Author: Max.s

After experiencing significant fluctuations in 2024 and profound reshuffling in 2025, the quantitative finance industry stands at a new crossroads. At last week's 2025/2026 China Quantitative Investment New Year Summit, Dr. He Kang, Chief Strategist and Chief of Financial Engineering at Huatai Securities Research Institute, delivered an in-depth speech titled "Trends in the Quantitative Industry for 2025 and Outlook for 2026." This is not only a strategy report for the A-share market but also a battlefield manual on how Alpha can find new survival space in an increasingly crowded market.

For practitioners at the intersection of Web3 and traditional finance, this report reveals a clear signal: traditional Alpha is diminishing, while new paradigms — whether based on large models like "Order as Token" or alternative assets represented by cryptocurrencies — are becoming the battleground for institutional investors.

Below is a deep review and industry outlook based on Dr. He Kang's speech.

The year 2025 is one of "high prosperity" and "high volatility" for the quantitative industry. A significant data change is that while the scale of securities private equity remains high, the growth of public quantitative funds is even more rapid. By the third quarter of 2025, the scale of public index products has surpassed 200 billion, with active quantitative funds reaching 120 billion.

Behind this lies an interesting structural change: the top player has changed.

The previous head player landscape has been disrupted, with institutions like Boda and Guojin emerging with extremely flexible strategies. In Dr. He's research, these top-performing public quant funds are essentially "private equity dressed in public clothing." They have extremely high turnover rates, astonishing strategy iteration speeds, and even match top private equity in the use of intraday reversals (T+0).

This phenomenon reveals the survival rule for 2025: due to the exponential increase in the difficulty of obtaining excess returns, only extreme flexibility can break through in a red ocean. For investors, the past logic of "choosing big brands and lying flat" is no longer applicable; it is necessary to conduct more refined attribution analysis to identify those managers who truly possess "agile development" capabilities.

In the past five years, the mainstream narrative in the quantitative industry has been "fully invested stock selection," using Alpha from stock selection to cover market volatility. However, after the market education of 2025, "timing" has returned to the center of the table. Dr. He Kang categorizes market managers into five types: A, B, C, D, and E, with the most noteworthy being E-type managers — timing-based on logic rules. Unlike black-box predictions, this type of strategy constructs an explicit logical chain of "If A then B."

The Rise of Sub-domain Modeling.

As market efficiency improves, universally applicable factors are becoming increasingly difficult to uncover. Top managers are beginning to adopt a "divide and conquer" strategy: segmenting the entire market into different "domains" such as growth, cyclical, small-cap, and micro-cap, and training models separately within each domain. It's like in Web3, where you cannot use the same logic to trade Bitcoin and on-chain meme coins — their pricing logic, liquidity characteristics, and participant structures are entirely different. Through sub-domain modeling, quantitative strategies can extract higher excess returns in local markets.

If sub-domain modeling is a tactical optimization, then the introduction of large language models (LLM) is a strategic dimensionality reduction strike. Dr. He Kang mentioned three application levels of large models in quant, with the most memorable being the third level: viewing financial transactions as a language, i.e., "Order as Token."

In traditional NLP (Natural Language Processing), GPT predicts the next word (Token); in financial large models, the input is a price sequence, trading volume, and order flow from the past period, and the model predicts the next "price Token." This is not only a technical migration but also a revolution in thinking.

Traditional quantitative models are often based on statistical linear or nonlinear regression, while the Transformer architecture allows models to capture extremely long-term dependencies and complex nonlinear patterns. Imagine that future trading is not based on a linear weighting of several factors but is "generated" by a pre-trained financial large model, like generating text, to create future price paths. This is akin to the intent-centric AI Agent trading logic currently in the Crypto field — AI is no longer an auxiliary tool but a direct executing entity.

The Blue Ocean of Alternative Data: Institutionalization of the Cryptocurrency Market

As excess returns in the A-share market are maximized, smart money begins to look towards alternative markets with lower correlations through total return swaps (TRS) or offshore entities.

Compared to the T+1 system and price limit restrictions of the A-share market, the crypto market features 24/7 trading, T+0 settlement, high volatility, and fragmented liquidity. For quantitative institutions with high-frequency trading capabilities and risk control models, this is akin to the A-share market before 2015 — abundant in Alpha, and the competitive landscape has yet to solidify.

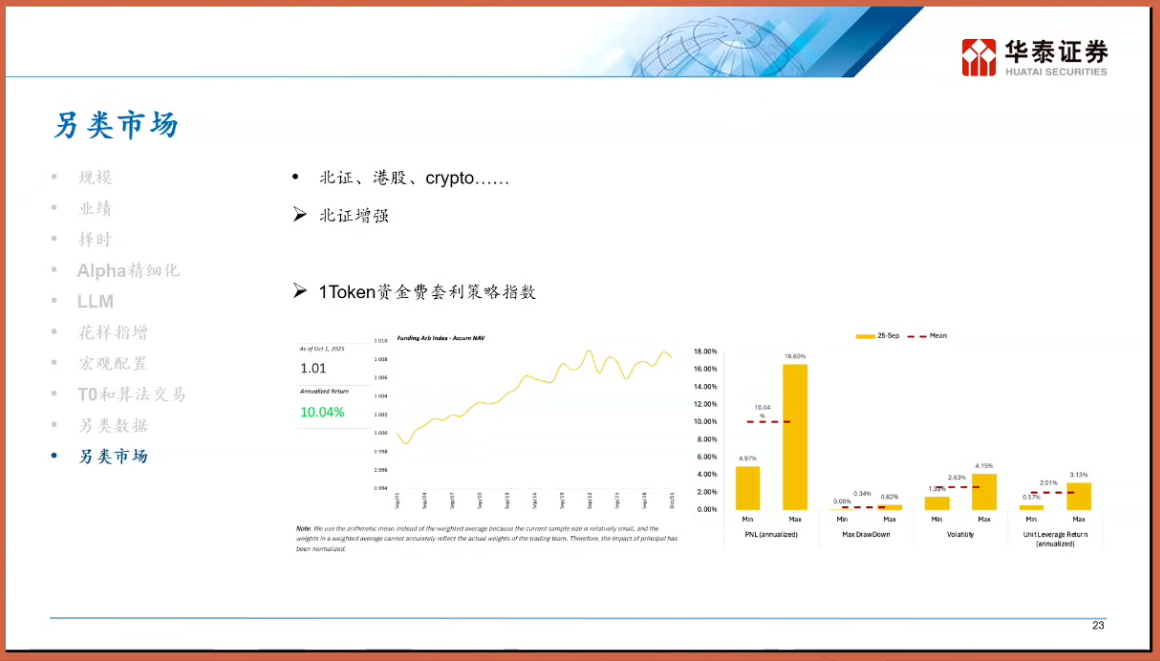

Here, we particularly introduce the Funding Rate Arbitrage strategy, where both long and short sides in the perpetual contract mechanism of the crypto market need to pay funding fees to maintain price anchoring. During bull market cycles, longs often have to pay high fees to shorts. This creates a quasi-fixed income "market-neutral strategy": buying spot and shorting an equivalent value of perpetual contracts, hedging against price volatility risks while steadily earning funding fees. In this field, the 1Token funding rate arbitrage strategy index has become an important industry barometer.

According to industry data, such strategies have annualized returns far exceeding traditional fixed income products under specific market cycles, with extremely low correlation to traditional assets (stocks, bonds). As a professional digital asset institutional service provider, 1Token's constructed index not only reflects the overall arbitrage space in the market but also embodies the evolution of Crypto quant from "workshop" to "institutionalized, indexed."

For traditional finance practitioners, the significance of focusing on indices like 1Token lies in: it provides a window to observe the liquidity premium in Web3. When funding rates remain high for an extended period, it indicates extreme market enthusiasm, serving as a warning for spot selling pressure; conversely, it may present a good opportunity for bottom-fishing.

Looking ahead to 2026, Dr. He Kang's keywords are "dynamic" and "anti-fragile."

From static allocation to dynamic game theory, in the past, doing FOF (fund of funds) or major asset allocation often set a static weight (like a 60/40 portfolio). However, in the future, a dynamic adjustment mechanism must be introduced. For example, when a certain type of strategy (like micro-cap index growth) becomes overcrowded, due to the "stampede risk" from homogenized trading, it is necessary to actively reduce the weight, even if its historical performance has been excellent.

The "airbag" nature of products: Having experienced the pain of drawdowns, investors' aversion to downside risk has reached its peak. Derivatives with "airbag" and "snowball" structures, as well as index products protected through options, will become mainstream in 2026. This is akin to the logic of DeFi structured products — sacrificing a portion of potential upside returns in exchange for higher certainty and principal protection.

Finding low-correlation assets: Whether seeking independent Alpha within the A-share market or allocating to Hong Kong stocks, U.S. stocks, or even Crypto assets, the core goal is to reduce the overall correlation of the portfolio. Dr. He Kang specifically mentioned that while doing pure Alpha in Hong Kong stocks is difficult (poor liquidity, expensive shorting tools), its value still exists as part of a diversified allocation. The Crypto market, with its unique driving logic, will become an important piece in hedging traditional financial risks.

Dr. He Kang's speech essentially reveals the essence of financial engineering: the process of seeking certainty in uncertainty.

In the quantitative industry of 2025, the traditional low-hanging fruit has been picked clean. Practitioners are left with only two paths: either to delve into technology, using large models to uncover deeper nonlinear patterns, or to venture into the asset side, seeking dimensionality reduction strikes in the blue ocean of Crypto.

For the natives of Web3, this is also a warning: as top institutions like Huatai Securities begin to deeply research and focus on this field, the entry of regular troops is only a matter of time. When traditional quantitative dragon-slaying techniques are applied to decentralized trading markets, new dividends and fierce competition will arrive simultaneously.

In 2026, whether in TradFi or Crypto, only the evolved will survive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。