Written by: Yangz, Techub News

As January 2026 comes to a close, Bitcoin continues to fluctuate at low levels. After dropping to around $86,000 over the weekend, it slightly rebounded to above $88,000 yesterday. However, compared to its performance earlier this month, when it rose from about $90,000 to around $98,000, Bitcoin's recent rebound appears significantly weaker.

The market often refers to Bitcoin as "digital gold," yet under the dual impact of Trump's tariff policies and the geopolitical situation in the Arctic, traditional gold prices have steadily surpassed the $5,000 per ounce mark, while Bitcoin has failed to strengthen in tandem and remains under pressure. Given the current trend, Bitcoin faces considerable challenges not only in attempting to breach the psychological barrier of $100,000 in the remaining time of the month but also in stabilizing above $90,000. If by the end of the month Bitcoin fails to maintain its current weak rebound and instead fluctuates downward, breaking below the $87,000 support, it will face the prospect of experiencing a consecutive four-month decline for the first time since the second half of 2018, a gap of over seven years.

So, what is the current market situation? The following analysis will focus on the macro environment and the internal dynamics of the cryptocurrency industry.

Macro Environment: Multidimensional Uncertainties Intertwined

At the beginning of 2026, the global financial market is facing pressure tests from multiple key areas.

First, Trump's "leveraged" diplomacy is exacerbating market volatility. Trump has continued and intensified his "transactional" diplomatic style during his second term, with tariffs becoming a core lever for achieving his political and economic goals, directly disrupting global trade flows and market expectations. His tariff policies have been multifaceted, from raising tariffs on certain South Korean products to 25%, to threatening 100% punitive tariffs on Canadian goods, and imposing tariff pressure on European countries to secure strategic interests in Greenland. Although there are negotiations and retreats in the specifics, the unpredictable nature of these actions continues to inject panic into the market.

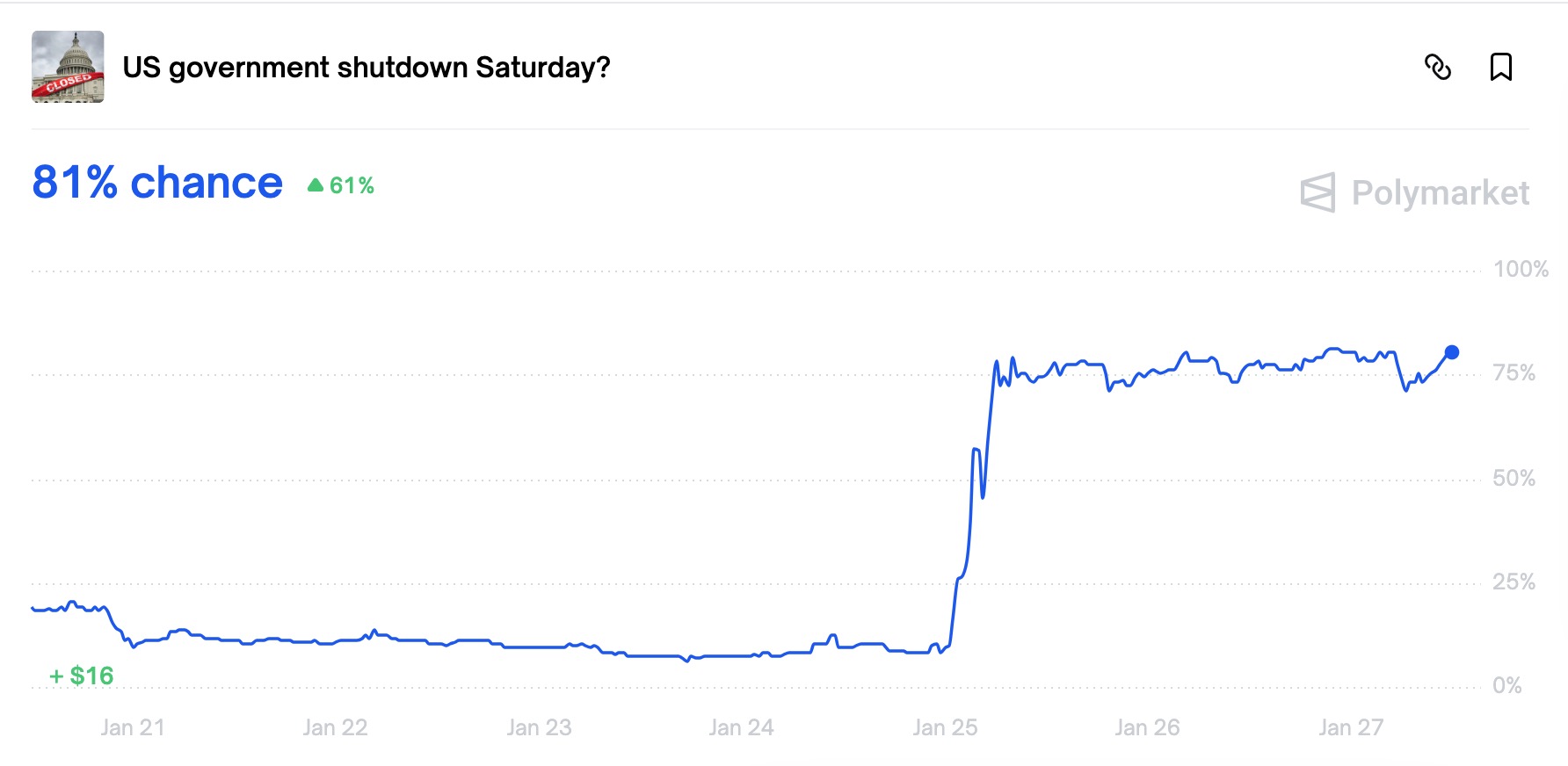

Meanwhile, the stability of domestic politics in the U.S. is facing severe tests. Predictive market data from Polymarket shows that the probability of another government shutdown at the end of the month has skyrocketed from single digits to over 80% this week. This risk of fiscal paralysis could not only directly impact the liquidity of the treasury market, causing short-term financial turmoil, but also foreshadows a more intense struggle between the two parties over key issues such as fiscal spending and the debt ceiling, further diminishing the predictability of long-term policies.

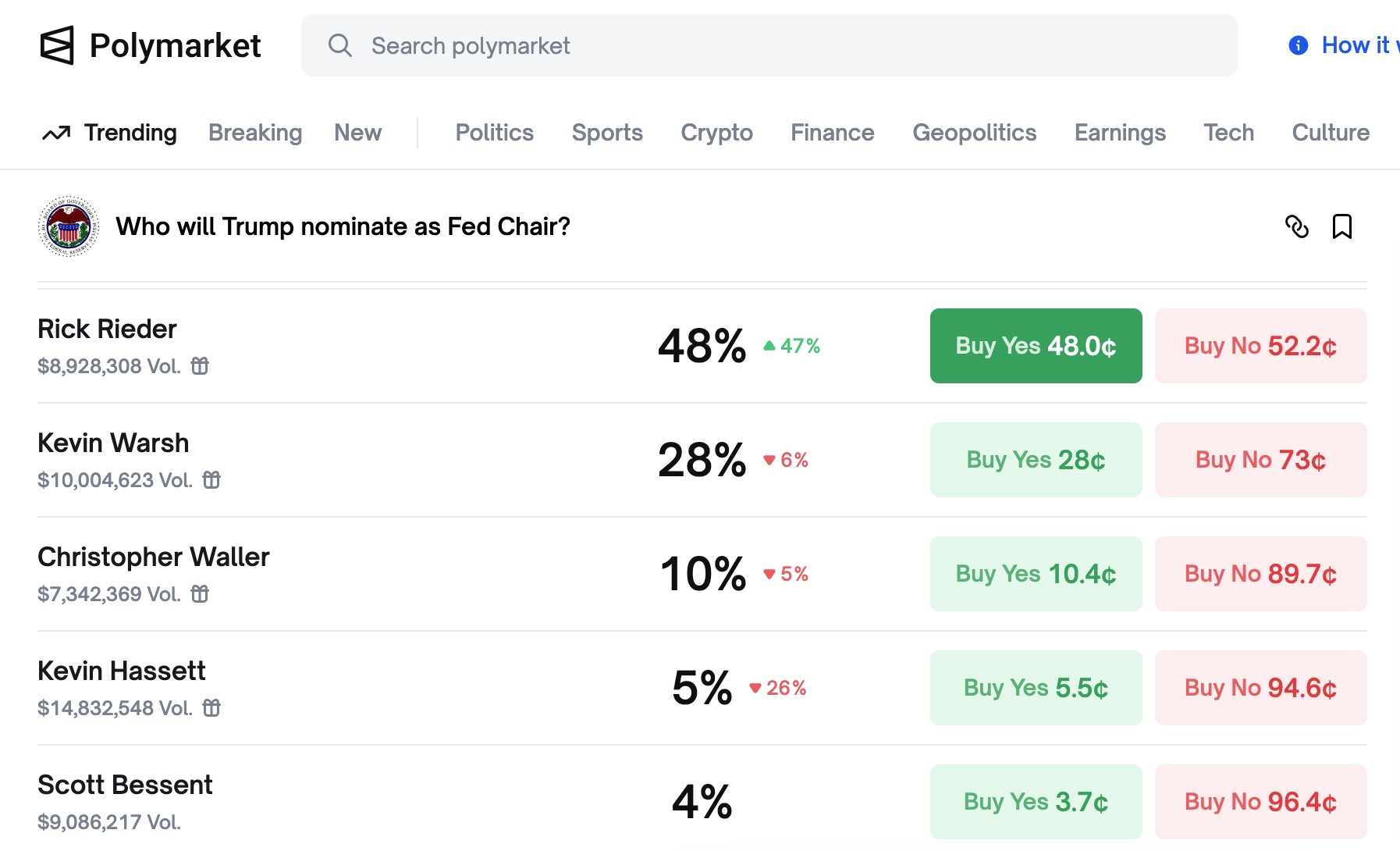

Additionally, the outlook for monetary policy is also shrouded in uncertainty. The Federal Reserve, the "master valve" of global capital flows, remains at a critical juncture of leadership transition. Powell's term will end in May 2026, and although Trump revealed at the Davos Forum that he has "locked in the final candidate in his mind," the market is still closely watching the direction of this key personnel change. Polymarket data shows that the leading candidate is Rick Rieder, an executive at BlackRock, with a nomination probability of 48%, followed by former Federal Reserve Governor Kevin Walsh, with a probability of 28%. However, regardless of who the final candidate is, it signifies significant uncertainty in the future path of monetary policy, which also suppresses market risk appetite in the current environment.

In summary, the current macro landscape presents a complex situation of intertwined multidimensional uncertainties. Logically, in such a scenario, Bitcoin, as a "safe-haven asset," should benefit similarly to gold, but the reality is quite different. NYDIG's global research director Greg Cipolaro analyzes that "during periods of market stress and uncertainty, liquidity preference dominates. This dynamic harms Bitcoin far more than gold. Although Bitcoin has good liquidity, it still maintains higher volatility and is prone to reflexive sell-offs during leveraged liquidations. Therefore, in a risk-off environment, regardless of its long-term narrative, it is often used as a tool to raise cash and reduce risk exposure; while gold continues to serve as a true liquidity 'safe haven.'"

Internal Environment: Insufficient Internal Momentum and Outflow Pressure

Amid the complex interplay of the macro environment, the cryptocurrency industry is also facing multiple challenges, from setbacks in regulatory processes to ongoing capital outflows, collectively indicating the current market's downward pressure.

First, the key process of cryptocurrency legislation in the U.S. has encountered unexpected setbacks. Due to public opposition from Coinbase CEO Brian Armstrong, the Senate Banking Committee canceled its scheduled review of the market structure bill. For Coinbase, stablecoin revenue is not just "extra money," but the economic foundation for its transformation from a trading platform to a global digital financial infrastructure. This is why it is willing to stand against the majority of players in the industry to defend its rights. Fortunately, the legislative process has not completely stalled. On one hand, the Senate Agriculture Committee has rescheduled the review of related bills to January 29; on the other hand, a Democratic senator's assistant indicated that the Democrats are still willing to return to the negotiating table to push for bipartisan compromise. However, the initial setback clearly indicates that the path to establishing a clear and stable regulatory framework remains rocky, and this uncertainty itself suppresses positive market sentiment.

Secondly, the already retreating DAT narrative has shown clear signs of divergence again. According to X user Ember, Strategy purchased another 2,932 Bitcoins last week, increasing its holdings to about 713,000; BitMine increased its holdings by over 40,000 Ethereum, bringing its total to about 4.343 million (with a cumulative staking amount exceeding 2 million). However, more companies are showing signs of fatigue: Metaplanet has not purchased Bitcoin for two consecutive weeks and confirmed a write-down loss of about $680 million for the 2025 fiscal year; Ethereum treasury company FG Nexus sold 2,500 Ethereum on January 20; GameStop also transferred all its Bitcoin holdings to Coinbase Prime on January 23, likely in preparation for a sale. Notably, Strategy's paper profits remain substantial, while BitMine is suffering significant paper losses due to Ethereum price fluctuations.

Moreover, the national-level Bitcoin reserve strategy in the U.S. has not been genuinely implemented, lacking policy buy-in support from the highest levels, which makes institutional buying behavior more of an individual business decision rather than a systemic trend.

At the same time, capital flow data further confirms the market's weakness. According to CoinShares data, last week saw a net outflow of $1.73 billion from digital asset investment products, the highest since mid-November last year. Among them, Bitcoin and Ethereum saw outflows of $1.09 billion and $630 million, respectively. Additionally, according to SoSoValue data, last week the total net outflow from U.S. Bitcoin spot ETFs was about $1.33 billion, marking the second-largest single-week net outflow in history; Ethereum spot ETFs saw a total net outflow of about $611 million. More concerning is that, according to crypto analytics platform Santiment, the total market capitalization of stablecoins has decreased by $2.24 billion in the past 10 days, indicating that funds may be flowing out of the crypto ecosystem and into traditional safe-haven assets like gold. This phenomenon corresponds with the record high in gold prices, suggesting that in the current environment, some investors prefer to choose traditional "safe havens" rather than prepare to buy crypto assets at lower prices.

Conclusion

As January 2026 comes to a close, Bitcoin's fluctuating trend seems to encapsulate the market's deep-seated anxiety. In the short term, multidimensional macro uncertainties, setbacks in regulatory processes, hesitance in institutional behavior, and shifts in capital flows collectively create strong downward pressure. However, as BitMine Chairman Tom Lee stated, "When the fundamentals continue to 'trend upward,' price increases are just a matter of time." The dazzling rise of gold may overshadow the ongoing advancement of the underlying infrastructure of crypto assets, but that does not mean that true value is stagnating.

The market's pendulum constantly swings between fear and greed. The current outflow of funds driven by risk-off sentiment sharply contrasts with the long-term fundamentals that have yet to be fully priced in. This divergence is often not the endpoint but rather a process of accumulating energy for future value recovery. For discerning investors, chasing after other assets that are already at high levels may not be a wise choice. Maintaining patience and a structural perspective, waiting for the macro fog to gradually clear, may be a more prudent stance to navigate the current cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。