I. Outlook

1. Macroeconomic Summary and Future Predictions

Last week, there was no directional change at the macro level in the U.S.; it felt more like a "validation of previous judgments." The economy is showing a "gradual slowdown" state: manufacturing continues to lag, while the service sector barely holds up. Growth has not stalled, but there is a lack of new driving forces.

In the market, U.S. stocks exhibited high-level fluctuations with increasing divergence this week. The indices remain strong, but the rise is more supported by valuations and expectations, with technology and defensive sectors relatively outperforming, while cyclical and small-cap stocks are under pressure. Investors, on one hand, acknowledge the overarching direction of the "end of the tightening cycle," while on the other hand, they are beginning to worry about the lagging impact of economic slowdown on profits. Looking ahead, the key to macro pricing has shifted from "will it turn" to "will the slowdown be uncontrollable": if data continues to weaken gently, U.S. stocks will still show resilience; however, once employment or consumption begins to decline rapidly, the pressure for a market correction at high levels will significantly increase.

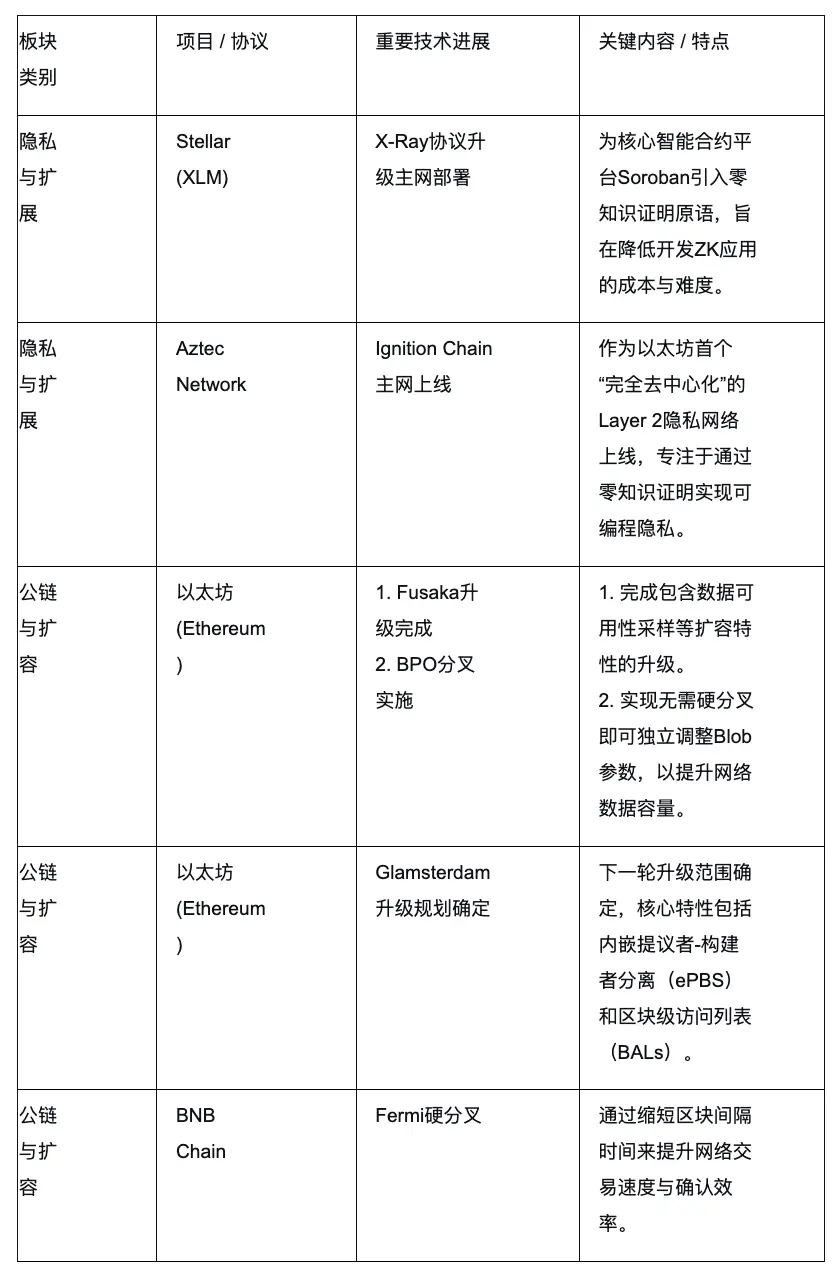

2. Market Changes and Warnings in the Cryptocurrency Industry

Last week, the cryptocurrency market showed a weak trend. The market lacked any sustained buying support; although trading volume did not dramatically increase, selling pressure remained stable, indicating that it was not a panic sell-off, but rather funds choosing to withdraw slowly and continuously under pressure. The decline in altcoins was more pronounced, with most tokens recording consecutive days of losses, and the MEME and high-volatility sectors retracing previous gains, indicating a clear contraction in market risk appetite.

Overall, last week's market was not a "sharp drop," but rather a typical slow decline and consumption trend: prices were moving down daily, and sentiment was continuously eroded, with any rebound quickly sold off. This rhythm itself indicates that the market is still in a weak phase, with no signs of stabilization or reversal.

3. Industry and Sector Hotspots

A total of $12 million was raised, led by Polychain and with participation from Amber, for ETHGAS, an off-chain infrastructure project aimed at connecting validators (also known as block proposers) with block space demand on a broader level; a total of $52 million was raised, with star institutions like Galaxy, Ark, and Coinbase participating in Architect, which focuses on providing high-throughput, low-latency trading and infrastructure solutions for traditional and tokenized assets.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Brief Analysis of the $12 Million Raised, Led by Polychain and Participated by Amber—ETHGAS, a Block Space-Centric Ethereum Deterministic Trading and Gas Market Infrastructure

Introduction

ETHGas is a hybrid market for acquiring and trading Ethereum block space commitments and Base Fee exposure.

It facilitates the matching of buyers and sellers through a centralized limit order book (CLOB), allowing users to hedge, speculate, or lock in future block space, while all collateral assets are held on-chain by non-custodial smart contracts. The fulfillment commitments of validators are guaranteed by on-chain mechanisms, achieving a combination of centralized matching efficiency and decentralized custody and settlement security.

ETHGas introduces transparency, risk management capabilities, and a mature market structure to the Ethereum block space economy.

Core Mechanism Overview

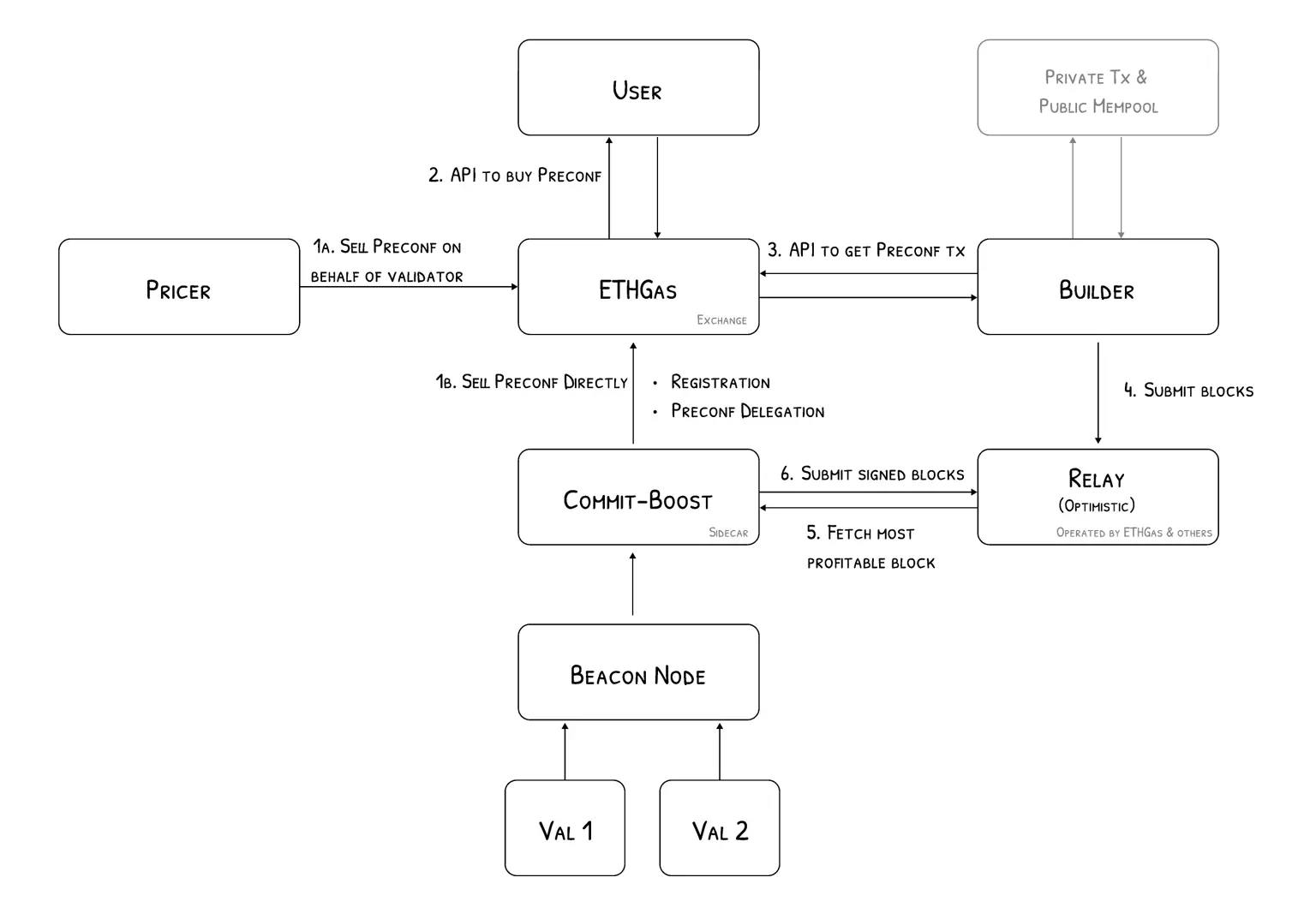

ETHGas is an off-chain infrastructure project that connects validators (also known as block proposers) with block space demand on a broader level.

It acts as an intermediary between validators and their gas market products and block space buyers, which include block builders, traders, searchers, wallets, end users, etc., who typically have a demand for customized order flow types.

The market structure and product design of ETHGas aim to maximize the long-term income of validators while considering the following factors:

What kind of block space products validators can sell under real-world conditions

The short- to medium-term technical roadmap of Ethereum L1

The real demand for customized order flow from traders, builders, etc.

Making the gas market as open and attractive as possible to more participants

At the micro design level, we strive to minimize the introduction of new concepts and terminology while avoiding market fragmentation. This has led to the following product and structural design.

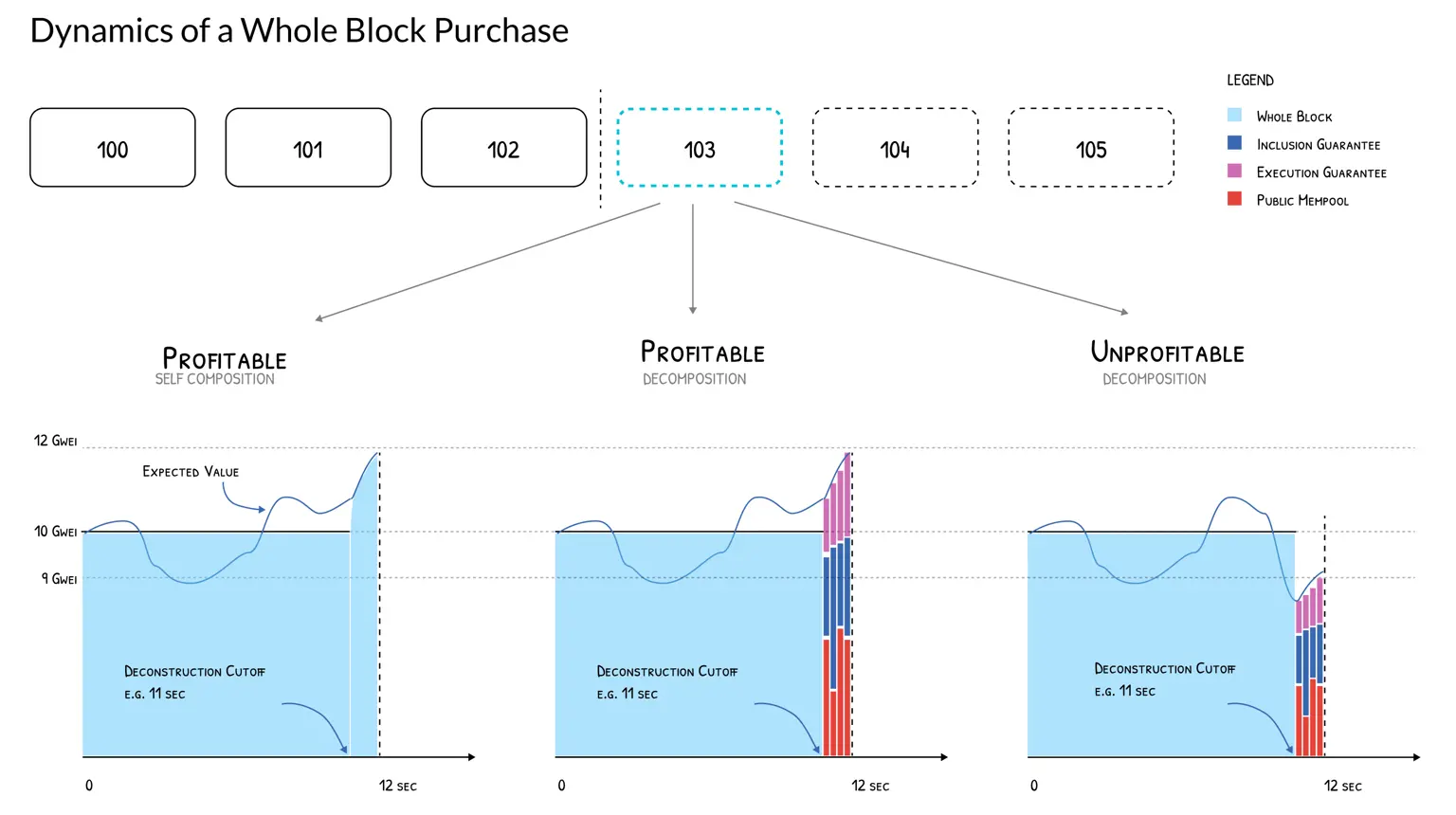

Whole Block

In a risk-neutral environment, selling whole blocks is economically optimal; under the premise of fully priced information, continuously selling multiple blocks is also a rational choice.

Under the "perfect information" assumption, a whole block contains the maximum amount of information and grants the buyer the highest degree of freedom, allowing them to freely order and insert any combination of transactions (including private orders and public mempool transactions) within the block.

Secondary Market and Product Standardization

To build a truly effective market, gas market products must be highly standardized. While various variants may emerge in the future, the fewer product types there are, the more conducive it is to gather enough buyers and sellers to form liquidity.

The secondary market is crucial for any valuable asset:

With a secondary market, the economic cost shifts from "purchase cost" to "holding cost"

For example, buying at T=0 and selling at T=1 second, the true cost is just the price change difference (plus time value)

The secondary market can also achieve price discovery, answering the question of "what is a reasonable price." Without price discovery, both buyers and sellers may fail to maximize their utility, ultimately leading to unnecessary losses (Deadweight Loss).

Therefore, product standardization + secondary market is a necessary and even critical condition for the healthy development of the gas market.

Deconstruction of Whole Blocks

The value of a whole block is usually greater than the sum of its parts. However, in cases of incomplete information, insufficient execution, or market irrationality, deconstructing the block may be more optimal.

In certain situations, external participants may assess the value of a portion of space within the block higher than the current holder (e.g., private order flow).

At this point, the buyer of the whole block can deconstruct it into multiple standardized block space products for sale, thereby:

Reducing their holding costs

Or enhancing overall value recovery rate

When holding a whole block, three scenarios may arise:

Complete self-use: The buyer constructs the block themselves, obtaining value above the purchase price

Partial resale: The buyer discovers strong demand but cannot fully utilize it, thus deconstructing and selling part of the block space

Passive stop-loss: The buyer is almost unable to capture value but can still recover some value through deconstruction, reducing losses

This is very similar to the current situation of integrated Block Builders, where current uncertainties often lead to insufficient value capture for validators.

Entry of Market Makers

Through product standardization, secondary markets, and deconstructible structures, ETHGas allows participants outside the traditional PBS system (such as market makers) to enter the gas market.

Market makers do not need to understand the complex details of PBS; they only need to focus on four types of standardized products:

Whole Blocks

Inclusion Guarantees

Execution Guarantees

Public mempool transactions

This structure is conceptually similar to the options market:

You can trade options directly or deconstruct and combine around their "Greeks" (Delta, Gamma, Theta, etc.).

Thus, the product roadmap of ETHGas follows one principle:

Start with the "big products" that have the highest value density, and only deconstruct when necessary to release more refined market opportunities.

Tron’s Commentary

ETHGas's core advantage lies in its first-time financialization and standardization of Ethereum block space and gas fees, providing validators, builders, and traders with hedgable, tradable, and deconstructible block space products through a hybrid model of CLOB matching + on-chain guarantees, significantly enhancing certainty, price discovery capability, and validator value capture; its design of "whole block—deconstruction—secondary market" also opens up a new market space for market makers and non-traditional PBS participants.

The disadvantage is that ETHGas does not belong to the Ethereum protocol itself, relying on off-chain matching, validator cooperation, and market adoption, with high early liquidity and participant education costs, while the complex product structure is not user-friendly for ordinary users, making it more suitable for professional institutions, MEV participants, and high-frequency trading scenarios.

1.2. Interpretation of the $52 Million Raised, with Participation from Star Institutions like Galaxy, Ark, and Coinbase—Architect, an Ultra-Low Latency and High Throughput Financial Infrastructure Engine for Institutional Trading

Introduction

Architect is a fintech company focused on providing high-throughput, low-latency trading and infrastructure solutions for traditional and tokenized assets. With a deep understanding of various asset classes, decades of industry experience, and a forward-looking system design philosophy, Architect empowers exchanges, trading firms, hedge funds, and professional investors to navigate the evolving digital asset market landscape with ease.

Architecture Overview

1. Symbology

Architect uses a unified, readable symbology system to identify financial instruments and standardizes naming across different exchanges, trading venues, and clearing institutions, thereby forming a consistent financial asset language across the platform. Symbols are essentially strings that follow certain rules to reduce ambiguity and enhance cross-market operational efficiency.

Three core types of symbols:

Product: Assets that can be held and form balances or positions, such as stocks, bonds, futures, options, crypto assets, and fiat currencies (e.g., BTC, AAPL, USD, gold futures, etc.).

Tradable Product: Used to describe specific trading pairs, typically composed of "asset / quoted asset" (e.g., BTC/USD, EUR/USD, futures/USD).

Venue: Refers to the name of the exchange or clearing institution (e.g., BINANCE, CME), used to distinguish different market environments.

Futures and perpetual contracts:

Since derivatives typically lack cross-exchange interchangeability, their product names will explicitly include the issuing exchange (e.g., CME futures, Binance perpetual contracts). OCC clearing options are a few exceptions.

Aliases:

In some exchanges (such as CME), Architect also supports commonly used aliases in traditional markets, such as using futures month codes (e.g., GCM5) as standardized name aliases to accommodate the usage habits of professional traders.

Overall, the goal of this symbology system is to unify naming, eliminate ambiguity, and enhance engineering efficiency for cross-market and cross-asset trading.

2. Orderflow

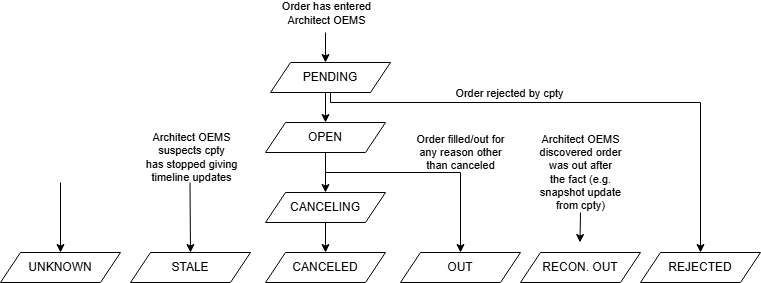

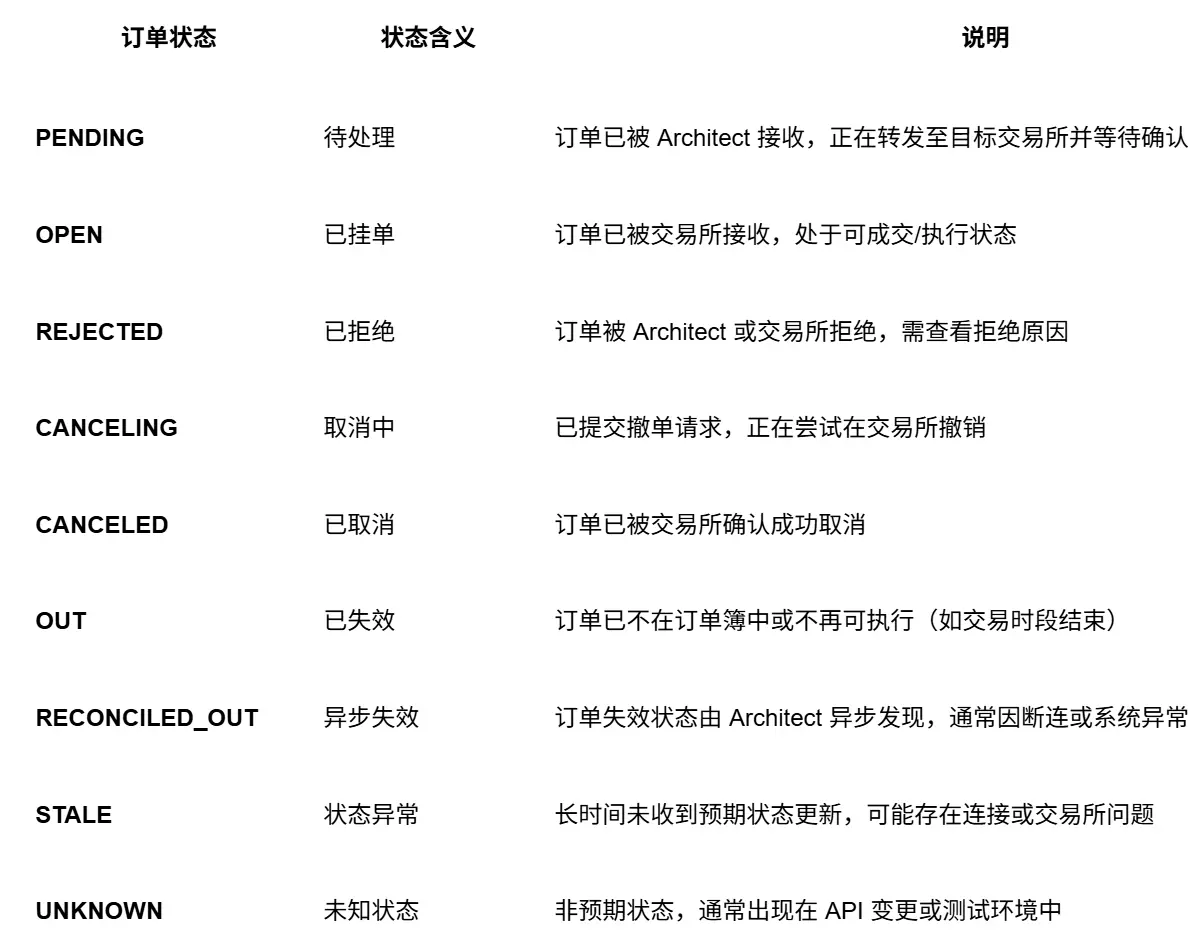

In Architect, the core of order management lies in the unified tracking of the entire lifecycle status of orders. Architect standardizes the order statuses across different exchanges and execution venues, providing users with a consistent view of the order lifecycle. Status transitions follow an expected path, with the bottom status of the lifecycle regarded as a terminal state that will not change further.

Main order status descriptions:

3. Account and Portfolio Management (Architect PMS)

In Architect's Portfolio Management System (PMS), an account refers to a portfolio.

Each account is used to manage the balances and positions in the corresponding trading venues (exchanges, clearing institutions, etc.) and is mapped one-to-one with real accounts in external venues.

All accounts managed by Architect use UUIDs for global unique identification.

One account ≈ an actual account in an exchange/clearing institution.

Balances

Represent the amount of cash or assets held in the account, for example:

Holding 5 BTC

Holding 20 shares of AAPL

Margin balance of 1000 USD

Positions

Represent the risk exposure or ownership of a financial instrument in the account, for example:

Net short 10 shares of TSLA

Net long 3 CME gold futures (GC)

Key Features:

By default, positions do not automatically aggregate.

Multiple orders for the same underlying → will form multiple independent positions.

Facilitates refined risk management, PnL splitting, and strategy-level analysis.

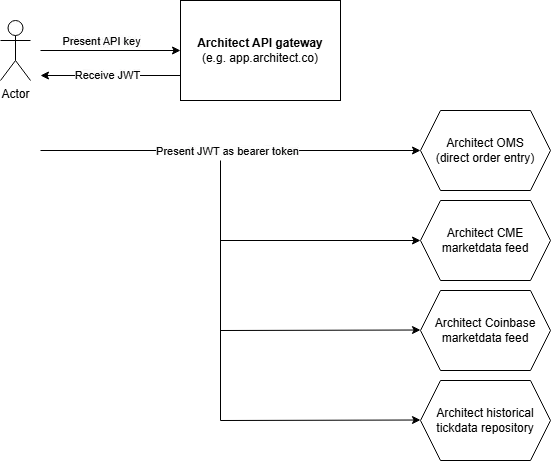

3. Authentication Mechanism

Architect uses the OAuth authentication system to verify platform user identities. Users can create secret API Keys for programmatic access to various services of Architect. These API Keys need to be exchanged for short-term valid JWTs (JSON Web Tokens) before they can be used to directly connect to the Architect system for order entry and market data access.

Core Features:

OAuth unified identity authentication, compliant with institutional security standards.

API Key + short-term JWT mechanism reduces the risk of long-term key leakage.

Supports high-performance, low-latency trading and market data direct connection needs.

Architect ensures system stability through a user-based token bucket rate-limiting mechanism; reasonable use of streaming interfaces, batch requests, and caching strategies can minimize the impact of rate limiting in high-frequency trading and market scenarios.

Tron’s Commentary

Overall, Architect's core advantage lies in its institutional-level, unified abstract trading and asset management infrastructure: through standardized symbology, order lifecycle, account and portfolio management, as well as high-performance, low-latency OEMS/PMS architecture, it significantly reduces the system complexity of parallel trading across multiple markets and assets (traditional assets + crypto assets); at the same time, based on streaming interfaces, strict permission control, and clear rate-limiting mechanisms, the system has obvious advantages in stability, scalability, and risk control consistency, making it suitable for long-term use by professional trading institutions.

Its main disadvantage is that the technical and usage threshold is relatively high, leaning more towards professional institutions rather than ordinary users; for developers, it requires adaptation to its abstract model and calling paradigm, resulting in higher initial integration costs, and may require additional engineering investment under highly customized demands.

2. Key Project Details of the Week

2.1. Detailed Explanation of the $7 Million Raised, Led by Portal, with Follow-on Investments from GSR and Animoca—BLIFE, a Full-Scenario Web3 Ecosystem and Value Collaboration Network Based on Bitcoin

Introduction

BLIFE stands at the intersection of Bitcoin's core philosophy and the unknown frontiers of the metaverse. In the face of today's highly fragmented and limited accessibility in the digital world, BLIFE, with its bold vision, is committed to reshaping the future of digital currency and virtual interaction. Looking ahead to the next decade, BLIFE envisions a profound transformation: moving from the current fragmented and decentralized ecosystem to a highly collaborative, globally accessible digital world, where finance, entertainment, education, and decentralized governance will seamlessly integrate and evolve together.

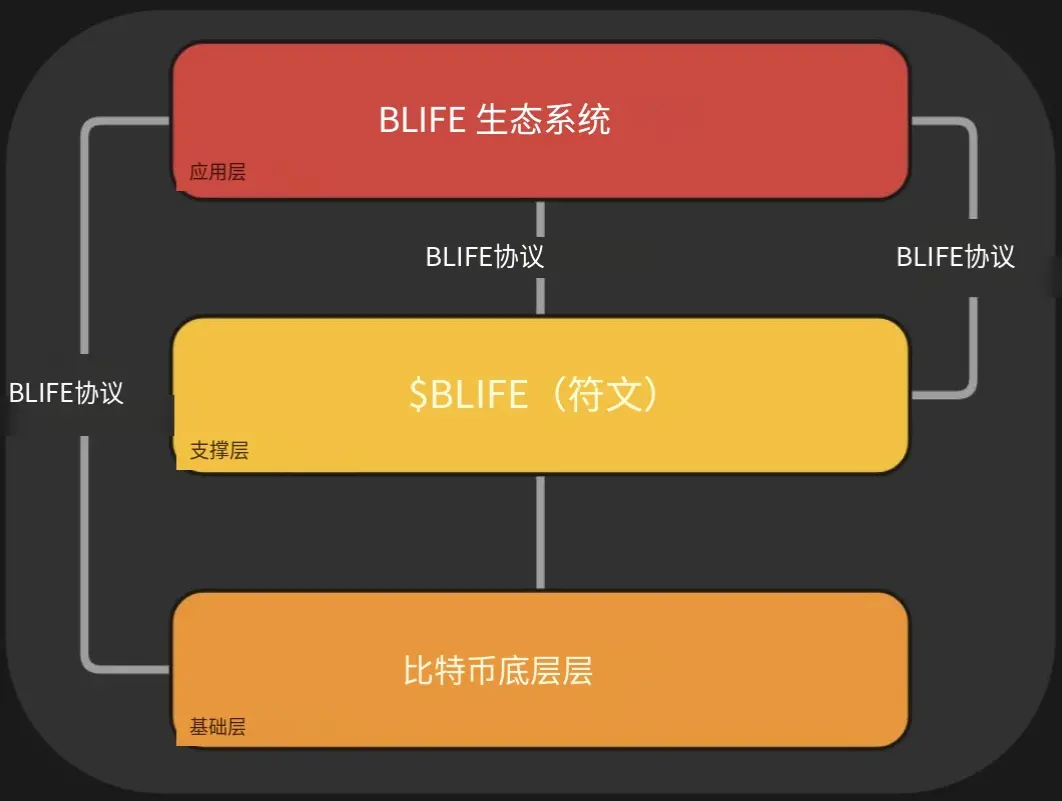

Architecture Overview

The BLIFE ecosystem adopts a three-layer architecture design: foundational layer, supporting layer, and application layer. The foundational layer centers on the Bitcoin network, serving as the underlying basis for the entire ecosystem, with the BRC-20 token $BLIFE anchored here, acting as the value and permission entry point into the ecosystem; the supporting layer is driven by $BLIFE, serving as a bridge for cross-layer interactions and transactions; the application layer constitutes a complete Web3 ecosystem, building an open, decentralized digital world based on Bitcoin infrastructure, supporting users to connect, create, and experience diverse digital scenarios.

BLIFE not only focuses on virtual spaces but also aims to bridge the digital and real worlds, enabling finance, entertainment, education, and social interactions to operate collaboratively within the same system, while ensuring security, transparency, and long-term innovation capabilities through blockchain technology, thus constructing a sustainably scalable digital reality extension.

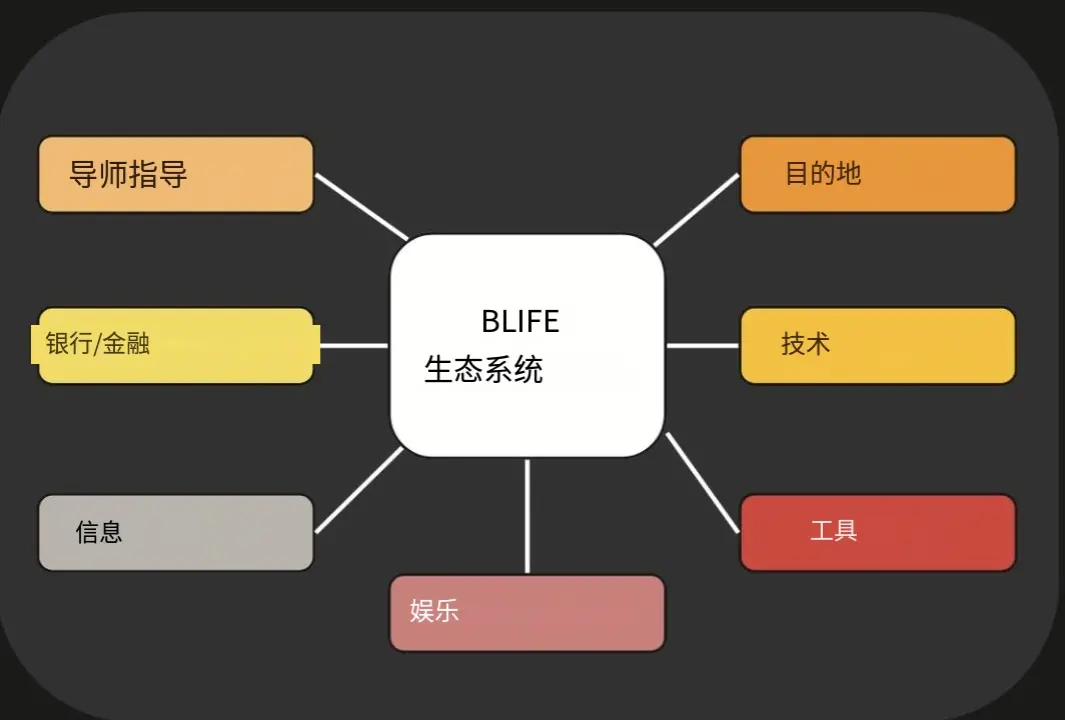

1. Scalable Ecosystem

BLIFE is building a highly scalable, community-centric digital ecosystem, not just a collection of disparate digital applications, but a digital extension of the real world. Its ecosystem consists of multiple key modules working in synergy, including immersive digital scenarios (games, shopping, etc.), underlying technology stack, composable tools, digital entertainment content, information and news channels, decentralized finance and banking infrastructure, as well as education and mentorship systems. These elements work together to bridge the real and virtual worlds, forming a unified, continuous digital experience.

In terms of participation mechanisms, BLIFE emphasizes empowering individuals and diverse co-construction, encouraging users to participate in the evolution of the ecosystem based on their skills, promoting inclusivity and innovation. Its architecture's uniqueness lies in the deep integration of Bitcoin's native assets: Bitcoin-based NFTs provide high security and credibility, while $BLIFE (BRC-20) serves not only as a payment tool but also as the core entry point for accessing ecosystem services and experiences, organically combining Bitcoin's stability with Web3's innovative capabilities to form a differentiated competitive advantage.

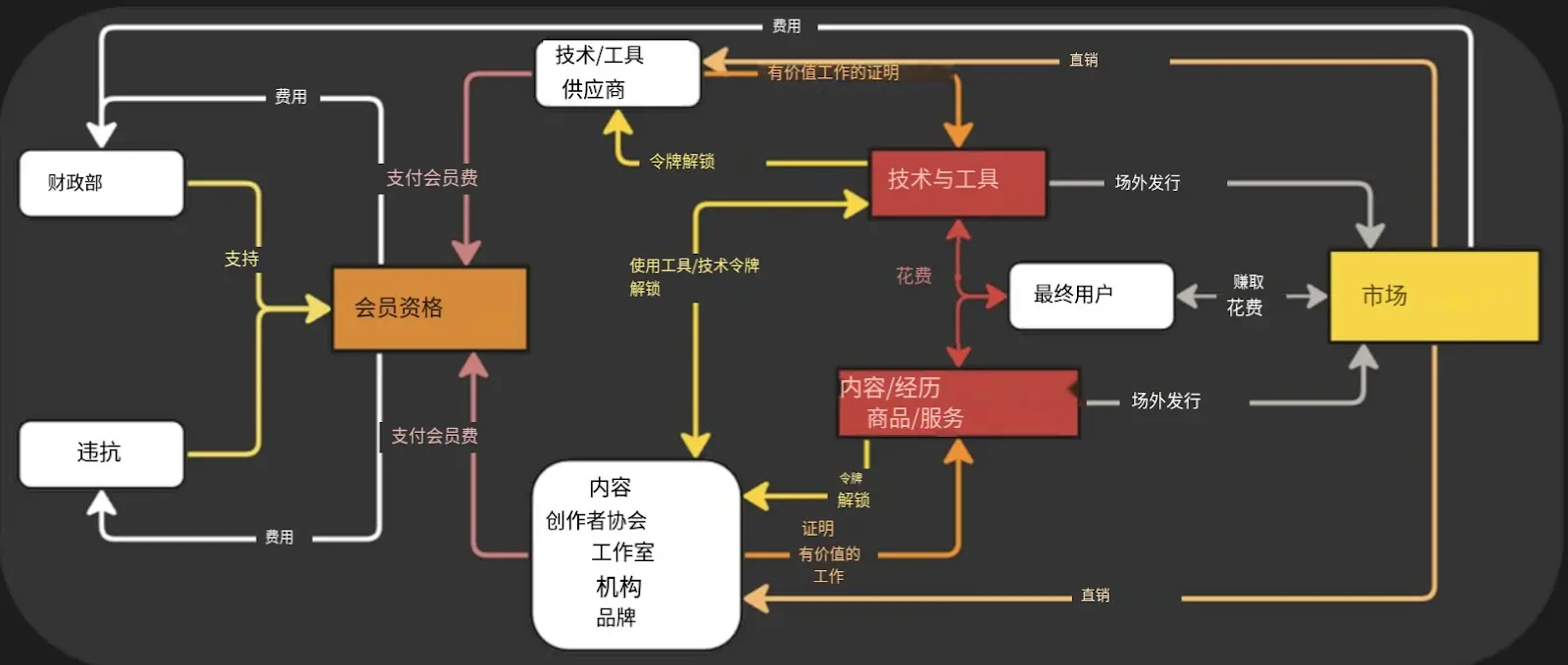

2. Stakeholders

The successful establishment of the BLIFE protocol ecosystem relies on the collaborative construction of diverse participants, mainly including:

Tool Providers: Provide software and hardware tools to help build user-centric applications.

Technology Providers: Responsible for the development and maintenance of the underlying technology stack and Layer 2 infrastructure.

Studios and Institutions: Focus on product design, development, and promotion within the Web3 and Bitcoin ecosystem.

Content Creators: Produce content and collaborate with studios to expand ecosystem influence.

End Users: The core participants of the ecosystem, both users and sources of content and feedback.

Guilds: Organized communities that promote the development of specific products or services.

Brands: Collaborate with creative teams to provide products, services, and experiences.

Miners: Ensure the security of the blockchain network and transaction validation.

DeFi Operators: Provide decentralized financial services and products.

Treasury: Responsible for the management, maintenance, and long-term expansion of ecosystem resources.

In summary, BLIFE is building a collaborative digital ecosystem based on Bitcoin, driven by diverse roles, through the deep integration of community, technology, and finance, continuously empowering individuals and organizations, and achieving long-term value growth through co-construction.

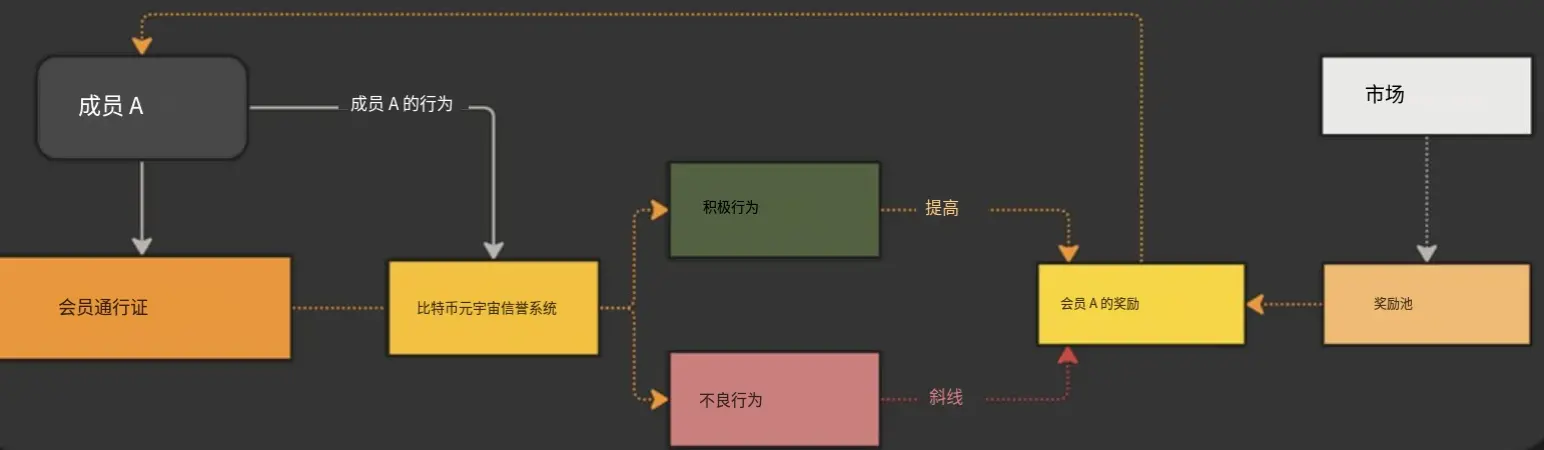

3. BLIFE Protocol Reputation (BPR) System

The BPR system is used to monitor the behaviors and interactions of various stakeholders within the protocol and to conduct qualitative and quantitative assessments. This system directly affects the distribution mechanism of treasury earnings: network fees generated from transactions within the ecosystem will be aggregated into the treasury and then distributed based on members' membership levels and tiers, according to their reputation performance.

The core goal of the BPR system is to incentivize positive contributions and suppress harmful behaviors by dynamically adjusting the proportion of treasury rewards that participants can receive. Stakeholders who comply with protocol norms and continuously create value for the ecosystem will see their reputation levels rise; conversely, if inappropriate or destructive behaviors occur, their reputation and share of earnings will decrease accordingly.

Overall, the BPR system works in conjunction with the protocol's phased design to shape a dynamic, collaborative ecosystem with positive incentive mechanisms, ensuring the long-term sustainable development of the protocol and healthy participant interactions.

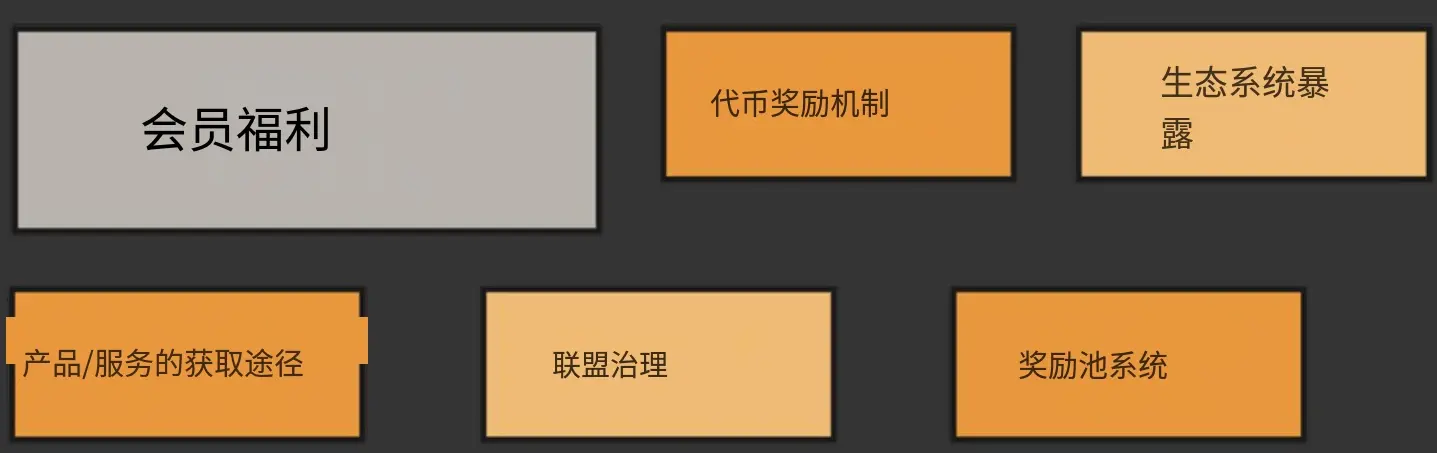

4. Membership System (Access Rights)

The membership system within the BLIFE protocol ecosystem serves as both an entry point for stakeholders into the ecosystem and a mechanism for incentivizing and rewarding their ongoing contributions. The protocol has multiple membership levels, with different levels corresponding to various rights, cost structures, and reward returns.

Free/Subsidized Access: Members can use all products and services within the protocol for free or at subsidized prices, avoiding one-time payments and promoting seamless collaboration and integration within the ecosystem.

Contribution Incentive Mechanism: Actively participating and contributing members will receive token rewards, with the amount of rewards matching their membership level and milestones achieved.

Higher Visibility: Members enjoy greater visibility within the BLIFE ecosystem and can gain cross-project promotion opportunities, as well as priority or exclusive access to new business sectors and partnerships.

Membership Reward Pool Mechanism: A dedicated membership reward pool is established, primarily funded by transaction fees within the protocol; rewards will be distributed based on members' levels and statuses within the tiered system.

Participation in Governance: Members can participate in protocol governance, with opportunities to be recognized as thought leaders and to run for and hold governance roles within the evolving DAO structure.

5. Continuous Development and Growth Mechanism of the Protocol Ecosystem

The BLIFE protocol maintains balance and promotes long-term growth within the ecosystem through carefully designed transaction, incentive, and interaction flow mechanisms.

Roles of the Treasury and DeFi Providers: Both play a core role in the ecosystem by sponsoring the embedded $BLIFE membership system, establishing a sustainable circular economy.

Membership Acquisition and Rights: Stakeholders can obtain membership badges through direct payments, staking tokens, or as protocol rewards. Membership status unlocks a wealth of ecosystem rights, enhancing participation experience and contribution potential.

User Pathways and Token Economics: Through user participation pathways, the collaboration methods of different roles within the ecosystem are showcased, further integrating with the token economic model to clearly present the distribution and usage logic of $BLIFE within the protocol.

Active Participation and Value-Driven: The protocol design emphasizes "value contribution equals reward," encouraging participants to continuously invest, forming an active and efficient digital economy system.

Tiered Membership and $BLIFE Unlocking: The membership system is divided into multiple levels, each corresponding to a certain amount of $BLIFE. Members can gradually unlock tokens by completing "Proof of Valuable Work," integrating technologies or tools, or using $BLIFE as their preferred payment method.

Fees and Economic Closed Loop: Membership fees and transaction fees generated in the market will flow back to the treasury and DeFi providers for reinvestment and incentives, thereby strengthening the economic closed loop of the ecosystem and ensuring the protocol's sustainability and scalability.

Tron’s Commentary

BLIFE, based on Bitcoin, attempts to deeply integrate BRC-20, Bitcoin NFTs, Web3 applications, the metaverse, and the membership system. Its advantages lie in anchoring Bitcoin's security and consensus layer, emphasizing the integration of the real and digital worlds, and constructing long-term incentives and community collaboration through the reputation system (BPR) and tiered membership mechanism, possessing strong narrative integrity and ecological imagination.

However, its disadvantages are also quite evident, including complex architecture and mechanisms, reliance on multi-party collaboration for implementation, high user understanding and participation thresholds, and limitations in performance, composability, and development maturity of BRC-20 and the Bitcoin ecosystem, leading to uncertainties in the actual application scale and sustainable demand in the short term.

### Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

2. Summary of Hot Sectors

### 3. Macroeconomic Data Review and Key Data Release Nodes for Next Week

Last week, there were no new "heavyweight" macroeconomic data releases from the United States, and the overall situation remains in a data vacuum and digestion period since January, leaning more towards continued interpretation of previous data.

Important data releases this week:

January 29: U.S. Federal Reserve interest rate decision as of January 28 (upper limit)

January 30: U.S. December PPI year-on-year

### 4. Regulatory Policies

United States: Seeking Leadership and Key Legislative Period

This week, U.S. policy dynamics have been very active, showcasing clear strategic intentions while highlighting the complex legislative game.

High-Level Positioning and Regulatory Reform: On January 24, the White House stated through official channels that the U.S. has become the "world's cryptocurrency capital" under the push of the Trump administration. On the same day, the new chairman of the Commodity Futures Trading Commission (CFTC), Mike Selig, responded that the CFTC is modernizing its rules to ensure that the future of crypto and on-chain finance is "made in America."

Urgency of Core Legislative Process: Patrick Witte, executive director of the White House Digital Asset Advisory Committee, recently emphasized that the cryptocurrency market structure bill being advanced in the Senate must be implemented as soon as possible by 2026 to end the regulatory gray area in the industry. The core goal of this bill is to clarify the regulatory responsibilities of the SEC and CFTC.

Important Bill Unexpectedly Delayed: The previously highly anticipated "CLARITY Act" has been shelved in the legislative process, with a delay expected until late February or even later for review. This delay has been viewed by some market analysts as a "breathing space" for the industry, as some restrictive clauses in the draft (such as government access to DeFi user data) had sparked controversy and led institutions like Coinbase to withdraw support.

China: Emphasizing Risk Prevention and Technical Regulation

During this period, China's policy focus has been on illegal activities involving the use of cryptographic technology.

- At the Central Political and Legal Work Conference held from January 18 to 19, a work deployment for 2026 was clearly proposed, emphasizing the need to strengthen regulatory research on blockchain and other cryptographic technologies to prevent their use in evading regulation. The meeting also called for legal action against illegal fundraising, financial fraud, and other economic crimes.

European Union and Japan: Tax Transparency Rules Officially Implemented

At the beginning of the new year, the tax reporting rules for crypto assets previously established by the European Union and Japan officially came into effect, with widespread impact.

European Union: As of January 1, the "DAC8" tax transparency rules came into effect. This rule requires crypto service providers (such as exchanges) to collect and report detailed transaction data of users, which will be shared among tax authorities across the EU to combat cross-border tax evasion.

Japan: Similarly, starting from January 1, the OECD's "Crypto Asset Reporting Framework" has been officially implemented, requiring domestic crypto exchanges to begin collecting information such as users' tax residency. Users who fail to provide information on time may face penalties.

United Kingdom and Other Countries

United Kingdom: Its new cryptocurrency trading reporting regulations also came into effect on January 1, 2026, requiring companies to report every customer transaction, including user full names, addresses, and transaction details.

Vietnam: According to a market weekly report, the Vietnamese Ministry of Finance announced the launch of a pilot program for the formal licensing system of cryptocurrency trading platforms, with some securities companies and banks already expressing interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。