is difficult for English memes to replicate.

A more critical change has occurred at the structural level of trading. The time lag for meme coins from "on-chain popularity" to "platform trading" has been significantly compressed. The common path in the past was for a chain to explode, the community to ferment, and then for emotions to fade before launching on exchanges; however, in this round of the Chinese meme market, many projects completed the transition from on-chain to Alpha and then to exchanges while community sentiment was just forming consensus, still able to sustain trading volume and volatility after going live.

In this high-frequency market measured in hours, the speed of listing itself has become a competitive variable. The quicker one can capture on-chain popularity and amplify liquidity, the more likely funds will gather there first. As a result, Gate, which has always had a fast listing rhythm, has become one of the main arenas where liquidity first gathers and games unfold in this round of the Chinese meme market.

2. Why is Gate the "Key Battleground" for Chinese Meme Coins?

1. Fast and Comprehensive Coverage to Meet Full-Chain Needs

In this round of the Chinese meme market, a very intuitive phenomenon is that as soon as consensus begins to form on-chain, Gate often enters the trading layer to take over immediately.

From early January to now, almost all high-heat Chinese memes can find corresponding trading entrances within the Gate system.

Including the recently heated discussions around "Life K-Line" and "Minor Shareholder," when the on-chain topics were just forming, Gate Alpha completed its initial launch; looking back further, a batch of popular leading Chinese meme coins like "Crying Horse," "Dark Horse," "Grassroots Culture," "Old Man," "I'm coming," and "Binance Life" all completed the integration of spot or contract, ETF leverage products within the heat cycle, rather than waiting for emotions to recede before filling in.

From a time dimension, most of these projects completed the integration of Alpha or spot contracts about a week after the on-chain heat appeared. Taking the leading Chinese meme coin "I'm coming" as an example, about a week after its issuance, Gate Alpha closely followed Binance Alpha's launch, and then Gate simultaneously pushed out spot, contract, and ETF leverage products within 24 hours.

Moreover, Gate's liquidity absorption capability has also shown outstanding performance in this round of the Chinese meme market. For example, "Old Man" once accounted for over 20% of the total market trading volume on the Gate platform, indicating that Gate not only "went live a step earlier" but also captured and amplified liquidity that might have otherwise dispersed on-chain, facilitating price discovery within the exchange.

Gate's ability to become one of the main battlegrounds for meme players is not just about "going live quickly and frequently" and "liquidity absorption capability," but about concentrating all the needs of Chinese meme coins on one platform, from Gate Fun → Gate Alpha → spot/contract → leveraged ETF → flash exchange, covering all demand segments from the birth, trading, to gaming of memes.

Take Gate Fun, for example; it focuses on "zero-code token issuance + full-scenario trading," addressing the front-end needs of memes, namely token creation and launch. Creators can quickly complete token creation, while early participants can also trade and circulate on the same platform, laying the foundation for subsequent market trading.

As for the trading phase, spot and contracts carry trends and long-short games; for users unfamiliar with contracts but wishing to participate in the market, Gate's leveraged ETF offers 3L/3S dual-direction products, currently supporting 258 cryptocurrencies, significantly lowering the participation threshold.

In the rapid switching of market conditions, Gate's flash exchange plays the role of an efficiency tool. Currently, the flash exchange supports over 2,200 crypto assets with zero fees and simultaneously covers Chinese memes, allowing funds to quickly switch between different meme coins and mainstream assets, enhancing overall liquidity turnover efficiency.

Overall, Gate does not focus on a single listing action but rather enables issuance, trading, gaming, and exchange to be completed within the platform through a complete product matrix. This is also a crucial reason why Gate can continuously attract different types of users to participate in the Chinese meme market.

2. The On-Chain Asset Entry Positioning of Gate Alpha

However, as the market for on-chain assets begins to be timed in hours or even minutes, relying solely on a single "first listing" can no longer maintain an advantage. The ability to form a stable absorption rhythm depends on whether there is a high-frequency, large-scale asset entry. This is the role Gate Alpha plays in this round of the Chinese meme market.

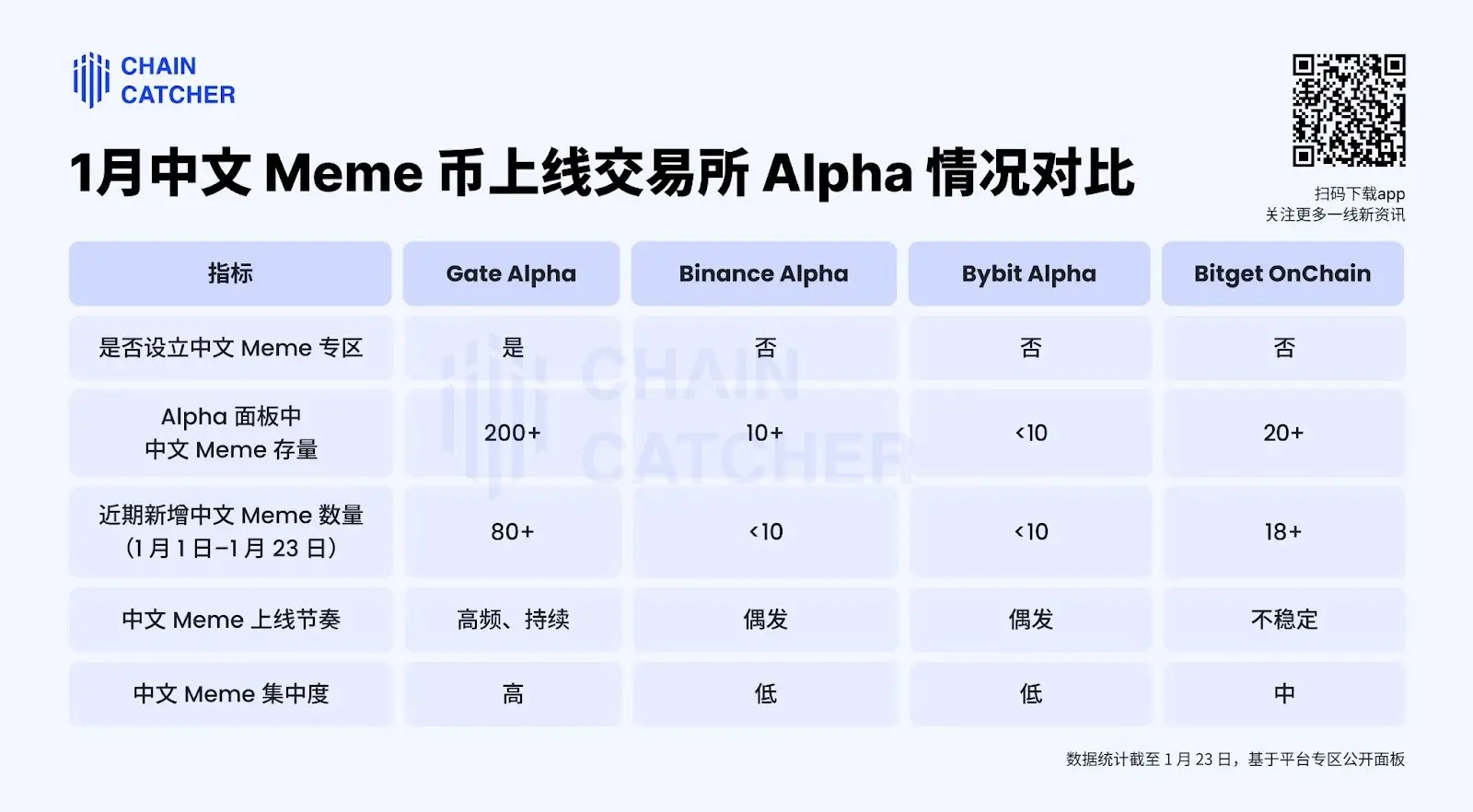

Comparing with the Alpha products of mainstream Chinese exchanges, Gate Alpha's strategy in this niche direction of Chinese memes is relatively clear, and the investment is more concentrated.

First, let's look at the coverage structure. Among the platforms that have been counted, Gate Alpha is currently the only Alpha product that has explicitly set up a special area for Chinese memes. Currently, there are over 200 Chinese meme coins on the Alpha panel, and since January of this year, about 80 Chinese memes issued that month have gone live on Gate Alpha, with over 30 new Chinese memes added to the selected area.

In contrast, Binance Alpha, which has also invested in Chinese meme coins, has launched no more than 10, while Bitget OnChain has responded relatively actively to new hotspots, but the overall coverage level is still somewhat behind Gate Alpha, with the density of Chinese memes being relatively limited. Bybit Alpha seems to be more focused on memes on the Solana chain this time, and the BSC round of Chinese memes is not its priority; in contrast, Gate Alpha has chosen to systematically and substantially absorb Chinese memes in this round of the market.

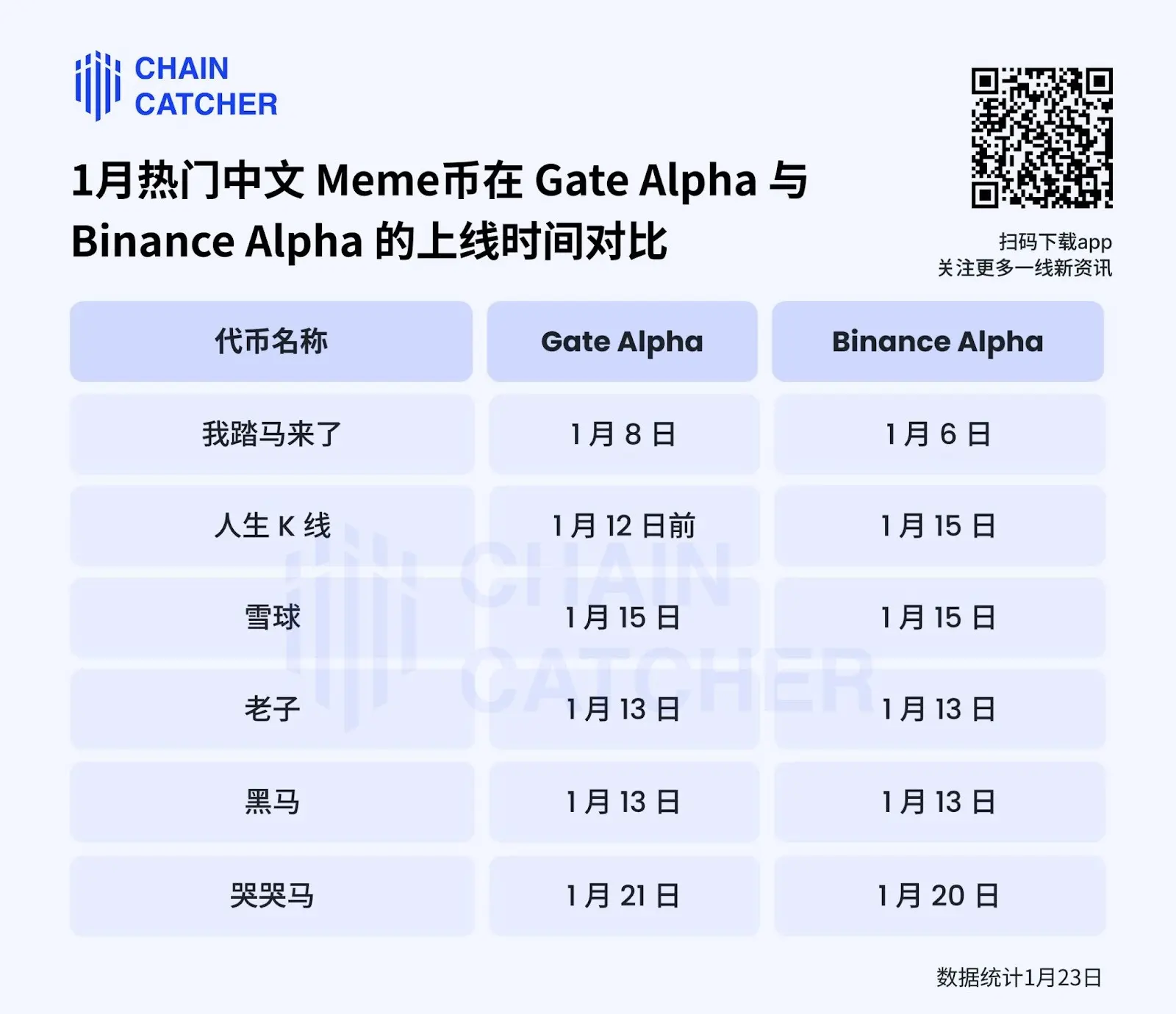

Regarding the response rhythm for leading Chinese meme coins, the recent launch times of several leading Chinese memes on Gate Alpha have generally been synchronized with Binance Alpha, with some tokens even launching faster.

This density and rhythm of coverage ultimately reflect in price feedback. Several Chinese memes like "Binance Life," "Life K-Line," "I'm coming," and "Dark Horse" achieved stage increases of several dozen times after going live on Gate Alpha. Among them, "I'm coming" saw a single-day peak increase of over 420% after launching on Gate Alpha.

From a positioning perspective, this difference also reflects the different emphases of Gate Alpha and Binance Alpha. Binance Alpha leans more towards "top-tier and selected leading coins," emphasizing representativeness and certainty; while Gate Alpha, while covering the leaders, is also more proactive in incorporating emerging Chinese meme coins, making the trading window more advanced and the density higher, emphasizing the strategic positioning of the entry.

According to announcements from Gate Alpha, its asset access frequency has been increased to a minute level, with hundreds of new tokens added each month. In a meme market that heavily relies on attention rhythms, this entry capability may be becoming one of Gate Alpha's core competitive points.

3. The Fast Launch Mechanism of Gate: Where Does the Speed Come From?

However, meme coins are also relatively high-risk assets; why does Gate dare to be fast?

1. Data and AI-Driven "Listing" Strategy

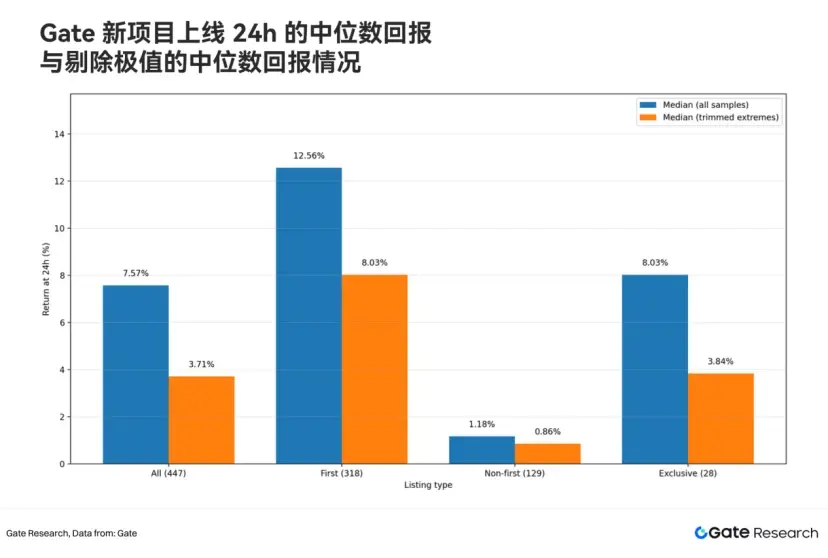

Recent insights can be found in Gate's 2025 listing report, and the answer is not complicated; as we feel, the wealth effect mainly occurs in that "early enough" segment of time.

In Gate's 2025 listing statistics, this difference is very intuitive. In a 30-minute window, the median increase for all sample projects that launched is 25.69%, while non-launch projects only see 0.98%, a difference of over 25 times; extending to 24 hours, the median increase for launch projects remains at 12.56%, while non-launch projects only achieve 1.18%, with a tenfold difference.

If we only look at exclusive launches, this "early advantage" is further amplified, with exclusive projects seeing an increase rate close to 80% within the first 30 minutes of trading, a median increase of about 81%, and over one-third of projects achieving over 100% increase within 30 minutes. In other words, the primary price discovery for many exclusive projects is almost completed within the first trading window after going live.

At the same time, the data provides a clear boundary condition: around 72 hours, the median returns across the entire sample basically revert to the breakeven point; by 7 days and 30 days, the proportion of rising projects continues to decline, and returns begin to highly differentiate. This means that new coins, especially meme coins, are not "more stable the later they are," but rather "the earlier the returns are more concentrated."

This also explains why Gate prioritizes "speed" in the listing decision itself. To capture this extremely short effective window, Gate continuously invests in AI-assisted judgment and real-time multi-chain monitoring, parallel tracking signals such as on-chain trading behavior, capital flow, contract creation, and social media heat to proactively identify potential consensus-forming hot assets, rather than passively responding after emotions have fully spread. In other words, it is not merely chasing hot trends but using data and models to structure and systematize "that brief period before emotional outbursts."

2. Gradually Upgraded Unlocking Game Mechanism

However, merely being early is not enough to support the possibility of sustained increases; Gate also continuously creates liquidity expectations for meme coins through multi-level, continuously unlocking trading scenarios.

Gate's various product modules each play different "liquidity roles." Gate Fun is responsible for capturing the earliest emotions and creator momentum. It allows the value of meme culture to be defined by community consensus and market mechanisms, enabling users to visually see changes in token issuance and trading through transparent on-chain contracts and real-time data; with the linkage of Gate Square and Gate Alpha, meme projects with discussion potential can reach a larger community of users more quickly, completing preliminary verification of consensus and pricing in the early stages. For example, the token "Malle Go Coin," launched on January 8, achieved a peak increase of 936.62% within less than 24 hours after being launched through Gate Fun.

Next is Gate Alpha. Gate Alpha is responsible for the first round of liquidity amplification after emotional validation. It has increased the listing frequency to a minute level, with hundreds of new tokens added each month, creating a higher frequency and more real-time on-chain asset access channel.

Following that are spot and contracts. Spot provides the main support for trend capital, while contracts introduce hedging and gaming demands, allowing memes to maintain trading activity even after volatility is amplified, rather than experiencing "a rise followed by a pause."

Through the continuous connection of Gate Fun, Gate Alpha, spot, and contracts, each stage becomes a source of expectations for the next stage. Therefore, the previously mentioned "I'm coming," "Binance Life," and "Life K-Line" have all continued to achieve high increases after going live on Alpha.

This is also one of the key reasons why Chinese memes can repeatedly generate market activity; it is not that the emotions are stronger, but that liquidity has never been "exhausted."

3. Risk Control

However, speed does not mean ignoring risk. Gate's willingness to act quickly in the high-gaming asset of memes has its boundaries.

On one hand, Alpha selection serves as the first filter; not all on-chain memes can make it all the way to spot and derivatives. Although over 80 Chinese memes were launched in January, only about 1/10 made it to spot and derivatives. On the other hand, contracts, leverage, and ETFs all have clear parameter limits, using rules rather than emotions to constrain volatility, along with Gate continuously providing risk warnings and user education.

4. Formation of a Closed Loop Infrastructure as a Long-Term Moat

From an overall structural perspective, what Gate has formed in the meme track is not a one-time market advantage, but a set of repeatable operational infrastructure.

Beyond listing, Gate has also invested significant effort in reducing the operational and capital migration costs of meme trading. For example, the Meme Go launched in 2025 is positioned for early token issuance and high-frequency gaming scenarios, providing millisecond-level full-chain scanning and real-time monitoring, supporting instant trading of Gate Fun tokens while covering multiple launch platforms. Users can complete discovery, judgment, and ordering on the same interface, reducing time and cost losses from cross-platform operations. As of December, the cumulative trading volume of Meme Go has reached $85.99 million, demonstrating its actual usage intensity in the highly active meme market.

These tools do not exist in isolation but are linked with Gate Fun, Gate Alpha, spot, and derivatives systems. On-chain monitoring, trading dashboards, customized K-lines, and rapid transaction mechanisms are integrated into a unified process, making the switching of funds between different memes and trading stages smoother.

On this basis, Gate gathers a group of highly active users centered around trading and meme culture through activities, incentives, and community operations. Community discussions, trading behaviors, and new project launches reinforce each other, gradually making the platform itself an important arena for the emergence and validation of new memes.

5. Conclusion

As Chinese memes are no longer short-term sporadic emotional noise but a market category with sustained supply and trading demand, it is expected that there will be multiple explosive opportunities for Chinese meme coins in the future.

In this round of market activity, Gate's performance reflects more of a validation of systemic capabilities. Faster response times, a more complete product matrix, and the ability to absorb liquidity and trading demands at different stages have positioned it in a key place in a market where attention shifts rapidly.

At the same time, data and cases clearly indicate that the high volatility and risk attributes of meme coins will not disappear. Returns are highly concentrated in the early window, with pullbacks and differentiation always accompanying them.

Therefore, the real differentiator is not who can seize a single emotional spike, but who can consistently and stably absorb emotions, organize trading, and keep this high-frequency gaming running continuously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。